A credit line offers greater borrowing flexibility when compared to a traditional loan.

As an ambitious business owner, you know that success often hinges on the ability to seize growth opportunities when they arise. Whether it’s expanding your product line, entering new markets, or investing in cutting-edge technology, having access to timely and flexible funding is crucial. In this blog, we will explore how you can leverage a Credit Line to take full advantage of business growth opportunities and propel your venture to new heights.

Understanding the power of a credit line

A Credit Line, also known as a Line of Credit (LOC), is a revolving loan facility offered by financial institutions to businesses. Unlike conventional loans, where a lump sum amount is provided upfront, a Credit Line allows you to borrow funds up to a predetermined limit, as and when you need them. This revolving structure means you only pay interest on the amount you utilise, giving you greater control over your finances.

Advantages of a credit line

In today’s digital era, the availability of an online line of credit has transformed the borrowing landscape, offering numerous advantages tailored to new-age businesses:

Ease

- Applying for a credit line in India has never been easier. Online applications eliminate the need for extensive paperwork and physical visits to financial institutions. Within a few simple steps, you can apply for a credit line from the comfort of your office or home, saving valuable time and effort.

- A credit line is collateral-free in nature. No longer do you need to worry about offering your assets as security. This financial flexibility is designed to empower businesses like yours without adding unnecessary burden.

- Once your credit line is approved, it’s ready to use within 24 hours (in most cases), allowing you to act on opportunities and tackle challenges swiftly.

Flexibility

- Unlike traditional loans with fixed repayment schedules, a business line of credit offers you the flexibility to borrow funds up to a predetermined credit limit, and you only need to repay the amount you borrow in easy EMIs, not the entire credit limit.

- The tenure is also flexible, spread across 3, 6 or 12 months. This feature allows you to tailor your repayments according to your business’s cash flow, easing financial strain during leaner periods.

- As you make repayments, the amount you repaid becomes available again to borrow.

Fair & square

- When you opt for a credit line, you only pay interest on the amount withdrawn from your line. For example, if you withdraw Rs. 1 lakh at 1.5% pm and repay in

20 days, you pay only Rs 1,000 as interest. - Lenders do not charge any additional fees or penalties if you decide to repay the outstanding balance or close the credit line before the agreed-upon tenure or term.

Maximising business growth with a credit line

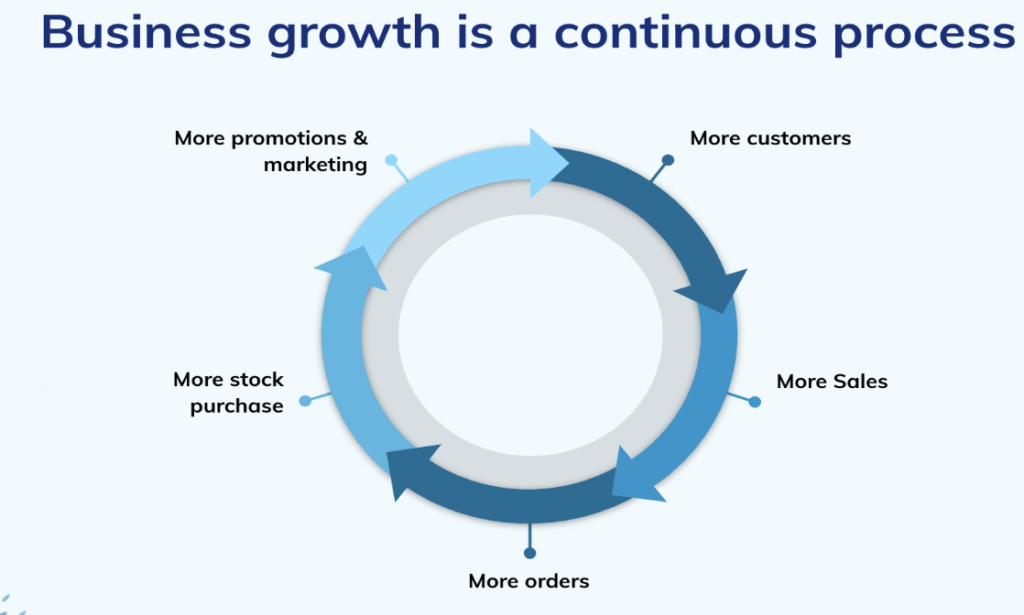

Business growth is a continuous process. To flourish, business owners must be prepared to invest time, effort, and financial resources into various aspects of their operations. This often entails upfront expenditures. As these investments take shape, it is natural for more money to flow out of the business before substantial returns are realised.

For instance, an e-commerce business may need to invest in creating an appealing website, developing an extensive product catalog, and implementing effective online marketing campaigns to attract customers. In doing so, they incur costs related to web design, inventory procurement, advertising, and hiring personnel. These initial expenses are vital for establishing a strong foundation and capturing the attention of potential customers.

The continuous process of business growth, with more money going out before money comes in, can lead to cash flow challenges.

A business can function only when it has enough cash flow for its various activities. And credit line is a key factor in ensuring optimum cash flow. When you manage credit (both receivables and payables) in your business effectively, you ensure that your business runs on its optimum cash flow.

Business credit line: New-age lending for new-age businesses

In the ever-evolving landscape of business financing, the traditional boundaries of borrowing have been redefined, ushering in a new era of lending perfectly suited for new-age businesses. Enter the “Business Credit Line,” a financial tool that aligns with the dynamic needs and aspirations of modern enterprises.

- Smoothing cash flow fluctuations: A business’s cash flow can experience ups and downs due to various factors such as seasonal variations or delayed payments. With a credit line in place, business owners can bridge the gaps in cash flow without compromising their day-to-day operations. It acts as a safety net, ensuring that essential expenses can be covered even during lean periods, allowing the business to maintain stability and seize growth opportunities.

- Preparing for cash needs: Growth often presents itself in unexpected ways, whether it’s a chance to expand into new markets, invest in cutting-edge technology, or launch a new product line. These opportunities may require upfront investments, and having a credit line readily available empowers business owners to seize the moment without hesitation. By leveraging a credit line strategically, businesses can position themselves at the forefront of innovation and stay ahead of the competition.

- Mitigating risk and enhancing financial planning: A credit line provides a valuable risk management tool for businesses. It can serve as a financial cushion during uncertain times, offering peace of mind to business owners and stakeholders. Moreover, having a credit line in place allows for more efficient financial planning, enabling businesses to allocate their capital wisely and make well-informed decisions that support sustained growth.

- Building a strong credit profile: Utilising a credit line responsibly and demonstrating prompt repayment can contribute to building a strong credit profile for the business. This, in turn, enhances the business’s borrowing capacity and opens doors to additional funding opportunities in the future. It showcases the business’s reliability and financial discipline to potential investors and lenders, bolstering confidence in its growth trajectory.

Did you know?

Razorpay Line of Credit offers a powerful solution that empowers businesses with immediate access to funds, flexible credit limits, and competitive pricing. It offers a pre-approved credit limit that allows you to access funds instantly, enabling you to manage cash flow disruptions effectively.

So what are you waiting for? Invest in the right financial tools today to prepare for the unexpected and secure a brighter future for your business.

Business Credit Line: Frequently Asked Questions

How is a business line of credit different from a personal line of credit?

A business line of credit is specifically designed to meet the financial needs of businesses, providing access to funds for business-related expenses such as working capital, inventory purchases, and managing cash flow gaps. Eligibility is based on the business’s creditworthiness, revenue history, and industry type. On the other hand, a personal line of credit caters to individual borrowing needs for personal expenses, emergencies, or home improvements, with eligibility determined by personal creditworthiness, income, and debt-to-income ratio. The credit limits are typically higher for business credit line when compared to personal line of credit, and the usage is reported to business or personal credit bureaus accordingly, impacting the respective credit profiles.

What are business line of credit interest rates like?

Business line of credit interest rates can vary widely depending on several factors, including the lender, the borrower’s creditworthiness, the business’s financial health, prevailing market conditions, and the type of line of credit being offered.

What is the eligibility for Line of Credit loans?

To qualify for line of credit loans, you will have to meet the lender’s standards, which typically include your business vintage, annual revenue, credit history, and other factors.

How do I apply for a line of credit online?

To apply for an online line of credit, start by researching reputable lenders that offer this financial product. Visit the lender’s official website and fill out the online application form, providing accurate details about yourself or your business. Some lenders may require additional documents to support your application, such as identification, financial statements, or business registration certificates. After submitting the application, the lender will review your eligibility and creditworthiness. If approved, you will receive information about your approved credit limit and terms. Once the line of credit is established, you can conveniently access funds as needed, making it a flexible and accessible financial tool for managing various expenses.

Do I have options for business credit line in India?

Yes, India offers credit line options for businesses. Various financial institutions, banks, and fintech companies in India provide business credit lines to help businesses manage their working capital needs, bridge cash flow gaps, and invest in growth initiatives.