What is Payroll?

Payroll is the compensation a company should pay to its employees for a specified period of time or on a given date. Payroll is generally managed by the Accounting or Human Resource department of a company. For some small businesses, payroll may be handled by the owner himself.

These days payroll is usually outsourced to third party companies that perform a wide range of payroll functions. The payroll consists of processes such as creating a list of paid employees, tracking their working hours, calculating pay, providing their salary on time, employee benefits, tax withholding.

RazorpayX Payroll is a fully-automated payroll and compliance software that automatically calculates and executes payroll with just 3 clicks every month. RazorpayX Payroll comes with best-in-industry employee self-serve portals, integrations with tools like Slack, Whatsapp, Zoho People and more.

Learn more: Features of RazorpayX Payroll

Functions of Payroll

Payroll as a function encompasses the following:

Payroll policy and process

Defining organisational payroll policy around payslip components like basic & variable pay, HRA, LTA and more

Calculating salary

Calculating gross salary, statutory and non-statutory deductions like PF, taxes, etc

Creating and maintaining records

The payroll function also creates and maintains payroll records such as payslips, time and attendance records, earnings, deductions, etc.

Tax and compliance

Payroll is also responsible for depositing dues like TDS and PF with appropriate authorities to comply with tax and other laws

Issuing salary

The primary duty of the payroll department is to disburse salary to the employees every month or week, depending on the payroll cycle as determined in the payroll policy.

Audit and reporting

Payroll function is also responsible for ensuring that proper documentation and reporting systems are in place for any audits or checks.

Answering queries

Both employees and management constantly have payroll and payslip-related queries. It is up to the payroll department to answer these queries and ensure all stakeholders have all the information they need.

Previously, businesses relied on spreadsheets or manual methods to calculate and disburse salaries. Today, automated payroll software helps businesses manage these complexities effortlessly.

A payroll cycle is the time gap between two salary disbursements. Businesses can opt to pay salaries on a weekly, bi-weekly, or monthly basis. Generally, in India, it is processed every month.

Read more: Payroll Service Provider

Advantages of Payroll

While there are benefits to a manual payroll process, automated payroll is the way to go today. Here’s why:

Reduced costs

Automated systems reduce the risk of payroll errors, which can lead to fewer penalties and fines. They also save time and resources, leading to lower labour costs.

Enhanced compliance

Automated systems can automatically calculate and withhold taxes and generate reports that can be used to verify compliance.

Improved employee satisfaction

Employees appreciate being paid accurately and on time. Automated payroll systems ensure that employees are paid correctly and on time, wh

Table of Contents

Error-free calculation

Automated payroll systems reduce the risk of errors in payroll calculations, leading to fewer discrepancies in employee paychecks.

Timely payments

Automated calculations and payment disbursals result in on-time payments with no errors. This results in happy employees and smooth business operations.

Time-saving

Manual payroll processes are time and resource-consuming. With automated payroll, most manual tasks are done automatically in a fraction of the time.

Data security

Robust, trustworthy payroll systems store employee data very securely. Data leaks and privacy issues are a one-in-a-million occurrence. With paper-based payroll, employee records can be stolen, mishandled or lost.

Easy data insights

With all employee data and records available digitally, employers can use analytics tools to forecast trends and employee behaviour.

Components of Payroll

Payroll, the process of compensating employees for their work, involves several crucial components. Understanding these parts ensures accurate and efficient payment for your workforce. Here’s a breakdown of some key elements:

Basic Salary

This is the fixed amount of money an employee earns before any bonuses or deductions. The basic salary is fixed and is determined based on the employees’ experience, role and industry standards.

Basic salary forms the basis for other parts of your compensation, like allowances and bonuses, which can be added on depending on your performance or company policies.

Allowances

These are additional payments made on top of the base salary to compensate for work-related expenses. Common examples include housing allowances, transportation allowances, and meal allowances. The taxability of allowances can vary.

Deductions

These are amounts withheld from an employee’s paycheck before receiving their net salary. Deductions can be mandatory (like taxes) or voluntary (like contributions to PF).

Gross Salary

This represents the total amount an employee earns before deductions are applied. It’s the sum of the base salary and any allowances.

Net Salary (Take-Home Pay)

This is the final amount an employee receives after all deductions are subtracted from their gross salary.

Ad-hoc Pay

Ad hoc pay is a non-regular payment given to an employee outside of their normal paycheck. Unlike your regular salary, it’s a one-time bonus triggered by specific reasons like a stellar project completion or covering unexpected work expenses. These payments are typically handled quickly to address the immediate need, and they may or may not be taxable depending on the situation.

Tax Deducted at Source (TDS)

TDS, or Tax Deducted at Source, acts like a prepayment of income tax deducted by your employer from your salary. This reduces your tax burden at year-end. The employer calculates the TDS amount based on your income, tax bracket, and investments. They then deposit this deducted tax to the government on your behalf.

Perks

These include perks offered by the employer, including gym memberships, company cars, accommodation, etc. They play a crucial role in attracting and retaining top talent.

Taxation

A significant aspect of payroll is calculating and withholding taxes from employee wages. This includes income tax and sometimes unemployment taxes. The appropriate tax rates and deductions depend on various factors like employee location, earnings level, and filing status.

Payroll Processing in India

Here are the series of steps involved in executing payroll successfully from ground zero.

Processing payroll is a sensitive task that involves the efforts of multiple departments like HR, finance and legal. This process includes the following functions:

Pre-Payroll Activities

Step 1: Payroll policy structure

Establish a payroll policy as a first step before beginning the payroll process. A good payroll policy should address the following:

- Pay structure and compensation: Define salary components, pay grades, overtime rules, bonuses, commissions, and incentive plans.

- Payroll schedule: Determine pay periods (weekly, bi-weekly, monthly), payday, and distribution methods (direct deposit, checks).

- Deductions and withholdings: Outline mandatory deductions (taxes, social security, Medicare) and optional deductions (health insurance, retirement contributions).

- Time and attendance tracking: Establish policies for recording hours worked, overtime, breaks, and leave.

- Payroll errors and corrections: Outline procedures for correcting payroll mistakes and handling disputes.

- Compliance: Ensure adherence to central, state, and local laws and tax regulations.

- Employee communication: Establish guidelines for communicating payroll information to employees (pay stubs, notices, policies).

- Payroll software and systems: Specify the payroll system used, data security measures, and access controls.

- Review and updates: Outline a process for regularly reviewing and updating the payroll policy to reflect changes in legislation or company practices.

Step 2: Consolidating payroll inputs

To process payroll, you need employee information like bank account details, time and attendance data, identity information like PAN and taxation details, etc. Consolidate all these inputs into an easily accessible and secure database in order to be able to process salaries without hassle.

Step 3: Validating inputs

Make sure you validate the employee information collected before using them in your calculations. Data validation can help avoid errors and ensure compliance.

- Verify that data entered matches the expected format (e.g., numbers for SSN, dates for birthdate)

- Match employee identification documents (e.g., driver’s license, passport) with provided information

- Conduct background checks on new employees

- Identify and remove duplicate records

Payroll Activities

Step 4: Calculating payroll

Calculating payroll manually is a tedious and highly complex task thanks to the complex taxes and deductions applicable for salaried employees in India. Automated payroll calculations take a few seconds and are error-free.

For manual calculations, you can calculate gross salary by adding the basic salary, dearness allowance, house rent allowance (HRA), other allowances, and overtime pay (if applicable).

Step 5: Deduct taxes and other statutory compliances

The next step in calculating final salary is to deduct taxes. Calculate deductions like Professional Tax (PT), Provident Fund (PF), Employee State Insurance (ESI), Income Tax (TDS), and other applicable deductions and deduct from the gross salary to arrive at the net take-home salary.

Step 6: Making the actual payment

The final step in the payroll activity is to disburse salaries to the employees. This is also a tricky step, since any errors can have huge negative consequences to both employer and employee. Make sure to double-check all calculations and payments before you make them.

Post-Payroll Activities

Step 7: Payroll Accounting

Payroll makes up a significant chunk of any business’s expenses. It’s important to account and reconcile payroll expenses so that the company can maintain accurate financial records, ensure compliance with tax regulations, identify potential errors or discrepancies, and make informed decisions about labor costs and budgeting.

Making statutory payments is a critical component of the payroll process. These payments are mandatory contributions made by employers and employees to various government-mandated schemes.

Common Statutory Payments Include:

- Provident Fund (PF): A mandatory savings scheme for employees, with contributions from both employer and employee.

- Employee State Insurance (ESI): A social security scheme providing medical benefits to employees and their dependents.

- Professional Tax (PT): A state-level tax levied on salaried individuals.

- Income Tax (TDS): Tax deducted at source from employee salaries.

- Other Statutory Payments: Depending on the nature of the business and location, other statutory payments might include gratuity, bonus, maternity benefits, etc.

Step 9: Payslips and tax computation sheets

A payslip is a detailed document provided to employees outlining their earnings, deductions, and net pay for a specific pay period. It serves as a record of the employee’s income and tax withholdings.

A tax computation sheet is a detailed breakdown of an employee’s income tax liability for a financial year. It outlines the calculations involved in determining the taxable income, tax deductions, and final tax payable.

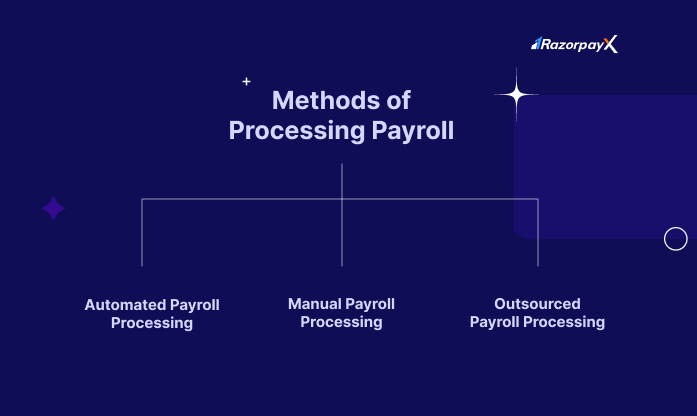

Methods of Processing Payroll

There are three ways to process payroll: the manual spreadsheet route, the automated route, or outsourcing the entire process.

Depending on the budget, size of the organisation and each business’s special set of circumstances, payroll can be processed in any way.

Manual Route

Many businesses at their initial stage of operations find spreadsheet-based payroll management convenient because they only have a handful of employees to manage.

This method involves calculations using standard templates that have set mathematical formulas for the salary and compliance payment computations.

While this is a cost-effective method, it’s not suitable for businesses when their employee count increases. Also, the opportunity cost of using a traditional system over automated methods is very high.

Automation

Automated software will do away with all the challenges of using spreadsheets or outsourcing them. There are many automation tools and software available in the market that can reduce manual efforts and increase efficiency.

Apart from carrying out payroll computations, the software needs to be updated with the latest compliance laws.

Read more: How to switch to automated software

Outsourcing

This means entrusting your payroll execution to an agency. A lot of businesses that don’t have dedicated personnel opt for outsourcing.

Based on their payroll cycle, they provide the agency with salary information and other data such as attendance, leaves, reimbursement details, etc. every month. The agency then calculates dues and is also responsible for complying with statutory compliances.

Current Payroll Landscape in India

To understand the current payroll landscape in India, RazorpayX Payroll commissioned a survey by the International Research Bureau, which spoke with HR executives from 163 organizations across 12 key industries.

The findings?

- Payroll automation is the norm. All the businesses IBR spoke to automated their payroll functions with payroll software. Only 37% of Indian businesses perform their payroll functions manually.

- Current payroll tools being used lack functional prowess. This was clearly indicated in the fact that 31% of organizations say that their payroll accuracy is below 90%. This is an unacceptable number since payroll is a very important function in every organization.

- There is limited insight into ideal payroll solutions. Most organizations today use sub-optimal payroll software that does not provide fundamental features like automated compliance, speedy and accurate processing, data security and more.

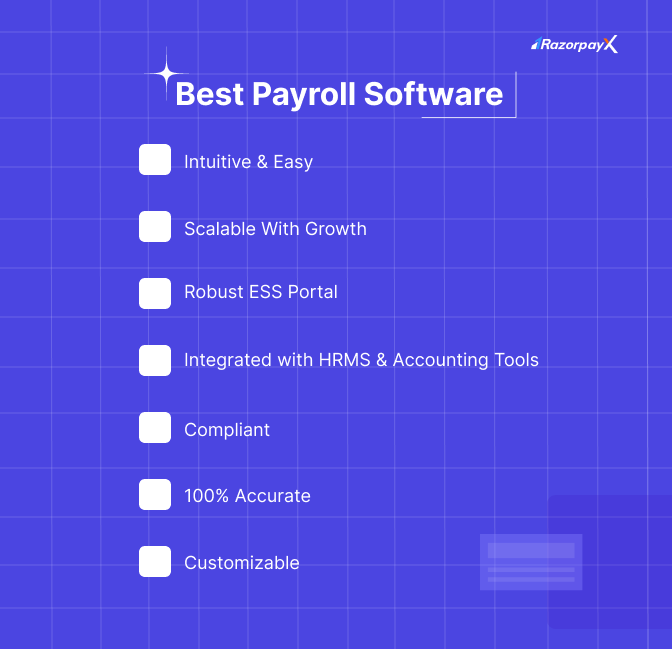

Best Payroll Software for Your Business

Out of all the ways to carry out your business’s payroll process, automated payroll is the most popular and economical. What does a good payroll software look like?

Intuitive & Easy: A good payroll software is intuitive and easy to operate. It should be easy to implement with minimal training for both HR teams and the employees.

Scalable: As a business grows, so does the size and complexity of its payroll function. A good payroll software should be able to handle payroll for businesses at all stages: small, mid-market and enterprise level.

Read more: Payroll for Enterprise

Robust ESS Mechanism: Payroll software is equally used by the employee to access payslips, submit declarations and other important payroll information. A good employee self-service portal thus becomes very important since it enables employees to be self-reliant.

Integrations

HRMS Integrations: Payroll is only one of the several functions that come under the purview of the HR department and is closely tied with other HRMS functions like time, attendance, and leave management.

A good payroll software should be able to integrate seamlessly with other HRMS software. For example, the RazorpayX Payroll integrates with 45+ HRMS like ZohoPeople, Springverify and more to provide an all-in-one, seamless experience for both HR and employees.

Accounting Integrations: Payroll is an important function of the finance team as well – employee salaries take up a sizeable chunk of most teams’ budgets, and ensuring that this expense is properly and accurately recorded is very important.

For this reason, most payroll software should provide you with integrations with accounting software which will automatically record payments to employees in your books of accounts.

Compliant: The tax regulations and requirements in India are ever-changing, and good payroll software should be able to keep up and stay updated in real time. Compliance includes elements like tax deductions, PF deductions and minimum salary payment requirements.

Not adhering to regulatory requirements can be very costly for a business – it can lead to hefty fines, lawsuits or even criminal punishment.

100% Accurate and Timely: Imagine if you paid the wrong salary to your employees – the consequences of this is immense; right from correcting the error to identifying the source of the error becomes a tedious, time-consuming task.

This is why it is important for payroll software to be 100% accurate right from the start, with no room for error.

Learn more: Timely & Accurate Payroll Software

Customizable: Every business’s needs are different; good payroll software should accommodate these unique needs with customizations. For example, businesses that pay employees on a shift-wise basis are different from those that pay on an hourly or a monthly basis.

Challenges in Handling Payroll Process

Keeping Up with Compliance

Businesses in India have to follow a legal framework while disbursing salaries to their employees. This framework is made up of four components.

Compliance is complicated because each tax is computed differently. Businesses must also periodically file returns on four different portals or risk expensive penalties.

Most businesses use spreadsheets and other manual methods to work on compliance, which is not the most efficient way to be compliant. The computations are lengthy, time-consuming and inaccurate.

In India, employee laws also change frequently, making it even tougher to stay updated.

Read more: Income Tax Slabs 2023

Spreadsheet Complications

According to a survey, over 57% of businesses in India still rely on paper or spreadsheet-based payroll management and payroll processing.

Manual payroll is easy and cheap, but also time-consuming and prone to mistakes. Information can also be mishandled and tampered with.

Spreadsheets also cannot be compliant with tax laws as they change.

Data Security

For processing payroll, employees are required to provide a substantial amount of sensitive data in the form of official documents to the concerned team. These include employee’s bank account details, rental agreements, PAN and Aadhaar details.

This data can be compromised; failure to protect it can seriously damage the reputation of the business and the personal security of employees.

Paper-based documents can be misplaced easily. Even if the documents are saved on spreadsheets, they are just a password away from being misused.

How to Manually Calculate Payroll

To calculate payroll taxes in India, follow these steps:

- Calculate your gross salary. This includes your basic salary, allowances, and any other taxable components.

- Subtract any exempt components from your gross salary. This includes the following:

-

-

-

- House Rent Allowance (HRA)

- Leave Travel Allowance (LTA)

- Standard Deduction

-

-

-

- Calculate your taxable income. This is the amount of your salary that is subject to income tax.

- Calculate your income tax. This is done by applying the income tax slabs to your taxable income. The income tax slabs for the financial year 2023-24 are as follows:

| Income slab | Tax rate |

|---|---|

| Up to ₹2.5 lakh | 0% |

| ₹2.5 lakh to ₹5 lakh | 5% |

| ₹5 lakh to ₹7.5 lakh | 20% |

| Above ₹7.5 lakh | 30% |

- Add any other payroll taxes, such as professional tax and provident fund contribution, to your income tax.

- The total amount of payroll taxes payable is the sum of your income tax and other payroll taxes.

Calculating these taxes manually for each and every employee is a tedious task. Learn more about automating your payroll with RazorpayX Payroll.

Payroll Glossary – Important Terms

1. Gross Pay: Gross salary is the total of all the components of the salary package offered to an employee. It is the salary before any mandatory and voluntary deductions such as income tax, provident fund, medical insurance, etc.

2. Net Pay: After calculating gross pay, you must make govt. mandated deductions such as income tax, provident fund, etc. from gross pay. The amount that an employee takes home after all such deductions is termed net pay or net salary.

3. Overtime: Overtime refers to the extra hours worked by an employee in a company than the usual defined as per govt. Law. The extra salary or remuneration that the employee will get depends on the company policies.

4. Pay Period: It is a time frame defined to calculate earned wages and determine when employees receive their payslips. Pay periods are fixed and recurring on a bi-weekly, or monthly basis.

5. Compensation: It involves managing, analysing, and determining the salary, benefits, and incentives paid to the employees for their work.

6. Contractual employees: These are not permanent employees and are usually employed on a temporary basis. Their terms of employment are mentioned in the contract.

Try RazorpayX Payroll for Free!

Responsibilities of HR and Payroll

HR focuses on employee well-being, development, and legal compliance, while Payroll handles the financial aspects of employee compensation, ensuring accurate and timely payments.

HR is responsible for attracting, interviewing, and hiring qualified candidates. They also manage the onboarding process, ensuring new hires are equipped and comfortable in their roles. They are responsible for managing benefits, performance and compliances.

Payroll, on the other hand, is a complementary function that manages the calculation and disbursal of employee wages. It also factors in deductions for taxes, benefits contributions, and garnishments.

In most businesses, payroll and HR coordinate on employee pay, benefits and taxation matters.

FAQs

What is payroll in HR?

Payroll in HR means managing and administering employee compensation. It involves ensuring accurate and timely payment to employees while adhering to legal requirements and company policies.

What is the formula to calculate payroll?

The payroll formula is used to calculate the net pay of an employee, which is the total amount of money they receive after deductions. The basic payroll formula is: Net pay = Gross pay - Deductions.

Gross pay is the total amount of money an employee earns before deductions, including base salary, bonuses, overtime pay, and commissions. Deductions can include taxes, social security, Medicare, health insurance, and retirement contributions.

What is the process of payroll?

The process of payroll begins with collecting employee information, which is then followed by deducting taxes, ensuring compliances and finally disbursing salaries to employees. The process of payroll also includes accounting for payroll related expenses and keeping up with the changing regulations.

What is the difference between payroll & salary?

Salary is the fixed amount of money paid to an employee for their work, and payroll is the process of calculating and distributing employee wages.

What is a payroll cycle?

A payroll cycle is the time between two salary payments. Most businesses follow monthly payroll cycles, where salaries are paid on the first or last day of every month. Some businesses may follow daily, weekly or fortnightly payroll cycles.

What is a payroll software?

Payroll software is any automation or tool that helps businesses manage payments made to employees. Good payroll software also helps businesses follow compliance and tax laws in the country it operates in. For example, in India payroll software like RazorpayX Payroll automates TDS payments and more.

What is payroll management?

Payroll management is the process of compensating employees for work done over a period of time. It involves tasks like tracking employee hours, wages, keeping track of employee information, calculating deductions for taxes, benefits and paying employees on time.

What is payroll processing?

Payroll processing is the series of steps taken to ensure employees are paid accurately and on time for their work. Payroll processing starts with gathering employee data and ends with timely and accurate payment of salaries.

Is payroll part of HR?

Payroll can be part of HR, especially in smaller companies. But ideally, they function as separate departments. HR focuses on employee relations, benefits, and development, while payroll ensures accurate and timely payments by handling calculations, deductions, and tax withholdings. Both departments work together to keep employee information up-to-date and ensure a compliant compensation process.