Starting a company in India has never been easier. You can begin with just ₹1,000 as paid-up capital. The Companies Amendment Act, 2015 eliminated the minimum capital requirement, making business ownership more available to everyone.

The difference between authorized and paid-up capital is vital to understand during company registration. Your authorized capital sets the maximum share capital limit for company issuance (like ₹10,00,000). The paid-up capital shows what shareholders have actually invested (say ₹1,00,000). This is a big deal as it means that your compliance needs, registration fees, and financial flexibility depend on these numbers.

Your paid-up capital must stay within the authorized capital limit - this creates a compliance boundary every business owner needs to follow. The authorized capital can increase through proper legal procedures, giving your business room to grow with future funding needs.

This piece will help you understand everything about authorized versus paid-up capital. You'll learn to pick the right amounts for your venture and create smart strategies to optimize your company's capital structure while keeping registration costs low.

Table of Contents

Understanding Company Capital Structure in 2025

Authorized capital is the maximum amount of share capital that a company is authorized to issue, while Paid-Up Capital is the actual amount of share capital issued and paid for by shareholders.

A company's capital structure forms the bedrock of its financial framework. This structure shows how a business funds its operations by mixing equity and debt to create a roadmap for growth and stability.

What is authorized capital and how is it defined in MOA?

Authorized capital (also called nominal or registered capital) sets the maximum share capital a company can legally issue to shareholders. The company's Memorandum of Association (MOA) clearly defines this limit under the Capital Clause.

This capital acts as a regulatory boundary. A private limited company with an authorized capital of ₹10 lakh can't issue more shares beyond this amount unless it changes its MOA. The company needs shareholder approval for this change and must file it with the Registrar of Companies within thirty days.

Paid-up capital meaning and its role in equity funding

Paid-up capital is the actual money shareholders give to a company when they buy shares. Unlike authorized capital, this represents real money in the company's accounts that it can use for business operations.

The 2015 Companies Act amendment removed the minimum paid-up capital requirement. Now entrepreneurs can start with just ₹5,000. This money proves valuable because you don't need to pay it back like a loan. The paid-up capital also shows the company's financial health, how much it relies on equity, and its loan repayment capacity.

Why capital structure matters during company registration

A well-laid-out capital structure shapes a new company's operations and growth potential. Your company's capital structure during registration affects:

- Financial flexibility - A smart capital structure lets you raise future funds without changing legal documents often.

- Risk assessment - Investors and lenders look at your capital structure to check financial stability.

- Registration costs - Your authorized capital amount decides the registration fees and stamp duty.

Companies should balance their original capital structure based on what their industry needs, how they plan to grow, and where they can get funding.

Authorized Capital vs Paid-Up Capital: Key Differences

Understanding the distinction between authorized capital and paid-up capital is fundamental to grasping a company's capital structure. This knowledge is crucial for effective corporate governance, regulatory compliance, and financial planning.

Legal Definitions and Compliance Framework

- Authorized Capital is the maximum share capital a company is legally permitted to issue, as specified in its Memorandum of Association (MoA). This acts as a ceiling, ensuring that the company cannot issue shares beyond this limit without amending its foundational documents.

- Paid-Up Capital is the actual amount of money received from shareholders in exchange for shares issued. By law, paid-up capital must always be less than or equal to authorized capital.

Impact on Share Issuance and Fundraising

- Authorized capital represents the company’s potential for raising funds, setting the upper boundary for share issuance. It provides flexibility for future fundraising and expansion without the need for immediate regulatory changes.

- Paid-up capital reflects the real investment made by shareholders and is the actual capital available for business operations. It is recorded in the company’s financial statements and directly impacts the company’s financial strength and investor confidence.

When a company reaches its authorized capital limit with paid-up capital, it faces two choices:

- Increase authorized capital through a formal amendment to the MoA, requiring shareholder approval and regulatory filings.

- Facilitate share transfers among existing and new shareholders, without increasing the total capital.

Capital Flexibility: Changes and Procedures

- Authorized Capital: Can be increased or decreased by amending the MoA, which involves:

- Reviewing the Articles of Association (AoA) for relevant provisions.

- Passing a board resolution to convene a shareholders' meeting.

- Obtaining shareholder approval via an ordinary or special resolution.

- Filing statutory forms (such as eForm SH-7 and eForm MGT-14) with the Registrar of Companies within the prescribed timeframe.

- Reviewing the Articles of Association (AoA) for relevant provisions.

- Paid-Up Capital: Changes only when the company issues new shares or when existing shares are fully paid up. This directly affects the company’s liability for dividends and its operational capital.

Complete your company incorporation seamlessly with guided documentation support, only with Razorpay Rize.

Comparative Table: Authorized Capital vs Paid-Up Capital

How to Decide Capital Amounts for New Companies

You need a well-laid-out approach to calculate the right capital amounts for your new company. This helps balance your current needs with future growth. Here's how you can break this down into four practical steps:

Step 1: Estimate operational and contingency needs

Start with a financing plan that shows your startup costs. Your plan should cover equipment purchases, premises costs, inventory, and working capital needs for your first 6-12 months. You'll need enough buffer money to handle unexpected expenses that could disrupt your operations. Capital projects always face uncertainties, so you should set aside a contingency fund—about 30% of your total estimated needs—to maintain financial stability. This fund serves as your safety net against future uncertainties.

Step 2: Set authorized capital for future scalability

After you figure out your requirements, you should set your authorized capital at 5-10 times your original paid-up capital. This gives you room to raise funds later without changing your MOA. To cite an instance, see how a ₹2 lakh immediate paid-up capital works better with ₹10-20 lakh authorized capital to create flexibility. Keep in mind that authorized capital sets your fundraising limit but doesn't represent actual money you can use.

Step 3: Determine paid-up capital based on shareholder commitment

Your shareholders' realistic contribution becomes your paid-up capital—the actual money invested in your company. Most startups work well with paid-up capital between ₹1 lakh and ₹5 lakh, based on what their industry needs. The final amount should match both your immediate operational needs and your shareholders' risk appetite.

Step 4: Consider ROC fees and stamp duty implications

The regulatory costs change with different capital amounts. ROC filing fees increase as your authorized capital grows—from ₹4,000 for capital under ₹1 lakh to ₹1,56,000 plus extra fees when capital exceeds ₹1 crore. The stamp duty (usually 0.15% of authorized capital) applies when you register or increase capital. A 2021 Supreme Court ruling made this duty a one-time payment with a maximum cap, whatever the future capital increases might be.

Case Study: Capital Planning for ABC Pvt Ltd

Let's get into how ABC Pvt Ltd planned its capital structure to balance current costs with future growth needs.

Original capital structure: ₹10 lakh authorized, ₹1 lakh paid-up

ABC Pvt Ltd set up its capital framework with ₹10 lakh authorized capital against ₹1 lakh paid-up capital. The company followed the post-2015 Companies Act amendment that removed the minimum paid-up capital requirement. This 10:1 ratio creates a perfect balance. It gives enough operational funds through actual investment while leaving room for future growth without needing regulatory changes.

ROC fee effects based on capital tiers

The company thought about how fees work at different capital levels. ABC Pvt Ltd kept its authorized capital at ₹10 lakh to avoid higher fee brackets. The ROC fee stays around ₹35,000 plus extra charges for authorized capital under ₹10 lakh. The company would pay much more if they go beyond this limit - ₹1,35,000 plus ₹100 per ₹10,000 for capital between ₹50 lakh and ₹1 crore.

Flexibility for future share issuance without MOA change

ABC Pvt Ltd can issue extra shares worth ₹9 lakh without changing its MOA. This difference between authorized and current paid-up capital gives them room to grow. Going beyond the ₹10 lakh mark would need shareholder approval, a board resolution, an extraordinary general meeting, and filing Form SH-7 with the Registrar within thirty days.

Cost-benefit analysis of higher authorized capital

The company's capital planning shows smart financial thinking. The ₹10 lakh authorized capital balances several factors:

Current savings: Lower ROC fees and stamp duty (usually 0.15% of authorized capital) Future flexibility: Room to issue extra shares worth ₹9 lakh without paperwork Credibility advantage: Better stability in the eyes of potential investors and partners

ABC Pvt Ltd shows how smart capital planning helps long-term business goals while keeping initial registration costs low. This matters a lot for new companies with tight budgets.

Looking for hassle-free pvt ltd company registration online? Start your company journey today with Razorpay Rize.

Frequently Asked Questions

Private Limited Company

(Pvt. Ltd.)

- Service-based businesses

- Businesses looking to issue shares

- Businesses seeking investment through equity-based funding

Limited Liability Partnership

(LLP)

- Professional services

- Firms seeking any capital contribution from Partners

- Firms sharing resources with limited liability

One Person Company

(OPC)

- Freelancers, Small-scale businesses

- Businesses looking for minimal compliance

- Businesses looking for single-ownership

Private Limited Company

(Pvt. Ltd.)

- Service-based businesses

- Businesses looking to issue shares

- Businesses seeking investment through equity-based funding

One Person Company

(OPC)

- Freelancers, Small-scale businesses

- Businesses looking for minimal compliance

- Businesses looking for single-ownership

Private Limited Company

(Pvt. Ltd.)

- Service-based businesses

- Businesses looking to issue shares

- Businesses seeking investment through equity-based funding

Limited Liability Partnership

(LLP)

- Professional services

- Firms seeking any capital contribution from Partners

- Firms sharing resources with limited liability

Frequently Asked Questions

What is paid up capital with an example?

Shareholders provide paid-up capital to companies in exchange for shares. To cite an instance, XYZ Pvt. Ltd. issues 50,000 shares with a face value of ₹10 each. The paid-up capital would reach ₹5,00,000 when shareholders fully pay for all shares. This money becomes available for company operations and shows up in the balance sheet's equity section.

What is an example of authorized capital?

A corporation might decide to authorize 10,00,000 shares as specified in its Articles of Incorporation, with each share valued at ₹10. The authorized capital would equal ₹1,00,00,000 in this scenario. Companies can't issue more capital than this amount without changing their Memorandum of Association.

What is 1lakh paid up capital?

Shareholders' contribution of ₹1,00,000 to a company creates a paid-up capital of ₹1 lakh. The Companies Act required this amount as minimum paid-up capital for private limited companies before its 2015 amendment. This requirement no longer exists, though companies still need ₹1 lakh authorized capital.

How to calculate authorized capital?

The authorized capital calculation uses this formula: Authorized Capital = Number of Authorized Shares × Par Value per Share

A company with 1 lakh authorized shares at ₹100 face value would have an authorized capital of ₹1 crore.

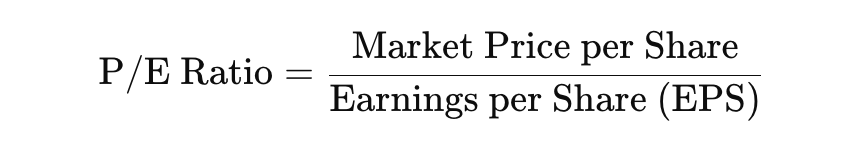

What is the formula for paid up capital?

This formula determines paid-up capital: Paid-up Capital = Par Value of Shares + Additional Paid-in Capital

The calculation combines nominal value (face value × number of shares) with any premium above par value. A company that issues 100 shares at ₹10 par value but sells them at ₹15 each would have ₹1,500 paid-up capital (₹1,000 par value + ₹500 additional paid-in capital).