Table of Contents

What is GSTIN?

GSTIN (Goods & Services Tax Identification Number) is a 15-digit unique identifier assigned to every GST-registered taxpayer, including businesses, firms, dealers, and suppliers, under the GST regime in India. It is mandatory for businesses engaged in taxable supplies and is issued upon successful GST registration.

Every business operating in a state or Union territory is assigned a unique Goods and Services Tax Identification Number (GSTIN) PAN, state and entity details. Under the GST Act 2017, businesses and individuals have to register their business with the state authorities and obtain a unique 15-digit GSTIN.

The GSTIN Number is used for various GST-related procedures, such as filing returns, claiming input tax credits and paying taxes.

Read More: What is GST and How Does It Work?

GSTIN Number Format & Example – Decoding the 15-Digit GSTIN

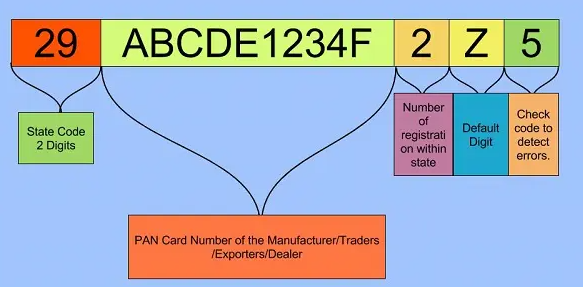

Each taxpayer within the GST system receives a unique 15-digit Goods and Services Taxpayer Identification Number (GSTIN), determined by their State, PAN, and Entity based details.

The structure of this number will be as follows:

- The first 2 digits are reserved for the GST state code as per the Indian Census. Indian states or union territories are assigned unique codes (01-35). For example, “29” is the state code for Karnataka (KA).

- The following 10 digits “ABCDE1234F” represent the PAN number of the business entity or the taxpayer.

- The thirteenth digit number “2” is the registrations done by the firm within the state using the same PAN number. It can be an alphanumeric figure (between 1-9 and then A-Z)

- The fourteenth is the default alphabet ‘Z’

- The fifteenth digit “5” will be a check code, which can be a number or an alphabet.

How to Apply for GSTIN?

Getting a Goods and Services Tax Identification Number (GSTIN) involves a straightforward process.

Here’s a step-by-step guide on how to get a GSTIN number online in India:

1. Login to the GST Portal

Log in to the GST portal of India (services.gst.gov.in). Then, click on the ‘New Registration’ tab

2. Share Details

Enter all the required details, which include name, number, email ID, and other details. Verify the details using the OTP that will be shared on your mobile number or email

3. Receive Application Reference Number (ARN)

Next, you will get an ARN (Application Reference Number) on your mobile or email. Note this down and fill out the Part-B Application Form for GSTIN.

4. Furnish Documents

Attach the documents as requested, which include proof of business, bank statements, residential proof, PAN Card, certificate of incorporation, partnership deed and more.

5. Submit Application

Submit the duly filled application form with all the documents attached. The verification process usually takes up to three working days and you will receive communication from GST REG 06 once the application is approved.

Alternatively, you can register for GSTIN by visiting the nearest GST, Seva Kendra and filling out the offline form with the duly requested documents.

Read More: How to register for GST?

What is the cost of obtaining GSTIN?

Obtaining a GSTIN (Goods and Services Tax Identification Number) and registering for GST in India is completely free of cost. There are no government fees for GST registration, and businesses can apply for a GSTIN online through the official GST portal at zero charges. However, if you seek assistance from a professional or consultant for GST registration, they may charge a service fee.

How is GSTIN Different From GSTN?

GSTIN and GSTN are two terms that are often confused by many people. However, they are very different from each other.

Here is a clear definition and comparison of GSTIN and GSTN:

GSTIN |

GSTN |

| GSTIN is a unique 15-digit alphanumeric code. It is assigned to every business registered under the GST regime in India. | GSTN is a Goods and Service Tax Network. It is an organisation that manages the entire GST portal’s IT system. |

| It is mandatory for every GST taxpayer and is used to identify, track, and verify the tax transactions and compliance of the taxpayers | It is a non-profit, non-government company that provides services to the government, taxpayers and other stakeholders related to the GST system |

| It is composed of the state code, PAN, entity code, blank digit, and checksum digit. GSTIN can be verified online through the GST Portal | GSTN is responsible for developing, maintaining, and operating the GST portal, the common interface for registration, filing, payment and refund of GST. It also facilitates data exchange between the central and state tax authorities and other agencies. |

Why is GSTIN Required?

Operating your business legally in India requires a GSTIN number. This applies if your business’s annual turnover exceeds Rs. 40 lakh (or Rs. 10 lakh for Northeast states). Registering for GST and obtaining a GSTIN helps you avoid penalties and fines.

Here are some reasons why you must know how to get a GST number online.

1. Filing GST Returns

A GST number is required to file GST returns, which are periodic statements of a registered person’s transactions and tax liability. Filing GST returns is mandatory for every GST-registered person, even if there is no business activity or tax liability in a given period.

2. Claiming Input Tax Credit

A GST number is also necessary to claim the input tax credit, which is the amount of GST paid on the goods or services purchased for business purposes. Input tax credit claim is likely for a GST-registered person only if the supplier has uploaded the invoice details in the GST portal and the GST number of the buyer is mentioned on the invoice.

3. Avoiding Penalties

A GST number is also important to avoid penalties for non-compliance with the GST Act. If a person is liable to register under GST but fails to do so, he or she may face a penalty of 10% of the tax due or Rs. 10,000, whichever is higher. Similarly, if a person collects GST from customers but does not deposit it with the government, they may face a penalty of 100% of the tax amount.

Tip: Before you start filing your GST returns, you need to know your liability. You can calculate GST online under different GST rate slabs for your business with Razorpay’s GST Calculator

Related Read: How to Check GST Registration Status Online?

What are the Benefits of GSTIN Number?

The benefits of GSTIN are as follows:

- It helps in reducing tax evasion, fraud, duplication, identity theft and other economic crimes.

- It helps in tracking transactions across States and Union Territories.

- It will provide a single point for all indirect tax-related compliances.

- Having GSTIN ensures businesses can operate in interstate sales without restrictions, improving the potential market for small and medium-sized businesses.

- Anyone with a GSTIN can take input credit on purchases and input services and make sure that your business is compliant with GST regulations, improving the GST rating of your firm.

Documents Required for GSTIN Number

To obtain a GST number or GSTIN, you need to submit the following documents along with your application:

- PAN Card: This applies to the business entity (company PAN for companies, etc.) and authorized signatory (individual PAN).

- Business Constitution: Partnership deed, registration certificate, memorandum of association, articles of association, etc.

- Identity and Address Proof of Promoters/Directors/Partners: This could be Aadhaar card, Passport, Voter ID card etc.

- Proof of Principal Place of Business: This can be a property tax receipt, electricity bill, rent agreement etc. with your business address.

- Bank Account Proof: Cancelled cheque or bank statement with business bank account details.

- Signed Authorisation Form: This authorises a person to act as your authorised signatory for GST purposes.

- Photographs

How to Apply for GSTIN Through GST Portal

You can apply for GSTIN online through the GST Portal by following these steps:

- Visit the GST Portal at https://www.gst.gov.in/ and click on Services > Registration > New Registration.

- Select your Taxpayer Type, State and District from the drop-down menus and enter your Legal Name, PAN, Email Address and Mobile Number. Click on Proceed.

- You will receive two OTPs on your email and mobile number. Enter the OTP and click on Continue.

- You will get a TRN on your email and mobile number. Note down the TRN and click on Proceed.

- Visit the portal again and tap on Services > Registration > New Registration. Select Temporary Reference Number (TRN) and enter your TRN and the captcha code. Click on Proceed.

- Enter the OTP and click on Proceed.

- See the application status as Draft. Tap on the Edit icon to fill out the application form.

- The application form has two parts: Part A and Part B. Part A contains basic information, such as business details, promoter details, authorised signatory details, etc. Part B contains additional information, such as goods and services details, bank account details, state-specific information, etc. You need to fill both parts and upload the required documents.

- After completing the form, submit it with a Digital Signature Certificate (DSC) or an Aadhaar-based OTP. For DSC, sign the application using an authorised signatory’s valid DSC. For an Aadhaar-based OTP, verify the Aadhaar number of the signatory and enter the OTP sent to the registered mobile number.

How to Apply for GSTIN through GST Seva Kendra

If unable to apply for GSTIN online, visit GST Seva Kendra, a government centre aiding with GST processes like registration, filing, payment, and refund. Find one on the GST Portal under Contact Us.

To apply for GSTIN through a GST Seva Kendra, you need to follow these steps:

- Visit the GST Seva Kendra

- Submit the documents and the application form to the GST officer

- The GST officer will verify your documents and details and upload them on the GST Portal.

- The GST officer will give you an acknowledgement slip with the ARN.

- Use the ARN to track the status of your application.

How to Verify GSTIN?

Since every GSTIN number follows this structure, it is easy for you to check the authenticity of the business. You can instantly validate a GSTIN number using the Razorpay Number Search & Verification Tool, which helps you verify the authenticity of a GST number online and for free. GSTIN is public information, and technology has made it easy to verify GSTIN, which is crucial before doing any business dealings.

Tip: You can find the different GSTINs associated with PAN using Razorpay’s GST search by PAN tool.

Verify GSTIN on GST Portal

Here are the steps to verify GSTIN on the GST Portal:

- Visit the official GST Portal at https://www.gst.gov.in/.

- Click on the Search Taxpayer tab on the homepage and select Search by GSTIN/UIN.

- Enter the taxpayer’s GSTIN or UIN and click the Search button.

- If the GSTIN is valid, you will see the taxpayer’s details, such as legal name, trade name, address, date of registration, status, and tax liability.

- If the GSTIN is invalid, you will see an error message saying No records found.

Alternatively, you can use the Razorpay GST Search Tool to verify GSTIN online.

Here are the steps to use this tool:

- Visit the Razorpay GST Search Tool.

- Enter the GSTIN of the taxpayer you want to verify and click the Search button.

- If the GSTIN is valid, you will see the details.

- If the GSTIN is invalid, you will see an error message saying Invalid GSTIN

Verifying GSTIN is vital to prevent fraudulent activities such as fake invoicing, tax evasion, and input tax credit fraud.

How to Spot Fake GSTIN?

Watch out for fake GSTINs dishonest entities use to dodge taxes or cheat customers; follow these steps to track.

- Go to the GST portal

- Click the Search Taxpayer tab on the homepage.

- Select the Search by GSTIN/UIN option and enter the GSTIN you want to verify in the box. Enter the captcha code if required.

- Tap on the Search tab. If the GSTIN is valid, you will see the information on your screen.

Some of the consequences of issuing or dealing with fake GSTINs are:

- Loss of input tax credit. This will increase your tax liability and reduce your profits.

- You may face a penalty of up to 100% of the tax amount involved, and imprisonment can be up to five years.

- Fake GST may damage your reputation and goodwill in the market.

Conclusion

GSTIN has replaced all state VAT laws and unique TIN numbers to become the unique identification number for the business. It acts as the legal recognition of the business entity and helps build trust among customers and business partners. Anyone with a GSTIN number can easily log in to the GST portal, file their details to get benefits and take input credit on their purchases and services.

Thus, GSTIN helps to improve tax compliance for businesses and makes the process simpler and completely online, resulting in transparent transactions and enhancing the scope of business.

FAQs on GST Number Format

1. Is the GSTN and GSTIN the same?

GSTN and GSTIN are not the same. GSTN is the Goods and Services Tax Network, which is an organisation that manages the IT system of the GST portal. GSTIN means Goods and Services Tax Identification Number. It is a unique 15-digit number assigned to every registered person under GST.

2. How do I find my GST number?

You can find your GST number using the GST number search tool on the GST portal or other websites. You need to enter the PAN or name of the business and select the state to search for the GST number.

3. Is GST number free?

Yes, the government does not charge any fees for GST registration.

4. Are GST and PAN numbers the same?

GST and PAN numbers are not the same. GST number is based on the PAN number of the business, but it also includes the state code, entity code and checksum digit. PAN number is a 10-digit alphanumeric number issued by the Income Tax Department to identify taxpayers.

5. How do I file a complaint regarding a forged GSTIN?

You can file a complaint regarding a forged GSTIN on the GST Grievance Redressal Portal by following the steps on the GST portal or other websites.

6. Can a student get a GST number?

A student can get a GST number if they meet the eligibility criteria for GST registration.

7. Is it compulsory to pay GST?

It is compulsory to pay GST if you are a registered person under GST and you make taxable supplies of goods or services.