Vendor payments are an important part of the procurement cycle, where the business makes the final payment to the supplier. It forms a crucial part of good vendor management and overall accounts payables.

Good vendor management contributes to positive cash flow and good financial health of the business. Well-managed vendor payments ensure accurate and timely payments, which result in a good relationship with your vendors.

Industry-first tools like RazorpayX Source to Pay come with features like automated vendor payments, vendor portal, automatic PO creation, customizable approval workflows and more – making vendor management and vendor payments the easiest it’s ever been.

What are vendor payments?

Vendor payments is the process of calculating and disbursing payment to vendors for goods or services purchased on credit. It is the final step in the procurement cycle. Vendor payments are also known as accounts payable or invoices to pay.

Vendor payments can be a complex and time-consuming process. It is very important to make these payments on time – delayed payments result in a deteriorating relationship with your vendors, and a delay throughout the supply chain.

The process of making these payments comes with complex calculations and tedious manual tasks. Inaccurate or delayed payments can result in a deteriorating relationship with your vendors.

Importance of Vendor Payments

Good vendor payments help maintain a good relationship with your vendors. Here are the reasons businesses invest so much in a good vendor management system.

- Builds trust and reliability: Vendors trust businesses that pay them on time and in full. This ensures a healthy and mutually beneficial relationship between the vendor and the business.

- Resource availability: Vendors, as long as they are paid on time, can continue to provide the business with the support they need, meaning the business has access to high-quality goods and services throughout.

- Avoid penalties: Avoiding late payments or delays can reduce the risk of having to pay penalties or fines. It also improves the business’s credibility with the vendor and may contribute to increasing credit limits.

- Reputation building: Vendor payments help improve a business’s reputation – when businesses pay their vendors on time and in full, it shows that they are a responsible and ethical business. This can help attract new customers and partners, and can also help to improve a business’s credit score.

Read more: Procure to Pay

Vendor Payment Process

Vendor payments is the processing of making payment to the vendor. It is processed by the procurement or accounts payable team along with the finance team.

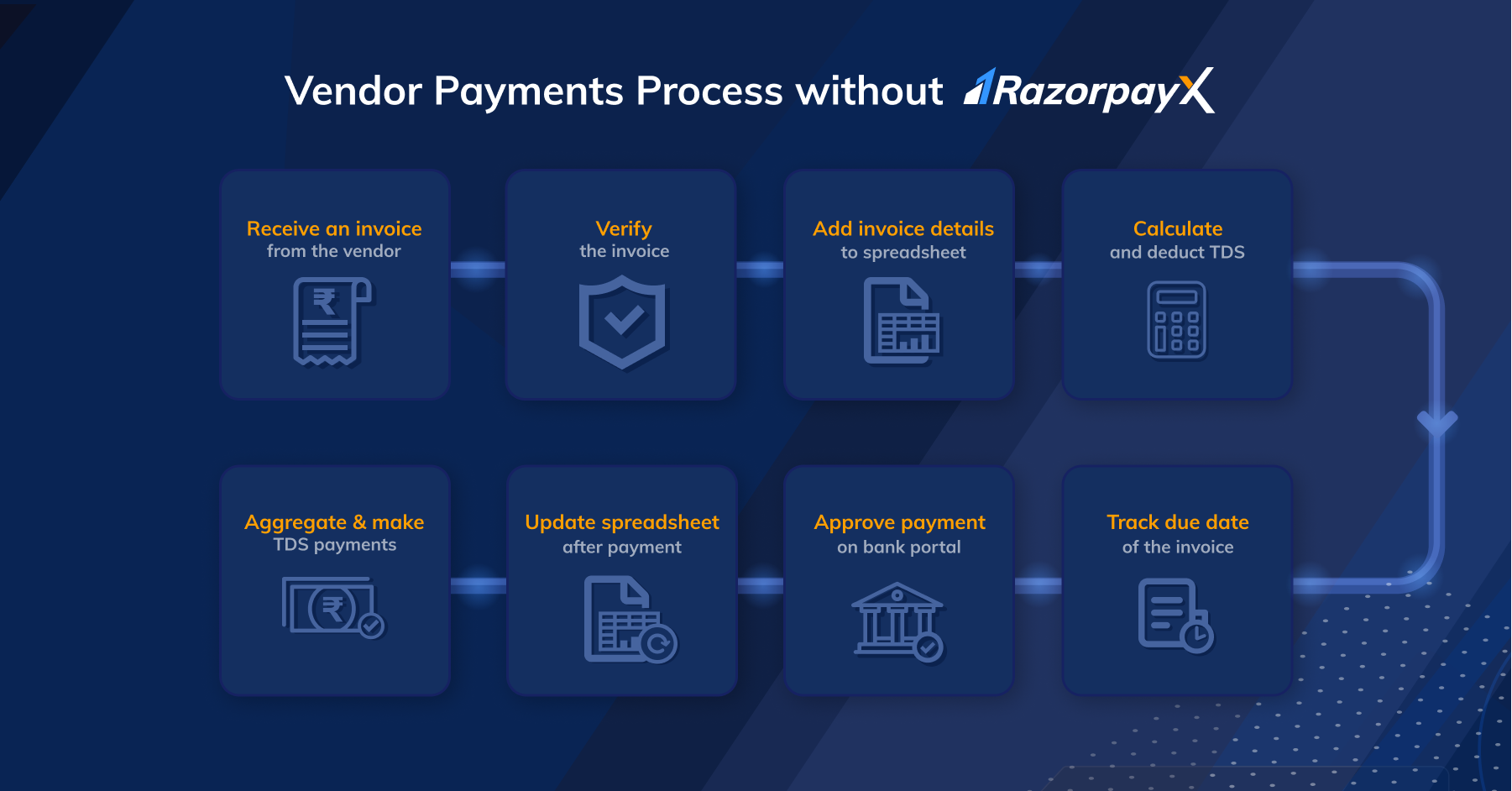

Here are the steps in the vendor payment process:

Step 1: Obtain the invoice from the vendor or supplier and validate accuracy and completion via 3-way matching of Bill, Purchase Order and Goods Receipt Note.

Step 2: Calculate and account for any advances or applicable taxes, such as TDS according to income tax regulations and ITC under GST.

Step 4: Deposit the TDS amount with the government within the deadlines specified in the Income Tax Rules, using the prescribed form where necessary.

Step 5: Regularly reconcile the data in GSTR-2A and GSTR-2B with your purchase register. Follow up with vendors who haven’t uploaded invoices that qualify for ITC and encourage them to report these in their GSTR-1. Include such ITC in your GSTR-3B return, which can be filed monthly or quarterly, depending on your business.

Step 6: Before the invoice due date, obtain approval from your business’s authorized signatory to initiate or complete the invoice payment.

Step 7: Reconcile vendor payments with accounting software such as Tally or SAP.

Read more: Business Banking

Related Read: What is the Difference Between Purchase Orders and Invoices?

How to Manage Vendor Payments?

Paying vendors can be a complex process, and the repercussions of errors can be overwhelming.

Previously, businesses would manage vendor payments on spreadsheets. Since this was a manual process, this resulted in delays and mistakes.

Today, tech-enabled solutions have automated the entire process of managing vendor payments, making it easier, faster and smoother than ever before.

- Complicated compliances like TDS or ITC can now be calculated automatically with zero errors

- Automated invoice sourcing and management

- OCR-tech automatically reads and auto-fills vendor information

- Scheduled payments ensures no delays and no penalties

- Auto-reconciliation and sync between accounting software and vendor payments

Read more: How RazorpayX Vendor Payments helped BeerBiceps achieve YouTube success

RazorpayX Vendor Payments is an all-in-one solution for enterprise-level vendor management. With all the features above and so much more, RazorpayX will soon be ready to manage your vendors right from procurement to payment.

What is RazorpayX?

RazorpayX is a banking solutions suite for businesses – the best modern fintech innovation has to offer. Vendor Payments is one of our several offerings; from payroll to payouts, we have everything you need right on one dashboard.

Read more:

FAQs

What is a vendor in accounts payables?

A vendor is an external supplier of goods or services that the business purchases for operations. The process of managing these vendors is called vendor management, and the final stage of making the payments is called vendor payments.

How are invoice payments made to vendors?

Invoice payments are how businesses pay vendors for goods or services. The vendor sends an invoice with details like amount and due date. The business verifies the invoice matches the order and is accurate. Once approved, the business sends a payment through a method agreed upon beforehand, like bank transfer or e-wallet. Finally, the vendor may provide a receipt as proof of payment.

What is reconciliation in accounts payables?

In accounts payable, reconciliation is double-checking your records for accuracy. It involves comparing what you owe vendors (according to your books) with what they say you owe (based on their statements). This helps identify errors, like missed invoices or overpayments. Regular reconciliation ensures you pay the right amount, maintain good vendor relationships, and have accurate financial statements.

What is an invoice?

An invoice is essentially a bill sent by a seller to a buyer. It lists the products or services provided, their quantities and prices, and the total amount owed. Think of it as an itemized receipt that also requests payment. Invoices serve as legal records of the transaction and are crucial for business accounting and tax purposes.