The Unified Payments Interface (UPI), launched in 2016, is a popular digital payment system in India that enables users to conduct quick bank-to-bank transactions using just their mobile phones. Google Pay, one of India’s most popular UPI apps, allows users to set up and manage their UPI IDs within the app.

You may occasionally experience issues using UPI to make payments or connect to your bank’s system. In such cases, you can always reset or modify your UPI ID. Google Pay users can create multiple UPI IDs linked to their bank accounts, with the ability to add up to 4 UPI IDs per account.

Related Read: How to Find UPI ID Using Google Pay: Step-by-Step Guide

Table of Contents

How to Change UPI ID in Google Pay?

Whether you’re updating bank details or want a more personalized UPI ID, you can learn how to change UPI ID in Google Pay in just a few simple steps right within the app:

STEP 1: Open Google Pay Application

Open the Google Pay app on your phone.

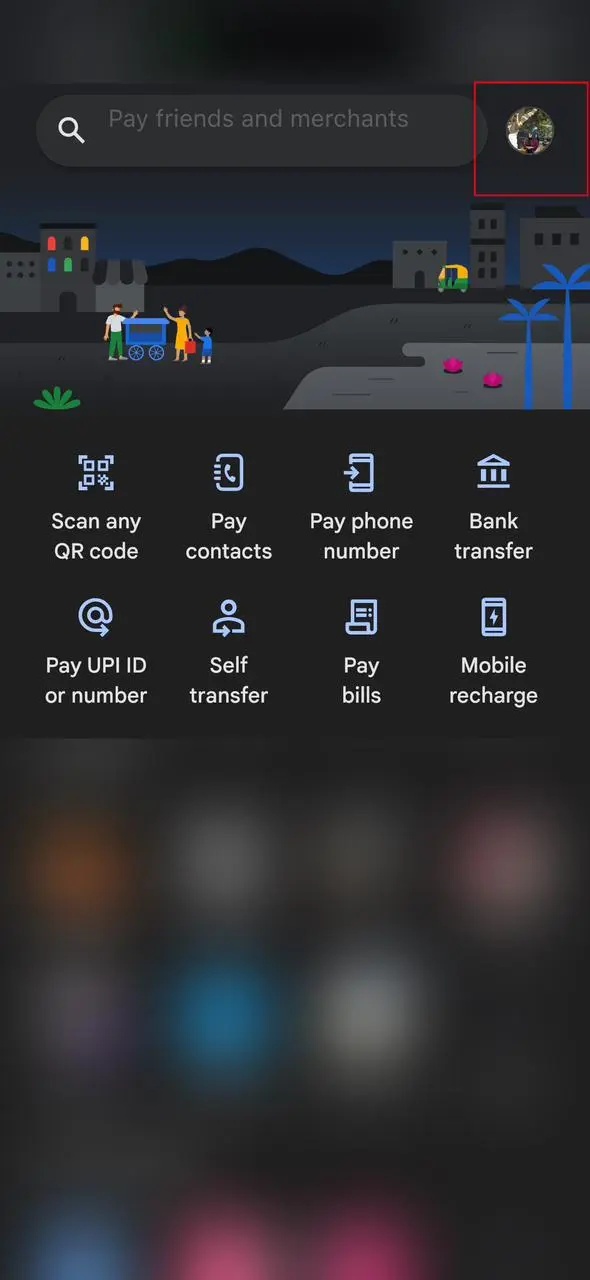

STEP 2. Access Your Profile

STEP 2. Access Your Profile

Click on your profile photo (usually in the top right corner of the screen).

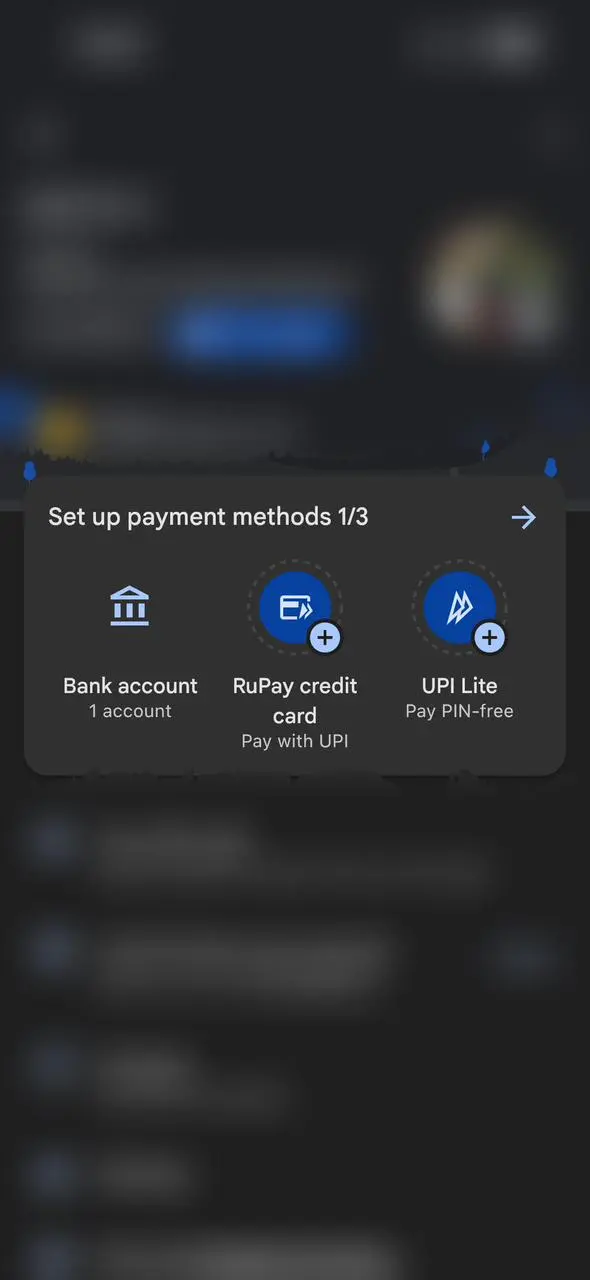

STEP 3: Choose an Account with a Bank

STEP 3: Choose an Account with a Bank

Click on the “Payment methods” part of your profile. All your connected bank accounts are displayed here.

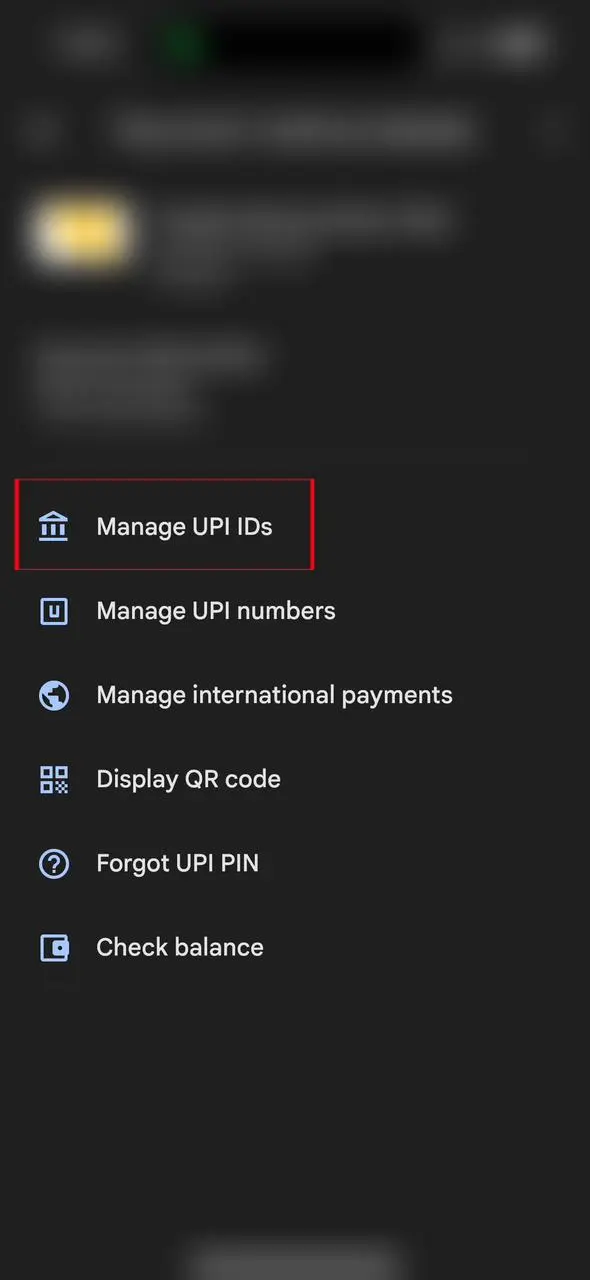

STEP 4: Manage UPI IDs

STEP 4: Manage UPI IDs

From the expanded list, select the option that reads ‘Manage UPI IDs.’ (you will get this option only if you’ve added your alternate bank account by visiting the “add bank” option.) You can also change your UPI PIN here.

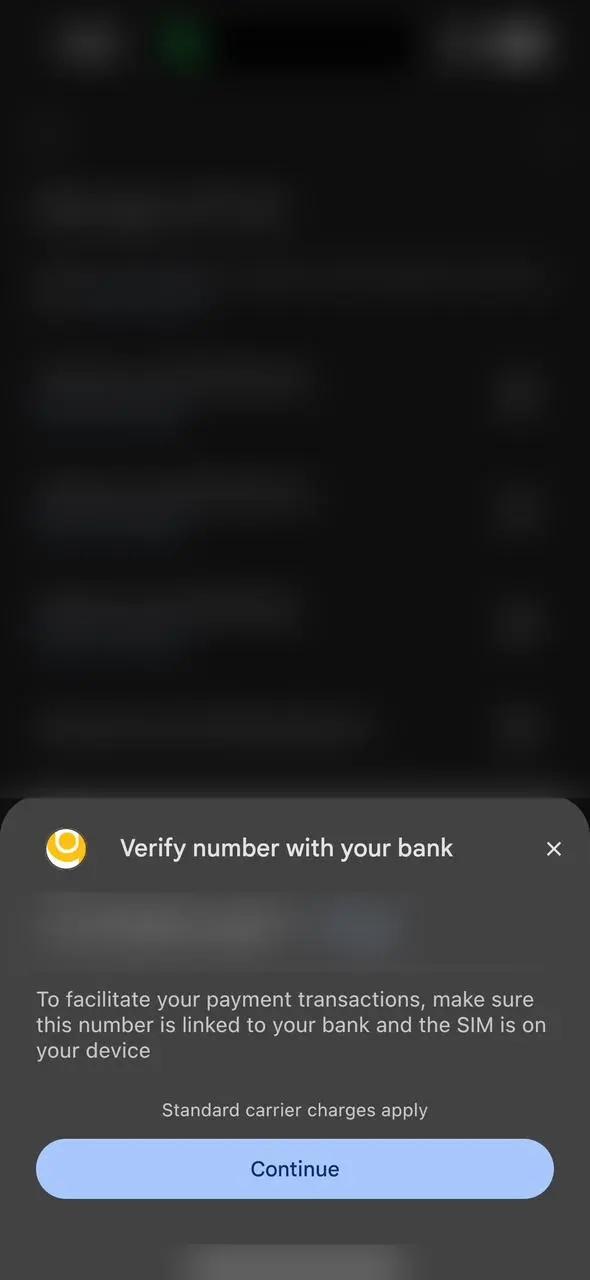

STEP 5: Verify Your Mobile Number

STEP 5: Verify Your Mobile Number

You will be asked to enter OTP, which is sent to the registered mobile number.

STEP 6: Add New UPI ID

STEP 6: Add New UPI ID

Click ‘Add’ next to the UPI ID you wish to change.

STEP 7: Completion

A new UPI ID will be created, and you can use this ID for your transactions.

Best Practices for Managing UPI IDs or VPA in GPay

1. Creating and Managing UPI IDs

You can generate up to four UPI IDs with Google Pay for every bank account you connect. UPI IDs generated via online banking websites or other UPI apps cannot be used with Google Pay. You will automatically receive a new VPA or UPI ID after logging into Google Pay.

2. Security Aspects

Turn on fingerprint or face unlock biometric authentication for secured access to your Google Pay app. Since your UPI PIN is required to authorise transactions, keep it private. Keep a frequent eye on your transaction history to spot any unauthorised activity.

3. Verification

Make sure the UPI ID you generate is up-to-date and successfully registered. Verify that the bank linked to your UPI ID supports all UPI features and functions. Ensure enough funds are in your bank account before starting any UPI transactions.

4. Setting and Managing Your Default UPI ID

This VPA or UPI ID that Google Pay generates for you will be your account’s default ID. You have the option to either keep the desired ID or delete any related IDs. Additionally, the bank account has to support UPI in order to be added to Google Pay.

5. Update Service Providers After Changing Your UPI ID

Changing your UPI ID may disrupt existing auto-payments or recurring transactions, so update your new UPI ID with relevant service providers to avoid interruptions.

Conclusion

Google Pay is currently one of the most popular UPI Payment Gateway. It allows users to easily modify and maintain their UPI IDs within the app, which is helpful in changing bank data or personalizing UPI IDs. The widespread use of Google Pay and its simple UPI ID management has boosted digital payments in India. Since customers value the simplicity and security of UPI transactions, systems such as Google Pay are important drivers of financial inclusion and the digital economy.

FAQs

1. How many VPAs or UPI IDs am I allowed?

You can create four UPI IDs on Google Pay linked to each of your bank accounts. This flexibility allows users to manage their digital payments more effectively.

2. Why need several UPI IDs?

Having numerous UPI IDs provides versatility. Users can build personalised IDs for a variety of purposes. Specific transactions can be identified using separate IDs. This makes it easier to organise and manage digital payments.

3. Are there extra UPI ID fees?

Creating UPI IDs in Google Pay does not incur any extra fees. For a single bank account, you can generate up to four UPI IDs at no cost, and the procedure of creating additional IDs is also free.

4. How to delete Google Pay UPI ID?

It is easy to remove your Google UPI ID. Under Manage UPI IDs, you’ll see a button that says “delete.” Click on it. The latter may be found in the Google Pay app, namely in the Profile section, under Payment Methods.

5. Is sharing my UPI ID safe?

Since your UPI ID only exposes your virtual address and not your bank account data, sharing it is completely secure. Nevertheless, use extreme caution and never entrust sensitive information to individuals or organisations you do not know or trust.

6. Could I use GPay on two phones with the same number?

No, Google Pay does not allow you to share a bank account across multiple devices. Each Google Pay account is tied to a specific mobile number. Users cannot use the same Google Pay account on two different phones with the same number.