A line of credit is a financial tool that provides businesses with a predetermined amount of funds that they can access on an as-needed basis. It functions similarly to a credit card, where businesses can borrow funds up to a specific limit, repay them, and borrow again without needing to reapply for a new loan each time.

The importance of a line of credit for businesses lies in its flexibility and convenience. It offers a safety net for managing cash flow fluctuations, covering unexpected expenses, seizing growth opportunities, and addressing short-term financing needs.

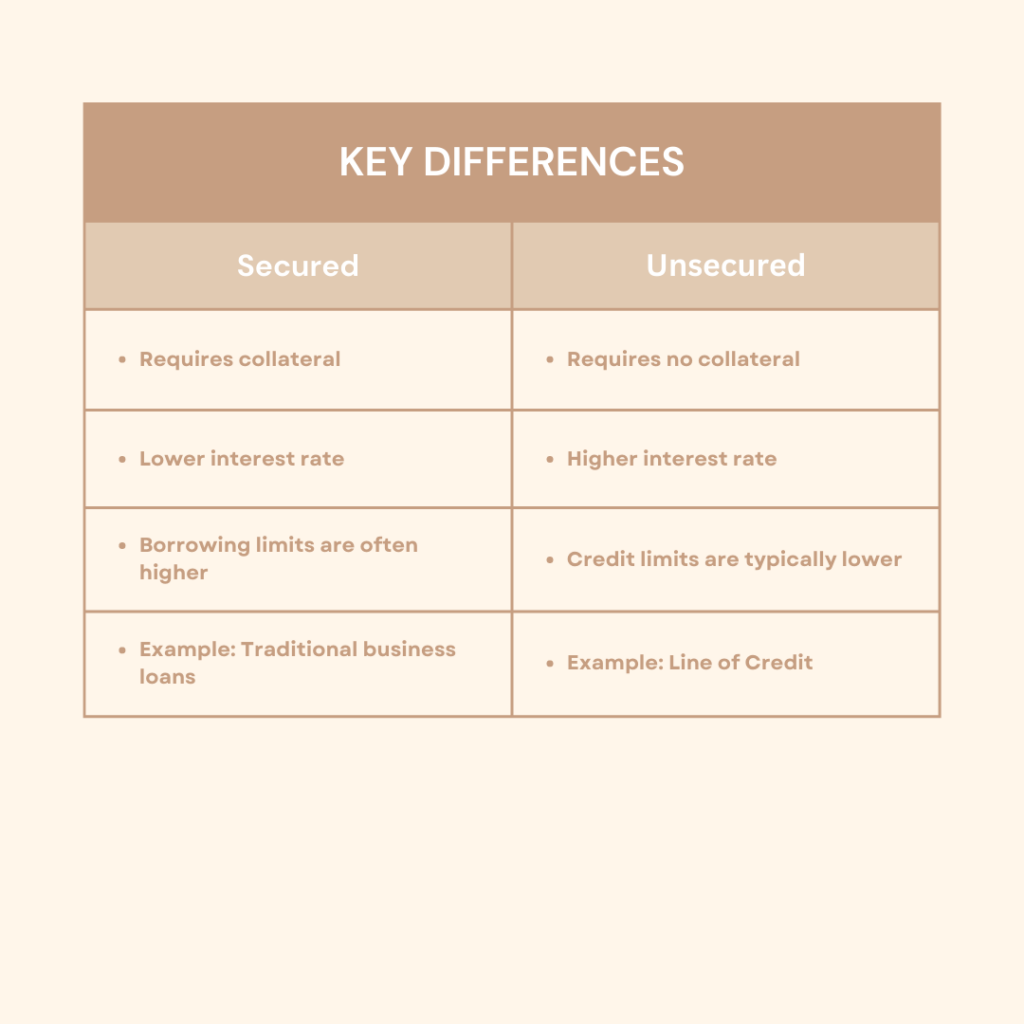

Line of credit can be secured or unsecured and understanding the difference between the two is crucial for businesses for several reasons. Firstly, it impacts the terms and conditions of the loan, including interest rates, repayment terms, and credit limits. Secondly, it determines the level of risk involved for both the borrower and the lender. Lastly, it influences the type and value of assets that may need to be pledged as collateral.

Let’s delve deeper:

Table of Contents

Understanding secured line of credit

Secured lines of credit are a type of financing arrangement where borrowers provide collateral as security against the loan. Collateral is an asset or property that the lender can claim if the borrower fails to repay the loan. This collateral serves as a guarantee, reducing the risk for the lender and allowing them to offer more favourable terms to the borrower.

Collateral for secured lines of credit can take various forms, including:

- Real estate: Residential or commercial properties, land, or buildings can be pledged as collateral.

- Equipment: Machinery, vehicles, or specialised tools used in business operations.

Inventory: Goods or products held by the business that have market value. - Accounts receivable: Outstanding invoices or payments owed to the business by customers.

The type of collateral accepted may vary depending on the lender and the specific terms of the loan. The value and liquidity of the collateral play a role in determining the credit limit or borrowing capacity of the line of credit.

Advantages of secured line of credit:

- Lower interest rates: Secured lines of credit generally come with lower interest rates compared to unsecured options. The collateral provides a level of security to the lender, reducing the risk of default, which translates into lower interest charges for borrowers.

- Higher borrowing limits: Since collateral is involved, lenders are often willing to extend higher credit limits, allowing businesses to access more substantial funds.

- Easier approval: Secured lines of credit are often more accessible for borrowers with lower credit scores or limited credit history, as the collateral mitigates the lender’s risk.

Disadvantages of secured line of credit:

- Risk of collateral loss: The primary risk for borrowers is the potential loss of the collateral if they default on the loan. Failing to repay the loan can result in the lender seizing and selling the collateral to recover the outstanding debt.

- Documentation and evaluation: Obtaining a secured line of credit may involve more paperwork and documentation to evaluate the value, ownership, and condition of the collateral.

Specific industries where secured line of credit is used:

Secured lines of credit are commonly used in industries where businesses have valuable assets that can be pledged as collateral. Some examples include:

- Construction and real estate: Builders and developers often utilise secured lines of credit to finance projects and acquire land or properties.

- Manufacturing and equipment financing: Businesses in manufacturing rely on secured lines of credit to purchase or lease machinery, tools, or equipment needed for production.

- Retail and inventory management: Retailers may use secured lines of credit to finance inventory purchases, especially during peak seasons or promotional periods.

- Service industries: Service-based businesses, such as consulting firms or healthcare providers, may leverage secured lines of credit to invest in technology, equipment, or facility expansions.

Understanding the nuances of secured lines of credit allows businesses to make informed decisions about collateral, interest rates, credit limits, and overall risk. This knowledge empowers businesses to leverage the benefits of secured lines of credit while mitigating potential risks involved in borrowing against collateral.

Exploring unsecured line of credit

Unsecured lines of credit are a type of financing that does not require borrowers to provide collateral. Unlike secured lines of credit, unsecured lines of credit rely primarily on the borrower’s creditworthiness and financial standing as the basis for approval.

Unsecured lines of credit are typically granted based on factors such as the borrower’s credit history, credit score, income stability, and business financials. Lenders assess the borrower’s ability to repay the loan based on these criteria, as there is no underlying collateral to serve as security.

Advantages of unsecured line of credit:

- No collateral requirement: The primary advantage of unsecured lines of credit is that borrowers are not required to pledge collateral, eliminating the risk of losing valuable assets in case of default.

- Quick access to funds: Unsecured lines of credit often have a faster application and approval process, allowing businesses to access funds quickly when needed.

- Flexibility: Borrowers have the freedom to use the funds from an unsecured line of credit for various business purposes without restrictions.

Disadvantages of unsecured line of credit:

- Higher interest rates: Unsecured lines of credit generally come with higher interest rates compared to secured options. Lenders compensate for the increased risk by charging higher interest rates to mitigate potential defaults.

- Lower credit limits: Without collateral as security, lenders may offer lower credit limits for unsecured lines of credit compared to secured options.

- Stricter eligibility requirements: Lenders impose stricter criteria for approving unsecured lines of credit, including higher credit score requirements, established business history, and stable income.

Specific industries where unsecured line of credit is used:

- Professional services: Businesses in sectors such as consulting, accounting, or legal services often rely on unsecured lines of credit to manage cash flow gaps, cover overhead expenses, or invest in business growth initiatives.

- Technology and innovation: Startups or businesses in the technology industry may utilise unsecured lines of credit to finance research and development, purchase software or hardware, or support marketing efforts.

- Retail and e-commerce: Unsecured lines of credit can assist retailers and e-commerce businesses in managing inventory, marketing campaigns, or expanding their online presence.

- Service-based businesses: Service-oriented businesses, such as healthcare providers, marketing agencies, or event planners, can benefit from unsecured lines of credit to cover operational expenses or invest in business expansion.

Understanding the nature of unsecured lines of credit allows businesses to evaluate their creditworthiness, assess their borrowing needs, and determine whether the absence of collateral is suitable for their financial goals and risk tolerance. By considering the advantages and disadvantages, businesses can make informed decisions regarding the use of unsecured lines of credit to support their operations and growth.

Key differences between secured and unsecured line of credit

Factors to consider when choosing between secured and unsecured line of credit

When considering whether to opt for a secured or unsecured line of credit, businesses should carefully evaluate several factors to determine the most suitable option. Here are important considerations to keep in mind:

- Financial stability: Assess your business’s financial stability, including cash flow, revenue, and profitability. A secured line of credit may be more appropriate if your business has fluctuating income or lacks a stable financial position. In contrast, a strong financial position may make you eligible for favourable terms with an unsecured line of credit.

- Collateral availability: Determine the availability and value of collateral assets. Secured lines of credit require collateral, such as real estate, equipment, or inventory, which can affect the borrowing limit and interest rates offered by lenders. If you have valuable assets that can serve as collateral, a secured line of credit may provide more favourable terms.

- Interest rates: Compare the interest rates associated with secured and unsecured lines of credit. Generally, secured lines of credit tend to have lower interest rates due to the presence of collateral, while unsecured lines of credit may come with higher interest rates to offset the increased risk for lenders. Consider the long-term implications of interest rates on your business’s financial health.

- Repayment terms: Evaluate the repayment terms offered by lenders for both types of credit lines. Factors to consider include repayment period, flexibility in repayment schedules, and the impact on your business’s cash flow. Secured lines of credit often provide longer repayment periods, while unsecured lines of credit may have shorter repayment terms. Choose the option that aligns with your business’s financial projections and ability to meet repayment obligations.

- Business needs and goals: Determine your specific business needs and goals that require financing. Consider whether you need a one-time lump sum for a specific project or ongoing access to funds for operational expenses. Assess the amount of funding required, the urgency of accessing funds, and the potential impact on your business’s growth and profitability.

Risk Tolerance: - Evaluate your risk tolerance as a business owner: Secured lines of credit provide a lower risk for lenders as they have collateral as security, but it means you could lose the collateral if you default on the loan. Unsecured lines of credit do not require collateral but involve higher risk for lenders and potentially higher interest rates for borrowers.

Did you know?

Razorpay offers an unsecured line of credit to businesses. With interest rates starting at 1.5% per month, Razorpay will approve your application under 2 days. Once Line of Credit is enabled, you can withdraw money, repay and borrow again from the approved credit limit.

✅ Credit Limit up to Rs. 25 lakhs

✅ 100% flexibility – No pre-closure charges

✅ Low interest rates – Starting from 1.5% per month

✅ Reduce interest flow – Pay as you use