The Capital Redemption Reserve (CRR) is a statutory reserve that companies create when redeeming preference shares. It ensures financial stability by retaining an equivalent amount of capital in the business, safeguarding creditor interests and maintaining compliance with regulatory requirements.

This blog explores the definition, usage, tax benefits, and legal framework surrounding the Capital Redemption Reserve.

Table of Contents

What Is Capital Redemption Reserve?

The Capital Redemption Reserve (CRR) is a special reserve that a company must create when it redeems (buys back) its preference shares using its profits. As per corporate law, companies must transfer an amount equal to the nominal value of redeemed preference shares to the CRR to prevent capital reduction and maintain financial integrity.

When Is Capital Redemption Reserve Used?

CRR is utilised in various financial scenarios to maintain corporate stability, including:

- Issuing bonus shares: CRR can be used to issue fully paid bonus shares to shareholders.

- Funding share redemption: Ensures funds are available for preference share redemption.

- Capital reconstruction: Helps restructure a company’s capital without impacting free reserves.

- Balancing capital losses: Used in cases where capital losses need adjustment.

- Source for share buybacks: Required when companies buy back shares using free reserves.

Redemption Of Preference Capital

The redemption of preference shares is subject to the following regulations:

- Must be permitted in the Articles of Association.

- Redeemable within 20 years of issue.

- Methods of redemption:

- Using Distributable Profits: Requires CRR creation.

- Issuing Fresh Shares: CRR creation is not required if new capital is issued.

- Using Distributable Profits: Requires CRR creation.

- Shareholder Approval (75%): Required for further preference share issues.

- Premium Payment: This can be funded from company profits or the securities premium account.

Modes of Redemption

The three primary modes of redemption are:

- Using Distributable Profits: CRR creation is mandatory, equal to the nominal value of redeemed shares.

- Issuing Fresh Capital: If a company issues fresh capital equal to the redemption amount, CRR creation is not required.

- Combination of Both: CRR is required only for the portion funded through distributable profits.

Modes of Redemption of Preference Shares

Companies can redeem (buy back) preference shares using one of the following methods:

- Using Distributable Profits

The company uses its retained earnings or other profits to redeem the shares. In this case, it must create a Capital Redemption Reserve (CRR) equal to the nominal value of the redeemed shares to maintain financial stability. - Issuing Fresh Capital

The company raises funds by issuing new shares to replace the redeemed preference shares. Since this method does not reduce capital, creating a CRR is not required. - Combination of Both

A company may use both profits and fresh capital for redemption. CRR is required only for the portion funded through distributable profits, while the part covered by fresh capital does not require CRR.

{{company-reg-cta}}

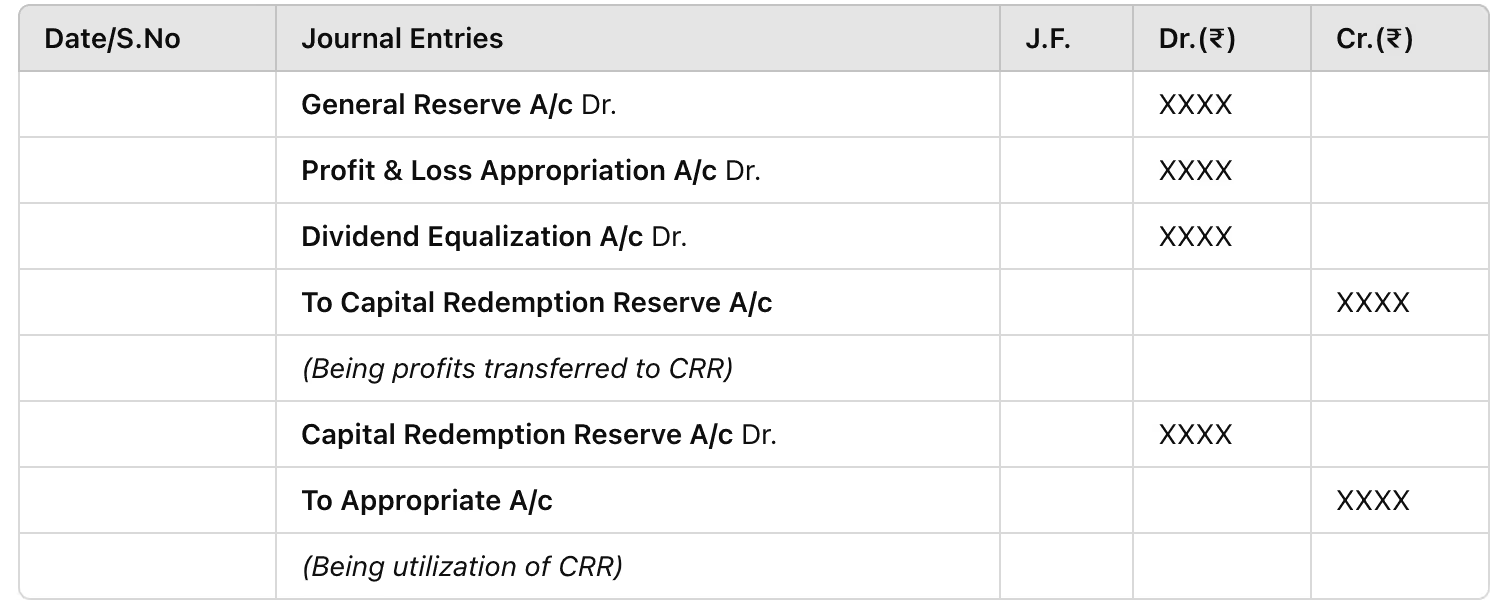

Calculation and Accounting Entries For Capital Redemption Reserve

Calculation of CRR

CRR = Nominal Value of Redeemed Preference Shares (if using distributable profits)

Journal Entries

Application of Capital Redemption Reserve

- CRR can only be used for issuing fully paid bonus shares.

- CRR cannot be used for dividend distribution.

- CRR must exclude unrealised gains and self-generated intangible assets before determining free reserves.

- Classified as a statutory reserve, separate from revenue reserves.

Ready to start your business? Begin your company registration today with Razorpay Rize.

Companies Act and Capital Redemption Reserve

- Section 55: Companies redeeming preference shares from profits must transfer an equivalent amount to CRR.

- Section 69: Companies buying back shares using free reserves or securities premiums must transfer an amount equal to the face value of bought-back shares to CRR.

Difference Between Capital Redemption Reserve and Other Reserves

Tax Benefits For Capital Redemption Reserve

Under Section 36(1)(viii) of the Income Tax Act, 1961, specified entities can claim a tax deduction on contributions to a Special Reserve, reducing their taxable income. The deduction is capped at 20% of profits from eligible business activities before applying this clause. However, any future withdrawal from the reserve is treated as taxable income in the year of withdrawal.

Importance Of Capital Redemption Reserve

- Maintains Financial Stability: Prevents a reduction in share capital.

- Protects Shareholders’ Interests: Ensures capital is available for redemption.

- Supports Capital Restructuring: Used in financial restructuring strategies.

- Ensures Legal Compliance: Meets regulatory requirements under the Companies Act.

- Enhances Investor Confidence: Used for issuing bonus shares, benefiting shareholders.

Final Thoughts

The Capital Redemption Reserve (CRR) plays a vital role in corporate finance by ensuring companies retain sufficient funds while redeeming preference shares. As a statutory reserve, it helps maintain financial stability, protects creditors' interests, and complies with legal requirements.

While it cannot be used freely like other reserves, its role in issuing fully paid bonus shares makes it a strategic asset for companies looking to optimise their financial position.

Choose online company registration with Razorpay Rize for a paperless company launch.

Frequently Asked Questions

Private Limited Company

(Pvt. Ltd.)

- Service-based businesses

- Businesses looking to issue shares

- Businesses seeking investment through equity-based funding

Limited Liability Partnership

(LLP)

- Professional services

- Firms seeking any capital contribution from Partners

- Firms sharing resources with limited liability

One Person Company

(OPC)

- Freelancers, Small-scale businesses

- Businesses looking for minimal compliance

- Businesses looking for single-ownership

Private Limited Company

(Pvt. Ltd.)

- Service-based businesses

- Businesses looking to issue shares

- Businesses seeking investment through equity-based funding

One Person Company

(OPC)

- Freelancers, Small-scale businesses

- Businesses looking for minimal compliance

- Businesses looking for single-ownership

Private Limited Company

(Pvt. Ltd.)

- Service-based businesses

- Businesses looking to issue shares

- Businesses seeking investment through equity-based funding

Limited Liability Partnership

(LLP)

- Professional services

- Firms seeking any capital contribution from Partners

- Firms sharing resources with limited liability

Frequently Asked Questions

What is the source of the Capital Redemption Reserve?

The Capital Redemption Reserve (CRR) is created from a company's distributable profits (such as retained earnings or general reserves) when it redeems preference shares. If shares are redeemed using fresh capital issuance, CRR is not required.

What is the difference between a Capital Redemption Reserve and a Debenture Redemption Reserve?

- Capital Redemption Reserve (CRR): Created when a company redeems preference shares using distributable profits. It ensures financial stability and protects creditors.

- Debenture Redemption Reserve (DRR): Created to ensure funds are available to repay debentures upon maturity. Unlike CRR, DRR is specific to debenture repayment obligations.

What is CRR in Preference Shares?

CRR is a statutory reserve that a company must create when redeeming preference shares using distributable profits. It ensures the company maintains its financial strength and does not reduce its capital base.

How is CRR created?

CRR is created by transferring an amount equal to the nominal value of redeemed preference shares from distributable profits (like retained earnings or general reserves) to a separate Capital Redemption Reserve account.

Which amount is transferred to the Capital Redemption Reserve?

An amount equal to the face (nominal) value of the redeemed preference shares is transferred to CRR when redemption is done using distributable profits. If redemption is done using fresh issue proceeds, no CRR transfer is needed.

Is Capital Redemption Reserve a distributable reserve?

No, CRR is not a distributable reserve. It cannot be used for dividend distribution or general business expenses. It can only be utilised to issue fully paid bonus shares to shareholders.

Is Capital Redemption Reserve a free reserve?

No, CRR is not a free reserve. Free reserves can be used for dividends or other business purposes, whereas CRR is restricted to bonus share issuance and cannot be utilised for any other purpose.

What are the conditions for the redemption of preference shares?

No, CRR is not a free reserve. Free reserves can be used for dividends or other business purposes, whereas CRR is restricted to bonus share issuance and cannot be utilised for any other purpose.

- Authorisation in Articles of Association (AOA): The company must have permission in its AOA to redeem preference shares.

- Redemption within 20 Years: Except for certain cases (like infrastructure companies), preference shares must be redeemed within 20 years of issuance.

- Fully Paid Shares: Only fully paid-up preference shares can be redeemed.

- Redemption Sources: Shares can be redeemed using distributable profits (requiring CRR creation) or by issuing fresh capital (no CRR required).

- Shareholder Approval: If a company wants to issue new preference shares post-redemption, it needs 75% shareholder approval.

- Premium Payment: If shares are redeemed at a premium, the premium must be paid from profits or the securities premium account.