Supercharge your business with Razorpay Payment Gateway

With the easiest integration, completely online onboarding, feature filled checkout and best in class performance, quickly go live with Razorpay and experience the future of payments.

A System Designed to Handle End to End Payments

Accept All Payment Modes

With Domestic and International Credit & Debit cards, EMIs ( Credit/Debit Cards & Cardless), PayLater, Netbanking from 58 banks, UPI and 8 mobile wallets, Razorpay provides the most extensive set of payment methods.

Checkout and Global Card Saving

An easy to integrate Checkout with cards saved across businesses so that your customers can pay seamlessly everywhere.

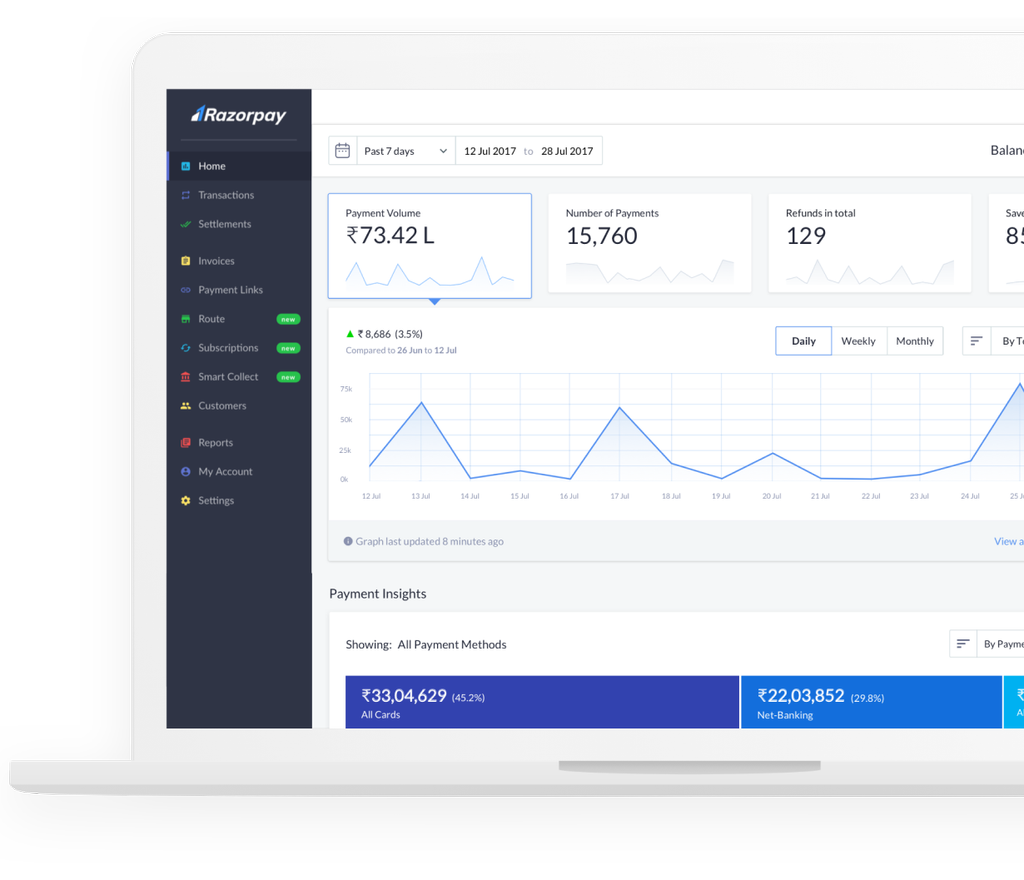

Powerful Dashboard

Get reports and detailed statistics on payments, settlements, refunds and much more for you to take better business decisions.

Built for Developers

Robust, clean, developer friendly APIs, plugins and libraries for all major languages and platforms that let you focus on building great products.

Robust Security

PCI DSS Level 1 compliant along with frequent third party audits and a dedicated internal security team to make sure your data is always safe.

Flash Checkout

Tap into a store of 4 million+ saved cards and say goodbye to requiring customers to type card details every time.

Better Conversions than ever

Flaunt your Brand with Custom UI

Easy Integration with less code

4+ Million saved cards across businesses

Personalised payment experience for every user

Native OTP

A Powerful dashboard to give you full control

Access and manage your payments, refunds, transfers, subscriptions, invoices, customer identifiers, API keys, webhooks, account and everything else.

See Key Statistics

Get access to real-time data and insights to take informed business decisions. View important stats and generate customizable settlement and reconciliation reports.

Easy to Use

We understand that when it comes to managing payments, speed and ease of use is what matters at the end of the day. We've spent endless hours to make it a great experience for you.

Get onboarded and start accepting payments within minutes.

Seamless onboarding with minimum documentation

Track payments on the go

Accept payments & issue refunds with a single click

Get detailed payments insights

Download the app now!

The Easiest Integration Ever

Integrating payments with Razorpay is as simple as it can get with well documented SDKs, RESTful APIs and plugins for all major platforms and languages.

Integrating Razorpay was a breeze and we must have spent about 30 minutes doing it Unquestionably the only Indian payment gateway truly designed and built for developers.

Kailash Nadh, Head of Technology, Zerodha

Run Offers at the Click of a Button

Run all your promotional offers via the Razorpay dashboard.

Create offers at the click of a button

Define the number of users who can avail offers

Run offers for specific banks, card networks and wallets

Razorpay customers have seen a 35% increase in sales through offers.

PRO TIP

Use Razorpay Offers to run ‘No Cost EMI’ schemes for your customers.

Go Global with Razorpay

Take your business global with no additional integration costs on Razorpay’s international payment gateway. Boost conversions with international customers by allowing them to pay in their local currency.

Integrate with a few simple steps

Display local currencies

Support for 92 currencies

Real-time currency conversion

All major International cards accepted

Settlements in INR available

Frequently Asked Questions

Simple pricing, no hidden charges

With no setup or maintenance fees and one of the lowest transaction charges in the industry, pay only when you get paid!

Standard Plan

2%*

Razorpay platform fee

Get access to Flash Checkout, Dashboard, Reports & much more

*GST applicable. Instruments like Diners and Amex Cards, International Cards, EMI (Credit Card, Debit Card & Cardless) & Corporate (Business) Credit Cards will be charged at 3%

One-Time Setup Fee

₹ 0.00

No setup fee

Annual Maintenance Fee

₹ 0.00

No maintenance fee

Enterprise Plan

Large number of monthly payments on your platform? Sign up now to get started.

Sign UpExplore how you can drive more value for your business with Payment Gateway with its smart features.

Use Razorpay Payment Gateway with our other products

Invoices

Send your customers GST compliant invoices with item level details to accept online payments through debit/credit cards, netbanking, wallets, UPI etc.

Payment Pages

Create custom-branded, hosted Payment Pages in a few clicks to accept payments online. Your business can go online with zero integration and tech efforts.

Smart Collect

Now accept NEFT, RTGS and IMPS transfers through customer identifiers that can be generated on-demand with automated reconciliation for payments at scale.

Supercharge your business with Razorpay

Sign up now to experience the future of payments and offer your customers the best checkout experience.

Quick onboarding

Access to entire product suite

API access

24x7 support