Accounts payable a short-term liability wherein a business owes money to vendors or suppliers for goods or services purchased on credit. Accounts payable management is an important financial management function.

Table of Contents

Accounts Payable Meaning

Accounts Payable is the total amount a business owes to its vendors. It is a short-term liability. Good accounts payable management is incredibly important for the financial health of a company. It indicates healthy cash flow, builds trust and reliability among vendors and ensures smooth operations for the business.

Let’s break down how accounts payable works, and how to streamline accounts payable processes.

Accounts Payable Process

Accounts payable is the process by which a company pays its suppliers and vendors.

It involves receiving invoices, reviewing them for accuracy, matching them to purchase orders, approving them, processing payments, and recording the payment in the accounting system. Automating the AP process can improve its efficiency, accuracy, and visibility.

“Accounts payable” also refers to the department that manages vendors and processes the invoices raised by them.

Accounts Payable Workflow

The accounts payable workflow begins when the vendor raises an invoice with the business’s accounts payable department.

The invoices are then checked and verified for validity against the goods or services received from the vendor. This involves a 3-way matching between the GRN, PO and Bill.

At this stage, taxes and advances also have to be calculated and deducted from the invoice. TDS and other tax payments will have to be made on government portals separately.

Once the invoice is checked and taxes are calculated, approval is to be obtained from the person in charge – such as the department head, accounts payable manager or CFO.

The payment can then be made electronically, by cheque or in cash. Once the payment is made, the transaction is recorded and reconciled in the books of accounts.

Accounts Payable Software & Automation

Manage all your vendors with just one click <>

Automating accounts payable processes is the most efficient way to manage your vendors. It has undeniable advantages:

- Improved efficiency: Automated vendor payment systems significantly reduce the time it takes to process invoices and payments. This frees up AP staff to focus on other tasks, such as strategic planning and managing vendor relationships.

- Reduced errors: Automated vendor payment systems can help to reduce errors in invoice processing, such as duplicate payments and overpayments. This can save the company money and improve its relationships with its suppliers.

- Increased visibility: Automated vendor payment systems can provide real-time visibility into the AP process. This allows companies to track the status of invoices and payments, and to identify any potential problems early on.

- Improved compliance: Automated vendor payment systems can help companies to comply with Indian financial regulations, such as the Goods and Services Tax (GST).

Recording Accounts Payable

When recording accounts payables, the asset or expenses account is debited and accounts payables is credited. When paying off an accounts payable liability, the reverse is recorded.

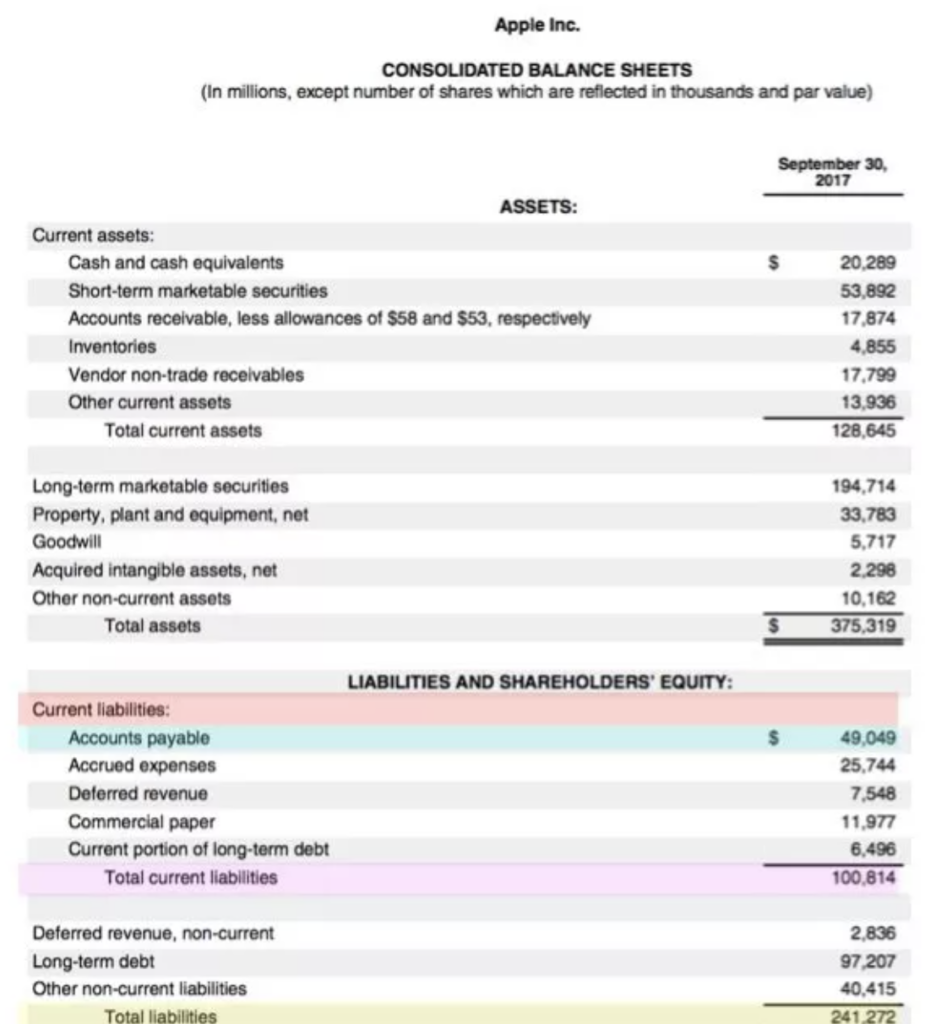

Businesses record their total Accounts Payable under the Current Liabilities section of the Liabilities part of the balance sheet.

The first record of AP is in the ledger: Accounts Payable is credited and the account of the good or service purchased is debited.

In an automated system, accounts payable transactions are recorded automatically with seamless accounting integrations. Your accounts payable software should be integrated with your accounting tool of choice.

CTA: Learn more about AP accounting integrations

Interpreting Accounts Payable

In the balance sheet, businesses record the values of assets and liabilities for this accounting period and the last.

The payable metric is also recorded in the Cash Flow Account to understand the movement of the business’s cash. A business that can pay its vendors in cash and on time is a business that has good cash flow.

A high accounts payable balance means the business has been unable to pay vendors on time. This could be because of several reasons.

- Insufficient cash flow

- Initial stages of business

Challenges in Accounts Payable Process

Accounts payables management comes with many challenges.

Inefficient processes

Most accounts payables processes are entirely manual. A procurement or AP team manages invoices, vendors, payments and compliances; leading to delays and inefficiencies

Errors and inaccurate payments

Since the AP process involves complex calculations and compliances, its easy to make mistakes. These errors can be expensive and time consuming to fix and may have an impact on the company’s overall financial performance.

Tedious and time consuming

With errors, inaccuracies and delays, the entire AP process can be quite tedious and time consuming. Additionally, accounts payables processes rely heavily on documents like invoices, GRNs, POs, PRs and more. If this document management is paper-based, misplacing or damaging the papers may lead to more delays and confusion.

Inconsistencies

Invoice, GRN and PR formats may vary across vendors and businesses. This may lead to confusion and inconsistencies which can then lead to delays to the entire process.

Benefits of Accounts Payable Automation

All the challenges within the accounts payable process can be solved with the help of automation. Automating the AP process involves the use of specialised tools or software like RazorpayX Source to Pay. Here are some benefits of automating the AP process.

Faster processing

The first and most immediate benefit businesses will see is that the entire process happens faster. From invoice management to vendor management and payments, automation ensures minimal errors and instant approvals, making the entire process much faster and more efficient.

Accuracy

With the help of automation, teams no longer need to manually calculate taxes, payments or manually sort and manage invoices. Automated processes eliminate the risk of human errors and thus make the entire process much more accurate.

Cost efficient

Automated processes reduce errors and optimise workflows and thereby reduce the need to spend money on manpower. Additionally, reduction in errors and on-time payments means the business saves money on late payment fines or accounting errors. This makes the entire accounts payables process most cost efficient.

How to Automate Accounts Payable?

The best thing you can do for your accounts payable process is automate it. RazorpayX Vendor Payments enables end-to-end automation for adding, tracking, and clearing invoice and TDS payments.

All you have to do is upload an invoice on the RazorpayX Dashboard or forward the invoice sent from your vendor, and the tech takes care of everything.

- Auto-Capture Invoice Details

Our intelligent OCR extracts and populates all the invoice details saving you the hassle of manual data entry and reducing the possibility of errors. - Pay your Vendors

You can make payments instantly via IMPS, UPI, NEFT, and RTGS or schedule them for a later date. - Auto-Pay TDS

RazorpayX automatically deducts and pays the applicable TDS before the due date. Not only that, you can view all the challans on the dashboard post-payment.