Table of Contents

What is Salary Breakup?

A salary breakup structure or a CTC (cost-to-company) breakup structure is the structure in which the CTC is divided into various components to arrive at the in-hand salary of an employee.

The CTC, or cost-to-company, is the total salary package that the company offers an employee during recruitment. Having said that, it is essential to note that CTC is never equal to the take-home pay received at the end of the month.

CTC is the total amount spent by the company on an employee, whether directly or indirectly. It includes various components like basic pay, provident fund, allowances, etc. Some companies calculate it by adding the employer’s contribution towards PF (Provident Fund) and Gratuity to the gross salary.

Fun Fact: RazorpayX Payroll platform provides this as a configuration option to users, so you can choose how to define the CTC structure for your employees.

Components of Salary Breakup Structure

1. Basic Salary: This is the fixed component of the salary, excluding any benefits and privileges. It can vary depending on the job location, industry and designation. It accounts for around 40-60% of the CTC and is fully taxable. Therefore, if the basic salary is too high, it will result in increased tax and PF liabilities, and if it is kept too low, it could violate the minimum wage norms.

2. Allowances: This refers to the expenditure incurred by the employer to enable you to render the services required. These allowances depend on the location, designation and your job role and are provided over and above the basic salary. The amount of allowance depends on the individual policies of the company. Given below are the most common forms of allowances.

- House Rent Allowance

- Leave Travel Allowance

- Conveyance Allowances

- Special Allowances

3. Statutory Bonus or Performance Bonus: The company provides a statutory bonus as a reward for an employee’s excellent performance. It is given in addition to the basic salary and is paid to motivate the employees under the Payment of Bonus Act 1965. The bonus amount is expressed as a percentage of the basic pay, depending on the company’s policies.

4. Employee Provident Fund (EPF or PF): A provident fund is a retirement benefit that the employer provides to the employees. A certain percentage of the basic pay is dedicated every month from the CTC of the employee, and the same amount is contributed by the employer every month towards this fund.

An employee can withdraw this amount after being unemployed for 1 month. This is a part of the retirement benefit plan of the company and is generally calculated at 12% of the basic salary.

5. Gratuity: It is the lump sum amount paid to the organisation’s employees after they complete 5 years of service. As the name suggests, it is the amount paid as a gratitude towards the employee for their dedication and hard work over the years of their service. The gratuity amount is calculated at 4.81% of the basic pay, per the Payment of Gratuity Act, 1972.

6. Insurance: Many companies provide group or individual life health insurance policies to promote the health and well-being of their employees. A small amount is deducted from the CTC of the employee every month and used towards the payment of the premium.

Provide Best Group Health Insurance

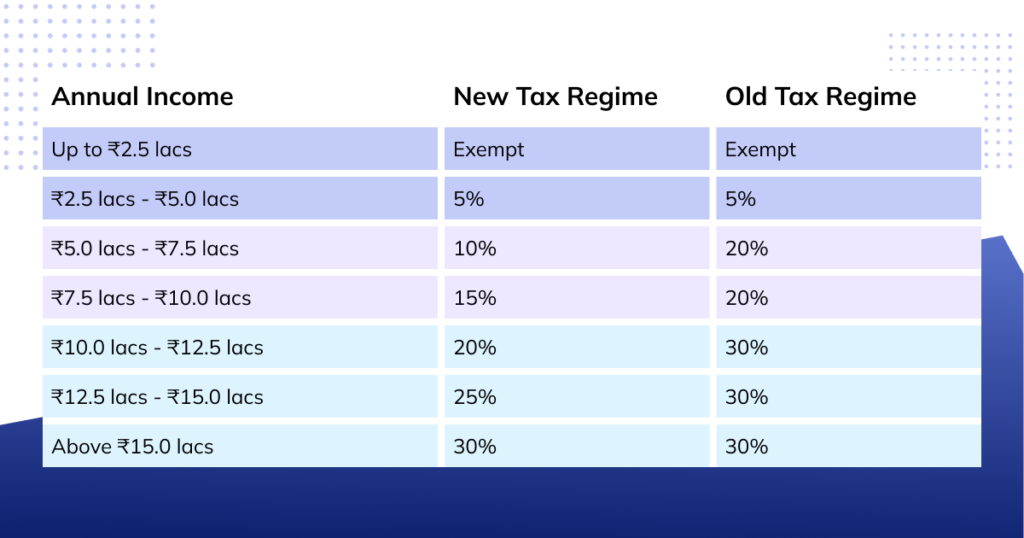

7. Taxes and Liabilities: After all the allowances, PF, gratuity, and bonus are deducted from the salary, the remaining amount is then adjusted towards the income tax and the professional tax. The tax due on the salary is calculated based on the slab rates applicable. Employees can choose between the new tax regime and the old one.

The amount of tax calculated is directly deducted from your salary before crediting it to your account. This amount deducted by the employer is known as TDS (Tax Deducted at Source).

The amount of tax calculated is directly deducted from your salary before crediting it to your account. This amount deducted by the employer is known as TDS (Tax Deducted at Source).

8. Gross Salary: It is the total salary before accounting for various deductions. Gross salary can be arrived at by adding the basic salary, HRA, bonus, and allowances.

9. In-hand or Take-Home Salary: The amount left after all the above adjustments are made is known as the in-hand or take-home salary. It is the salary that employees receive at the end of every month. In other words, it is the amount that is credited into employees’ bank accounts every month.

Here is the formula to calculate in-hand salary –

Net Salary = Basic Salary + Allowances – (Provident fund + Gratuity + TDS + Professional Tax)

How is Salary Structure Determined?

The salary structure of every employee is distinct and is decided based on several factors, such as:

- The level of education and the years of experience

- The industry they belong to and the significance of the work being done

- Location of the job and the cost of living in the city

- The skill sets that the employee possesses and the demand for those skills

- The demand and supply of talent in the given area

Salary Breakup Calculation

There are usually 3 components of salary: Basic Salary, Allowances and Deductions. Net Salary is calculated as follows:

| Particulars | Amount | |

| Basic Salary | (A) | XXXXX |

| Add: Allowances | (B) | XXXXX |

| Gross Salary | (C = A+B) | XXXXX |

| Less: Deductions | (D) | XXXX |

| Net Salary (In-hand Salary) | (E = C-D) | XXXXX |

CTC is calculated by adding the employer’s contribution for PF and Gratuity to the Gross Salary.

Salary Breakup Calculation Example

Let’s consider an annual CTC of Rs. 3,60,000. For this the salary breakup structure will look like this:

| Salary Components | Calculation | Amount | Deductions | Amount |

| BASIC | 50% OF CTC | 15000 | PF EMPLOYEE CONTRIBUTION | 1800 |

| HRA | 50% OF HRA | 7500 | PF EMPLOYER CONTRIBUTION | 1800 |

| LEAVE TRAVEL ALLOWANCE | FIXED AMOUNT | 3000 | ||

| SPECIAL ALLOWANCE | BALANCE FIGURE | 2700 | ||

| PF EMPLOYER CONTRIBUTION | [GROSS-HRA] * 12 % LIMIT TO 1800 |

1800 | ||

| GROSS SALARY | Basic + allowances | 30000 | TOTAL DEDUCTIONS | 3600 |

Hence, net pay or in-hand salary = 30,000 – 3600 = Rs. 26,400

Automated Payroll Compliance

RazorpayX Payroll is an all-in-one payroll software that automatically bifurcates CTC into basic, HRA, special allowance etc.

All you have to do is set a date, and your employees get paid on time. Yes, we calculate and disburse salaries into employee bank accounts in just 3 clicks.

RazorpayX Payroll also takes care of compliances such as TDS, PF, PT & ESIC. Sign up once and automate everything from salary calculation & disbursement to managing compliances.

[Read how Zo World Reduced Its Payroll & Reimbursement Timelines by 75% with RazorpayX Payroll]

Read more:

FAQs

What is a Payslip or Salary Slip?

A Payslip or Salary Slip is a document provided by the employer to all the employees. It is a monthly statement that consists of the details about all the components of the salary. All elements of the salary breakup, including the deductions, are enlisted in a payslip or a salary slip. It provides the detailed structure of the salary at a glance.

What is the difference between CTC and in-hand salary?

While CTC represents the sum total of all components of the salary breakup structure, the in-hand salary is the amount that you actually receive in your bank account after deductions. Read more in the blog post.

What are the components of salary breakup?

Basic salary, allowances, performance bonus, EPF, gratuity, insurance, tax & liabilities, gross salary, and in-hand salary. Read the blog post for more details.