Tax Collected at Source (TCS) is a tax that is imposed by the seller on the buyer when certain products are purchased. It was introduced in 1961 to curb tax evasion and money laundering by the Income Tax Department.

Read on to know everything about Tax Collected at Source and its impact on your business.

Table of Contents

What is Tax Collected at Source (TCS)?

Section 206C of the Income Tax Act says that when certain specified goods are sold, a certain amount must be added to their sale price – this is TCS, or Tax Collected at Source.

The seller imposes this amount on the buyer and then has to deposit it with the government by a certain deadline.

Let’s use an example to further understand. Abhinav buys a car worth Rs 20 lakhs from a popular luxury car manufacturer. The car manufacturer, according to the rates set down by the Income Tax Department, has to impose an additional 1% tax on top of the price of the car.

Therefore, Mr Abhinav would be paying an additional Rs 20,000 on top of Rs 20 lakhs – making a total of Rs 20,20,000 for his luxury car.

In this case, Abhinav is the buyer and the car manufacturer is the seller.

TCS is applicable only to specific goods like liquor, timber wood, minerals, and luxury vehicles. But why these specific goods?

Classification of Sellers for TCS

There are certain organisations who have been termed as “sellers” for tax collected at source. So these sellers can only collect TCS from the buyers:

- Central Government

- State Government

- Local Authority

- Statutory Corporation or Authority

- Company registered under the Companies Act

- Partnership firms

- Co-operative Society

- Any person or HUF who is subjected to an audit of accounts under the Income-tax Act for a particular financial year.

Classification of Buyers for TCS

A buyer may purchase goods directly from the seller, or through an intermediary such as a wholesaler, a retailer, or an online platform. They may also purchase goods by bidding on them at an auction or using a shopping app. Buyers typically pay for their goods using cash, bank transfer, credit or debit cards, or other forms of payment. Here is a list of buyers who are exempted from the collection of TCS.

- Public sector companies

- Central Government

- State Government

- Embassy of High Commission

- Consulate and other Trade Representation of a Foreign Nation

- Clubs such as sports clubs and social clubs

- Where resident buyer utilises such purchase for the purposes of manufacturing, processing or producing articles or things or for the purposes of generation of power (not for trading) and gives this declaration in writing in duplicate.

When is TCS Collected?

In Abhinav’s situation, the car manufacturer collected TCS when it received money from Abhinav via cash/cheque/draft.

Sellers can also collect TCS when they are debiting money payable by the buyer in the books of accounts if it comes earlier.

In short, the seller collects TCS on whichever is earlier of the following two dates:

- While debiting money payable by a buyer in the books of accounts

- After receiving money from a buyer via cash/cheque/draft

TCS Rate Chart: Goods Collected Under TCS Provisions and Rates Applicable To Them

When the below-mentioned goods are used for the purpose of manufacturing, processing, or production purposes, then no taxes are levied.

But if the same goods are used for trading purposes, then taxes will be levied. The tax payable is collected by the seller at the point of sale. The rate of TCS is different for goods specified under different categories :

| Type of Goods or transactions | Rate |

| Liquor of alcoholic nature, made for consumption by humans | 1% |

| Timber wood under a forest leased | 2.5% |

| Tendu leaves | 5% |

| Timber wood by any other mode than forest leased | 2.5% |

| Forest produce other than Tendu leaves and timber | 2.5% |

| Scrap | 1% |

| Minerals like lignite, coal and iron ore | 1% |

| Purchase of Motor vehicle exceeding Rs.10 Lakhs | 1% |

| Parking lot, Toll Plaza and Mining and Quarrying | 2% |

Note: If the buyer fails to furnish his PAN, he shall be liable to pay Tax Collected at Source @ 5% or twice the normal rates, whichever is higher.

What are the Cases of TCS Exemptions?

Tax collection at the source is exempted in the following cases:

- When the goods are used for personal consumption

- The goods are bought for manufacturing, processing or production and not for the purpose of trading those goods.

How to Deposit TCS?

The seller must deposit TCS by submitting Challan 281 within 7 days from the last day of the month in which the tax was collected, on a monthly basis.

For example, if Abhinav bought his luxury car on the 15th of November, the luxury car manufacturer will have to submit Challan 281 before the 7th of December.

There are two exceptions to this rule.

Any taxes collected in the month of March must be submitted on the 30th of April, and any taxes collected on the purchase of the property must be submitted on the 30th of the following month. Here is a table for easy understanding.

| Particulars | When to Submit Challan 281 |

| TDS collected on the purchase | Before the 7th of the following month |

| TDS collected on the purchase of property | Before the 30th of the following month |

| TDS collected in March | On 30th April |

Sellers can submit Challan 281 online or offline.

-

Online TCS Submission Process

Go to the Income Tax Department’s website for tax collection

Select Challan No./ ITNS 281 for TDS/TCS

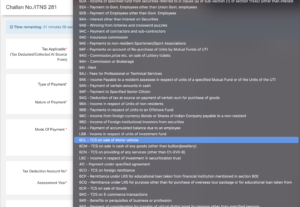

Here are the sections you will need to fill out in the selected Challan 281 form:

- Deductee

This refers to the person from whose payment the tax has been deducted. In our example, Abhinav is the deductee, and the car manufacturer would be the deductor. There are two kinds of deductees:0020 Company Deductee

0021 Non-Company Deductee If the deductee is not a part of the business, select 0021 Non-Company Deductee. Otherwise, if the deductee is a part of the business, select 0200 Company Deductee.

SAd - Type of payment

There are two options in this category:200 TDS/TCS Payable by Taxpayer

400 TDS/TCS Regular AssessmentWhat is the difference between 200 TDS/TCS Payable by Taxpayer and 400 TDS/TCS Regular Assessment? Select 200 TCS Payable by Taxpayer when the taxpayer is paying TCS on their own and not at the demand of the Income Tax Department.

Select 400 TCS Regular Assessment when the taxpayer is paying TCS at the demand of the Income Tax Department as part of its regular assessment. - Nature of payment

This is where the taxpayer declares what kind of good or service was traded. When the luxury car manufacturer is submitting its TCS, it would select:

- Mode of Payment

Taxpayers can choose to pay TCS through a debit card or net banking. - TAN

The Tax Deduction Account Number (TAN) is a 10-digit alphanumeric identity number. It is issued to the deductor or the party that collects the TCS. To get the TAN number, apply on the official website separately, or visit a Facilitation Centre of the Tax Information Network (TIN) - Assessment Year

If the payment is made on the 15th of November 2022, the Assessment Year would be 2023-2024. This is because income earned between 1st April 2022 and 31st March 2023 will be taxable only in the following year, i.e., 2023-2024. - Personal Details

Finally, fill out personal details – address, PIN code, email ID and mobile number.

Once you submit this form, you will be redirected to the payment page.

-

Offline TCS Submission Process

To submit TCS offline, the deductor will need to visit the bank branch and submit a challan. The bank will provide proof of submission once you’ve submitted the challan and made the payment.

Tax Collected at Source Certificate

After the successful filing of TCS returns, the IT department issues a Tax Collected at Source (TCS) certificate, also called Form 27D. The taxpayer, or the seller, needs to submit TCS certificates to buyers while filing quarterly TCS returns.

Form 27D or the TCS certificate comes with the following information:

- TAN of seller filing the quarterly returns

- PAN of buyer and seller

- Names of the seller and buyer

- The total amount of Tax collected by the seller

- Tax rate

- Date of collection

When will a Higher Rate of TCS Apply?

A seller will collect TCS at a higher rate in the following situations:

- If a buyer hasn’t filed Income Tax Returns for the previous two financial years before the year of TCS collection

- In case the total amount of Tax Collected at Source and Tax Deducted at Source exceeds Rs. 50,000 in each of the two financial years

- If the period for filing ITR has passed

Confused?

Choose RazorpayX Tax Payments.

The process of submitting TCS can be tedious. Luckily, RazorpayX makes paying TCS super easy.

The benefits of RazorpayX Tax Payments:

- No data entry error since details like TAN number and address are autosaved in the system.

- No need to provide account details for every TDS payment.

- The dashboard will display CIN and CRN numbers after the TDS payment.

- It saves you a lot of time and errors.

Tax Deducted at Source vs Tax Collected at Source

TDS and TCS are often confused with one another. Here’s a table highlighting the difference between the two.

| Basis of difference | TDS | TCS |

| Definition | TDS is tax deducted at source by any company or individual making a payment if the payment exceeds the thresholds mentioned under respective sections. | TCS is a tax collected by the seller, at the time of sale. |

| Liability to deduct | It’s the liability of the buyer of goods and services to deduct TDS | The seller recovers TCS |

| Nature | TDS is an expense | TCS is an Income |

| Applicability | TDS is deducted from contractors’ payments, professional fees, commission, salary, rent, brokerage, interest, etc. | TCS is collected on the sale of specified goods mentioned above. |

If the process of depositing TCS and filing returns seemed long and annoying, don’t worry. You’re not alone. Thousands of smart merchants trust RazorpayX with their TCS payments.

Read more

Frequently Asked Questions (FAQs)

What are TCS exemptions?

TCS exemptions are applicable if a buyer procures goods for processing, manufacturing and production and not for the purposes of trading. There are also exemptions if the goods are being used for personal consumption.

Should sellers collect TCS on an amount inclusive of GST?

According to income tax law, the seller is required to collect TCS from the buyer while debiting the amount payable to the buyer’s account, or when the seller receives such an amount from the aforementioned buyer by any mode, whichever is earlier. So, the amount debited to the buyer’s account or payment received by the seller would include VAT/excise/GST. Hence, as a seller, you must collect TCS inclusive of GST.

What happens in the case of late filing of TCS return?

If you fail to file the TCS return on or before the due date prescribed in the income tax law, you will have to pay a fee of Rs.200 per for as long as the failure continues. However, the amount of late fees cannot be more than the TCS dues. Moreover, you would be required to pay the late filing fees before you file the TCS return. Rs. 200 per day is a fee for the late filing of TCS returns, and not a penalty.

Are there penalties in the case of incorrect TCS return filing?

If the tax collector files an incorrect TCS return, then they would be liable to pay a penalty under Section 271H of the Income Tax Act. The minimum amount of the penalty is Rs. 10,000 and the maximum amount is Rs.1,00,000.

Does Form 26AS contain my TCS details?

Yes. Form 26AS contains details of Tax Collected at Source (TCS) by the seller of specified goods when the seller sold you such goods. Form 26AS displays the details of the seller, as well as the TCS amount, and the transaction on which tax was collected.

If a buyer has a PAN and has not filed Income Tax Returns for last two years and the seller deducts TCS @ 5%, can the buyer recover this TCS later?

Yes. The buyer has the provision to adjust the TCS at the time of making a payment towards self-assessed tax liability in further assessment years.

What is a TCS Return?

Tax returns are a form that every income-earning citizen of the country within a certain bracket must file with the Income Tax Department. We file this form so that the government has information on where we get our income so that every source of income is accounted for and taxed appropriately.

When to submit TCS return?

The seller must file a quarterly return via Form 27EQ online on or before the 15th of the next month from the close of each quarter: Quarter Last date for filing 1st Quarter- 15th July 2nd Quarter-15th October 3rd Quarter-15th January 4th Quarter-15th May Any interest on delay in TCS payment to the authorities must be paid before the return is filed. If TCS is collected by any office of the Government, the collected amount has to be deposited on the same day of collection. Note: The seller must also provide the buyer with a certificate in form 27D.