Table of Contents

What is Procure to Pay Process (P2P)?

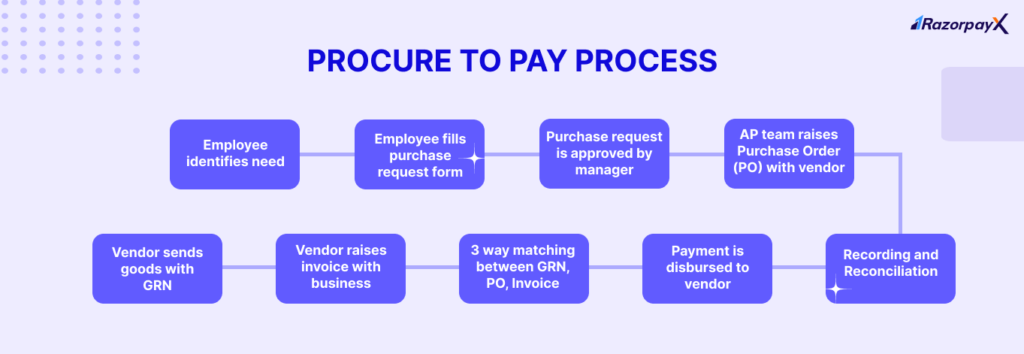

Procure to pay is the process of acquiring required goods and services from external suppliers. A well-managed, streamlined procure to pay process brings significant cost and time savings for the business.

The process of procure to pay includes the following steps:

- Measuring requirements for goods and services

- Creating POs, compliance and approvals

- Receipt of goods/services, reconciliation

- Invoicing and payment

The most efficient way to manage procurement involves software and automation. With the innovation available today, businesses can manage the entire procurement supply chain in one place instead of the disconnected approach of manual or semi-digital tools.

Tools like RazorpayX Source to Pay can optimize your entire procurement process – every single step. Find out how.

Procure to Pay Process Steps

The procure to pay process has multiple steps. All these steps should be managed from one single dashboard.

The procure to pay process has multiple steps. All these steps should be managed from one single dashboard.

Identifying needs and creating requisitions

The process begins with identifying business requirements. Employees with a need for goods or services fill out a purchase request form with specifications of the required items or services.

At this step, it is also important to match requirements to the department’s budget and alter specifications appropriately. This improves the chances of getting the purchase request form accepted by the department head or manager.

Some businesses carry out this process manually, while others have software and automation to make the process easier and error-free. RazorpayX Source to Pay is an industry-first central tool to manage the entire procurement process, including budgeting and department-level management.

Get a FREE Demo for Source to Pay

Purchase request creation

After deciding the requirements, the second step is to create a formal purchase request. The requesting department raises a PR with the procurement team, after ensuring it matches the budget and administrative requirements.

Purchase request approvals

Once the purchase request is created and budgeted, the next step is to get the necessary approvals. Managers or department heads evaluate the need, verify the budget and either approve or reject the purchase request form.

Purchase Order creation

After approval of the purchase request, it is sent to the procurement department. The procurement or accounts payable (AP) team then reviews the purchase request and creates a Purchase Order (PO) to send to the vendor.

The PO should contain specifications, prices, expected delivery date, and business details like the delivery address and a POC contact number.

RazorpayX Source to Pay comes with a vendor portal allowing vendors to view Purchase Orders and other documents anytime.

If the item requested is low-value or a one-time unique purchase, the AP team might choose to bypass creating a Purchase Order, and spot buy the item required.

Related Read: What is the Difference Between Purchase Orders and Invoices?

PO Approval

The purchase order is now to be sent through an approval loop to all relevant department heads and stakeholders. The PO is approved first by the head of the requesting department, then by the procurement team, and sometimes by the finance and legal teams as well.

Getting these approvals manually is a tedious, time-consuming process. With automated software, each stakeholder can independently view and approve the PO on their dashboards, significantly cutting down on the time taken for the entire approval process.

Receipt of goods

The vendor then delivers the goods or services with a Goods Receipt Note (GRN). The goods received should be checked against the GRN and the PO to ensure compliance with contract terms.

If any items received are damaged, faulty, or missing, the business can request a replacement or a refund. Once all the goods have been checked to the business’s satisfaction, the GRN is accepted.

Matching and checks

Once the goods have been accepted by the business, the vendor raises an invoice or a bill specifying the amount due and a due date.

Upon receipt of the vendor’s invoice, a three-way match between the Goods Receipt Note (GRN), the Purchase Order (PO) and the Invoice raised by the vendor is mandatory for accurate payment and internal control purposes.

The following details must be matched:

- Items ordered and received: Quantity, description, and any identifying codes.

- Prices and totals: Unit price, total amount, and agreed-upon discounts.

- Delivery details: Dates, locations, and carrier information.

RazorpayX Source to Pay is the ONLY solution on the market that offers free 3-way matching with OCR technology.

Vendor payment

Finally, the invoice is sent to the finance team for payment disbursal. The finance team will process and make the payment to the vendor.

This payment must be made on time and accurately to maintain a good relationship with the vendor. Happy vendors will deliver good quality supplies on time and be more open to negotiation and collaboration.

Automated and scheduled vendor payments ensure that no payment is missed. With good procurement software, you can schedule vendor payments of different types: partial payments, advance payments, instalment payments or holdback payments.

Recording and reconciliation

Once the vendor receives the payment, the payment is then recorded and reconciled in the books of accounts. The finance team does this step if your procurement process is not automated.

Find out how to automate your procurement process

How Can Procure to Pay Automation Help the Procurement Process?

The procurement process involves:

- A lot of paperwork – purchase request forms, POs, GRNs, invoices

- Multiple stakeholders – finance teams, procurement teams, individual buying departments

- Tedious manual tasks – getting approvals, disbursing payments, recording and reconciling transactions in books of accounts

These factors make manual procurement processes highly inefficient and costly. With automated solutions like RazorpayX Source to Pay, businesses can streamline the whole process – bringing huge time and cost savings.

How can software and automation improve every step in the procurement process?

Why is Procure to Pay Important?

The procure-to-pay (P2P) process might sound complex, but it’s actually the backbone of any well-run business. Imagine trying to manage all your purchases – from office supplies to raw materials – without a clear system! An effective P2P system keeps everything organized and efficient, saving you time, money, and frustration.

Here’s why a good P2P process is so important: First, it helps you control your spending. By having a clear overview of what’s being ordered and how much it costs, you can identify areas to cut back or negotiate better deals with suppliers. P2P also prevents maverick spending – unauthorized purchases that can throw your budget off track.

Second, P2P streamlines the entire process, from identifying a need to making the final payment. This means less time wasted on paperwork and chasing down approvals. Automated systems can handle routine tasks, freeing up your team to focus on more strategic initiatives. Finally, a smooth P2P process keeps your suppliers happy. Clear communication, timely payments, and accurate records build strong relationships that benefit your business in the long run.

Related Read: PO and Non-PO Invoices: Meaning, Differences and Examples

Best Practices in Procure to Pay Process

Businesses with good procure to pay processes follow certain best practices that other businesses would also benefit from:

- Automated procurement processes for error-free, non-labour intensive procurement

- Ensure proper policies are put in place to support transparency for all stakeholders

- Support seamless collaboration between different departments: requesting department, procurement department, finance department

- Create quantifiable OKRs with concrete success metrics to track progress. These OKRs can be: number of delayed payments in a month, amount paid as late fees to vendors, etc.

How Procure to Pay Software Brings Efficiency to Purchasing

| Budgeting | Start by assigning budgets to different cost centres.

Procurement software allows businesses to measure budgets and spending simultaneously, enabling department-wise spending analysis and accurate forecasting. |

| Purchase request approval | With automated procurement software, multiple stakeholders can view and approve purchase requests from one single dashboard as soon as they are raised. |

| Purchase requests that exceed the budget can be auto-declined to avoid overspending. | |

| Purchase order creation | As soon as the manager approves a purchase request, procure to pay software can auto-create a Purchase Order (PO) to be sent to the vendor. |

| Vendor management | Here are all the touchpoints the business has with the vendor:

Vendor-business touchpoints can be handled entirely digitally with a vendor portal. Vendors can access these documents as soon as they are created by the business. Vendor portals also make the vendor onboarding process so much easier – the RazorpayX Source to Pay vendor portal allows for self-onboarding and KYC. |

| 3 way matching of GRN, PO and Invoice | 3 way matching can be entirely automated – Source to Pay is the only solution on the market that allows for automated 3-way matching with OCR reading.

The software automatically reads, matches and verifies your GRN-PO-Invoice, resulting in error-free invoice processing. |

| Vendor payments | The best way to maintain a good relationship with your vendors is to pay them on time.

Procure to pay software helps businesses do this with scheduled payments, automatic GST ITC credit checks and instant bulk payouts. |

| Accounting | With procurement software, vendor payments are automatically entered into the business’ accounting tool, removing the need for manual entry and reconciliation.

RazorpayX Source to Pay also allows businesses to create smart rules, automating bookkeeping by categorizing transactions. |

Speak with our Procurement Automation experts

Read more