The e-way bill portal streamlines the process of creating e-way bills. It ensures the smooth movement of goods across state borders. The portal offers various features, including generating single and consolidated e-way bills, updating vehicle numbers, and cancelling previously generated EWBs.

To create an e-way bill in EWB-01, you can choose from three primary methods: generate it directly on the official web portal, send specific details via SMS, or automatically via the e-invoicing system when invoices are generated. Here’s a detailed discussion of the procedure to generate e-way bill online using the web-based option on the e-way bill portal.

Table of Contents

What are E-way Bills?

[Source]

An e-way bill is a virtual document that serves as evidence for the movement of goods valued over ₹50,000. Unregistered individuals must also generate e-way bills when supplying goods inward. Businesses must complete GST e-way bill registration to ensure compliance when transporting goods valued over a specified threshold.

One can proceed with e-way bill generation through the e-way bill portal, SMS, Android app, and API Integration. Once an e-way bill is generated, a unique e-way bill number (EBN) is allocated and made accessible to the supplier, recipient, and transporter. This number serves as a reference throughout the transportation process.

What are the Prerequisites for Generating E-way Bills?

[Source]

Registering on the EWB portal is crucial before generating an e-way bill. The process requires the following documents:

- Invoice: Possession of the tax invoice or bill of supply or delivery challan for the consignment is mandatory.

- If you are transporting goods by road, you need either the Transporter ID or the Vehicle number.

- If the goods are being transported by rail, air, or ship, you will need the Transporter ID. Additionally, outline the transport document number, a unique document number associated with the transportation, and the date on the document.

Guide to Generating E-way Bill on the E-way Bill Portal

The process of generating E-way Bills online simplifies and streamlines the documentation required for transporting goods. Additionally, it enhances transparency and improves compliance with the GST regime.

Step 1 – Login

Navigate to the e-way bill portal. Enter your username, password, and the captcha code displayed on the screen. Click on the login button to access the dashboard.

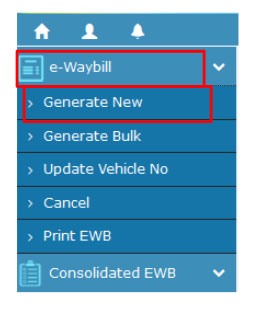

Step 2: Generate New

On the dashboard, locate and click on the ‘Generate New’ link under the ‘E-way Bill’ option.

Step 3: Data Entry

The data entry process is crucial and requires attention to the following details:

-

Transaction Type: Choose ‘Outward’ if you are the supplier, or ‘Inward’ if you are the recipient.

-

Sub-type: Select the applicable sub-type based on the transaction type.

-

Document Details: Enter the document type, number and date.

-

From/To Details: Provide details of the consignor and consignee as per the transaction.

-

Item Details: Include the product name, description, HSN Code, quantity, unit, value/taxable value, and tax rates.

-

Transporter Details: Fill in the mode of transport, distance, transporter name/ID, document number, and date or vehicle number.

Note: The details entered here may auto-populate in respective GST Returns on the GST portal.

Step 4 – Submission and Validation

After entering all the necessary information, click on the ‘Submit’ button. The system will validate the data and display errors if any, allowing you to correct them before final submission.

Result

Upon successful submission, an e-way bill (EWB-01) is generated with a unique 12-digit number. The e-way bill includes all the details that have been entered and is ready for print. It is mandatory to print and carry the e-way bill while transporting goods, as it serves as proof of compliance with GST regulations.

Related Read: E-Way Bill Validity Explained

Which Entities Are Required to Generate GST E-way Bills?

[Source]

It is crucial to understand who can generate e-way bill, in accordance with the GST regulations:

- Registered persons who act as consignees, consignors, transporters, or recipients can initiate the e-way bill. Whether they use their transport or hire one, they can generate the e-way bill.

- Unregistered individuals intending to supply goods to a registered person must also generate an e-way bill if the worth of the goods exceeds ₹50,000.

- If the consignee or consignor has not generated the e-way bill despite handing over the goods to the transporter then the transporter is responsible for generating the e-way bill GST document to comply with the regulatory requirement.

Validity and Extension of E-way Bills

[Source]

The validity of the e-way bill relies on the distance of transportation. For distances up to 200 kilometers, the validity is one day. For every additional 200 kilometers or part thereof, an extra day is added to the validity period.

For example, the validity is two days if the distance is 250 kilometers. If the distance is 450 kilometers, the validity extends to three days.

Suppose the goods are not transported within the stipulated validity period because of exceptional circumstances (such as natural calamities, law and order issues, trans-shipment delays, or accidents). In that case, the transporter can extend the validity.

The current transporter (or the generator if no transporter is assigned) can extend the validity between 8 hours before and 8 hours after the expiry time. To extend the validity:

-

Log in to the e-way bill portal.

-

Select ‘Extend Validity’ under the e-way bill section.

-

Enter the e-way bill number and provide the reason for the extension and other necessary details.

Remember that the extension option is available before and after the initial validity period, allowing flexibility for unforeseen situations.

Cancellation and Updation of E-way Bills

[Source]

a) For Cancellation:

-

Step 1: Visit the e-way bill portal.

-

Step 2: Click the ‘e-way bill’ or ‘Consolidated EWB’ option and select “Cancel” from the dropdown menu.

-

Step 3: Enter the 12-digit e-way bill number you wish to cancel and tap on ‘Go.’

-

Step 4: The selected EWB will appear. Provide a suitable reason for the GST e-way bill cancellation.

Related Read: How to Cancel E-Way Bill?

b) Updating E-way Bills:

You can update only part B of the e-way bill. The vehicle number is optional when generating part A of the e-way bill. However, a bill without a vehicle number is not valid for moving goods. In the following situations, you may need to update the vehicle number:

-

The vehicle number was not entered during the initial bill generation.

-

Due to breakdown or trans-shipment, goods are shifted to another vehicle/conveyance during transit.

-

Use the “Update Vehicle No” sub-option under the “e-way bill” section on the portal to add the vehicle number.

-

An Excel template is also available to update vehicle details for multiple e-way bills at once.

Consequences of Failing to Generate the E-way Bill

[Source]

Failing to create an e-way bill can significantly affect businesses transporting goods.

-

The foremost consequence is a monetary penalty. The defaulter may face a penalty of ₹10,000, which can impact the business’s profitability.

-

Beyond the penalty, authorities can seize or detain the goods transported and even the vehicle used for moving goods. This action can disrupt supply chains, delay deliveries, and lead to financial losses.

Best Practices and Tips

-

Ensure precise data entry when creating an e-way bill. Double-check the consignor and consignee addresses, item descriptions, vehicle numbers, and all the other required details. Mistakes in data entry can lead to delays or compliance issues during transportation.

-

To ensure compliance, businesses must calculate GST accurately for each transaction and verify GST details while generating e-way bills to avoid discrepancies.

-

Keep a record of all e-way bills generated. Maintain copies for future reference and audits. Proper documentation helps in case of any disputes or inquiries.

-

Be cautious with GSTIN details. Incorrect GSTINs can cause problems during transit. Check the validity of the e-way bill. Expired bills may lead to penalties.

-

Stay informed about changes in e-way bill rules and regulations such as changes in e-way bill generation limit. Regularly check for updates on the EWB portal.

Frequently Asked Questions (FAQs)

1. Are there any exemptions or thresholds for e-way bill generation?

The default threshold is ₹50,000, mostly for interstate movement. However, each state can set its own limits within the state. This bill is not mandatory for goods valued below ₹50,000, except for specific cases like the movement of handicraft goods.

2. Is it possible to track the status of an e-way bill once it is generated?

After filing Part A of form GST EWB-01, the other party can view the e-way bill generated against their GSTIN. One needs to log on to the e-way bill system to check the status.

3. How to check e-way bills generated by others?

To check e-way bills generated by others, follow the following steps: log in to the GST portal → click on e-way bill→ Tap e-waybill print→ enter e-way bill number→ tap on the ‘Go’ button.

4. How do I generate an e-way bill on my mobile app?

Visit the e-way bill portal→ Select Registration→ Choose SMS→ Share your registered mobile number. Verify OTP→ Choose user ID→ Click “Submit” to generate the e-way bill.

5. Who needs to generate e-way bills?

Registered persons who transport goods worth more than ₹50,000 in value need to generate E-Way Bills. This includes both suppliers and recipients of goods.

6. What are the different methods available for generating e-way bills?

E-way bills can be generated using the GST portal, SMS, e-Invoicing, Android and iOS apps, bulk generation, API integration, and Suvidha Provider services.

7. Can I generate e-way bills for both interstate and intrastate transactions?

Yes, you can generate e-way bills for both interstate and intrastate transactions. The process remains the same, regardless of the type of transaction.

8. How do I calculate the validity period of an e-way bill?

The validity of an e-way bill is contingent upon the distance that the goods need to cover. For up to 200 km, it’s one day. For each additional 200 km or part thereof, there will be one more day.

9. Can I generate e-way bills offline or through mobile apps?

E-way bills can be generated offline using Excel-based tools or mobile apps provided by the government. These tools allow you to create e-way bills even without an internet connection.

10. Is there a limit on the number of e-way bills I can generate in a day?

There is no specific limit on the number of e-way bills you can generate in a day. However, ensure compliance with the relevant rules and regulations.