Starting a franchise business in India is a lucrative opportunity for aspiring entrepreneurs. Franchising allows individuals to operate a business under an established brand with a proven business model. It offers benefits like brand recognition, operational support, and reduced risk compared to starting an independent venture.

This blog will walk you through everything you need to know about franchising in India.

Table of Contents

What Is The Meaning of Franchising a Business?

Franchising is a business model where a franchisor grants the rights to an individual (franchisee) to operate under its brand, using its products, services, and business processes. The franchisee pays a fee and agrees to operate under the franchisor’s guidelines in exchange for brand licensing, training, operational support, and marketing assistance.

The franchising model benefits both parties:

- Franchisor Benefits: Rapid expansion, increased brand reach, and revenue from franchise fees.

- Franchisee Benefits: Access to a recognised brand, reduced startup risk, and operational guidance.

Key aspects of franchising include:

- Brand Licensing: The franchisee gets permission to use the franchisor's brand name and trademarks.

- Operational Support: Training, marketing, and business strategy support are provided.

- Profit-sharing Agreements: Franchisees pay royalties or a percentage of revenue to the franchisor.

Types of Franchises

Franchises can be categorised based on their structure and operational model:

Product Distribution Franchise:

- Franchisee sells the franchisor’s products under its brand.

- Examples: Automobile dealerships (Maruti Suzuki), and soft drink bottlers (Coca-Cola).

Business Format Franchise:

- Franchisee adopts the entire business model, including operations, branding, and marketing.

- Examples: McDonald’s, Domino’s, KFC.

Manufacturing Franchise:

- Franchisee manufactures and sells the franchisor’s products under its brand name.

- Example: Food and beverage brands allowing third-party bottlers.

Job Franchise:

- A low-cost model where individuals operate small-scale service businesses.

- Examples: Cleaning services, travel agencies, real estate consultancy.

How Long Does It Take To Franchise a Business?

Franchising a business typically takes between six months to two years, depending on factors like:

- Industry type and regulatory requirements.

- Business readiness and operational scalability.

- Development of legal and training documents.

- Marketing efforts to attract franchisees.

How Much Should It Cost To Franchise a Business?

The cost to franchise a business can vary significantly based on factors like industry, business model, and support provided. On average, franchising a business may cost between ₹5 lakh to ₹50 lakh or more in India. Key expenses include:

- Franchise Fee: ₹2 lakh to ₹10 lakh (varies by brand reputation).

- Legal and Registration Fees: ₹50,000 to ₹2 lakh.

- Training and Support Costs: ₹1 lakh to ₹5 lakh.

- Marketing and Branding Expenses: ₹1 lakh to ₹3 lakh.

- Infrastructure Setup: Varies depending on the business type.

Additional factors like franchise location, infrastructure requirements, and marketing strategy impact the overall investment.

Advantages of Franchising a Business

- Rapid Expansion: Scale business operations quickly with minimal capital investment.

- Lower Financial Risk: Franchisees fund their business setup, reducing financial burden.

- Brand Recognition: Established branding makes it easier to attract customers.

- Operational Support: Franchisees receive training, marketing, and business guidance.

- Access to Motivated Franchisees: Entrepreneurs invest time and money, ensuring dedication to success.

Disadvantages of Franchising a Business

- Loss of Control: Franchisees operate independently, which can lead to inconsistencies.

- Reputation Risk: Poorly managed franchises can damage brand image.

- Legal & Financial Complexity: Requires detailed agreements and ongoing compliance.

- Ongoing Training & Support: Continuous investment in franchisee development is necessary.

Franchise Vs Licensing: What’s The Difference?

How to Start a Franchise Business - 8 Key Steps

Step 1: Determine If Franchising is Right For Your Business

Before diving into franchising, evaluate whether your business is scalable, profitable, and replicable. Ask yourself:

- Is there consistent demand for my product or service?

- Can my business model be easily duplicated in different locations

- Do I have strong branding and operational processes in place?

Not all businesses are fit for franchising. A successful franchise model requires a proven track record, solid profit margins, and strong brand appeal to attract potential franchisees.

Step 2: Protect Your Business’s Intellectual Property

Your brand is one of your most valuable assets. Before offering franchises, secure trademarks, copyrights, and proprietary processes to prevent misuse and ensure brand consistency.

Step 3: Prepare Your Franchise Disclosure Document (FDD)

The Franchise Disclosure Document (FDD) is a legal document that provides prospective franchisees with full transparency about their business. This document must comply with franchise laws and typically includes:

- Franchise fees and ongoing costs

- Training and support provided

- Franchisor and franchisee responsibilities

- Earnings potential (if disclosed)

- Legal obligations and dispute resolution process

A well-structured FDD builds trust with potential franchisees and helps you stay compliant with franchise laws.

Step 4: Draft a Franchise Agreement

The franchise agreement is a legally binding contract outlining the rights and responsibilities of both the franchisor (you) and the franchisee. Key elements to include:

- Operational guidelines – How franchisees must run the business

- Fee structure – Initial franchise fees, royalties, and marketing fund contributions

- Territory rights – The defined area where the franchisee can operate

- Training and support – What assistance franchisees will receive

- Exit clauses – Terms under which a franchise can be sold or terminated

This document ensures both parties are aligned and protects your brand from misuse.

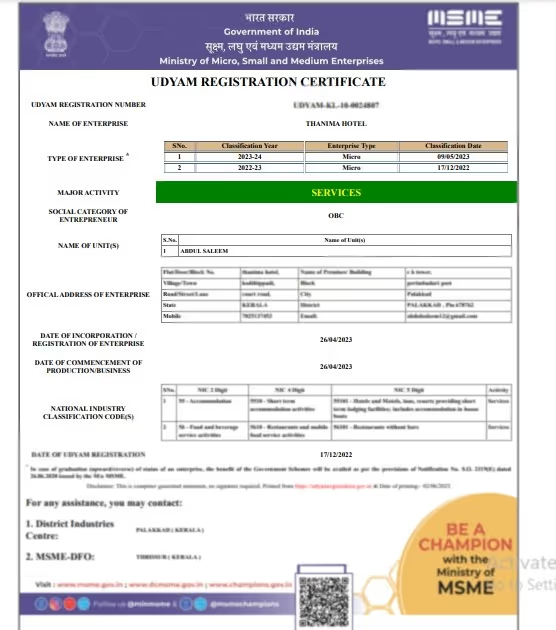

Step 5: Register Your Company

Depending on your state and region, you may need to register your franchise with government authorities before selling franchise units. Registration is not mandatory, but it is required to obtain GST registration depending on the turnover.

Head over to Razorpay Rize to Register your Company.

Step 6: Compile an Operation Manual

A franchise operations manual is a step-by-step guide that helps franchisees run the business successfully while maintaining brand consistency. It should cover:

- Day-to-day business processes

- Hiring and training staff

- Customer service guidelines

- Marketing and advertising strategies

- Financial management and reporting

Step 7: File or Register Your FDD

Once your FDD is finalised, keep it securely stored for easy access and updates as needed. While the FDD is a mandatory document, filing requirements vary by state.

Step 8: Set Strategy To Achieve Your Sales Goal

Develop marketing and recruitment strategies to attract the right franchise partners. The strategy should be tailored to your business, community, and growth objectives. Here are some effective ideas to consider:

- Provide a referral incentive for those who bring in qualified franchisee applicants.

- Develop a strategic marketing plan from the start to capture attention.

- Recruit sales professionals who understand your business and its story.

5 Strategies to Help You Succeed at Franchising

- Maintain Brand Consistency: Implement strict guidelines for uniformity across locations.

- Select the Right Franchisees: Screen candidates for skills, experience, and commitment.

- Provide Ongoing Training & Support: Regularly update franchisees with best practices.

- Implement Effective Marketing Strategies: Invest in advertising and localised promotions.

- Ensure Strong Financial Management: Monitor franchise performance and optimize cost structures.

Case Studies of Successful Franchise Businesses

Franchising is a proven business model that allows entrepreneurs to leverage established brands and systems for success. Below are examples of successful franchise businesses, showcasing their revenue, profit margins, and operational highlights.

1. McDonald's

- Industry: Quick-Service Restaurant (QSR)

- Investment: ₹6–14 crores

- Profit Margin: 50–60%

- Break-even Period: 4–5 years

McDonald’s is one of the most profitable franchises globally due to its standardized operations and strong brand recognition. In India, its franchise model offers high footfall and consistent demand, making it a lucrative investment.

2. Baskin Robbins

- Industry: Ice Cream and Dessert

- Investment: ₹10–20 lakhs

- Profit Margin: 50–60%

- Break-even Period: 6–12 months

With over 800 outlets in India, Baskin Robbins has built a strong presence in the dessert market. Its diverse flavors and year-round demand ensure steady sales and excellent returns for franchisees.

3. Haldiram

- Industry: Food and Snacks

- Investment: ₹30 lakhs–₹6 crores (depending on store format)

- Profit Margin: 50–60%

- Break-even Period: 2–3 years

Haldiram is a trusted name in Indian snacks and sweets. Its franchise model offers multiple formats, including quick-service restaurants and dine-in outlets, ensuring high profitability backed by a loyal customer base.

4. Marco’s Pizza

Marco’s Pizza achieved remarkable growth with a revenue increase of 23.5% in one year by opening 113 stores. The brand focuses on strategic revenue-boosting approaches, making it one of the fastest-growing pizza franchises globally.

5. Lenskart

- Industry: Eyewear Retail

- Investment: ₹25 lakhs

- Profit Margin: Approx. 33%

Lenskart is India’s largest eyewear brand, offering trendy products such as prescription glasses and sunglasses. With innovative features like "Try Before You Buy," its franchise model generates average monthly sales of ₹9 lakhs, making it ideal for urban markets

Final Thoughts

Franchising can be a great way to start a business without building everything from scratch. You get a known brand, a proven business model, and ongoing support but it’s not a shortcut to success. It still takes effort, investment, and commitment to make it work.

The key is choosing the right franchise. Think about what fits your skills, budget, and long-term goals. A great brand in the wrong location or with poor financial planning can still struggle. Do your homework, understand the costs, and be ready to follow the franchisor’s guidelines.

Frequently Asked Questions

Private Limited Company

(Pvt. Ltd.)

- Service-based businesses

- Businesses looking to issue shares

- Businesses seeking investment through equity-based funding

Limited Liability Partnership

(LLP)

- Professional services

- Firms seeking any capital contribution from Partners

- Firms sharing resources with limited liability

One Person Company

(OPC)

- Freelancers, Small-scale businesses

- Businesses looking for minimal compliance

- Businesses looking for single-ownership

Private Limited Company

(Pvt. Ltd.)

- Service-based businesses

- Businesses looking to issue shares

- Businesses seeking investment through equity-based funding

One Person Company

(OPC)

- Freelancers, Small-scale businesses

- Businesses looking for minimal compliance

- Businesses looking for single-ownership

Private Limited Company

(Pvt. Ltd.)

- Service-based businesses

- Businesses looking to issue shares

- Businesses seeking investment through equity-based funding

Limited Liability Partnership

(LLP)

- Professional services

- Firms seeking any capital contribution from Partners

- Firms sharing resources with limited liability

Frequently Asked Questions

How do I open up my own franchise?

To start your own franchise-

- You’ll need to create a business model that can be replicated. This involves building a strong brand, developing detailed operational processes, and ensuring your business is profitable.

- Next, you’ll need to register as a franchisor, create legal agreements (Franchise Disclosure Document & Franchise Agreement), and establish a support system for franchisees.

- Once everything is in place, you can start recruiting franchise partners.

Do I need to register my franchise?

Yes, in most countries, you need to register your franchise before offering it to potential franchisees. The requirements vary by region—some require a Franchise Disclosure Document (FDD) and legal agreements, while others may have additional licensing requirements.

Which franchise is best for beginners?

For beginners, it’s best to choose a franchise with low initial investment, strong brand recognition, and comprehensive support. Some beginner-friendly franchises include:

- Food & Beverage: Subway, Dunkin’

- Retail: Miniso, FirstCry

- Education & Coaching: Kumon, The Learning Experience

- Service-Based: Urban Company

Look for franchises with a simple operating model and strong training programs to make the transition smoother.

Which franchise is most profitable?

Profitability depends on location, investment, and management. Before investing, analyse franchise fees, profit margins, and ongoing costs to determine the best fit.

Are franchise fees monthly?

Most franchises charge ongoing royalty fees, which can be monthly, quarterly, or annually. These fees are typically a percentage of your revenue (ranging from 4% to 12%) or a fixed amount. Some franchises also charge additional marketing or operational fees.

Is licensing an alternative to franchising?

Yes, licensing can be an alternative to franchising, but it’s a different business model. In licensing, you grant permission to use your brand, trademark, or product without controlling business operations. In franchising, you provide a complete business model, training, and support while maintaining control over operations. Licensing offers more flexibility but less oversight, while franchising ensures brand consistency but comes with more regulations.