RAZORPAYX CORPORATE CARD

One card,

many possibilities

RazorpayX Corporate Card - One card,

many possibilities

RazorpayX Corporate Card - One card,

many possibilities

RazorpayX Corporate Card - One card,

many possibilities

Designed for corporate powerhouses, growth-oriented organisations and industry leaders.

Designed for corporate powerhouses, growth-oriented organisations and industry leaders.

Designed for corporate powerhouses, growth-oriented organisations and industry leaders.

Designed for corporate powerhouses, growth-oriented organisations and industry leaders.

Higher credit limit | No collateral | 24/7 Support | Trusted & Reliable

Higher credit limit | No collateral | 24/7 Support | Trusted & Reliable

Higher credit limit | No collateral | 24/7 Support | Trusted & Reliable

Higher credit limit | No collateral | 24/7 Support | Trusted & Reliable

Powered By

Your ambitions are limitless.

Your rewards should be too.

Your ambitions are limitless.

Your rewards should be too.

Your ambitions are limitless.

Your rewards should be too.

Get industry-best offers on 500+ SaaS offers. Save up to Rs. 2,00,000 annually.

Get industry-best offers on 500+ SaaS offers. Save up to Rs. 2,00,000 annually.

Get industry-best offers on 500+ SaaS offers. Save up to Rs. 2,00,000 annually.

Your ambitions are limitless.

Your rewards should be too.

Get industry-best offers on 500+ SaaS offers. Save up to Rs. 2,00,000 annually.

Your ambitions are limitless. Your rewards should be too.

Get industry-best SaaS offers.

Save up to Rs.2,00,000 annually.

Explore business

discounts on several

Razorpay products.

Explore exclusive business discounts

on several Razorpay Products.

Explore business

discounts on several

Razorpay products.

Explore business

discounts on several

Razorpay products.

Exclusively for existing Razorpay users.

Exclusively for existing Razorpay users.

Exclusively for existing Razorpay users.

Exclusively for existing Razorpay users.

Explore business

discounts on several

Razorpay products.

Exclusively for existing Razorpay users.

Credit where

credit is due.

Credit where credit is due.

Credit where

credit is due.

Credit where

credit is due.

Enjoy higher credit limits tailored to your

business’s unique needs, up to Rs. 25 crores.

No collateral required.

Power your business with every swipe. Enjoy Higher Credit Limits tailored

to your business’s unique needs, up to Rs. 25 crores.

Enjoy higher credit limits tailored to your

business’s unique needs, up to Rs. 25 crores.

No collateral required.

Enjoy higher credit limits tailored to your

business’s unique needs, up to Rs. 25 crores.

No collateral required.

Credit where

credit is due.

Enjoy higher credit limits tailored to your

business’s unique needs, up to Rs. 25 crores.

No collateral required.

Trust first, second

and always.

Trust first, second and always.

Trust first, second

and always.

Trust first, second

and always.

Our trusted and reliable banking partners ensure the

highest standards of governance, compliance & risk

management.

Our trusted and reliable banking partners ensure the highest standards

of governance, compliance & risk management.

Our trusted and reliable banking partners ensure the

highest standards of governance, compliance & risk

management.

Our trusted and reliable banking partners ensure the

highest standards of governance, compliance & risk

management.

Trust first, second

and always.

Our trusted and reliable banking partners ensure the highest standards of governance, compliance & risk management.

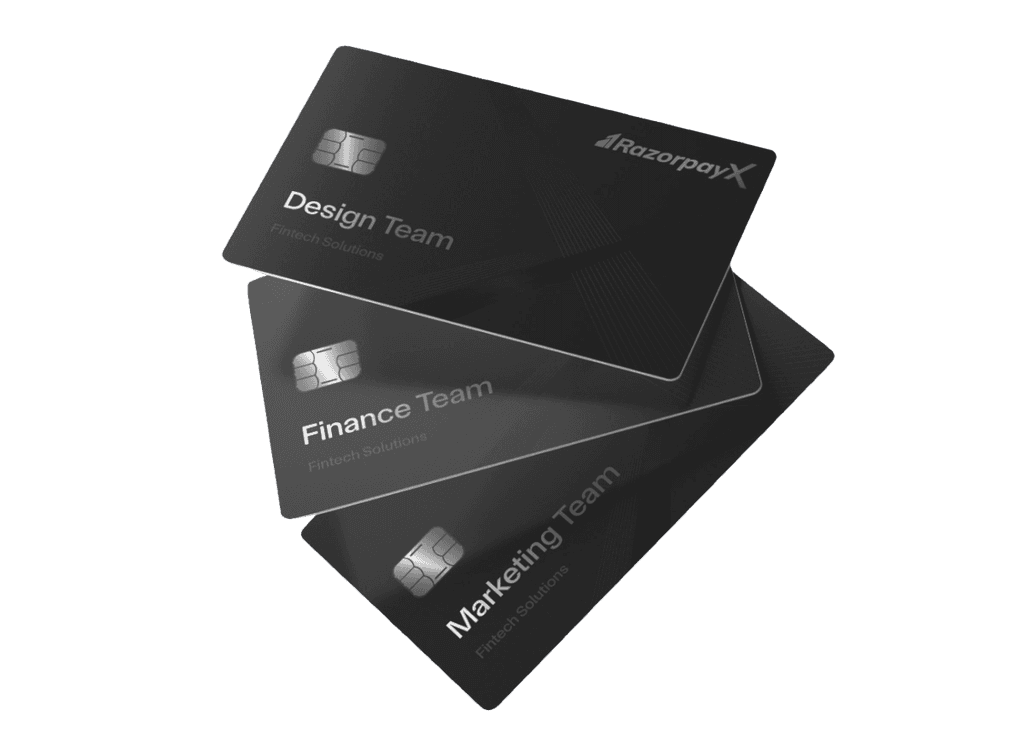

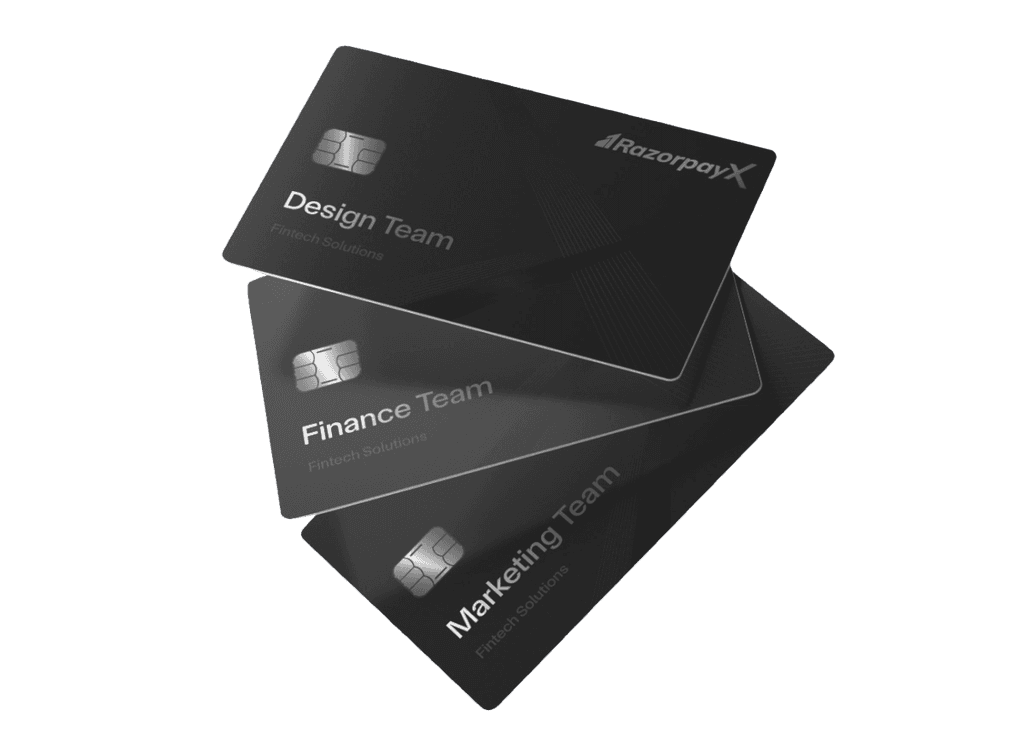

Add-on Cards on your terms

Add-on Cards on your terms

Add-on Cards on your terms

Get unlimited Add-on cards for your team and maximise your savings.

Get unlimited Add-on cards for your team and maximise your savings.

Get unlimited Add-on cards for your team and maximise your savings.

Unlimited cards for

your team members

at zero fees

Unlimited cards for your

team members at zero fees

Unlimited cards for

your team members

at zero fees

Change spending

limits and lock/

unlock anytime

Change spending limits

and lock/ unlock anytime

Change spending

limits and lock/

unlock anytime

Add-on Cards

on your terms

Get unlimited Add-on cards for your

team and maximise your savings.

Unlimited cards for your team members at zero fees

Change spending limits and lock/ unlock anytime

Everything you wished for,

in one card.

Everything you wished for,

in one card.

Everything

you wished for,

in one card.

Everything you wished for,

in one card.

No security deposit, no personal

guarantees and real business savings

No security deposit, no personal guarantees and real business savings

No security deposit, no personal

guarantees and real business savings

No security deposit, no personal

guarantees and real business savings

Higher credit limit with even more

limit for Razorpay users

Higher credit limit with even more limit for Razorpay users

Higher credit limit with even more

limit for Razorpay users

Higher credit limit with even more

limit for Razorpay users

International transaction at low forex fee

International transaction at low forex fee

International transaction at low forex fee

International transaction at low forex fee

Seamless team spends, non-card vendor

payments, marketing spends and much more

Seamless team spends, non-card vendor payments, marketing spends and much more

Seamless team spends, non-card vendor

payments, marketing spends and much more

Seamless team spends, non-card vendor payments, marketing spends and much more

Seamless team spends, non-card vendor payments, marketing spends and much more

Seamless team spends, non-card vendor

payments, marketing spends and much more

Spend smarter. Save better.

Spend smarter. Save better.

Financial Benefits

Financial Benefits

Higher credit limits tailored to your needs

Higher credit limits tailored to your needs

Interest-free credit for up to 50 days

Interest-free credit for up to 50 days

Exclusive discounts on 500+ software tools

Exclusive discounts on 500+ software tools

Low forex fee

Low forex fee

Control & Efficiency

Control & Efficiency

Easy statements & payments

Easy statements & payments

Floater limit

Floater limit

Multiple billing cycles

Multiple billing cycles

Dedicated support for any queries

Dedicated support for any queries

Spend smarter. Save better.

Financial Benefits

Higher credit limits tailored to your needs

Interest-free credit for up to 50 days

Exclusive discounts on 500+ software tools

Low forex fee

Control & Efficiency

Easy statements & payments

Floater limit

Multiple billing cycles

Dedicated support for any queries

Spend smarter.

Save better.

Financial Benefits

Higher credit limits tailored to your needs

Interest-free credit for up to 50 days

Exclusive discounts on 500+ software tools

Low forex fee

Control & Efficiency

Easy statements & payments

Floater limit

Multiple billing cycles

Dedicated support for any queries

Ready. Steady. Grow!

Swipe for success

Swipe for success

Ready. Steady. Grow!

Swipe for success

Ready. Steady. Grow!

Swipe for success

Frequently Asked Questions

Frequently Asked Questions

Frequently Asked Questions

Explore our FAQ section to find answers about RazorpayX's Corporate Cards Program

Explore our FAQ section to find answers about RazorpayX's Corporate Cards Program

Explore our FAQ section to find answers about RazorpayX's Corporate Cards Program

What is a RazorpayX Corporate Card?

How does RazorpayX Corporate Card work?

How are RazorpayX Corporate Cards different from other corporate cards?

How to apply for a RazorpayX Corporate Card?

Can I use RazorpayX Corporate Card for personal use?

Will my credit score be affected if I use RazorpayX Corporate Card?

What is a RazorpayX Corporate Card?

How does RazorpayX Corporate Card work?

How are RazorpayX Corporate Cards different from other corporate cards?

How to apply for a RazorpayX Corporate Card?

Can I use RazorpayX Corporate Card for personal use?

Will my credit score be affected if I use RazorpayX Corporate Card?

What is a RazorpayX Corporate Card?

How does RazorpayX Corporate Card work?

How are RazorpayX Corporate Cards different from other corporate cards?

How to apply for a RazorpayX Corporate Card?

Can I use RazorpayX Corporate Card for personal use?

Will my credit score be affected if I use RazorpayX Corporate Card?

What is a RazorpayX Corporate Card?

How does RazorpayX Corporate Card work?

How are RazorpayX Corporate Cards different from other corporate cards?

How to apply for a RazorpayX Corporate Card?

Can I use RazorpayX Corporate Card for personal use?

Will my credit score be affected if I use RazorpayX Corporate Card?

What is a RazorpayX Corporate Card?

How does RazorpayX Corporate Card work?

How are RazorpayX Corporate Cards different from other corporate cards?

How to apply for a RazorpayX Corporate Card?

Can I use RazorpayX Corporate Card for personal use?

Will my credit score be affected if I use RazorpayX Corporate Card?

What is a RazorpayX Corporate Card?

How does RazorpayX Corporate Card work?

How are RazorpayX Corporate Cards different from other corporate cards?

How to apply for a RazorpayX Corporate Card?

Can I use RazorpayX Corporate Card for personal use?

Will my credit score be affected if I use RazorpayX Corporate Card?

Razorpay is the only payments solution in India that allows businesses to accept, process and disburse payments with its product suite. It gives you access to all payment modes including credit card, debit card, netbanking, UPI and popular wallets including JioMoney, Mobikwik, Airtel Money, FreeCharge, Ola Money and PayZapp.

RazorpayX supercharges your business banking experience, bringing effectiveness, efficiency, and excellence to all financial processes. With RazorpayX, businesses can get access to fully-functional current accounts, supercharge their payouts and automate payroll compliance.

Manage your marketplace, automate bank transfers, collect recurring payments, share invoices with customers and avail working capital loans - all from a single platform. Fast forward your business with Razorpay.

Disclaimer: The RazorpayX powered Current Account and VISA corporate credit card are provided by RBI licensed banks. Your RazorpayX powered current account is provided by our partner banks i.e, ICICI, RBL, Yes bank, in accordance with RBI regulations. RazorpayX itself is not a bank and doesn't hold or claim to hold a banking license.

ACCEPT PAYMENTS

PAYROLL

BECOME A PARTNER

DEVELOPERS

SOLUTIONS

COMPANY

HELP & SUPPORT

Razorpay is the only payments solution in India that allows businesses to accept, process and disburse payments with its product suite. It gives you access to all payment modes including credit card, debit card, netbanking, UPI and popular wallets including JioMoney, Mobikwik, Airtel Money, FreeCharge, Ola Money and PayZapp.

RazorpayX supercharges your business banking experience, bringing effectiveness, efficiency, and excellence to all financial processes. With RazorpayX, businesses can get access to fully-functional current accounts, supercharge their payouts and automate payroll compliance.

Manage your marketplace, automate bank transfers, collect recurring payments, share invoices with customers and avail working capital loans - all from a single platform. Fast forward your business with Razorpay.

Disclaimer: The RazorpayX powered Current Account and VISA corporate credit card are provided by RBI licensed banks. Your RazorpayX powered current account is provided by our partner banks i.e, ICICI, RBL, Yes bank, in accordance with RBI regulations. RazorpayX itself is not a bank and doesn't hold or claim to hold a banking license.

ACCEPT PAYMENTS

PAYROLL

BECOME A PARTNER

DEVELOPERS

SOLUTIONS

COMPANY

HELP & SUPPORT

Razorpay is the only payments solution in India that allows businesses to accept, process and disburse payments with its product suite. It gives you access to all payment modes including credit card, debit card, netbanking, UPI and popular wallets including JioMoney, Mobikwik, Airtel Money, FreeCharge, Ola Money and PayZapp.

RazorpayX supercharges your business banking experience, bringing effectiveness, efficiency, and excellence to all financial processes. With RazorpayX, businesses can get access to fully-functional current accounts, supercharge their payouts and automate payroll compliance.

Manage your marketplace, automate bank transfers, collect recurring payments, share invoices with customers and avail working capital loans - all from a single platform. Fast forward your business with Razorpay.

Disclaimer: The RazorpayX powered Current Account and VISA corporate credit card are provided by RBI licensed banks. Your RazorpayX powered current account is provided by our partner banks i.e, ICICI, RBL, Yes bank, in accordance with RBI regulations. RazorpayX itself is not a bank and doesn't hold or claim to hold a banking license.

ACCEPT PAYMENTS

PAYROLL

BECOME A PARTNER

DEVELOPERS

SOLUTIONS

COMPANY

HELP & SUPPORT

Razorpay is the only payments solution in India that allows businesses to accept, process and disburse payments with its product suite. It gives you access to all payment modes including credit card, debit card, netbanking, UPI and popular wallets including JioMoney, Mobikwik, Airtel Money, FreeCharge, Ola Money and PayZapp.

RazorpayX supercharges your business banking experience, bringing effectiveness, efficiency, and excellence to all financial processes. With RazorpayX, businesses can get access to fully-functional current accounts, supercharge their payouts and automate payroll compliance.

Manage your marketplace, automate bank transfers, collect recurring payments, share invoices with customers and avail working capital loans - all from a single platform. Fast forward your business with Razorpay.

Disclaimer: The RazorpayX powered Current Account and VISA corporate credit card are provided by RBI licensed banks. Your RazorpayX powered current account is provided by our partner banks i.e, ICICI, RBL, Yes bank, in accordance with RBI regulations. RazorpayX itself is not a bank and doesn't hold or claim to hold a banking license.

ACCEPT PAYMENTS

PAYROLL

BECOME A PARTNER

DEVELOPERS

SOLUTIONS

COMPANY

HELP & SUPPORT

Razorpay is the only payments solution in India that allows businesses to accept, process and disburse payments with its product suite. It gives you access to all payment modes including credit card, debit card, netbanking, UPI and popular wallets including JioMoney, Mobikwik, Airtel Money, FreeCharge, Ola Money and PayZapp.

RazorpayX supercharges your business banking experience, bringing effectiveness, efficiency, and excellence to all financial processes. With RazorpayX, businesses can get access to fully-functional current accounts, supercharge their payouts and automate payroll compliance.

Manage your marketplace, automate bank transfers, collect recurring payments, share invoices with customers and avail working capital loans - all from a single platform. Fast forward your business with Razorpay.

Disclaimer: The RazorpayX powered Current Account and VISA corporate credit card are provided by RBI licensed banks. Your RazorpayX powered current account is provided by our partner banks i.e, ICICI, RBL, Yes bank, in accordance with RBI regulations. RazorpayX itself is not a bank and doesn't hold or claim to hold a banking license.

ACCEPT PAYMENTS

PAYROLL

BECOME A PARTNER

DEVELOPERS

SOLUTIONS

COMPANY

HELP & SUPPORT

Razorpay is the only payments solution in India that allows businesses to accept, process and disburse payments with its product suite. It gives you access to all payment modes including credit card, debit card, netbanking, UPI and popular wallets including JioMoney, Mobikwik, Airtel Money, FreeCharge, Ola Money and PayZapp.

RazorpayX supercharges your business banking experience, bringing effectiveness, efficiency, and excellence to all financial processes. With RazorpayX, businesses can get access to fully-functional current accounts, supercharge their payouts and automate payroll compliance.

Manage your marketplace, automate bank transfers, collect recurring payments, share invoices with customers and avail working capital loans - all from a single platform. Fast forward your business with Razorpay.

Disclaimer: The RazorpayX powered Current Account and VISA corporate credit card are provided by RBI licensed banks. Your RazorpayX powered current account is provided by our partner banks i.e, ICICI, RBL, Yes bank, in accordance with RBI regulations. RazorpayX itself is not a bank and doesn't hold or claim to hold a banking license.

ACCEPT PAYMENTS

PAYROLL

BECOME A PARTNER

DEVELOPERS

SOLUTIONS

COMPANY

HELP & SUPPORT