A good credit score proves creditworthiness. Any lender such as a bank or any non-banking financial institution assesses the credit score of business before extending loans. This provides them with an idea of whether a business can repay the borrowed money or not.

We all know that the COVID-19 pandemic has played havoc with the world’s economy. Though the government has relaxed the lockdown regulations, not all businesses have picked up pace yet. There are high chances that those businesses might need a business loan for survival.

When an individual or business applies for a loan, the first factor considered by lenders is the credit score. If your business has a good credit score, you are almost halfway through to getting approval for a business loan.

In this article, we will talk about the ways to ensure your business credit score remains healthy during the pandemic too.

Check your business credit score often

To maintain a good credit score, a business owner needs to be aware of their existing credit score. Unless an owner keeps an eye on credit score regularly, he wouldn’t know if it has improved or worsened.

For those who are unaware, a credit score ranges from 300-900. Usually, a credit score of 750 is considered ideal by lenders. Crisil, Experian, CRIF high mark, TransUnion CIBIL, Equifax are some of the credit rating agencies that provide credit score to businesses in India.

For those who are unaware, a credit score ranges from 300-900. Usually, a credit score of 750 is considered ideal by lenders. Crisil, Experian, CRIF high mark, TransUnion CIBIL, Equifax are some of the credit rating agencies that provide credit score to businesses in India.

Good payment history

The lenders decide the terms, conditions and rate of interest of a business loan based on the credit score. Since a good credit score reflects creditworthiness, it is important to pay dues on time.

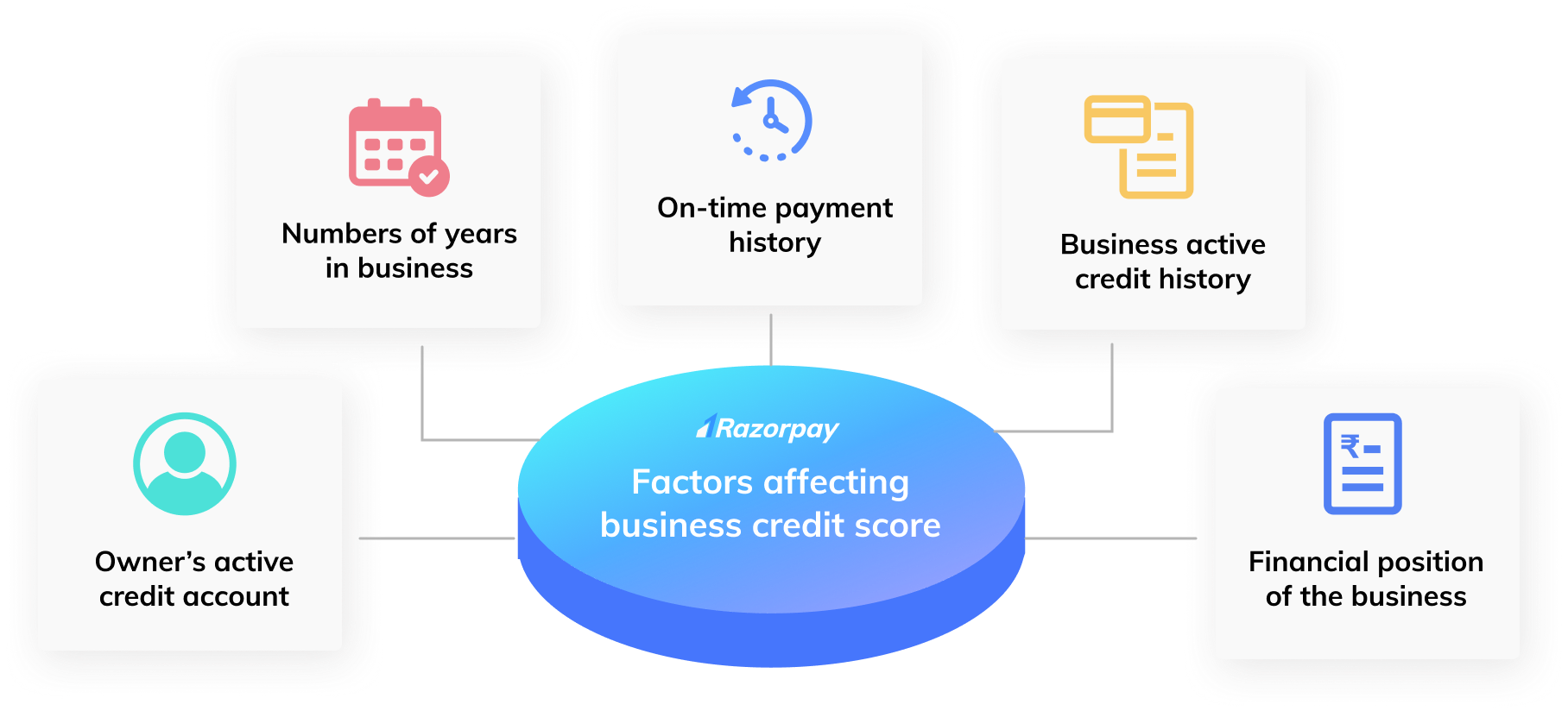

As mentioned earlier, the credit rating agencies provide a credit score to businesses after assessing the debts availed, repayments of those debts, duration of credit history, and the capability of repaying debts.

Any default in repayment of debts might affect your business credit score negatively.

Opt for Moratorium, if needed

The Reserve Bank of India (RBI) has extended a 3-month moratorium for all term loan repayments during COVID-19, without harming the borrower’s credit score. This moratorium period has been extended for 3 more months until September 2020.

If you are unable to pay your monthly business debts or other obligations, it is ideal to opt for a moratorium. Atleast, you will be able to save your credit score from dropping.

The chance of getting a new loan during the moratorium period might be difficult, but you will save your cash outflow for 3/6 months and use such capital to procure inventory or pay wages. Optimal use of working capital will kick start your business operations again.

Limit your credit utilisation

It would be best if you aim for lower credit utilisation. Given the current financial burden on businesses, the owners may find it reasonable to withdraw a larger amount of the credit. But, this might harm the business credit score.

The general rule of credit utilisation is 30% of the approved limit. If the usage exceeds 30% at any given time, your credit score starts deteriorating. Keep a check on your credit utilisation and if you are withdrawing a larger amount, make sure to repay those on time.

Different credit agencies have different credit utilisation rules. For instance, Equifax flags 50% credit utilisation as green. Any credit usage beyond 30% but less than 50% is flagged as amber. A red flag signals credit usage of more than 75%.

Do not avail new loans unless required

Business credit lines, term loans or credit card balances represent liabilities on your credit report. Avail more loans or credit lines without repaying the previous ones might land your business credit score in trouble.

Your business might need financial assistance during the pandemic, but you should avoid availing for new debts.

Sit back, evaluate the reason for availing new credit facilities and decide wisely!

Check for red flags in your credit score report

As a business owner, you should check for any red flags in your credit report and take remedial measures to improve the business credit score.

Some of the red flags that will need immediate resolutions are:

- Negative cash flows

- Many credit accounts

- Bounced cheques

- High credit utilisation

- Negative consumer feedback

- Assets write-offs

To summarise, maintaining a good business credit score is not difficult provided a business owner remains responsible towards the credit availed. Follow the tips as mentioned earlier to maintain a good credit score during the pandemic and after that too.

2 Comments

Good site.

Hi Jagannath Sil,

Thank you so much.