Table of Contents

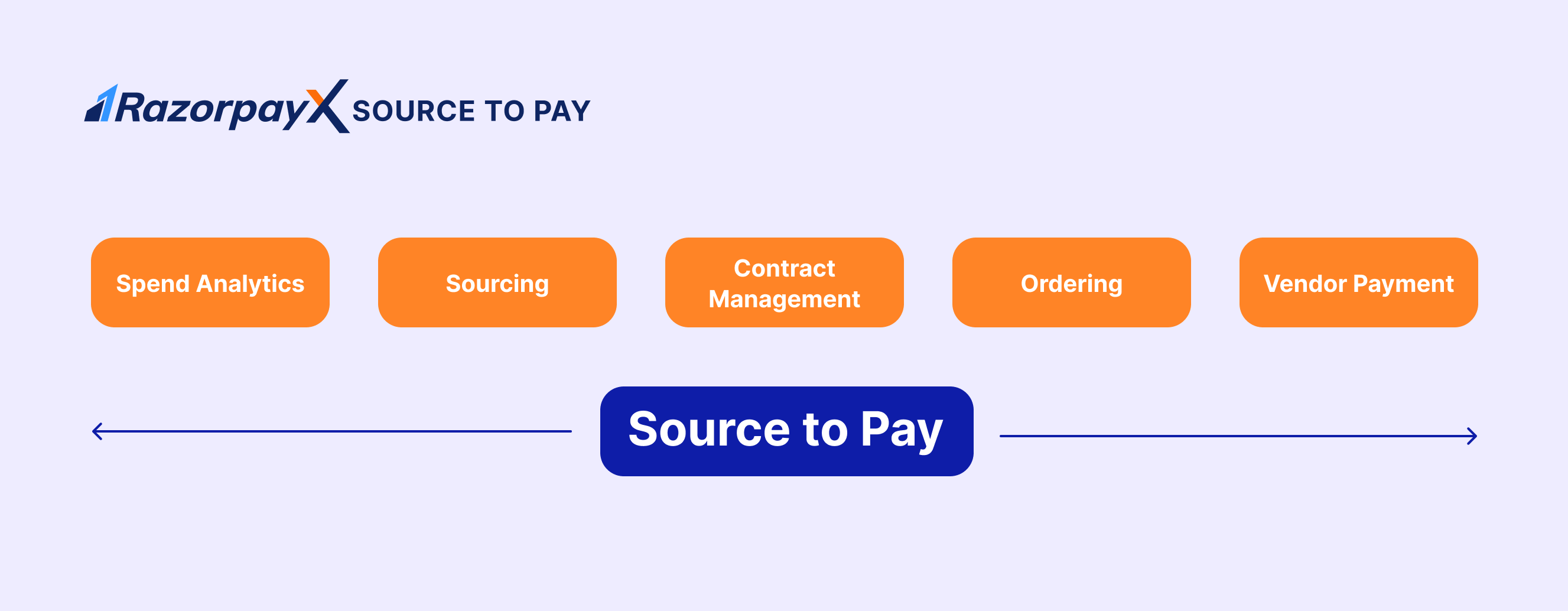

What is Source to Pay?

Source to pay is the end-to-end process of managing vendors who provide goods and services for a business’s daily operations. The source to pay process involves measuring need, budgeting, sourcing vendors, managing invoices and finally making payment.

The procurement process is tedious, involving multiple stakeholders, repetitive tasks and huge amounts of money – a well-optimized and automated source-to-pay process takes a holistic approach, connecting workflows, stakeholders and tasks.

Source to Pay Process Overview

Source-to-Pay (S2P) is a comprehensive end-to-end process that manages the entire lifecycle of procurement, from sourcing suppliers to the final payment of goods or services. This process ensures efficiency, compliance, and cost control in procurement operations.

- Sourcing: Identify and evaluate suppliers through RFPs/RFQs and select the best fit.

- Contract Management: Negotiate, draft, and finalize supplier contracts.

- Procurement: Create purchase requisitions, issue purchase orders (POs), and manage orders.

- Receiving & Invoicing: Verify delivery, match invoices with POs, and approve for payment.

- Payment: Process payments and reconcile transactions.

- Supplier Relationship Management: Monitor performance, provide feedback, and foster long-term partnerships.

S2P streamlines procurement, enhances transparency, and reduces risks, often supported by automated S2P software for greater efficiency.

Benefits of Source to Pay Automation

A well-optimized source to pay process is important for healthy cash flow and business reputation. Most businesses automate their source to pay process with dedicated source to pay (S2P) software or enterprise resource planning (ERP) solutions.

Automation is key to optimizing any source to pay process and always results in an improved cash flow, reduced costs and, ultimately, better business reputation.

Here are the various benefits of automating your source to pay automation:

- Increased transparency: Every action, from picking suppliers to paying invoices is tracked digitally, giving all stakeholders a clear, real-time view of the process.

- Better compliance with regulation: Automation ensures consistency with pre-defined rules, minimizing human error and keeping the process compliant.

- Improved vendor relationships: Timely payments, self-service portals and transparent communication results in an improved relationship with vendors

- Easier negotiation and pricing: Automated source to pay processes provide real time data and supplier insights, giving businesses an edge in negotiations to secure the best pricing.

- Cost savings: Automated processes are highly optimized – resulting in huge cost savings thanks to minimal errors and accurate payments.

Source to Pay Lifecycle

The source to pay lifecycle is long and tedious, and involves a lot of red tape and multiple stakeholders. It’s important for procurement managers to be fully aware of the entire process to ensure its as optimized as possible.

The source to pay lifecycle is long and tedious, and involves a lot of red tape and multiple stakeholders. It’s important for procurement managers to be fully aware of the entire process to ensure its as optimized as possible.

- Need identification

The S2P process starts out within a department that has identified a need. It could be anything – the office crews team may need a coffee machine, or the marketing department might need to outsource sales activities. Once this need is identified, the concerned manager raises a request with the procurement department of the business.

- Sourcing vendors

The first step in the process of source to pay is find the right supplier. Choosing the right vendor can impact everything from cost and quality to delivery times. Procurement teams use pre-qualification questionnaires to filter out unsuitable candidates. Requests for Proposals (RFPs), Requests for Information (RFIs) and Requests for Quotes (RFQs) are all sent at this stage to evaluate various suppliers.

- Supplier evaluation

At this stage, the procurement team conducts various checks to evaluate the vendor’s financial stability, reputation, performance history and more. At this stage, the business also takes pricing, quality and delivery periods into account to make a well-informed decision.

- Contracting & negotiation

Once the supplier has been selected, the business can negotiate the best possible price. The best way for businesses to save costs across the supply chain is to procure goods and services as cheaply as possible. By procuring bigger volumes of goods or services, businesses can negotiate for discounts, bringing the purchase price down.

- Vendor onboarding

After all deal details have been finalized, the business can onboard the vendor onto its database – the business has to collect information like the vendor’s GSTIN, PAN, bank account details and more.

These details have to be 100% accurate when entered into the business’s database. Manual entry always comes with the risk of errors; it is best to automate this process. A good source to pay software will come with vendor self-service portal functionality, allowing vendors to add their information to the database.

- Purchase Order

The business can now raise a purchase order with the vendor, listing details of the goods and services required, like the quantity, price, delivery date and more. This PO is raised with the vendor, who accepts it and starts working on the deliverables.

- Delivery of goods

The vendor finally delivers the goods or performs the services along with a Goods Receipt Note (GRN). Once the goods are verified by the business, the vendor raises an invoice which is matched against the PO and GRN. With an automated solution, all these documents are digitally recorded and matched.

- Payment to vendor

Finally, the vendor is paid after getting the required approvals from department heads, finance teams and the procurement department. It’s very important to make sure that the vendor is paid on time, or the relationship with the vendor will deteriorate.

Source to Pay vs Procure to Pay

While the source to pay and the procure to pay processes are closely related, there are some key differences between the two.

Source to pay refers to the end-to-end process of acquiring goods and services, starting from the identification of a need, all the way to payment.

On the other hand, procure to pay focuses solely on the purchasing and payment stages, excluding the sourcing and contracting aspects.

By understanding the distinction between source to pay and procure to pay, organizations can better tailor their procurement strategies to meet their specific needs and goals. For example, companies that prioritize cost-effectiveness may choose to focus more on the procure to pay process, streamlining their purchasing and payment activities to achieve greater efficiency.

How to Automate Source to Pay

The source to pay process is long, tedious, error-prone and full of red tape. Done manually, the procurement process becomes delayed, expensive and painful to deal with.

One of the key steps in optimizing procurement is to automate the entire process. Automation helps streamline repetitive manual tasks, reduce errors, and improve process efficiency.

Solutions like RazorpayX Source to Pay allow businesses to integrate all the steps in the procurement process in a single platform, giving visibility to all stakeholders involved.

With features like advanced custom workflows, seamless integrations with your financial ecosystem and vendor self-serve portals, S2P solutions are a powerful way to achieve greater efficiency, cost-effectiveness and improve business reputation.

FAQs

What is the difference between S2P and P2P?

S2P, or Source to Pay starts with the need identification stage and goes all the way up to payment. It involves a strategic approach to finding the best suppliers, negotiating competitive prices and building strong relationships with vendors. P2P, or Procure to Pay, has a more narrow scope, beginning with ordering and ending with the payment. S2P is ideal for businesses with complex procurement needs, while P2P is ideal for businesses with established supplier relationships, and clear purchasing policies.

What are examples of source to pay?

An example of the source to pay process would be an online business looking to implement a new technology platform. The first step is to scout and evaluate the market and align with the business's budget and needs. Once a vendor is chosen, the procurement team negotiates the best possible price and signs a contract. Next, hand-in-hand with the chosen vendor, they implement the platform, procuring any additional hardware or services necessary. Finally, payments are made in sync with milestones achieved throughout the implementation process, ensuring both parties remain invested in a successful outcome.

What is source to pay and source to contract?

Source to Pay and Source to Contract have different scopes: S2P focuses on the entire procurement cycle, from sourcing and budgeting to payment of vendors. S2C, meanwhile focuses on the early stages of the procurement cycle specifically identifying and selecting suppliers, negotiating contracts, and finalizing agreements.

Read more