Table of Contents

What is P2P Lending?

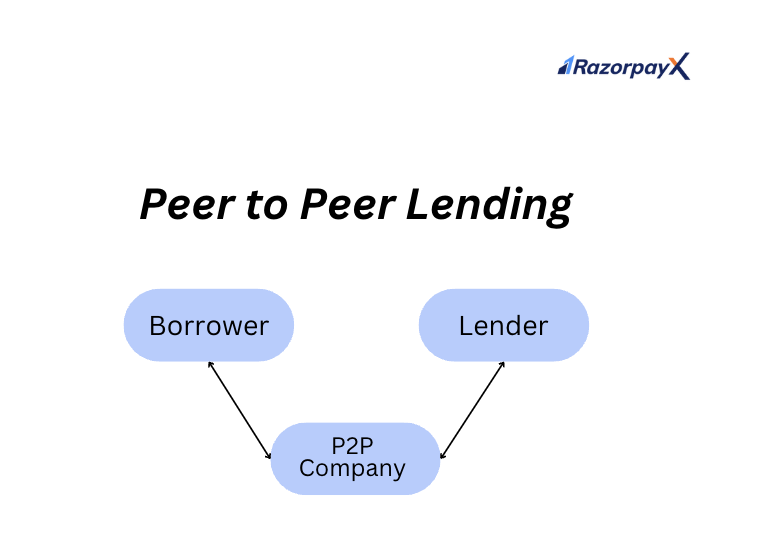

P2P lending, also known as peer-to-peer lending, is a modern online lending platform that connects borrowers with investors directly. This eliminates the need for traditional banks or non banking financial companies (NBFCs) as intermediaries and provides borrowers access to potentially lower interest rates while offering investors the opportunity to earn higher returns. P2P platforms act as facilitators, managing risk assessments, payments, and loan approvals.

The concept of P2P lending has gained popularity because it offers a more straightforward application process and faster approval times than traditional banks. Moreover, the transparency and flexibility of this model provide a win-win situation for both borrowers and investors alike. However, it is essential to note that P2P lending involves risks, such as default risk and fraud risk. Therefore, it’s crucial to conduct thorough research before investing or borrowing on these platforms.

The Mechanism of Peer to Peer (P2P) Lending

There are three parties involved in a peer to peer transaction: the borrower, the investor/lender and the P2P platform. The borrower and investor both register with the platform and are then matched based on the investor’s risk appetite and borrower’s funding requirements. The P2P platform acts as an intermediary, facilitating the borrowing and repayment process between borrowers and lenders.

There are three parties involved in a peer to peer transaction: the borrower, the investor/lender and the P2P platform. The borrower and investor both register with the platform and are then matched based on the investor’s risk appetite and borrower’s funding requirements. The P2P platform acts as an intermediary, facilitating the borrowing and repayment process between borrowers and lenders.

Through the online portal, the investor can track their investment and monitor repayment activity. The borrower has the option of flexible repayment options based on their income level and other capabilities.

One of the main advantages of P2P is that it often provides access to unsecured personal loans, which means that borrowers don’t have to provide collateral to secure the loan. Some P2P lenders also offer secured loans that are backed by luxury assets such as jewelry, watches, vintage cars, fine art, buildings, aircraft, and other business assets as collateral.

How P2P Lending Works for Investors

Investors or lenders have the flexibility to choose from a variety of borrowers, allowing them to align their investments with their risk appetite. P2P platforms provide valuable information about borrowers’ credit history, enabling lenders to make informed decisions.

To mitigate risk, investors can diversify their investments across multiple borrowers. Lenders receive regular monthly repayments, which include both the principal amount and interest. They also have the option to reinvest their returns or withdraw funds from the platform. This mechanism ensures that lenders can effectively manage their investments and optimise their overall experience with P2P lending platforms.

How P2P Lending Works for Borrowers

When applying for a loan through a P2P lending platform, borrowers submit a list of necessary documents. This includes proof of identity such as a passport or driver’s license, proof of address like a utility bill or bank statement, and proof of income such as pay stubs or tax returns.

Additionally, borrowers may be asked to provide references and other documentation to support their loan application. Once all necessary documents have been submitted and reviewed, the P2P platform will determine whether the borrower is eligible for a loan and at what interest rate.

The lending platforms then assess the creditworthiness of the borrowers based on multiple criteria, including their credit history and other factors. Once the application is approved, borrowers receive the loan amount in their bank account directly.

To repay the loan, they have to make monthly instalments as per the agreed-upon terms. This enables them to manage their repayments effectively and plan their finances accordingly. Making timely repayments can also positively impact one’s credit score, making it easier to obtain loans and credit in the future.

Benefits of Peer to Peer (P2P) Lending

One of the key advantages of P2P lending is the access to funding it provides, especially for individuals and small businesses who may face challenges procuring loans from traditional financial institutions. P2P lending can also offer lower interest rates than traditional loans, making it an affordable financing option.

Another benefit of P2P lending is flexibility in terms of loan amount and repayment options, providing borrowers with customized borrowing experiences that meet their specific needs. Investors can also diversify their portfolios by investing in multiple loans with varying risk levels, while P2P lending platforms provide transparency regarding fees, interest rates, and borrower information.

In addition to these advantages, P2P lending has streamlined the loan application process with quick approvals and disbursements. Borrowers can apply online easily without visiting any physical branches or sending any paperwork. This makes the whole process quicker and more convenient than traditional banks.

Overall, P2P has transformed the way people borrow money by providing an efficient, transparent and highly flexible system that benefits both lenders and borrowers alike.

Peer to Peer (P2P) Lending in India

India has always been very receptive of innovation, and P2P lending is no exception. In 2016, when P2P lending was gaining popularity, there were already 30-odd startup P2P companies in India. P2P helps people access quick funding without having to deal with the complex creditworthiness checks and paperwork that comes with traditional lending through banks or NBFCs.

P2P companies in India have become a popular way to connect investors and borrowers. These companies, which now number in the dozens, charge a commission of 1-3% for facilitating transactions.

According to Bhavin Patel, the Co-founder and CEO of LenDenClub, a P2P platform established in 2015, P2P platforms in India have invested approximately Rs 20,000 crore in loans. Additionally, these platforms have a combined outstanding AUM of around Rs 4,000 crore.

To regulate this growing industry, the Reserve Bank of India provided guidelines for P2P platforms to ensure consumer protection. As the industry matures, we can expect more regulation and legal framework around P2P lending.

The Regulatory Framework for Peer to Peer (P2P) Lending & Investing in India

The regulatory framework for P2P lending in India is overseen by the Reserve Bank of India (RBI). In order to ensure the safety and security of investors and borrowers, the RBI has established guidelines and regulations that P2P platforms must adhere to.

Regulation by the Reserve Bank of India (RBI)

The Reserve Bank of India (RBI) plays a vital role in regulating P2P lending platforms in India to safeguard the interests of investors and borrowers. It sets guidelines and establishes a regulatory framework to ensure fair practices and protect against fraud.

In its Consultation Paper on Peer to Peer Lending, the RBI detailed its recommendations to regulate P2P in India. Here is the RBI’s proposed regulatory framework:

- Platforms will be registered as intermediaries only.

- Platforms will not lend on their own or provide credit enhancement or guarantees.

- Platforms will be prohibited from giving any assured return.

- Funds will have to move directly from the lender’s bank account to the borrower’s bank account.

- Platforms need to put in place adequate risk management systems, including a business continuity plan and back up for the data.

investors need to be aware of the tax implications of investing in P2P lending. If an individual falls under the 30% tax bracket, they will pay a tax of Rs. 4,500 on the earned interest of Rs. 15,000. Additionally, RBI guidelines state that investors can only invest up to Rs. 10 lakh through these apps without furnishing a net-worth certificate, after which they can invest up to Rs. 50 lakh.

Compliance Requirements for Peer to Peer Platforms

P2P platforms in India are subject to regulatory requirements set by the Reserve Bank of India (RBI). Here is a list of these compliance requirements:

- P2P platforms must obtain a Certificate of Registration from the RBI to operate as a P2P lender.

- The minimum capital requirement for a P2P platform is set at INR 2 crore.

- P2P platforms must adhere to the Know Your Customer (KYC) guidelines and Anti-Money Laundering (AML) standards set by the RBI.

- The maximum exposure of a lender to a single borrower across all P2P platforms is limited to INR 50,000.

- P2P platforms must maintain a minimum level of capital adequacy ratio (CAR) of 15%.

- P2P platforms are mandated to disclose all information related to charges, fees, and interest rates to both lenders and borrowers.

- P2P platforms must ensure that borrower loans are not guaranteed or secured by the platform or its promoters.

The Risks Associated with Peer to Peer Lending

P2P is frequently considered a high-risk investment option due to the uncertainty of borrower repayment. As the lending platform is not legally bound to guarantee your return if the borrower defaults or goes bankrupt, investing in P2P loans can be quite risky. However, some investors are willing to undertake this risk in exchange for potentially higher returns than traditional investments.

It is crucial to conduct thorough research and gain an understanding of the possible risks involved before investing in P2P. To minimize these risks, it is advisable to diversify your investments across various borrowers and loan types. Some platforms provide more options for selecting creditworthy borrowers, reducing the risk for lenders.

Investors must also keep track of their portfolios regularly, ensure diversification and monitor any changes that might impact their investments’ performance. It is also important to note that there may be tax implications on P2P returns. Finally, it is best to stay informed about any regulatory changes that may affect P2P lending in the future and adjust your investment strategies accordingly.

Is Peer to Peer Lending the Future of Finance in India?

P2P is gaining popularity in India due to its potential for high returns, which is regulated by the RBI to ensure transparency and protect investor and borrower interests. By directly connecting borrowers and lenders, it promotes financial inclusion and offers an alternative investment option with attractive interest rates.

It’s clear that P2P has the potential to become a significant part of India’s financial ecosystem, as the Indian P2P lending market is projected to reach $10.5 billion by 2026, growing at a rate of 21.6% between 2021 and 2026, according to a report by IndustryARC.

The Reserve Bank of India (RBI) is actively working to tighten its regulations on the financial industry, particularly regarding KYC (know your customer) and creditworthiness checks. This move towards stricter guidelines is aimed at reducing fraud and increasing transparency in the sector.

As these regulations come into effect, financial institutions will need to adapt their processes accordingly, ensuring that they are in compliance with the new rules. These changes will help improve the overall stability and credibility of the financial industry in India.

Learn more: Digital Lending is Easier Than Ever

Read more

Frequently Asked Questions

Is P2P legal?

P2P lending is legal in many countries, such as the US and UK. However, regulations vary by country and state. It's crucial to research and comply with applicable laws and platform rules when engaging in P2P lending.

What is an example of P2P lending?

LendingClub and Prosper are popular examples of P2P lending platforms. These platforms enable individuals to borrow money from others through an online platform. Borrowers can benefit from lower interest rates, while investors have the potential for higher returns. Before funds are transferred, there is a process of credit checks and loan approval.

Why should one invest in P2P lending in India?

Investing in P2P lending in India offers the potential for higher returns compared to traditional investment options. It also provides diversified investment opportunities with varying risk levels. Additionally, investing in P2P lending can support small businesses and individuals who need access to credit, while benefiting from the transparency and accountability provided by regulation.

What are the best peer-to-peer lending platforms in India?

Some of the leading P2P lending platforms in India include Faircent, Lendbox, and LenDenClub. These platforms have their own eligibility criteria and interest rates, so it's important to compare them before investing or borrowing. Lenders can diversify their portfolio by investing small amounts in multiple loans on the platform, while borrowers can access loans at lower interest rates than traditional banks.