To register for GST, the Indian Government conveniently allows taxpayers to access the GST Portal online. After submitting your GST registration application, it typically takes 15 days for processing and registration. In the meantime, you can track your GST registration status online using your ARN number.

Read About: How to Register for GST Online?

Table of Contents

What is ARN (Application Reference Number) in GST?

The Application Reference Number (ARN) is a unique 15-digit code that is generated after you successfully submit your GST registration application. It serves as a reference to track the application status until the registration is granted.

Once you submit your GST registration application, the GST portal automatically generates the ARN. This number allows you to monitor the status of your application at various stages, from submission to approval or rejection.

Format of ARN

The ARN follows this format: “AA999999999999Z,” consisting of a mix of letters and numbers.

Where to Find Your ARN

After submitting your application, the ARN is sent to your registered email address and mobile number for easy access.

Recent Developments in GST Registration

- Delay in Registration Process for Aadhaar-Authenticated Applicants, 28th February 2024

The GST Network (GSTN) announced that applicants who have undergone Aadhaar authentication but have been selected for a detailed risk-based verification will have to wait up to 30 days from their application submission for the registration process to be completed. - Mandatory Aadhaar Authentication for Revocation, 21st December 2021

Effective from 1st January 2022, Aadhaar authentication became mandatory for taxpayers seeking to revoke cancelled GST registrations, as outlined in CGST Rule 23 through the REG-21 form. - Extension for Revocation of Cancelled GST Registrations, 29th August 2021

An extension was provided until 30th September 2021 for taxpayers to apply for revocation of GST registration cancellations. This applied to cases where the registration was cancelled between 1st March 2020 and 31st August 2021, under Section 29(2) (b) and (c) of the CGST Act, according to notification no. 34/2021.

How to Check GST Registration Status Without Logging In?

If you’re applying for GST registration for the first time, you can easily track your application status without logging into the GST portal using the ARN. Follow these steps:

Step 1: Navigate to the GST Portal

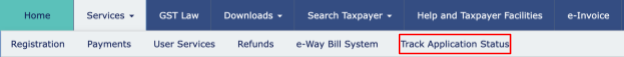

Go to the GST portal, navigate to ‘Services,’ and click on ‘Track Application Status.’

Step 2: Choose the Registration Option

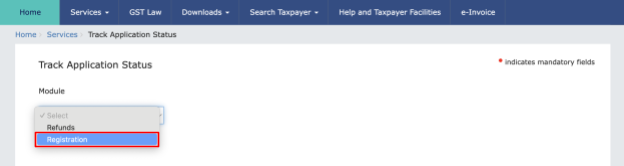

From the drop-down menu, select the ‘Registration’ option.

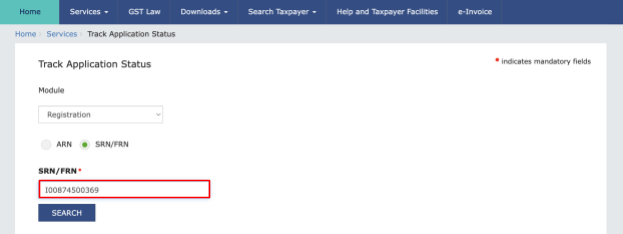

Step 3: Enter ARN or SRN

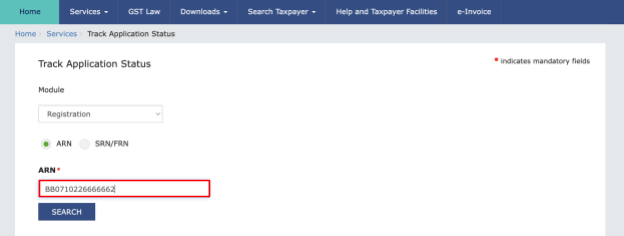

Enter the Application Reference Number (ARN) or Service Request Number (SRN) provided to you. Then, click ‘Search.’

Step 4: Review the Application Status

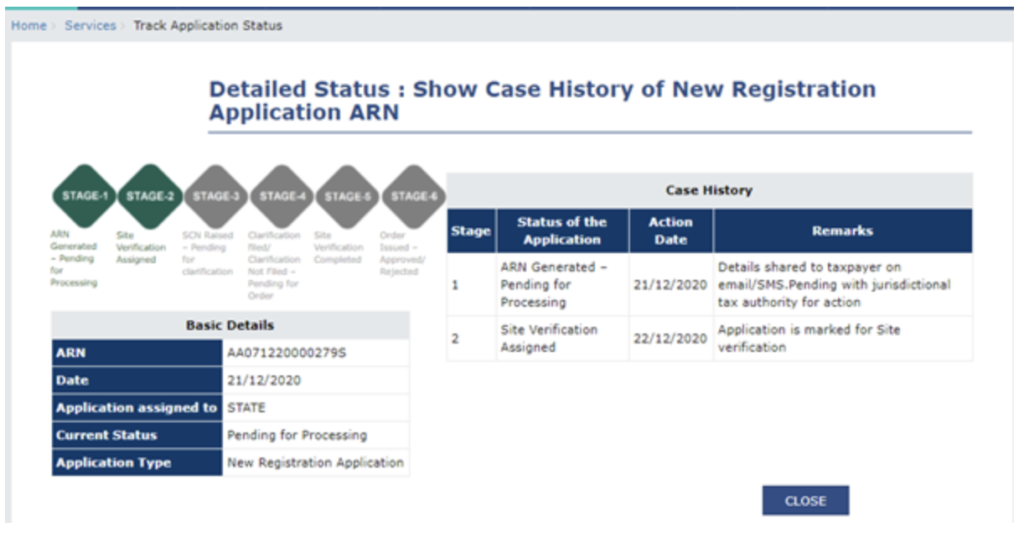

A report titled ‘Detailed Status: Show Case History of New Registration Application’ will appear. This report shows the current stage of your application, with completed stages highlighted in green and pending ones in grey. Your GST registration application must pass through seven stages, all of which can be tracked here.

How to Check GST Registration Status After Logging In?

Taxpayers eligible for various applications (such as new registration, core amendment, or cancellation) can track their application status after logging in to the GST portal using the ARN or submission period.

Note: First-time GST registration applicants do not have access to this feature.

Follow this guide to track your GST application post-login:

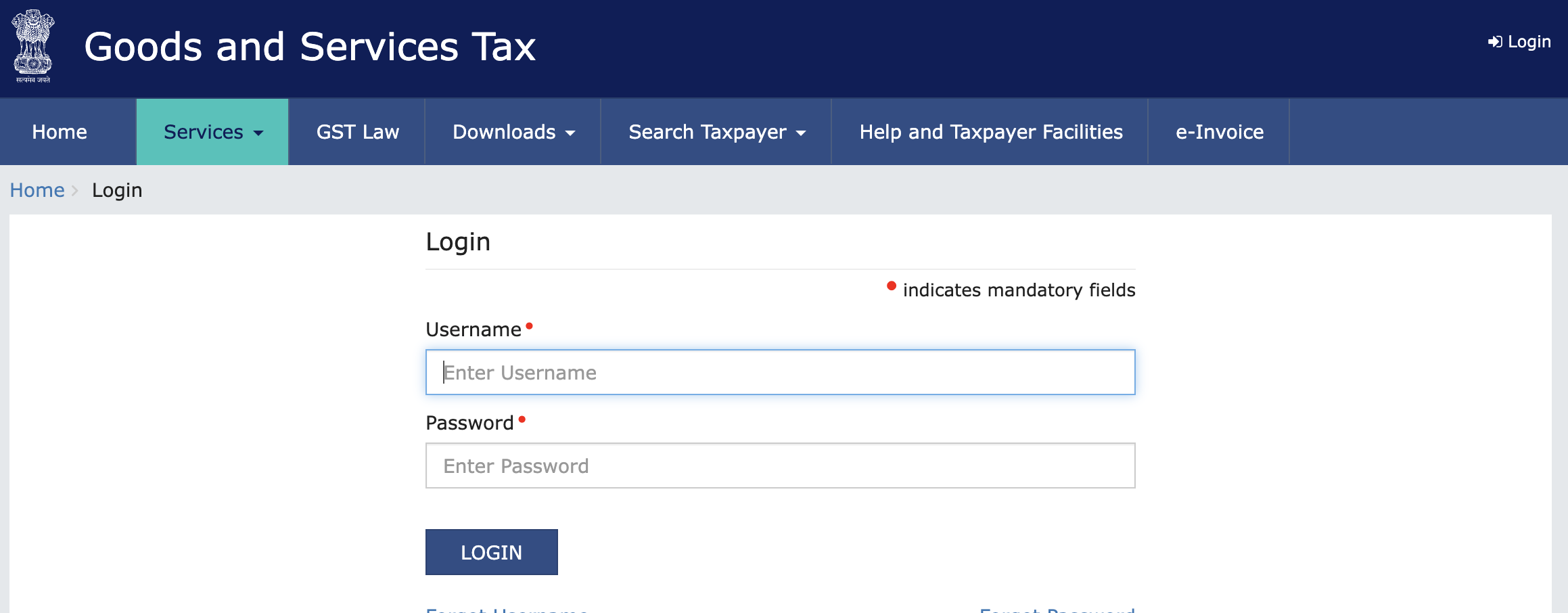

Step 1: Log in to the GST Portal

Log in to the GST portal using your credentials. After logging in, go to the “Services” section and click on “Application Status Tracking.”

Step 2: Navigate to Services > Track Application Status

Once logged in, access the ‘Services’ tab on the dashboard. Under this tab, select ‘Track Application Status’ to proceed.

Step 3: Choose “Registration” from the Dropdown Menu

You will see a dropdown menu titled “Module Selection.” Select “Registration” from this menu to focus on tracking the status of your GST registration.

Step 4: Enter ARN

Enter the Application Reference Number (ARN), Service Request Number (SRN), or the submission date of your application to check the status.

Step 5: Click on ‘Search’

Once the ARN or SRN is entered, click the ‘Search’ button. The system will retrieve the current status of your GST registration application.

Step 6: View the Status

The application status will be displayed. It could be pending, approved, rejected, or indicate any other relevant stage.

Step 7: Take Necessary Action

Based on the status, take the appropriate action. If approved, you can download your GST registration certificate by clicking on the “Download” link. If rejected or pending, follow the instructions provided to address any issues or supply additional information.

Types of GST Registration Statuses Based on ARN Search

When you track your GST registration application using the ARN, the following status types may appear:

1. Pending for Processing

This indicates that the new registration application has been successfully filed and is awaiting processing by the Tax Officer.

2. Site Verification Assigned

This status shows that a site visit has been scheduled, and verification is assigned to the Site Verification Officer.

3. Site Verification Completed

After the Site Verification Officer completes the visit, the report is submitted to the Tax Officer, which will reflect this status.

4. Pending for Clarification

When the Tax Officer requires further details, a notice is issued to the applicant seeking clarification.

5. Clarification Filed – Pending for Order

Once the applicant provides the requested clarification, the status indicates that it has been successfully submitted and is awaiting the Tax Officer’s decision.

6. Clarification Not Filed – Pending for Order

If the applicant does not file the required clarification within the stipulated time, the status will show as pending for the officer’s order.

7. Approved

This status means the Tax Officer has approved the application. You will receive the GST Registration ID and password via email.

8. Rejected

The Tax Officer has rejected the application for new registration.

9. Withdrawn

This status indicates that the applicant has voluntarily withdrawn their GST registration application.

If the registration application was submitted on the MCA Portal instead of the GST portal, you will need to track it using the SRN (Service Request Number). Simply enter the SRN and click ‘Search’. The status screen will show a detailed history of the application, highlighting each completed stage in green and pending stages in grey.

Status Types for Applications Tracked via SRN

When tracking GST registration status using the SRN (Service Request Number), you may encounter the following statuses:

1. Pending with MCA

This status indicates that your new registration application has been filed and is awaiting processing by the Ministry of Corporate Affairs (MCA).

2. COI (Certificate of Incorporation) Issued by MCA – TRN (Temporary Reference Number) Generated – Pending with GST Common Portal

Once the GST Portal receives information from the MCA Portal, a TRN is generated, and the application is pending further action on the GST Portal.

3. COI Issued by MCA – Pending for Processing by GST Common Portal

This status reflects that the application has been successfully submitted on the GST Portal and is awaiting processing.

4. COI Issued by MCA – Approved / Rejected by GST Common Portal

The final status shows whether your application has been approved or rejected by the GST Common Portal. You will be notified via SMS and email.

You can click on the ARN hyperlink to view the detailed status of your application or click on ‘Close’ once you have checked your GST registration status.

If your GST application is approved, you will receive the User ID and password on your email ID and mobile number. Use these details to log in to the GST common portal.

Since you are logging in for the first time, a separate link is provided: “If you are logging in for the first time, click here to log in.” Click on this link, and the new window will prompt you to enter your GSTIN and password.

Since you are logging in for the first time, a separate link is provided: “If you are logging in for the first time, click here to log in.” Click on this link, and the new window will prompt you to enter your GSTIN and password.

Once you have logged in, you can download your GST Registration Certificate.

Related Read: GST State Code List

Conclusion

Although GSTIN is usually allotted within 15 days, it can get allotted within 2-3 days or a week. Hence, it is important to regularly conduct the GST application status check on the portal. Once GSTIN is allotted, you must quote it on your invoices to your customers and provide it to your vendors to claim the input tax credit.

Frequently Asked Questions (FAQs)

1. Where can I track my ARN?

You can track GST ARN on the GST Portal. Log in to your account, go to the ‘Registration’ section, and select the option to track your ARN.

2. How do I check my GST application status via TRN?

To check GST status application using the TRN, visit the GST Portal, navigate to the ‘Registration’ section, and select the ‘Track Application Status’ option. Enter your TRN to view the current status of your application.

3. What is an example of an ARN?

An ARN is a unique 15-digit number assigned to each GST registration application. The ARN code has a specified format that has 6 components.

Sample: BB 07 10 22 666666 2

4. How do I find a company’s GST number by name?

You can find a company’s GST number by name on the GST portal. Visit the ‘Search Taxpayer’ section, enter the company’s name or other relevant details, and the search results will display the GST number if the company is registered under GST.