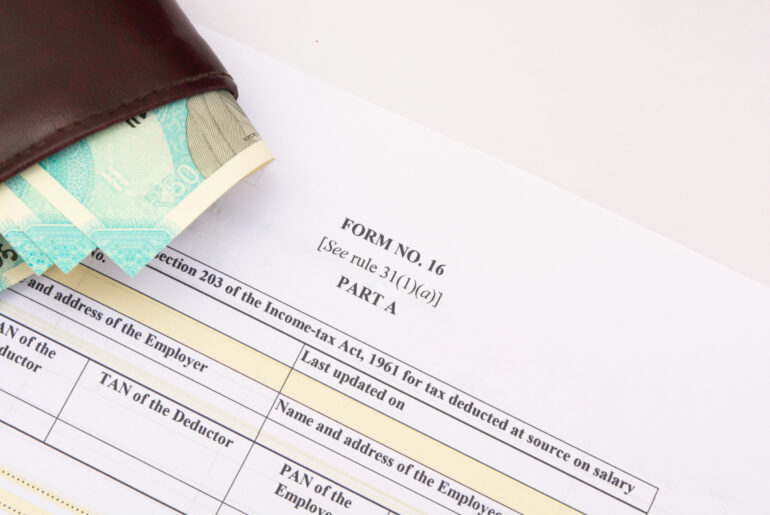

Form 16, also known as the TDS certificate, is a certificate that employers issue to employees. It is valid proof that TDS has been deducted and deposited with the employer.

TDS (Tax deducted at source) is the tax collected at the very source of income. But what happens to this amount deducted from employee salary?

As per the Income Tax Act, 1961, employers in India must deposit this TDS with the government. Now you must be wondering, is there any way to verify that the TDS was deposited with the government. This is where Form 16 comes in. This article will detail everything about Form 16 – its components, eligibility, benefits and more.

Table of Contents

What does Form 16 mean?

It consists of the salary details, the amount of TDS deducted and when it was deposited. Form 16 not only helps verify the details of TDS but also provides the necessary information to file income tax.

Part A & B of Form 16

Form 16 consists of two parts – Part A and Part B. While part A consists of the details of TDS deducted and deposited, part B is the annexure to part A and consists of the detailed salary breakup and the details of TDS deducted.

The employer prepares this part for the employee. It also consists of the details of exempted allowances and deductions. Let us look at their components in detail –

Form 16 – Part A

- Name and address of the employee

- Employer’s PAN number and TAN number

- Summary of the tax deduction quarterly

- Year of assessment

Part A of Form no 16 can be downloaded through the TRACES portal.

Form 16 – Part B

- The breakup of salary paid

- Deductions from salary approved under Chapter VI A of the Income Tax Act, 1961.

- The relief provided under section 89

Part B of Form 16 has to be prepared by the employer and shared with the employee. Payroll software such as RazorpayX Payroll provides Part A and B of Form 16.

Form 16 Eligibility

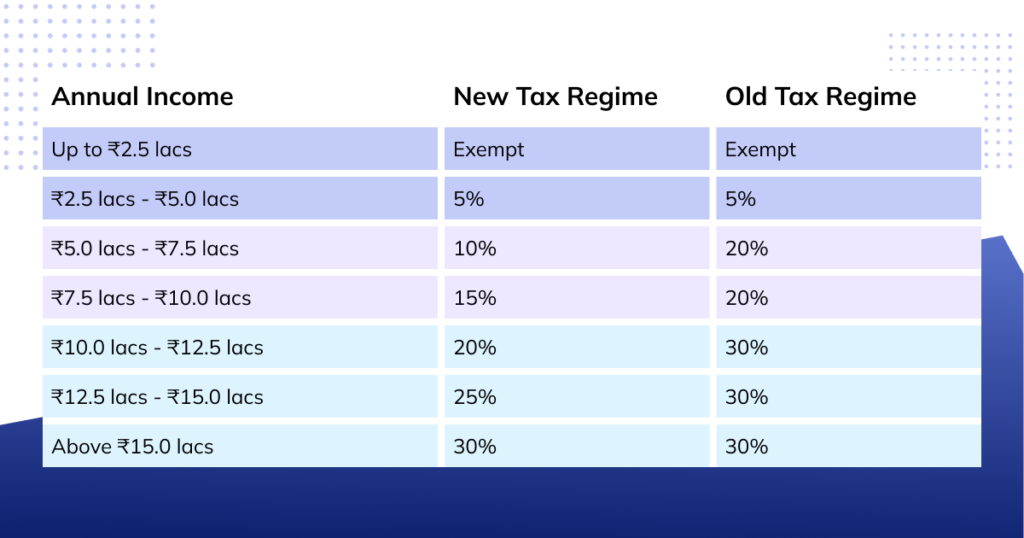

Employees whose total salary falls under the taxable income slab are eligible to receive Form 16 from their employers. According to the Finance Ministry of India, if an individual’s income does not exceed the minimum slab rate and is taxable, they do not require a TDS certificate or Form 16, and the employer is not obligated to provide the same.

However, if an individual’s salary does not fall under the taxable income slab, they must furnish form 15G to the employer. This acts as proof of income, and the employer does not deduct TDS.

Refer to the below table for tax slabs in India against the annual income:

Form 16 vs form 16A vs Form 16B

Form 16 vs form 16A vs Form 16B

There are three types of Form 16 – Form 16, Form 16A and Form 16B. Let us look at the difference between these.

Form 16

As mentioned above, Form 16 means a certificate of tax deducted on source for the income derived in the form of salary. It consists of all the details of the salary amount, the deductions and the amount of TDS deducted.

Form 16A

Form 16A represents the details of TDS deducted on income from sources other than salary. These sources can be interest on investment in fixed deposits, bonds, capital gains, gold etc.

The income on such investments is generally taxable as per the income tax rules. The financial institutions issuing these investments have to deduct TDS and issue a TDS certificate to the individual, known as Form 16A.

Form 16B

Whenever there is a sale of immovable property other than agricultural land, for a consideration of more than Rs 50 lakhs, the buyer is required to deduct 1% TDS and issue a TDS certificate to the seller, known as Form 16B. Form 16B consists of the details of the sale of property and the details of the TDS deducted.

How to get Form 16?

You can ask your employer to issue Form 16 to you. The employer can log in on the TRACES website with their deductor account, download Form 16 online, and share it with the employees. If your employer uses payroll software like RazorpayX Payroll, you can download Form 16 by simply logging in to your account.

Benefits of Form 16

From the above discussion, you must have already understood that Form 16 is proof that the deducted amount has been deposited with the government and has not been misused. But, the benefits of Form 16 are not limited to this. There are various other ways in which it can benefit you, such as:

- It helps in filing income tax returns

- It acts as proof of income

- Provides details of the amount of salary, exemptions, deductions and computation of Tax

- Checking if there is an error in the information and getting it corrected

- Get the details of all your tax-saving investments in a single place

- It helps you claim refunds, if applicable

Filing ITR with Form 16 Process

Form 16 is essential for filing income tax returns. But before you go on to file your return, it is important to register on the income-tax website and download the relevant ITR. Here are the steps that you must follow after downloading the ITR –

- Fill in the details such as employee name, PAN no., complete address, email ID, phone number and DOB. You must also fill in the details of tax deductions, like the amount deducted and the deduction date. The details mentioned in Form-16 are essential for income tax filing.

- The next step is to fill in the income details and attach the required documents as proof. After this, the system will auto-populate the tax liability.

- After calculating the tax liability, a tab will show the details of the tax paid, tax to be paid and the tax amount due for refund. You have to fill in the bank details and verify the declaration.

- The next step involves re-checking the details and uploading the return by clicking on submit.

- Once you have submitted the return, ITR-V is sent to the mentioned email ID. ITR-V is a verification document that acknowledges that the return has been submitted.

- After successfully submitting the ITR, e-verify the details using the link provided.

This article must have helped you understand Form-16, its uses and why it is important to issue it. But, computing Part-B of Form-16 manually for each employee can be time-consuming. Software like RazorpayX Payroll makes it extremely easy. And it offers many other features like:

- Automatic Salary computation along with deductions

- Auto-generation of Form-16

- Leave and attendance management

- Affordable group health insurance

- Automatic compliance calculation & filing such as TDS, ESI, and PF

- Integrations with leading software such as Slack, Freshteam, and more

FAQs

Is it necessary to issue Form 16?

Yes, the employer must provide Form-16 to the employee. It is an important document that consists of all the details regarding the salary and deductions. It also helps the employees file their Income Tax Returns.

What to do if you don’t have a Form-16?

If you don’t have a form 16, you can ask your employer or the tenant/buyer in the case of 16A and 16B forms to provide you with the form. If, for some reason, you still can’t get it, you can use salary slips or Form 26 AS to file your income tax returns.

Under which section is TDS deducted from income?

For salary income, the TDS is deducted under section 192. For income from sources other than salary like rent/commission, TDS is deducted under section 194.

Is it necessary to take Form-16 from a previous employer when job switching?

Yes, you can ask your previous employers to issue Form-16 as you will have to include the details of income from each job while filing your income tax return.