A cancelled cheque serves as a financial instrument used to validate if a user has an account with a particular bank or institution. Essentially, a cancelled cheque is invalidated by the account holder.

Cancelled cheque can help financial institutions with validating a customer’s credentials.

Table of Contents

What is a Cancelled Cheque?

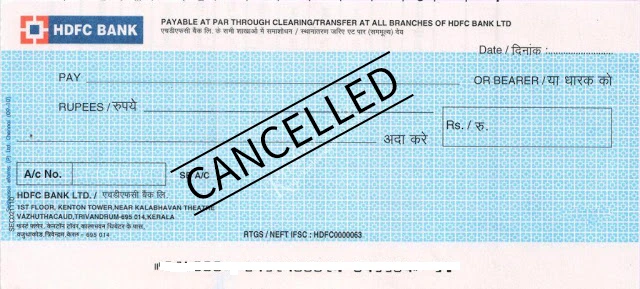

A cancelled cheque is a cheque that contains two parallel lines drawn across the layout with “CANCELLED” written between them . You do not need to make a signature on the cancelled cheque. The cancelled cheque contains account holder’s information such as account number, IFSC code, bank branch details, cheque number and MICR (Magnetic Ink Character Recognition) code. Notably, it does not require the account holder’s signature.

A cancelled cheque is used for verifying account details for electronic fund transfers (EFTs), registering for automatic bill payments, withdrawing Employee provident fund (EPF), applying for new investments or insurance policies, verifying bank details for loans or credit cards, and fulfilling the requirement for KYC documents for businesses.

Related Read: What is Stop Payment and How Does it Work?

Cancelled Cheque Example

You can recognise a cancelled cheque by seeing the word “CANCELLED” between two parallel lines on a normal cheque. It contains several standard components, including the bank name, branch name, account holder’s name, account number, IFSC and MICR code.

Here is a cancelled check photo example:

Cancelled Cheque Image

Uses of a Cancelled Cheques

You will require a cancelled cheque for following use cases.

1. Verification of Bank Account Details

Primary use of cancelled cheques is to verify the individual bank account details. When you open a new bank account, apply for loans, or set up electronic fund transfers (EFTs) you need to submit a cancelled cheque.

Financial institutions like NBFCs also require a cancelled cheque for verifying authenticity of your details.

2. KYC Completion

A cancelled cheque plays a crucial role in completing the requirements of KYC details when investing in stock markets, mutual funds, and other financial schemes.

By submitting a cancelled cheque online, you provide proof of your bank account details to verify your identity and link it to your investment portfolio. This helps financial institutions ensure compliance with regulations and safeguard against fraudulent activities.

3. EPF Withdrawal

Cancelled cheque is mandatory while withdrawing funds from your Employee Provident Fund (EPF) account. It serves as proof of your bank account details, ensuring that the funds are transferred to the correct account.

4. Electronic Clearance Service (ECS)

A cancelled cheque is required to activate the Electronic Clearance Service (ECS) facility for secure fund transfers between bank accounts.

By attaching a cancelled cheque, you authorise the transfer of funds directly from your account to the designated recipient’s account.

5. Automatic Bill Payment

Cancelled cheque can be used to authorise utility bill payments to service providers, subscription-based businesses, and product companies, etc. The company is authorised to debit your bank account for recurring payments such as electricity bills, phone bills, insurance premiums, or membership fees.

6. EMIs

A cancelled cheque is needed to activate Equated Monthly Installments (EMIs) for loans or credit from banks or NBFCs. It facilitates direct debit from your bank account on a specified date, ensuring timely repayment.

7. Demat Account

When opening a Demat account for trading in stocks, a cancelled cheque verifies that you have an active bank account under your name. This ensures seamless transfer of funds during trading transactions.

8. Insurance

Submitting a cancelled cheque is essential when purchasing insurance policies. It acts as proof of your bank account details and aids in premium payments and other transactions related to insurance policies.

How Do You Write a Cancelled Cheque?

-

Ensure that you pick a new and unused cheque from the chequebook.

-

Start by drawing two parallel lines across the cheque. These lines should be drawn in such a way that they indicate that the cheque has been cancelled.

-

Between these parallel lines, write “CANCELLED” in capital letters. Make sure that the word is legible and visible.

-

Do not fill in any extra information such as the payee’s name or amount. The purpose of a cancelled cheque is to provide proof of your bank account details, so you must not include any additional information on the cheque.

-

It is important to ensure that you do not obscure any vital details on the cheque, which include your account number, IFSC, MICR code, bank name and bank address.

What are the Risks Associated with Cancelled Cheque?

Cancelled cheques cannot be misused. It is important to understand that no transaction can occur with a cancelled cheque. However, it still contains the valid account holder information, and all this information can be misused for fraudulent activities.

Here’s a breakdown of the main concerns:

Identity Theft

Be cautious with cancelled cheques, as they contain sensitive details like your account number, bank name, and routing codes. If someone with malicious intent gets hold of this information, they could commit fraud by opening new accounts under your name or stealing your money.

Data Breaches

Data breaches are a concern even with trusted organizations. A security lapse on their end could expose the information on your cancelled cheque, even if you provided it to a reputable company.

Unauthorized Use

There’s a slight chance that someone you trust with a cancelled cheque could misuse it. While the cheque itself cannot be used for transactions, the account details could be used for unauthorized online payments or money transfers if proper security measures aren’t followed.

Conclusion

A cancelled cheque remains a secure way to share essential bank account details. These details are vital for automated systems, Know Your Customer (KYC) verification, and various banking tasks. By relying on this information, banks can efficiently identify their customers. However, due to the sensitive nature of the information it reveals, it’s crucial to handle a cancelled cheque with caution to prevent potential fraud. When used responsibly, a cancelled cheque becomes a valuable tool for facilitating secure banking experiences.

Frequently Asked Questions (FAQs)

1. Is it mandatory to write a cancelled cheque?

No, it is not mandatory to write a cancelled cheque, but it is often required for various financial transactions.

2. Can my bank cancel my cheque?

Banks can cancel cheques upon customer requests, particularly in situations involving lost or stolen cheques. This provides an added layer of security and helps you protect your financial assets from potential misuse or fraudulent activities.

3. Is it permissible to sign a cancelled cheque?

Yes, it is permissible to sign a cancelled cheque as long as you mark it as “CANCELLED”.

4. What are the risks linked to cancelled cheques?

A cancelled cheque carries the risk of misuse or fraud if not properly destroyed. It may reveal sensitive banking information.

5. Is red ink acceptable for cancelling a cheque?

No, black or blue ink should be used to cancel a cheque.

6. Is it possible to block a cheque leaf online?

No, you cannot block a cheque leaf online. You must physically write “CANCELLED” across the cheque to render it financially invalid.