What is a Chargeback?

cardholder (end-user), and reported to their card issuing bank.

cardholder (end-user), and reported to their card issuing bank.Why Chargeback?

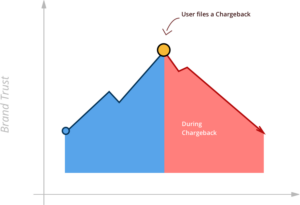

Why avoid Chargebacks?

business as a fraudulent/high risk business, hampering your image. A customer has a timeframe of 120 days to file a chargeback, which means your sales are reversible for that time period.

business as a fraudulent/high risk business, hampering your image. A customer has a timeframe of 120 days to file a chargeback, which means your sales are reversible for that time period.What’s the process to resolve a chargeback?

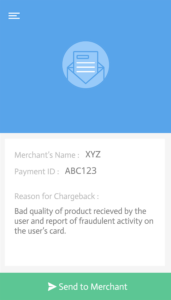

of both the customer’s bank as well as our partner banks. At Razorpay we have a process to resolve disputes/chargebacks.

of both the customer’s bank as well as our partner banks. At Razorpay we have a process to resolve disputes/chargebacks.- In order to represent the chargeback, review the chargeback and explain to us the chain of events that took place.

- In case the goods/services have not been provided, review the issue and let us know if the customer is willing to accept the goods/services.

- In case the goods/services have been provided, share the proof of deliveries, invoices, any other authorised proof of product/service delivery.

- In case of a duplicate payment made, let us know so we can ask the bank to refund the amount back to the cardholder.

How to avoid Chargebacks?

Chargebacks on International Transactions

Cross-border e-commerce can be a great way to boost sales and widen your reach to new markets and prospective buyers. But it also comes with risks related to transaction fraud, identity theft fraud & fraud related to misuse of policies among other risks. Therefore, every business that is looking to expand business across the border, needs to be aware upfront about what it is up against. Businesses usually cite cross-border payments fraud as one of their major concerns. Following is the elaboration on some of the key areas to be aware about and to remember before starting to accept cross border business :

a) Type of Authentications for International Transactions (3DS Vs Non-3DS) :

3D Secure (3DS) is an additional security step of authentication of the card (as well as the cardholder) that is initiated every time the card not present (CNP) / online transaction is made. It enhances the security measures for both the shoppers and the merchants. The 3DS authentication can happen through various means including but not limited to PIN, One-Time-Passwords, Static passwords among others. On the other side, the Non-3DS transactions are those wherein the card is not authenticated with an additional security of the 3DS. Since the card / cardholder is not verified and authenticated in such a type of transaction, it carries a heightened risk of the transaction being reported as fraudulent or even being charged back. While the participation into the 3DS authentication programs by the card networks is a prerogative of the cardholder and/or the card issuing institution, a well-informed and diligent decision is still to be made by the merchants regarding their participation in cross border card transactions, especially the non-3DS ones. The stakeholders on the acquiring side of the transaction have very limited rights of defending against chargebacks on the non-3DS transactions that are reported as frauds.

b) What is a Cross Border Transaction chargeback?

An international chargeback is a request made by a cardholder or issuing bank to reverse a transaction that was made using a card instrument (credit , debit or prepaid) that is issued outside of India (International issuance). This request is made when the cardholder disputes the transaction, either because they did not authorize it or because they are dissatisfied with the goods or services they received amongst several other reason codes.

c) How does a Cross Border Transaction differ from a domestic transaction chargeback?

An international chargeback is a chargeback that involves a transaction made in a different country than the issuing bank. This can be more complex than a domestic chargeback because it involves currency conversion and may involve different laws and regulations applicable to the country of merchant/Cardholder/Delivery destination.

d) How do I prevent International Payment Transaction chargebacks?

There are several steps you can take to prevent international chargebacks:

- Clearly communicate the terms & conditions of the transaction and refunds/returns related to it in a clear and concise way to the cardholder, including the price and any fees or taxes

- Ensure that the cardholder has authorized the transaction

- Provide high-quality goods or services that meet the expectations of the cardholder

- Respond promptly to any customer complaints or disputes

e) How can a merchant resolve an International Transaction chargeback?

If you receive a request for an international chargeback, it is important to respond promptly and provide any relevant documentation to support your case. This may include (but not limited to):

- Proof of cross border delivery

- Customs clearance copy,

- Proof of authorization by customer

- A copy of the terms and conditions of the transaction etc.

If you are unable to resolve the dispute with the cardholder, you may need to seek legal assistance.

f) Fees & Penalties for Dispute Stages

You are requested to keep a regular track of ever evolving guidelines of digital payment acceptance. Please make a note of the following table associated with fees and penalties. Your acknowledgement of the same is deemed :

| Associated Fees & Penalties for Dispute Stages | ||||

| Card Networks | ||||

| No | Dispute Stages | Mastercard | Visa | Rupay |

| 1 | Chargeback | NA | NA | NA |

| 2 | Pre Arbitration | USD 15.00 | USD 0.75 | NA |

| 3 | Arbitration | USD 520.00 | USD.500.00 | Rs.3000.00 |

——————