Be it an enterprise or small and mid-sized firms, the Goods and Services Tax (GST) has touched every sector of India’s economy. And, yes, even freelancers fall under its radar, but they may or may not have to pay GST.

Even if you are not required to pay GST for the moment, it is important to know the chapters and verses of how GST works as a freelancer; because you will have to register your business under GST once it grows. If you are looking for information on ‘freelancer GST India’, this guide provides all the information on the subject.

Table of Contents

What is a Freelancer under GST In India?

A freelancer is an individual who provides services on a contract basis. He or she is not an employee of the company and doesn’t fall under the same employment laws. However, the GST rules relating to service providers shall apply to freelancers.

Examples of Services Subject to GST in India

GST rate applies at the rate of 18% on the following services:

- Membership Fees: Any fees charged by a club, association, or society for providing any service, facility, or benefit to its members.

- Connects Purchases & Freelancer Service Fees: Connects are virtual tokens freelancers use to submit job proposals on online platforms. Freelancer service fees are the commissions or charges the platforms deduct from the freelancers’ earnings.

Other services include:

- Accounting/Bookkeeping

- Technical services

- Software/App Development

- Designing services

- Call centre

- Data entry

- Marketing Services

- Domain and hosting

- Voice over

- Language Translation

- Management/Consultancy Services

Tips: For freelancers who already have a GST number, it’s essential to ensure its validity. One can do this by using Razorpay’s GST number search tool.

Does a freelancer need to register for GST?

Freelancers in India must register for GST if their yearly income surpasses the government’s threshold, usually ₹20 lakhs. This limit may vary depending on the state and service type.

As a service provider, it is mandatory for a freelancer to register under GST in the following situations:

- When turnover exceeds Rs 20 lakh in a financial year (For states other than the North-Eastern States)

- When turnover exceeds Rs 10 lakh in a financial year (For North-Eastern states)

- For services covered under Online Information and Database Access and Retrieval services (OIDAR services*)

- In the case of an export service whose value exceeds Rs 20 lakh.

Related Read: How to Sell Online Without GST Number in India?

Understanding OIDAR Services

According to the GST Act, OIDAR services include the following services:

- Providing cloud-based services

- Advertising on the Internet

- Online gaming services

- Provision for selling e-books, music, movies, software, and other intangibles via the internet.

- Providing data or information, retrieval or otherwise, to any person in electronic form through a computer network.

Tips: Additionally, freelancers can easily verify their GST details or search for their GST number using Razorpay’s GST Search by PAN.

Related Read: GST on Online Gaming – Latest Online Gaming GST Rates in 2024

Can a freelancer register as a composite dealer?

As per the provisions of the GST Act, any service provider is not allowed to opt for the composition scheme. However, a service provider providing restaurant services is an exception to this rule.

So, this means that a freelancer cannot opt for the composition scheme.

If you want to know the merits and demerits of the composition scheme, you can read about the GST Composition Scheme.

Documents required for GST registration

It is important to know the documentation process for freelance GST registration. The following are the documents required for freelancer GST registration:

- A recent passport-sized photograph

- Copies of the freelancer’s PAN and Aadhaar card

- The most recent bank account statement or a canceled cheque

- Proof of both identity and address

- Digital signature certificate (DSC)

- Copies of utility bills such as electricity or telephone

- A copy of the lease/rental agreement for office premises and a No Objection Certificate (NOC) from the landlord or property owner confirming approval for business use of the premises

- SAC (Service Accounting Code) or HSN (Harmonized System of Nomenclature) Codes.

Read More: Documents Required for GST Registration

How to Register for GST for Freelancers?

- STEP 1: Visit the GST portal and proceed with online registration. Create an account or login if you already have one.

- STEP 2: Navigate to the section for GST registration and begin the application process. Provide accurate information as requested in the registration form.

- STEP 3: Enter details about your freelance business, such as business name, address, contact information, nature of services provided, and turnover details.

- STEP 4: Upload scanned copies of the required documents, including identification proof, address proof, and any other supporting documents as specified by the tax authority.

- STEP 5: Verify the information provided and review the application before submission. Ensure all details are accurate to prevent delays or complications in the registration process.

- STEP 6: Upon successful submission, a provisional ID will be generated, indicating your application is under process.

- STEP 7: After submitting the application, the tax authority will process the registration request. This may take a few days to weeks depending on the jurisdiction.

- STEP 8: If all goes well, you’ll receive your GST registration certificate with your unique GST Identification Number (GSTIN) via email.

Read More: How to Register for GST Online?

Which GST rates are applicable to freelancers?

The GST rates applicable to freelancers are 0%, 5%,12%, 18% and 28% depending on the type of service provided. If there is no specified rate for the service provided, you will have to charge 18% GST from your clients.

If you’re wondering how to include profit margins in your freelance services and get real-time GST, inclusive & exclusive rates you can check out our free GST calculator.

How to Calculate GST for Freelancers in India?

As a freelancer in India, calculating GST involves understanding the applicable rate and adding it to your service fee.

Here’s a breakdown:

The GST rate for most freelance services is 18%. However, there can be exceptions depending on the specific service you provide. You can find the SAC (Service Accounting Code) for your service in the HSN and SAC Code list on the government website to confirm the exact rate.

If a specific rate isn’t mentioned, assume an 18% GST applies.

Calculating GST Amount:

For example, if your service fee is Rs. 10,000 and the GST rate is 18% (0.18), multiply the service fee by the GST rate expressed as a decimal.

GST amount = Service Fee * GST Rate

= Rs. 10,000 * 0.18

= Rs. 1,800

Add the calculated GST amount to your service fee to arrive at the final amount you’ll invoice your client.

Clearly mention the service fee (exclusive of GST), the applicable GST rate, and the total amount payable (inclusive of GST) on your invoice.

Example Invoice:

Service Fee (Excluding GST): Rs. 10,000

GST @ 18%: Rs. 1,800

Total Amount Payable: Rs. 11,800

Related Read: GST Registration Limits: Threshold limit for GST Registration for 2025

Invoicing rules for freelancers

Any invoice raised by a freelancer should be GST-compliant. The invoice should contain all the necessary information such as name, address, GSTIN of the service provider as well as the recipient, SAC of services, date, the value of service provided and so on. You can refer to our GST invoice guide and create GST-compliant invoices using Razorpay Invoices.

Is a freelancer eligible to claim an input tax credit?

Input tax credit (ITC) means you can reduce the tax, which was already paid on purchases, from the GST payable arising from your sales. As per the provisions of GST, all the normal taxpayers registered under GST can use ITC to reduce their GST liability.

Similarly, a registered freelancer can also use such taxes paid on services used by him to provide any service.

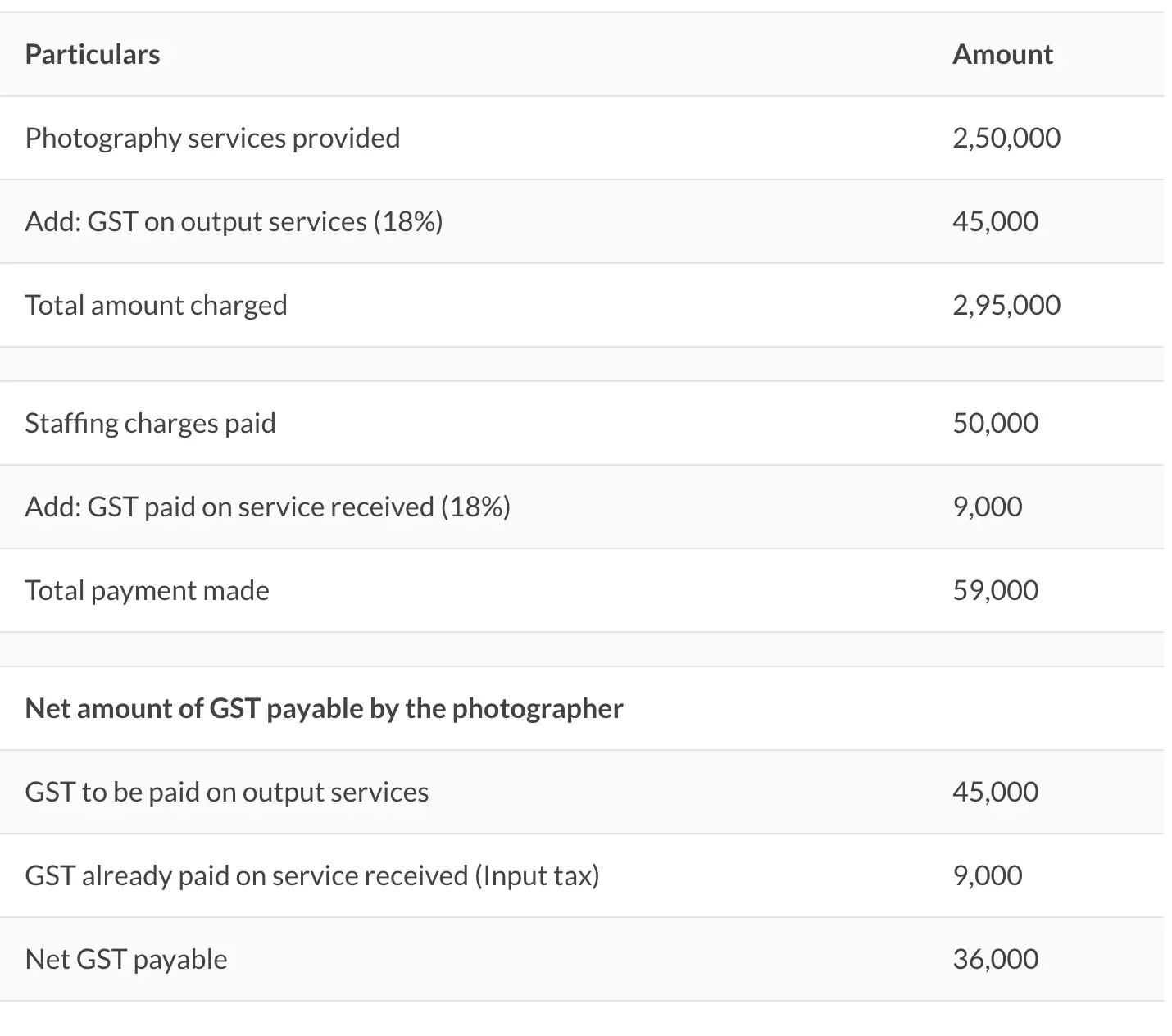

For instance, a freelance photographer charges Rs 2,50,000 for a wedding shoot and hires a printing agency at Rs 50,000. In this case, the net GST for freelancer payable will be as follows:

How many GST returns does a freelancer have to file?

How many GST returns does a freelancer have to file?

A freelancer will have to file 25 GST returns in a year if he is registered as a normal taxable person.

What is the penalty for late filing of returns?

Late filing of GST for freelancers in India is subject to the following consequences:

- A late fee of Rs 200 will be levied.

- An interest of 18% per annum will also be levied. This will be calculated by the taxpayer on the tax to be paid.

- A minimum penalty of Rs 10,000 will be levied if the tax has not been paid.

- For the unpaid tax, the maximum penalty is 10% of the tax amount due.

Conclusion

In conclusion, understanding and adhering to Goods and Services Tax (GST) regulations is crucial for freelancers to ensure legal compliance and smooth business operations. Registering under GST allows freelancers to establish credibility, streamline tax processes, and avoid penalties. Moreover, calculating and charging GST accurately not only enhances transparency in financial transactions but also fosters trust with clients. While navigating the complexities of GST may seem daunting, staying informed about applicable rates and compliance requirements empowers freelancers to effectively manage their tax obligations and contribute to the economic landscape.

Frequently Asked Questions (FAQs)

1. How to calculate tax for freelancers?

Freelancers calculate tax by subtracting direct expenses from their income and applying the relevant tax slab rates.

2. Do freelancers need to pay GST?

Freelancers must pay GST if their turnover exceeds ₹20 lakhs or ₹10 lakhs for special category states.

3. Why is GST for freelancers important?

GST for Indin freelancers is crucial as it uniformizes tax laws and allows input tax credit claims.

4. What is the tax limit for freelancers?

The tax limit for freelancers is based on the income tax slab rates, with presumptive taxation available for income up to ₹50 lakhs.

5. Can freelancers avoid tax?

Freelancers cannot avoid tax but can reduce liability through deductions and exemptions. It is crucial that you know the GST exemption limit for freelancers.

6. Do freelancers need to pay both GST and income tax?

Freelancers in India need to pay both, GST and income tax if applicable under the law.

4 Comments

Can i still get registered GST though my annual income is around 4 lakh as a freelancer.

If yes then what would be it’s benifit for me?

Hey Nazim,

No, you don’t have to. We’ve updated the article with other FAQs, too. Do check them out. 🙂

Thanks

Does Instagram Page Come under OIDAR Services ?

Hey Ganesh,

Here’s a list of electronic services that will be considered as OIDAR:

Advertising on internet:

*Providing cloud services

*Provision of e-books, movie, music, software and other intangibles via telecommunication networks or internet

*Providing data or information, retrievable or otherwise, to any person, in electronic form through a computer network

*Online supplies of digital content (movies, television shows, music, etc.) ? digital data storage

*Online gaming