Embedded Payments for Platforms & Marketplaces

Embedded Payments for Platforms & Marketplaces

Unlock growth with Embedded Payments

Unlock growth with Embedded Payments

Offer end-to-end payments within your platform. Get full control of money movement while being 100% compliant.

Be 100% compliant

Be 100% compliant

Enable commerce while we take care of the evolving regulatory requirements

Launch faster!

Launch faster!

Leverage our powerful SDK & go-to-market real quick. Save cost & development time!

Unlock revenue growth

Unlock revenue growth

Discover new sources of revenue by choosing to earn a mark-up on every transaction!

Do everything with one

simple integration!

Do everything with one

simple integration!

ONBOARD CLIENTS

Give your clients a seamless

sign-up experience

Give your clients a seamless sign-up experience

Give your clients a seamless

sign-up experience

Add clients on to your platform in just minutes

Add clients on to your platform in just minutes

Add clients on to your platform in just minutes

Verify users’ identity on the fly & reduce drop-offs

Verify users’ identity on the fly & reduce drop-offs

Verify users’ identity on the fly & reduce drop-offs

Customise the look & feel of the journey

Customise the look & feel of the journey

Customise the look & feel of the journey

Witness an increase in conversions

Witness an increase in conversions

Witness an increase in conversions

ACCEPT PAYMENTS

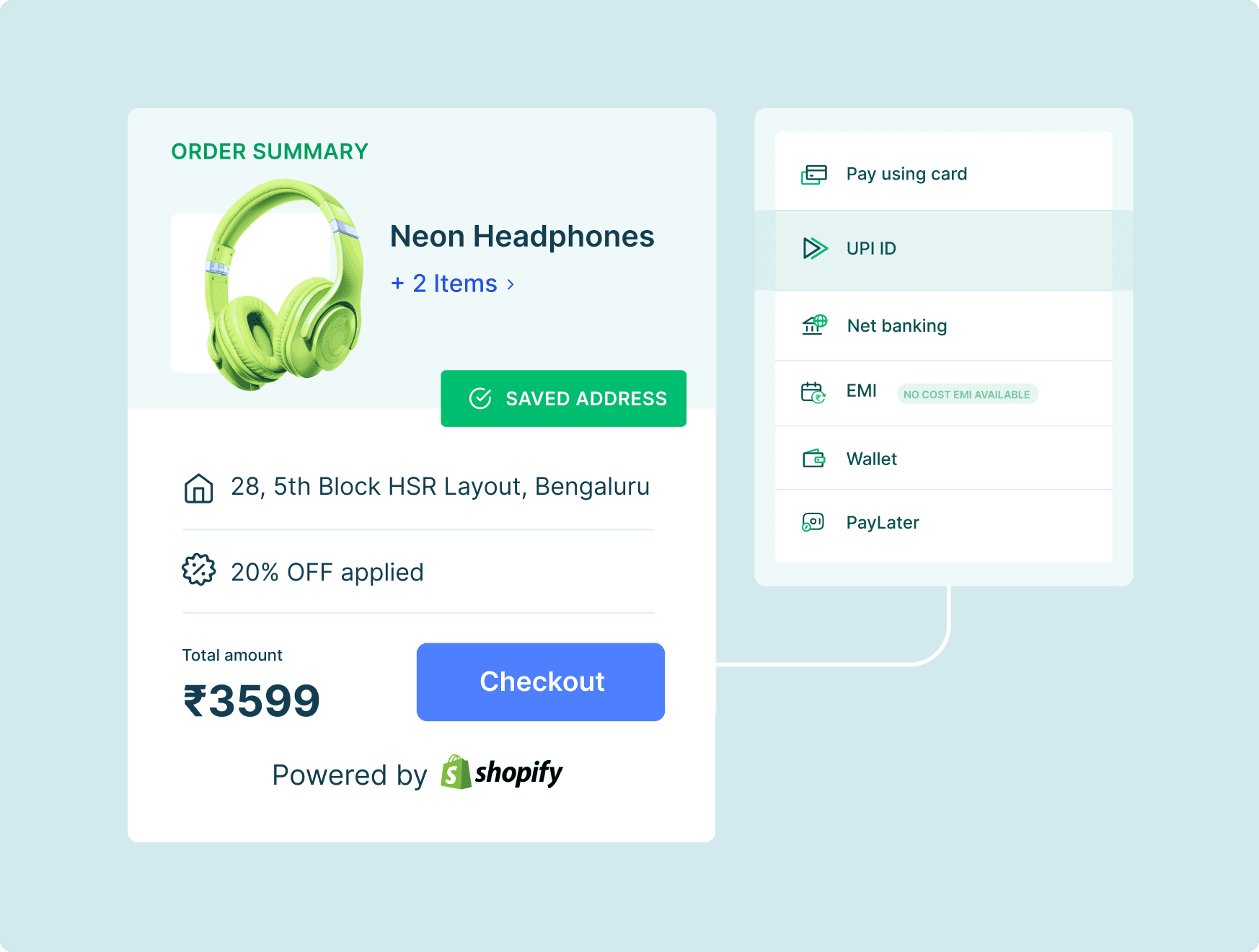

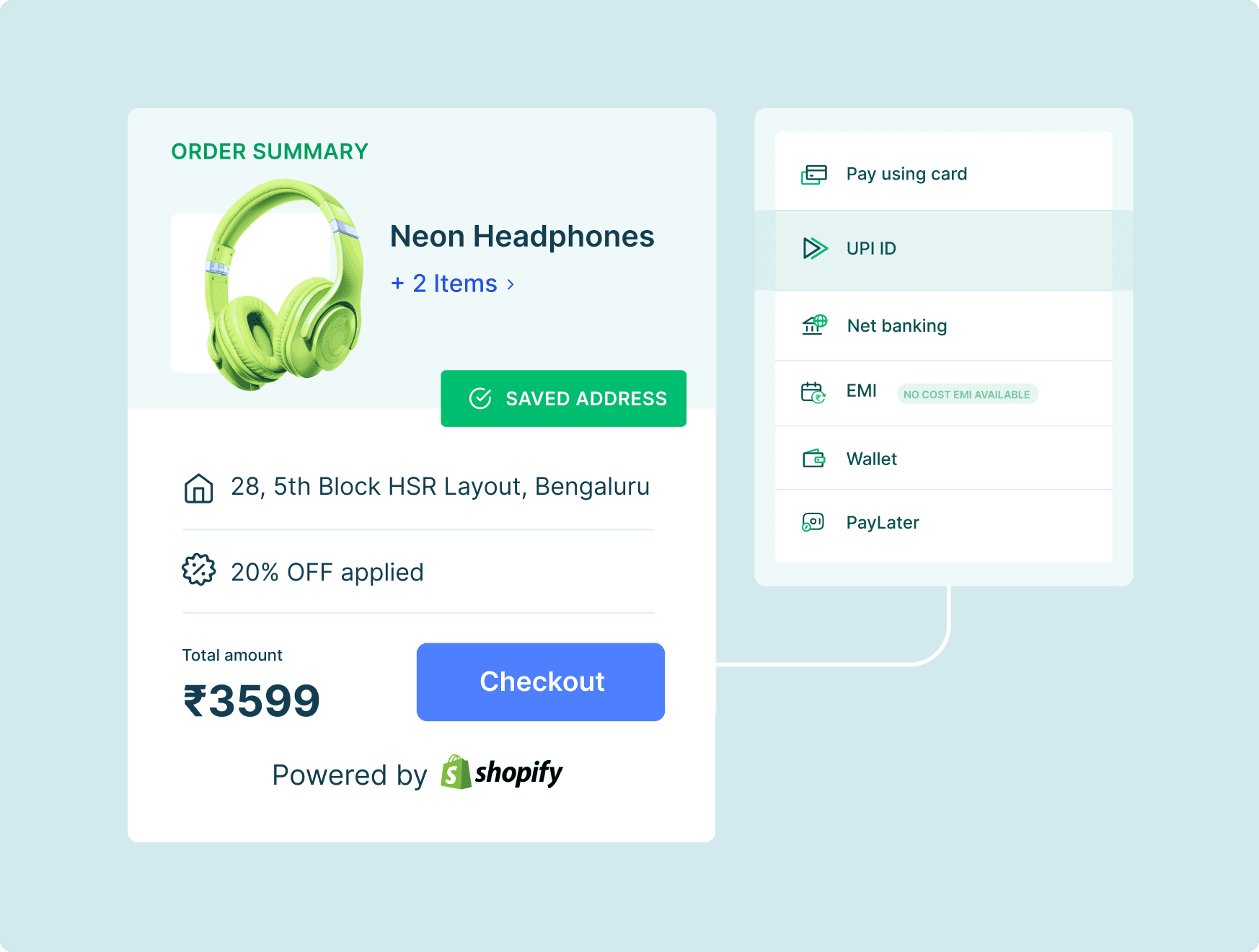

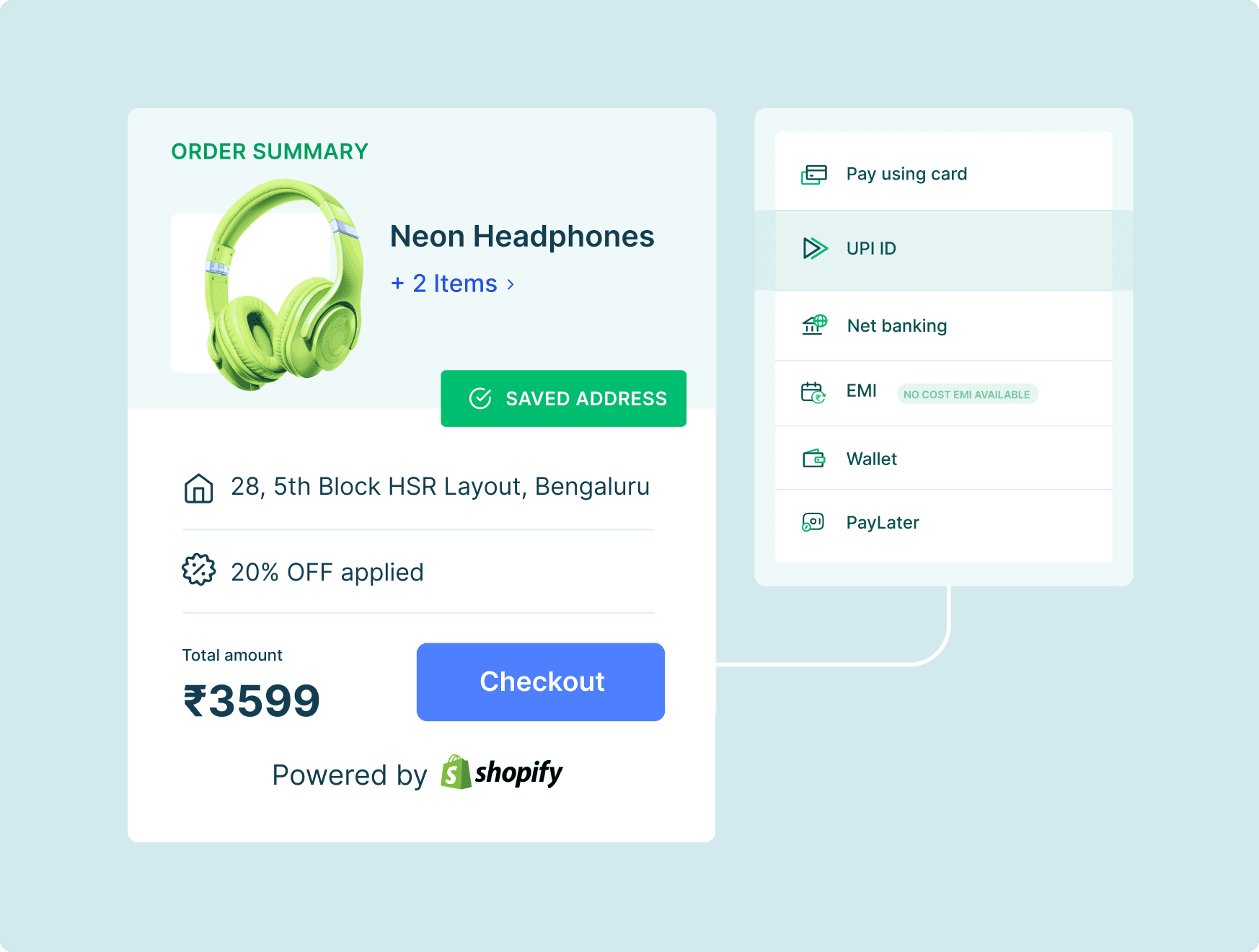

Accept & Process Payments on your platform, across channels

Accept & Process Payments on your platform, across channels

Offer 100+ payment modes within your platform

Offer 100+ payment modes within your platform

Offer 100+ payment modes within your platform

Best-in-industry success rates with dynamic routing

Best-in-industry success rates with dynamic routing

Best-in-industry success rates with dynamic routing

Seamless payments experience across channels

Seamless payments experience across channels

Seamless payments experience across channels

Witness a spike in your conversions

Witness a spike in your conversions

Witness a spike in your conversions

CONTROL FLOW OF FUNDS

Move funds flexibly, the way

you want!

Move funds flexibly, the way you want!

Move funds flexibly, the way

you want!

Split your funds between multiple parties

Split your funds between multiple parties

Split your funds between multiple parties

Charge a mark-up on the transactions you want

Charge a mark-up on the transactions you want

Charge a mark-up on the transactions you want

Control settlements basis delivery of goods or service

Control settlements basis delivery of goods or service

Control settlements basis delivery of goods or service

Manage refunds & disputes with pre-built workflows

Manage refunds & disputes with pre-built workflows

Manage refunds & disputes with pre-built workflows

360° VIEW OF DATA

Monitor all transaction data

from one dashboard

Monitor all transaction data from one dashboard

Monitor all transaction data

from one dashboard

Track & Reconcile with ease

Track & Reconcile with ease

Track & Reconcile with ease

Customised dashboard for all parties

Customised dashboard for all parties

Customised dashboard for all parties

Instant notifications & alerts on-the-go

Instant notifications & alerts on-the-go

Instant notifications & alerts on-the-go

Schedule Data reports in your inbox

Schedule Data reports in your inbox

Schedule Data reports in your inbox

Ready to get started?

Ready to get started?

Reach out to know how Embedded Payments can help your platform in- getting more users, engaging with them, and retaining them. Discover new revenue streams along the way!

Frequently Asked Questions

Frequently Asked Questions

What is Embedded Payments for Platforms & Marketplaces?

What kind of businesses can use Embedded Payments?

Do I need to use all the modules that are a part of Embedded Payments?

How do I drive growth for my business using Embedded Payments?

Is there a possibility to customize the modules per my business’ needs?

Is there a separate integration for every module?

How can I get started with Embedded Payments?

What is Embedded Payments for Platforms & Marketplaces?

What kind of businesses can use Embedded Payments?

Do I need to use all the modules that are a part of Embedded Payments?

How do I drive growth for my business using Embedded Payments?

Is there a possibility to customize the modules per my business’ needs?

Is there a separate integration for every module?

How can I get started with Embedded Payments?

What is Embedded Payments for Platforms & Marketplaces?

What kind of businesses can use Embedded Payments?

Do I need to use all the modules that are a part of Embedded Payments?

How do I drive growth for my business using Embedded Payments?

Is there a possibility to customize the modules per my business’ needs?

Is there a separate integration for every module?

How can I get started with Embedded Payments?

Razorpay is the only payments solution in India that allows businesses to accept, process and disburse payments with its product suite. It gives you access to all payment modes including credit card, debit card, netbanking, UPI and popular wallets including JioMoney, Mobikwik, Airtel Money, FreeCharge, Ola Money and PayZapp.

RazorpayX supercharges your business banking experience, bringing effectiveness, efficiency, and excellence to all financial processes. With RazorpayX, businesses can get access to fully-functional current accounts, supercharge their payouts and automate payroll compliance.

Manage your marketplace, automate bank transfers, collect recurring payments, share invoices with customers and avail working capital loans - all from a single platform. Fast forward your business with Razorpay.

Disclaimer: The RazorpayX powered Current Account and VISA corporate credit card are provided by RBI licensed banks. Your RazorpayX powered current account is provided by our partner banks i.e, ICICI, RBL, Yes bank, in accordance with RBI regulations. RazorpayX itself is not a bank and doesn't hold or claim to hold a banking license.

LENDING

BECOME A PARTNER

ACCEPT PAYMENTS

DEVELOPERS

SOLUTIONS

COMPANY

HELP & SUPPORT

Razorpay is the only payments solution in India that allows businesses to accept, process and disburse payments with its product suite. It gives you access to all payment modes including credit card, debit card, netbanking, UPI and popular wallets including JioMoney, Mobikwik, Airtel Money, FreeCharge, Ola Money and PayZapp.

RazorpayX supercharges your business banking experience, bringing effectiveness, efficiency, and excellence to all financial processes. With RazorpayX, businesses can get access to fully-functional current accounts, supercharge their payouts and automate payroll compliance.

Manage your marketplace, automate bank transfers, collect recurring payments, share invoices with customers and avail working capital loans - all from a single platform. Fast forward your business with Razorpay.

Disclaimer: The RazorpayX powered Current Account and VISA corporate credit card are provided by RBI licensed banks. Your RazorpayX powered current account is provided by our partner banks i.e, ICICI, RBL, Yes bank, in accordance with RBI regulations. RazorpayX itself is not a bank and doesn't hold or claim to hold a banking license.

LENDING

BECOME A PARTNER

ACCEPT PAYMENTS

DEVELOPERS

SOLUTIONS

COMPANY

HELP & SUPPORT

Razorpay is the only payments solution in India that allows businesses to accept, process and disburse payments with its product suite. It gives you access to all payment modes including credit card, debit card, netbanking, UPI and popular wallets including JioMoney, Mobikwik, Airtel Money, FreeCharge, Ola Money and PayZapp.

RazorpayX supercharges your business banking experience, bringing effectiveness, efficiency, and excellence to all financial processes. With RazorpayX, businesses can get access to fully-functional current accounts, supercharge their payouts and automate payroll compliance.

Manage your marketplace, automate bank transfers, collect recurring payments, share invoices with customers and avail working capital loans - all from a single platform. Fast forward your business with Razorpay.

Disclaimer: The RazorpayX powered Current Account and VISA corporate credit card are provided by RBI licensed banks. Your RazorpayX powered current account is provided by our partner banks i.e, ICICI, RBL, Yes bank, in accordance with RBI regulations. RazorpayX itself is not a bank and doesn't hold or claim to hold a banking license.

LENDING

BECOME A PARTNER

ACCEPT PAYMENTS

DEVELOPERS

SOLUTIONS

COMPANY

HELP & SUPPORT