The PAN Aadhaar link is mandatory for all Indian citizens. The last date for PAN-Aadhaar linking was 30th June 2023. PAN cards not linked with Aadhaar will become inoperative after 1st July 2023. The Indian government and the Central Board of Direct Taxes (CBDT) have further set May 31st, 2024, as the last date to link PAN with Aadhaar.

The penalty for not linking Aadhaar and PAN is Rs. 1,000 as a late fee if individuals link Aadhaar and PAN after May 31st, 2024. Furthermore, a penalty of higher TDS/TCS collection is also imposed on Individuals and entities who haven’t linked their Aadhaar and PAN cards.

If you already made the request to link Aadhaar and PAN card, you can check the Aadhaar and PAN card link status online

Table of Contents

How to Pay the Penalty Before Linking Aadhaar Card and PAN Card?

As mentioned previously, a penalty fee must be paid on the e-filing portal for linking Aadhaar with PAN card after May 31st, 2024. Before submitting a link request, ensure you have paid the required penalty.

Here’s the step by step guide on how to pay the penalty fee to link Aadhaar Card and PAN card

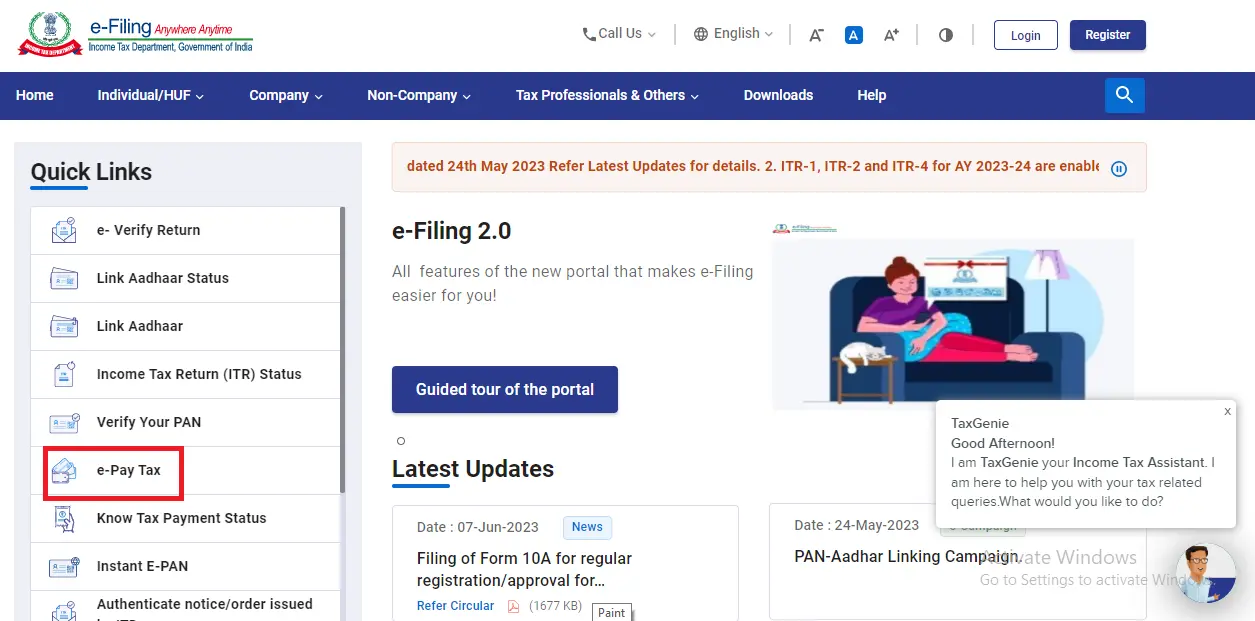

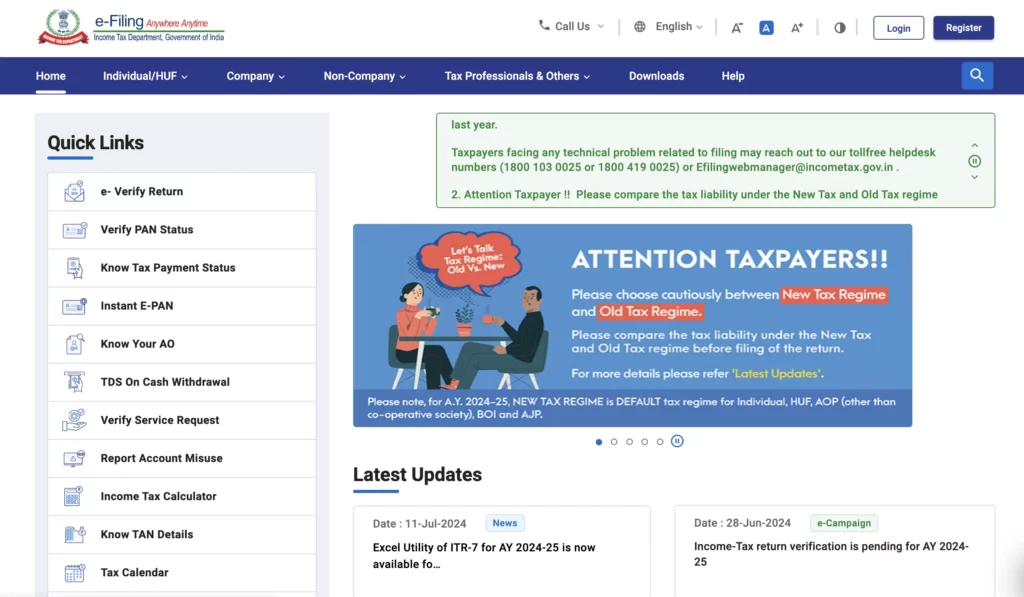

STEP 1: Visit the Income Tax e-filing portal

Go to the official Income Tax Department website.

STEP 2: Click on ‘e-Pay Tax’

Click the “e-Pay Tax” link under the “Quick Links” section.

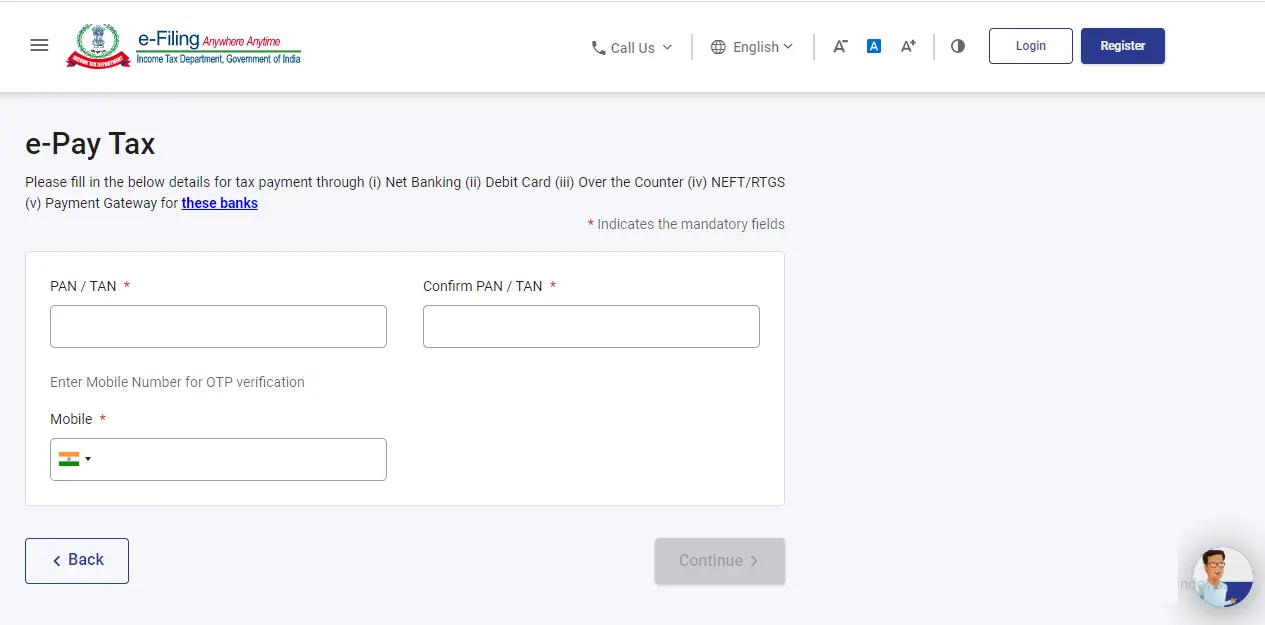

STEP 3: Enter PAN/TAN details

STEP 3: Enter PAN/TAN details

Enter your PAN number under PAN/TAN number, Confirm PAN/TAN number and enter your registered mobile number in the designated field.

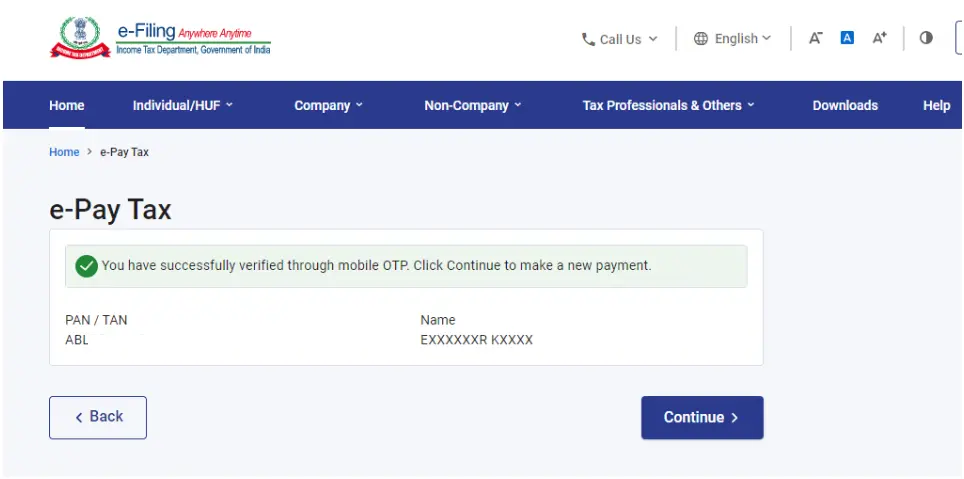

STEP 4: OTP Verification

STEP 4: OTP Verification

After OTP verification, you will be redirected to the e-Pay Tax page. Click the “Continue” button.

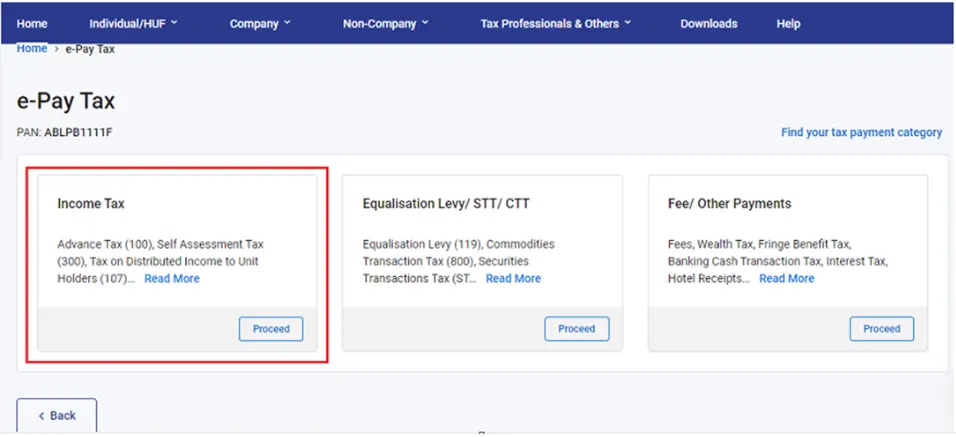

STEP 5: Click Proceed Button Under Income Tax

STEP 5: Click Proceed Button Under Income Tax

Click the “Proceed” button under the Income Tax tab.

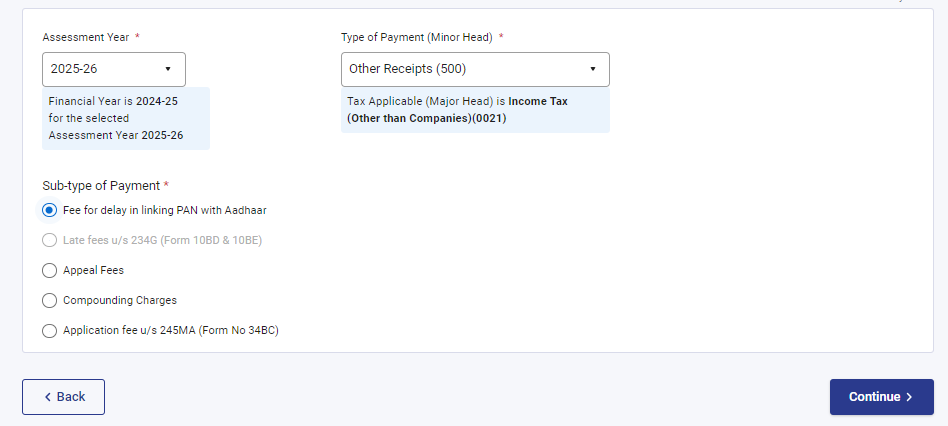

STEP 6: Specify penalty details

STEP 6: Specify penalty details

- Assessment Year: Select the current financial year (e.g., 2024-25).

- Type of Payment (Minor Head): Choose ‘Other Receipts (500)’.

- Sub-type of Payment: Select ‘Fee for delay in linking PAN with Aadhaar’.

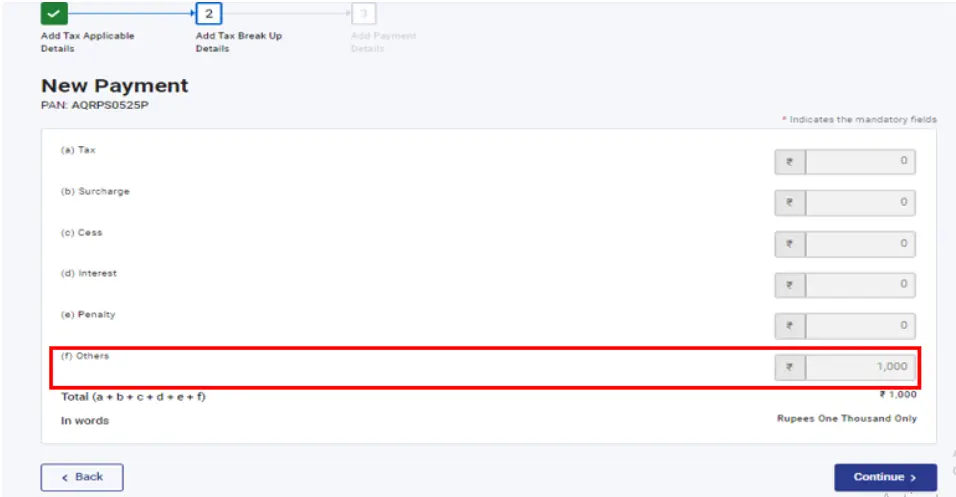

STEP 7: Make the Payment

STEP 7: Make the Payment

The penalty amount will be automatically filled in under the ‘Others’ option. Click ‘Continue’ to proceed with payment.

A challan will be generated. Choose your preferred payment method: net banking, debit card, over-the-counter, NEFT/RTGS, or payment gateway.

Payment gateway options are available for select banks:

- Axis Bank

- Bank of Baroda

- Bank of India

- Bank of Maharashtra

- Canara Bank

- Central Bank of India

- City Union Bank

- Federal Bank

- HDFC Bank

- ICICI Bank

- IDBI Bank

- Indian Bank

- Indian Overseas Bank

- IndusInd Bank

- Jammu & Kashmir Bank

- Karur Vysya Bank

- Kotak Mahindra Bank

- Punjab & Sind Bank

- Punjab National Bank

- RBL Bank

- South Indian Bank

- State Bank of India

- UCO Bank

- Union Bank of India

After the payment process, proceed to link your Aadhaar and PAN card immediately.

Read More: What is a Payment Gateway and How Does it Work?

How to Link Aadhaar and PAN Card Online?

There are two methods to link your Aadhaar card and PAN card:

- Method 1: PAN Aadhaar link without logging in to your account

- Method 2: PAN Aadhaar link after logging in to your account

Method 1. How to Link Aadhaar and PAN Card Without Logging in to your Account?

STEP 1: Visit the Income Tax e-Filing Portal

Go to the official Income Tax Department website.

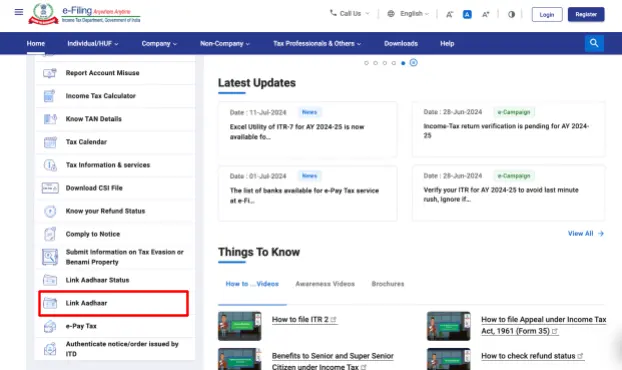

STEP 2: Locate “Link Aadhaar”

STEP 2: Locate “Link Aadhaar”

Look for the “Link Aadhaar” option under the Quick Links section on the left side of the homepage.

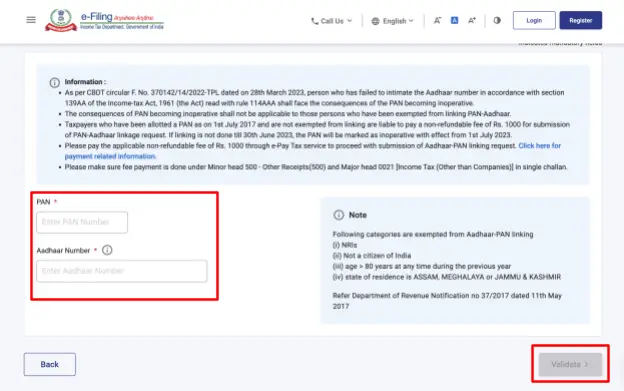

STEP 3: Enter PAN and Aadhaar Number to Validate

STEP 3: Enter PAN and Aadhaar Number to Validate

Enter your PAN and Aadhaar number accurately in the designated fields and click validate.

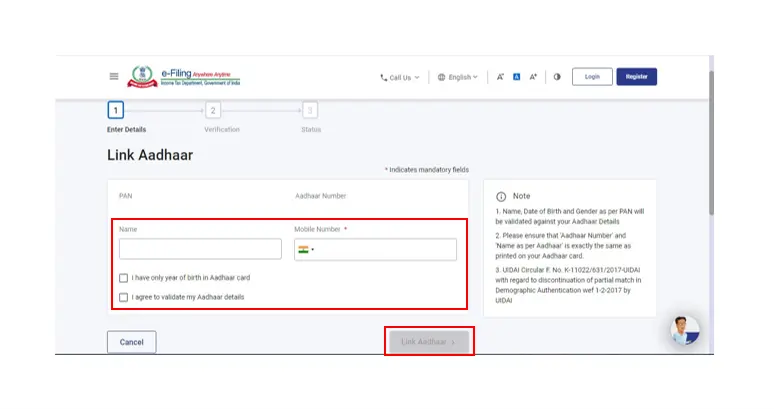

STEP 4: Enter Name and Mobile Number

STEP 4: Enter Name and Mobile Number

Enter your name as per Aadhaar, registered mobile number and click link Aadhaar.

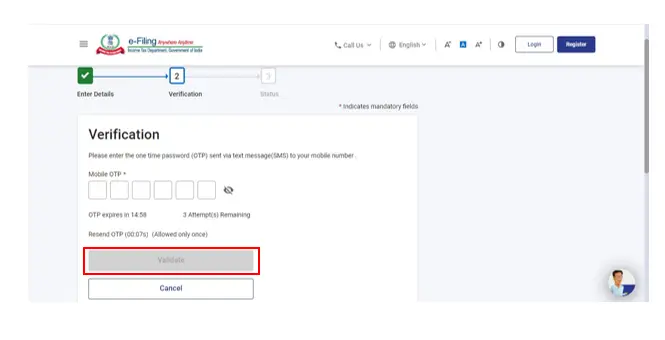

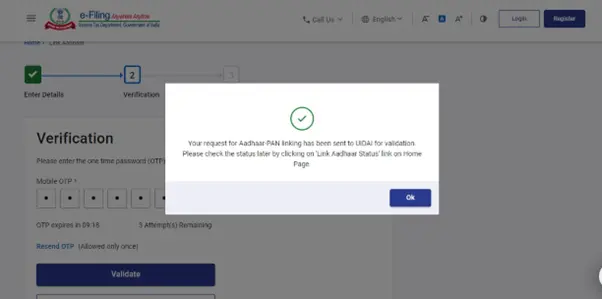

STEP 5: OTP Verification

STEP 5: OTP Verification

An OTP will be sent to your registered mobile number. Enter the 6 digit OTP and click on validate button

STEP 6: Submission

STEP 6: Submission

Once the OTP is verified, your Aadhaar-PAN linking request will be submitted.

Method 2. How to Link Aadhaar and PAN Card After Logging in to your Account?

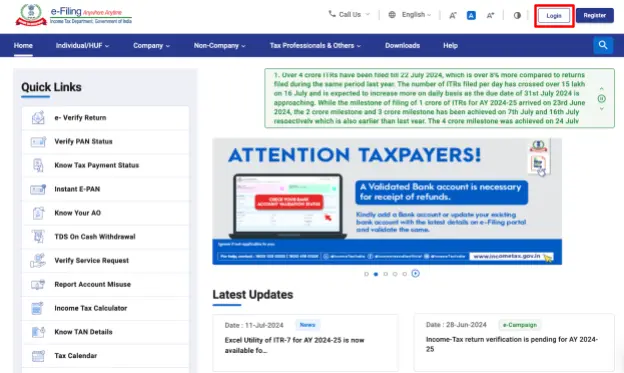

STEP 1: Go to Income Tax e-filing Portal > Log In

Visit the Income Tax e-filing Portal and click on the “Log In” button.

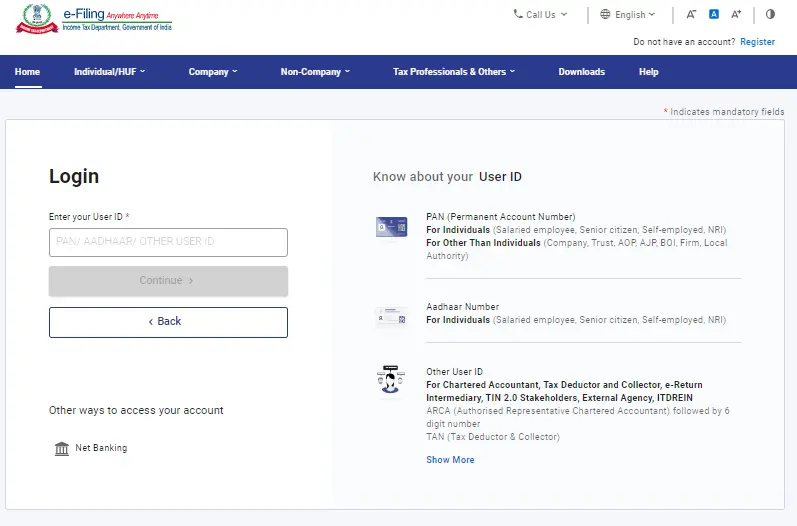

STEP 2: Log in to Income Tax e-Filing Portal

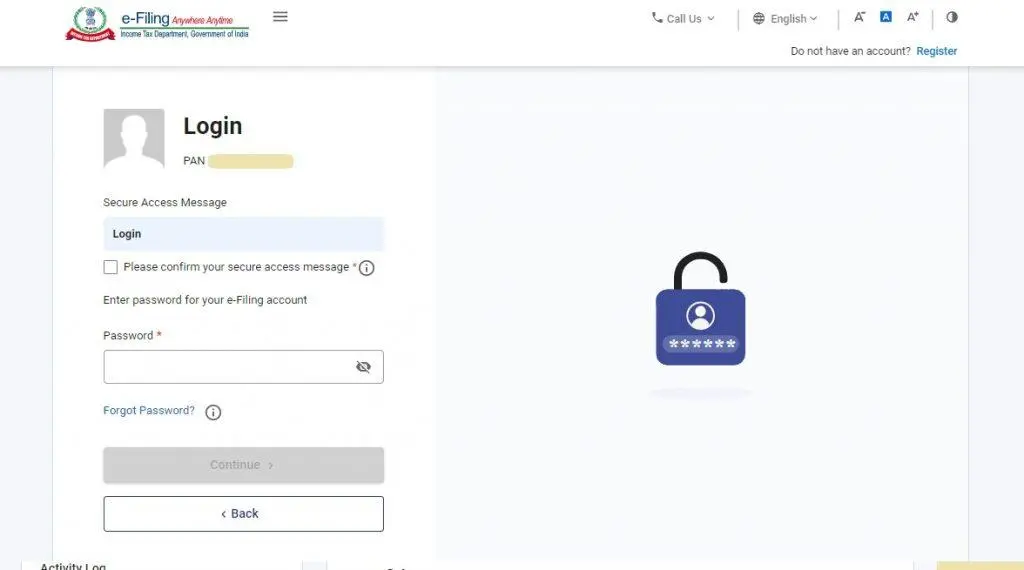

STEP 2: Log in to Income Tax e-Filing Portal

Enter your User ID as Aadhaar number/PAN number and click the “Continue” button.

STEP 3: Enter Your Password

Enter your password created during registration and click “Continue” button to access your profile. If you’ve forgotten your password, click the “Forgot password” link.

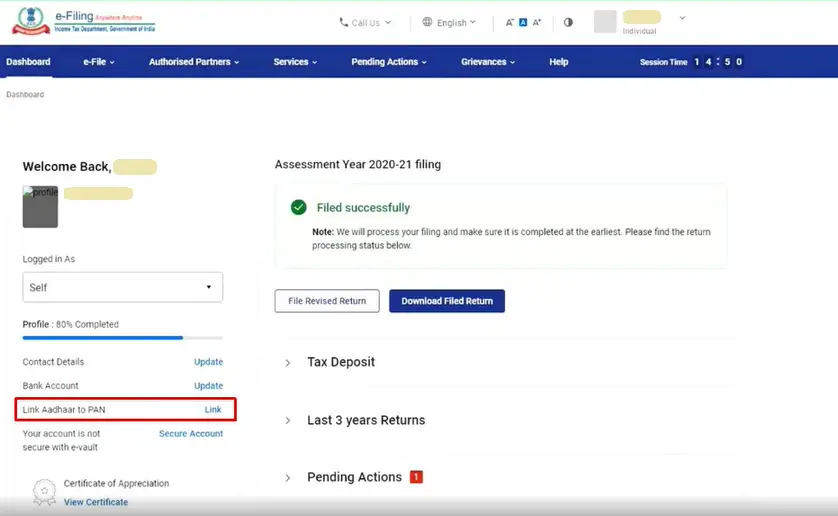

STEP 4: Navigate to Profile Section > Link Aadhaar to PAN Option

STEP 4: Navigate to Profile Section > Link Aadhaar to PAN Option

Look for the “Profile” section on your dashboard. Under the “Profile” section, click on the “Link Aadhaar to PAN” option.

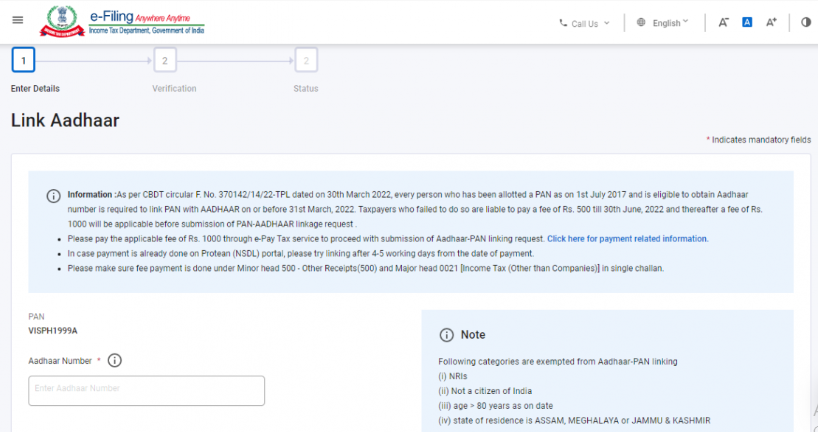

STEP 5: Enter Aadhaar Number

STEP 5: Enter Aadhaar Number

Enter your Aadhaar number accurately in the designated field.

STEP 6: Aadhaar to PAN Link Confirmation

STEP 6: Aadhaar to PAN Link Confirmation

A pop-up message will confirm successful Aadhaar linking to your PAN.

Related Read: How to Download Aadhaar Card Using Mobile Number in 2025?

How to Check if Your Aadhaar is Linked to Your PAN Card

To check the status of your PAN-Aadhaar linkage, follow these steps:

-

Go to the Income Tax e-filing portal.

-

Click on ‘Link Aadhaar Status’ under the Quick Links section on the homepage.

-

Enter your PAN and Aadhaar number, then click on ‘View Link Aadhaar Status’.

If your PAN and Aadhaar are not linked, a message will appear stating that the linkage is pending. If they are already linked, the status will be displayed accordingly.

PAN-Aadhaar Link Fee

A penalty of ₹1,000 must be paid before submitting the PAN-Aadhaar linking request on the Income Tax e-filing portal.

However, individuals who received their PAN card on or after 1st October 2024 using their Aadhaar enrolment ID are exempted from this penalty, provided they complete the linking process by 31st December 2025.

PAN-Aadhaar Link Customer Care Numbers

For any assistance or queries related to the PAN-Aadhaar linking process, you can contact the following helplines:

-

UIDAI (Aadhaar support): 1947

-

NSDL/Protean (PAN-related queries): 020-27218080 (Available daily from 7:00 AM to 11:00 PM)

-

Income Tax Department (Penalty and portal-related help):

-

1800 419 0025

-

1800 103 0025

-

080-46122000 / 080-61464700 (Available Monday to Friday, 8:00 AM to 8:00 PM)

-

Note: Failure to link PAN with Aadhaar by the deadline will result in the inactivation of your PAN, which can affect various financial transactions. After paying the applicable penalty and submitting your request, the linking is usually processed within 30 days, and your PAN will be reactivated.

Frequently Asked Questions

1. What is the PAN Aadhaar link last date in 2024?

31st May 2024 is the last date to link Aadhaar and PAN card without penalty. However, still you can link with penalty fees.

2. What are the documents required to link Aadhaar and PAN card?

- Aadhaar Card

- PAN Card

- Registered mobile number linked to Aadhaar

3. How long does it take to link Aadhaar and PAN card?

Once you submit the request to link your Aadhaar with your PAN, it may take 7 to 30 days for the process to complete and your PAN card to be reactivated.

4. What if there is a mismatch in name between Aadhaar card and PAN card?

If there’s a name mismatch between your Aadhaar and PAN cards, linking them might be problematic. It’s advisable to correct any discrepancies in your Aadhaar card before proceeding.

5. Can I link multiple Aadhaar cards to one PAN card?

As per Indian law, each individual is entitled to only one PAN card and one Aadhaar number, both of which must be unique. Therefore, linking multiple PAN cards to a single Aadhaar number is prohibited.

6. Is PAN Aadhaar link free?

No, linking PAN and Aadhaar is not free. There was a deadline of 30th June 2023 to link them without a penalty, but that has passed. Now, you need to pay a penalty of Rs. 1,000 to link your PAN and Aadhaar.

7. How to check PAN-Aadhaar link status via SMS?

To check your PAN-Aadhaar link status via SMS, follow these steps:

- Compose a new SMS: Type “UIDPAN <12-digit Aadhaar number> <10-digit PAN number>” (without quotes).

- Send the SMS: Send this message to either 567678 or 56161.

- Wait for the response: You will receive an SMS indicating whether your Aadhaar is linked to your PAN.

8. Who is exempt from the PAN Aadhaar link?

Individuals residing in Jammu and Kashmir, Assam, or Meghalaya; non-resident taxable persons as per the Income Tax Act, 1961; and individuals aged 80 years or older (super senior citizens).

9. What is the alternate way to link Aadhaar to PAN card?

You can link your Aadhar and PAN cards using SMS. Simply send a text message with this format: “UIDPAN [your 12-digit Aadhar number] [your 10-character PAN number]” to the number provided by the Income Tax Department. You’ll get a confirmation message once the linking is done.

10. Who needs to link Aadhaar and PAN card?

If you have a PAN card and were assigned one on or before July 1, 2017, and you have an Aadhaar number, you need to link your Aadhaar to your PAN. This is required by law for everyone who meets these conditions.