Accept Online Payments Seamlessly in India with Razorpay Payment Gateway

Accept Online Payments Seamlessly in India with Razorpay Payment Gateway

Accept Online Payments Seamlessly in India with Razorpay Payment Gateway

Accept Online Payments Seamlessly in India with Razorpay Payment Gateway

With easy integration, quick online onboarding, and a feature-rich checkout, Razorpay’s payment gateway makes online payments effortless. Get started and experience the future of payments.

With easy integration, quick online onboarding, and a feature-rich checkout, Razorpay’s payment gateway makes online payments effortless. Get started and experience the future of payments.

A Payment Gateway that Handles End to End Payments

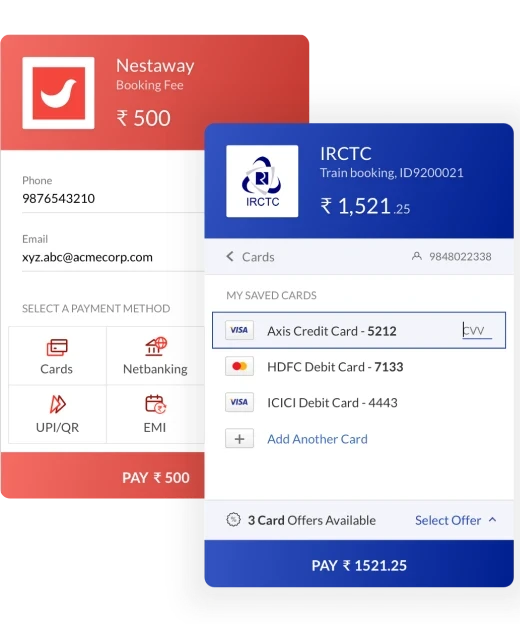

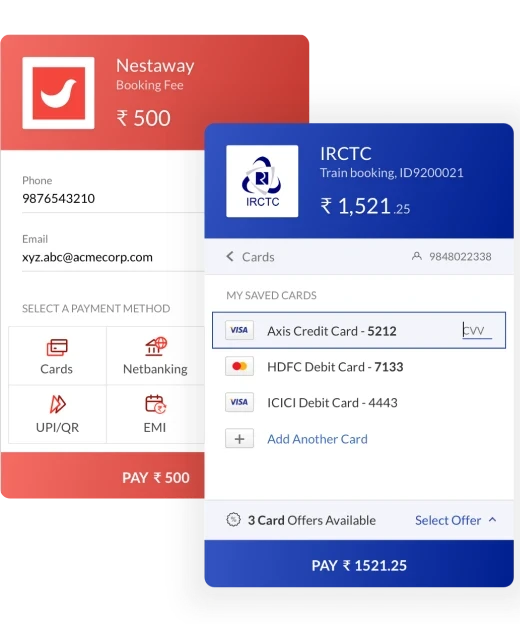

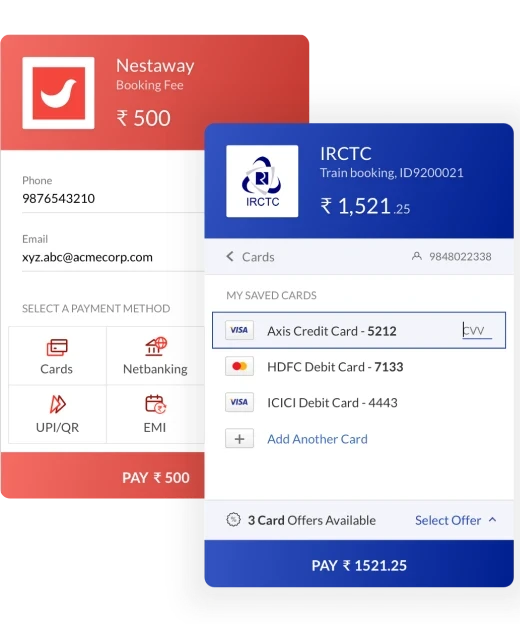

Accept All Payment Methods

With Domestic and International Credit & Debit cards, EMIs ( Credit/Debit Cards & Cardless), PayLater, Netbanking from 58 banks, UPI and 8 mobile wallets, Razorpay provides the most extensive set of payment methods.

Checkout and Global Card Saving

An easy to integrate Checkout with cards saved across businesses so that your customers can pay seamlessly everywhere.

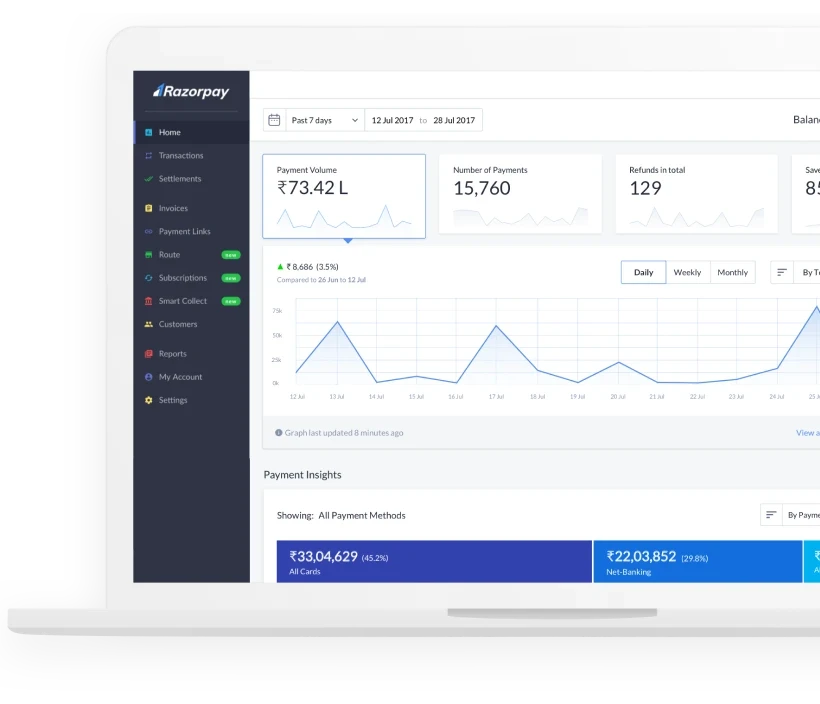

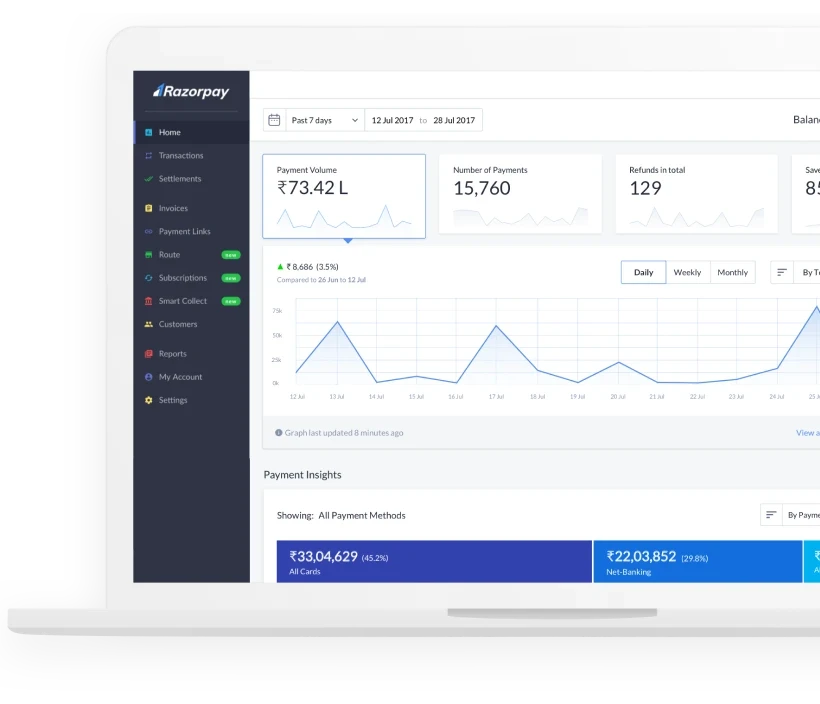

Powerful Dashboard

Get reports and detailed statistics on payments, settlements, refunds and much more for you to take better business decisions.

Built for Developers

Robust, clean, developer friendly APIs, plugins and libraries for all major languages and platforms that let you focus on building great products.

Robust Security

PCI DSS Level 1 compliant along with frequent third party audits and a dedicated internal security team to make sure your data is always safe.

Breathing Room

Breathing Room achieved shorter sales cycle and faster revenue realisation

FreshToHome

FreshToHome sees 30% drop in no-shows with Razorpay Payment links

Breathing Room

Breathing Room achieved shorter sales cycle and faster revenue realisation

FreshToHome

FreshToHome sees 30% drop in no-shows with Razorpay Payment links

Flash Checkout

Better Conversions than ever

Flaunt your Brand with Custom UI

Easy Integration with less code

4+ Million saved cards across businesses

Personalised payment experience for every user

Native OTP

A Powerful dashboard to give you full control

Access and manage your payments, refunds, transfers, subscriptions, invoices, customer identifiers, API keys, webhooks, and more with Razorpay’s payment gateway.

See Key Statistics

Get access to real-time data and insights to take informed business decisions. View important stats and generate customizable settlement and reconciliation reports.

Easy to Use

We understand that when it comes to managing payments, speed and ease of use is what matters at the end of the day. We've spent endless hours to make it a great experience for you.

Get onboarded and start accepting payments within minutes.

Seamless onboarding with minimum documentation

Track payments on the go

Accept payments & issue refunds with a single click

Get detailed payments insights

Effortless Website Integration with Razorpay Payment Gateway

Integrating payments with Razorpay is as simple as it can get with well documented SDKs, RESTful APIs and plugins for all major platforms and languages.

Integrating Razorpay was a breeze and we must have spent about 30 minutes doing it Unquestionably the only Indian payment gateway truly designed and built for developers.

Kailash Nadh, Head of Technology, Zerodha

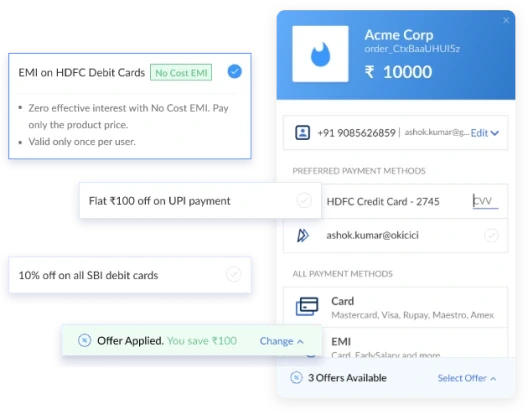

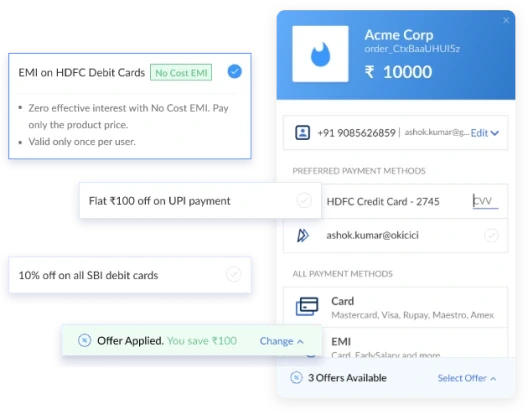

Run Offers at the Click of a Button

Run all your promotional offers via the Razorpay dashboard.

Create offers at the click of a button

Define the number of users who can avail offers

Run offers for specific banks, card networks and wallets

Razorpay customers have seen a 35% increase in sales through offers.

PRO TIP

Use Razorpay Offers to run ‘No Cost EMI’ schemes for your customers.

Frequently Asked Questions

What is a Payment Gateway?

What types of platforms and integrations are supported by Razorpay Payment Gateway?

Does Razorpay provide international payments support?

With MoneySaver Export Account, businesses and freelancers can accept international bank transfers via SWIFT, ACH, SEPA, or FPS, with settlement in INR to their Indian bank accounts. Razorpay also enables non-Indian businesses to unlock the Indian market by accepting seamless payments from Indian customers. Businesses can accept payments using UPI – India’s favourite payment method, net banking and credit and debit cards, with support for both subscriptions and one-time payments. The funds are settled directly in their foreign bank accounts, in a currency of their choice.

What types of businesses can use Razorpay Payment Gateway?

How long does it take to set up a Razorpay merchant account?

What are the charges associated with a Payment Gateway?

How long will it take to integrate Razorpay into my website?

How does Razorpay protect customer & transaction data?

What happens if my Payment Gateway account is inactive for a long time?

Is there a demo or trial available for Razorpay Payment Gateway before committing to a plan?

What is a Payment Gateway?

What types of platforms and integrations are supported by Razorpay Payment Gateway?

What payment modes are supported by Razorpay

With MoneySaver Export Account, businesses and freelancers can accept international bank transfers via SWIFT, ACH, SEPA, or FPS, with settlement in INR to their Indian bank accounts. Razorpay also enables non-Indian businesses to unlock the Indian market by accepting seamless payments from Indian customers. Businesses can accept payments using UPI – India’s favourite payment method, net banking and credit and debit cards, with support for both subscriptions and one-time payments. The funds are settled directly in their foreign bank accounts, in a currency of their choice.

What types of businesses can use Razorpay Payment Gateway?

How long does it take to set up a Razorpay merchant account?

What are the charges associated with a Payment Gateway?

How long will it take to integrate Razorpay into my website?

How does Razorpay protect customer & transaction data?

What happens if my Payment Gateway account is inactive for a long time?

Is there a demo or trial available for Razorpay Payment Gateway before committing to a plan?

What is a Payment Gateway?

What types of platforms and integrations are supported by Razorpay Payment Gateway?

Does Razorpay provide international payments support?

With MoneySaver Export Account, businesses and freelancers can accept international bank transfers via SWIFT, ACH, SEPA, or FPS, with settlement in INR to their Indian bank accounts. Razorpay also enables non-Indian businesses to unlock the Indian market by accepting seamless payments from Indian customers. Businesses can accept payments using UPI – India’s favourite payment method, net banking and credit and debit cards, with support for both subscriptions and one-time payments. The funds are settled directly in their foreign bank accounts, in a currency of their choice.

What types of businesses can use Razorpay Payment Gateway?

How long does it take to set up a Razorpay merchant account?

What are the charges associated with a Payment Gateway?

How long will it take to integrate Razorpay into my website?

How does Razorpay protect customer & transaction data?

What happens if my Payment Gateway account is inactive for a long time?

Is there a demo or trial available for Razorpay Payment Gateway before committing to a plan?

What is a Payment Gateway?

What types of platforms and integrations are supported by Razorpay Payment Gateway?

Does Razorpay provide international payments support?

With MoneySaver Export Account, businesses and freelancers can accept international bank transfers via SWIFT, ACH, SEPA, or FPS, with settlement in INR to their Indian bank accounts. Razorpay also enables non-Indian businesses to unlock the Indian market by accepting seamless payments from Indian customers. Businesses can accept payments using UPI – India’s favourite payment method, net banking and credit and debit cards, with support for both subscriptions and one-time payments. The funds are settled directly in their foreign bank accounts, in a currency of their choice.

What types of businesses can use Razorpay Payment Gateway?

How long does it take to set up a Razorpay merchant account?

What are the charges associated with a Payment Gateway?

How long will it take to integrate Razorpay into my website?

How does Razorpay protect customer & transaction data?

What happens if my Payment Gateway account is inactive for a long time?

Is there a demo or trial available for Razorpay Payment Gateway before committing to a plan?

Simple pricing, no hidden charges

With no setup or maintenance fees and one of the lowest transaction charges in the industry, pay only when you get paid!

Standard Plan

2%*

Razorpay platform fee

Get access to Flash Checkout, Dashboard, Reports & much more

*GST applicable. Instruments like Diners and Amex Cards, International Cards, EMI (Credit Card, Debit Card & Cardless) & Corporate (Business) Credit Cards will be charged at 3%

One-Time Setup Fee

₹ 0.00

No setup fee

Annual Maintenance Fee

₹ 0.00

No maintenance fee

Use Razorpay Payment Gateway with our other products

Invoices

Send your customers GST compliant invoices with item level details to accept online payments through debit/credit cards, netbanking, wallets, UPI etc.

Payment Pages

Create custom-branded, hosted Payment Pages in a few clicks to accept payments online. Your business can go online with zero integration and tech efforts.

Supercharge your business with Razorpay

Supercharge your business with Razorpay

Supercharge your business with Razorpay

Sign up now to experience the future of payments and offer your customers the best checkout experience.

Quick onboarding

Access to entire product suite

API access

24x7 support

Razorpay is the only payments solution in India that allows businesses to accept, process and disburse payments with its product suite. It gives you access to all payment modes including credit card, debit card, netbanking, UPI and popular wallets including JioMoney, Mobikwik, Airtel Money, FreeCharge, Ola Money and PayZapp.

RazorpayX supercharges your business banking experience, bringing effectiveness, efficiency, and excellence to all financial processes. With RazorpayX, businesses can get access to fully-functional current accounts, supercharge their payouts and automate payroll compliance.

Manage your marketplace, automate bank transfers, collect recurring payments, share invoices with customers and avail working capital loans - all from a single platform. Fast forward your business with Razorpay.

Disclaimer: The RazorpayX powered Current Account and VISA corporate credit card are provided by RBI licensed banks. Your RazorpayX powered current account is provided by our partner banks i.e, ICICI, RBL, Yes bank, in accordance with RBI regulations. RazorpayX itself is not a bank and doesn't hold or claim to hold a banking license.

ACCEPT PAYMENTS

PAYROLL

BECOME A PARTNER

DEVELOPERS

SOLUTIONS

COMPANY

HELP & SUPPORT

REGD. OFFICE ADDRESS

Razorpay Software Private Limited,1st Floor, SJR Cyber,22 Laskar Hosur Road, Adugodi,Bengaluru, 560030,Karnataka, India CIN:U72200KA2013PTC097389 © Razorpay 2024All Rights Reserved Razorpay Software Private Limited (RSPL) is an RBI Autorised Online Payment Aggregator

Razorpay is the only payments solution in India that allows businesses to accept, process and disburse payments with its product suite. It gives you access to all payment modes including credit card, debit card, netbanking, UPI and popular wallets including JioMoney, Mobikwik, Airtel Money, FreeCharge, Ola Money and PayZapp.

RazorpayX supercharges your business banking experience, bringing effectiveness, efficiency, and excellence to all financial processes. With RazorpayX, businesses can get access to fully-functional current accounts, supercharge their payouts and automate payroll compliance.

Manage your marketplace, automate bank transfers, collect recurring payments, share invoices with customers and avail working capital loans - all from a single platform. Fast forward your business with Razorpay.

Disclaimer: The RazorpayX powered Current Account and VISA corporate credit card are provided by RBI licensed banks. Your RazorpayX powered current account is provided by our partner banks i.e, ICICI, RBL, Yes bank, in accordance with RBI regulations. RazorpayX itself is not a bank and doesn't hold or claim to hold a banking license.

ACCEPT PAYMENTS

PAYROLL

BECOME A PARTNER

DEVELOPERS

SOLUTIONS

COMPANY

HELP & SUPPORT

Razorpay is the only payments solution in India that allows businesses to accept, process and disburse payments with its product suite. It gives you access to all payment modes including credit card, debit card, netbanking, UPI and popular wallets including JioMoney, Mobikwik, Airtel Money, FreeCharge, Ola Money and PayZapp.

RazorpayX supercharges your business banking experience, bringing effectiveness, efficiency, and excellence to all financial processes. With RazorpayX, businesses can get access to fully-functional current accounts, supercharge their payouts and automate payroll compliance.

Manage your marketplace, automate bank transfers, collect recurring payments, share invoices with customers and avail working capital loans - all from a single platform. Fast forward your business with Razorpay.

Disclaimer: The RazorpayX powered Current Account and VISA corporate credit card are provided by RBI licensed banks. Your RazorpayX powered current account is provided by our partner banks i.e, ICICI, RBL, Yes bank, in accordance with RBI regulations. RazorpayX itself is not a bank and doesn't hold or claim to hold a banking license.

ACCEPT PAYMENTS

PAYROLL

BECOME A PARTNER

DEVELOPERS

SOLUTIONS

COMPANY

HELP & SUPPORT

REGD. OFFICE ADDRESS

Razorpay Software Private Limited,1st Floor, SJR Cyber,22 Laskar Hosur Road, Adugodi,Bengaluru, 560030,Karnataka, India CIN:U72200KA2013PTC097389 © Razorpay 2024All Rights Reserved Razorpay Software Private Limited (RSPL) is an RBI Autorised Online Payment Aggregator

Razorpay is the only payments solution in India that allows businesses to accept, process and disburse payments with its product suite. It gives you access to all payment modes including credit card, debit card, netbanking, UPI and popular wallets including JioMoney, Mobikwik, Airtel Money, FreeCharge, Ola Money and PayZapp.

RazorpayX supercharges your business banking experience, bringing effectiveness, efficiency, and excellence to all financial processes. With RazorpayX, businesses can get access to fully-functional current accounts, supercharge their payouts and automate payroll compliance.

Manage your marketplace, automate bank transfers, collect recurring payments, share invoices with customers and avail working capital loans - all from a single platform. Fast forward your business with Razorpay.

Disclaimer: The RazorpayX powered Current Account and VISA corporate credit card are provided by RBI licensed banks. Your RazorpayX powered current account is provided by our partner banks i.e, ICICI, RBL, Yes bank, in accordance with RBI regulations. RazorpayX itself is not a bank and doesn't hold or claim to hold a banking license.

ACCEPT PAYMENTS

PAYROLL

BECOME A PARTNER

DEVELOPERS

SOLUTIONS

COMPANY

HELP & SUPPORT

REGD. OFFICE ADDRESS

Razorpay Software Private Limited,1st Floor, SJR Cyber,22 Laskar Hosur Road, Adugodi,Bengaluru, 560030,Karnataka, India CIN:U72200KA2013PTC097389 © Razorpay 2024All Rights Reserved Razorpay Software Private Limited (RSPL) is an RBI Autorised Online Payment Aggregator