Table of Contents

What is a Salary Slip?

A salary slip or payslip, is a document issued by an employer to an employee every month with pay-related details. It includes information like gross salary, deductions like taxes and contributions, and net pay received. It can be emailed or posted to the employee, and businesses are legally required to provide payslips as proof of salary payment made.

The salary slip acts as a record of earnings and deductions and is required for applying for loans or proving income.

Most businesses have automated processes in place to automatically create payslips as soon as the salary is sent out. RazorpayX Payroll auto-creates stunning, innovative payslips and sends them directly on Slack or Whatsapp.

Demo RazorpayX Payroll for Free

Components of Salary Slip

Your salary slip typically breaks down your pay into three main components:

-

Earnings:

- Basic Salary: Your fixed portion of monthly income.

- House Rent Allowance (HRA): Allowance for housing expenses, may be partially taxable.

- Conveyance Allowance: Covers travel expenses related to work.

- Medical Allowance: Medical allowance is a fixed amount to help cover employees’ medical expenses, separate from any reimbursement claims they might submit.

- Other Allowances: May include special allowances or bonuses.

-

Deductions:

- Professional Tax: State-levied tax on income.

- Employee Provident Fund (EPF): Mandatory contribution towards your retirement fund.

- Tax Deducted at Source (TDS): Income tax withheld by the employer.

-

Net Pay: The final amount deposited into your bank account after deductions.

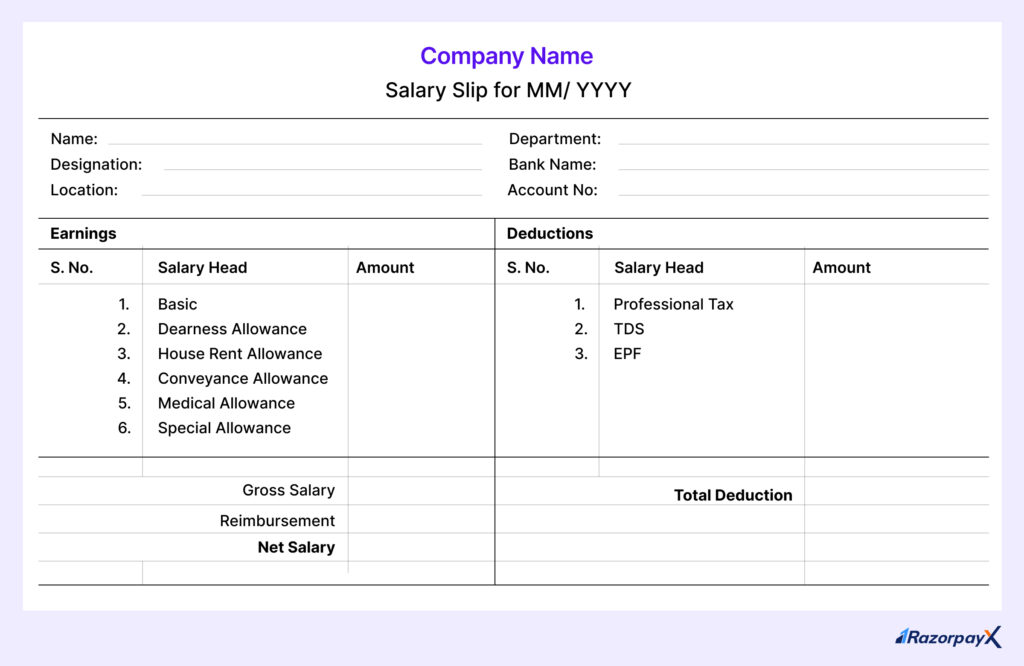

Salary Slip Format

Earnings

- Basic salary: The basic salary is the foundation of an employee’s compensation. It’s the fixed amount paid before any bonuses or allowances are added.

- Dearness Allowance: Dearness allowance is a salary supplement for Indian government employees that combats inflation by increasing with rising living costs. It’s a percentage of their base salary, helping maintain their purchasing power.

- House Rent Allowance: House Rent Allowance (HRA) is a partial reimbursement for rent paid by salaried individuals in India. It reduces your taxable income if you live in rented housing.

- Conveyance Allowance: Conveyance Allowance helps salaried people cover commuting expenses to and from work. It’s a fixed amount or a portion of your salary, depending on your company’s policy.

- Medical Allowance: Medical Allowance is a fixed amount paid by some employers in India to help cover medical bills for you and your dependents.

- Special Allowance: Special Allowance is a broad category that encompasses various allowances beyond basic salary. It can include things like uniform allowances, shift allowances, or remote work allowances, depending on your company and job.

Deductions

- Professional tax: Professional tax is a state-level tax deducted from your salary in India. It’s a small direct tax that varies by state and income slab.

- Tax Deducted at Source: Tax Deducted at Source (TDS) is another tax deducted from your salary by your employer in India. It’s an advance payment towards your annual income tax liability. The TDS rate depends on your income tax bracket.

- Employee Provident Fund: Employee Provident Fund (EPF) is a retirement savings scheme in India. Both you and your employer contribute a portion of your salary towards this fund. The accumulated amount is then available to you upon retirement or under certain other specific circumstances.

Net Pay

Salary Slip – Different Formats

Salary Slip – Different Formats

Importance of Salary Slip

A salary slip, also known as a payslip, is more than just a piece of paper detailing monthly earnings:

Proof of Income

The salary slip serves as official documentation of your income and deductions. It’s vital for various purposes, including:

Loan applications

When applying for loans like home loans or personal loans, financial institutions often require salary slips as proof of income to assess your eligibility and repayment capacity.

Visas and travel documents

When applying for visas or travel documents, some countries may request your salary slip as evidence of financial stability.

Rental applications

Landlords may request your salary slip to verify your income and assess your ability to pay rent. A salary slip provides a clear breakdown of your earnings and deductions. This transparency allows employees to:

Verify accuracy

Ensure your employer is calculating your salary and deductions correctly.

Budget effectively

Understand your net income after accounting for all deductions, helping you manage your finances effectively.

Track contributions

Monitor your contributions towards social security schemes like EPF, crucial for your retirement planning. Your salary slip plays a crucial role in filing your income tax return (ITR). It contains essential information like your:

- Gross salary: Total income before deductions.

- TDS (Tax Deducted at Source): Tax already deducted by your employer and deposited to the government.

- Investment proofs: Details of any investments you’ve made for tax deductions.

RazorpayX Payroll software creates stunning, innovative payslips – created by our team of best-in-class designers to give your employees a modern and engaging way to view their financial information.

The payslip is just one of RazorpayX Payroll’s many functionalities and abilities.

Where Can I Find My Salary Slip?

Finding your salary slip depends on your company’s process. Traditionally, it may be:

- Printed: Handed out physically or left in a designated location.

- Online: Accessed through a company portal or HR system.

However, modern solutions like RazorpayX Payroll offer innovative methods like WhatsApp integration which allows employees to receive their payslips directly and securely on their phones, eliminating the need for physical copies and enhancing accessibility.

This convenient option simplifies the process and ensures employees have immediate access to their payment information.

Automated Payslips and Payroll

Read More

| Basic Salary |

FAQs

What is the difference between CTC and in hand?

CTC (Cost to Company) is the total amount your employer spends on you, including your salary, allowances, and benefits. These benefits include health insurance, provident fund contributions and others. In-hand or gross salary is the amount actually received after deductions.

How can I check my salary slip?

The method for checking your salary slip depends on your company's specific process. Here are the common options: Physical copies: Traditionally, some companies may distribute paper copies of salary slips to employees. These might be handed out directly, placed in a designated location, or even sent via internal mail. Online access: Many companies have transitioned to online portals where employees can access their salary slips electronically. This typically involves logging into a company portal or HR system using your credentials. Mobile apps: Some companies, especially those utilizing modern payroll solutions like RazorpayX Payroll, offer mobile apps where employees can easily view and download their payslips directly on their smartphones.

Is it important to provide salary slip to employees?

In India, providing a salary slip to employees is not legally mandatory. However, it is considered highly recommended and falls under the domain of "fair labor practices". This is because salary slips are very important documentation for employees to understand their compensation, manage their finances, file for taxes and more.

How can I download my salary slip?

Downloading your salary slip likely involves your company's internal employee portal. If there is one, log in with your credentials and navigate to the payroll or salary section. There should be an option to view and download your paystubs, usually for various months or years. If you can't find it or your company doesn't use a portal, contact your HR department for assistance.

What is the impact of Standard Deduction on Salary Slip?

The standard deduction won't directly appear as a line item on your salary slip. However, it reduces your taxable income. This means a higher portion of your salary escapes income tax, potentially lowering your tax liability. You'll likely see a higher net pay amount on your slip due to the standard deduction being factored into the tax calculations.

What Role Does a Salary Slip Play in Taxation?

A salary slip plays a crucial role in taxation. It breaks down your earnings and deductions, including taxable income and tax deducted at source (TDS). This information helps you understand how much tax has already been withheld and estimate your final tax liability. By analyzing allowances like HRA and deductions like EPF on your slip, you can see how they affect your taxable income. Armed with this information, you can make informed decisions about tax-saving investments or consult a tax advisor for further optimization.