Every employer seeks a tax declaration from their employees at the beginning of a financial year. This declaration is a list of all tax-saving investments that an employee commits to make in that particular year.

Based on the information provided in the tax declaration, the employer calculates and deduct tax at source (TDS) proportionately from the employee’s monthly income. TDS on salary payments is governed by Section 192 of the Income Tax Act, 1961.

Declaring tax-saving investments is not all! Employees need to submit proof of expenses or investments during the year to support their declaration. If they fail to do so, the employer will have to recover the tax shortfall from the employee’s salary in the remaining months.

Employers managing payroll traditionally using spreadsheets collect investment proofs in physical copies or via email. Then, the concerned team verifies the details and approves the tax declarations. The whole process becomes cumbersome and confusing.

But, this process can be simplified for employers as well as their employees through automation.

Let’s shed some light on the entire tax declaration process using payroll automation and see how RazorpayX Payroll helps employers with all-things payroll.

Table of Contents

What is Form 12BB – Tax declaration form

Form 12BB is a statement that has to be submitted by the employees to their employers, generally at the end of the financial year.

[bctt tweet=”Employees declare their tax-saving investments or expenses made during a financial year to reduce their tax liability. ” via=”no”]

Why is tax declaration important

According to the income tax law, an employer needs to deduct tax at source on the estimated income of the employee every month.

Before Union Budget 2020, the Income Tax Act allowed employees to claim certain expenses & investments and reduce their tax burden.

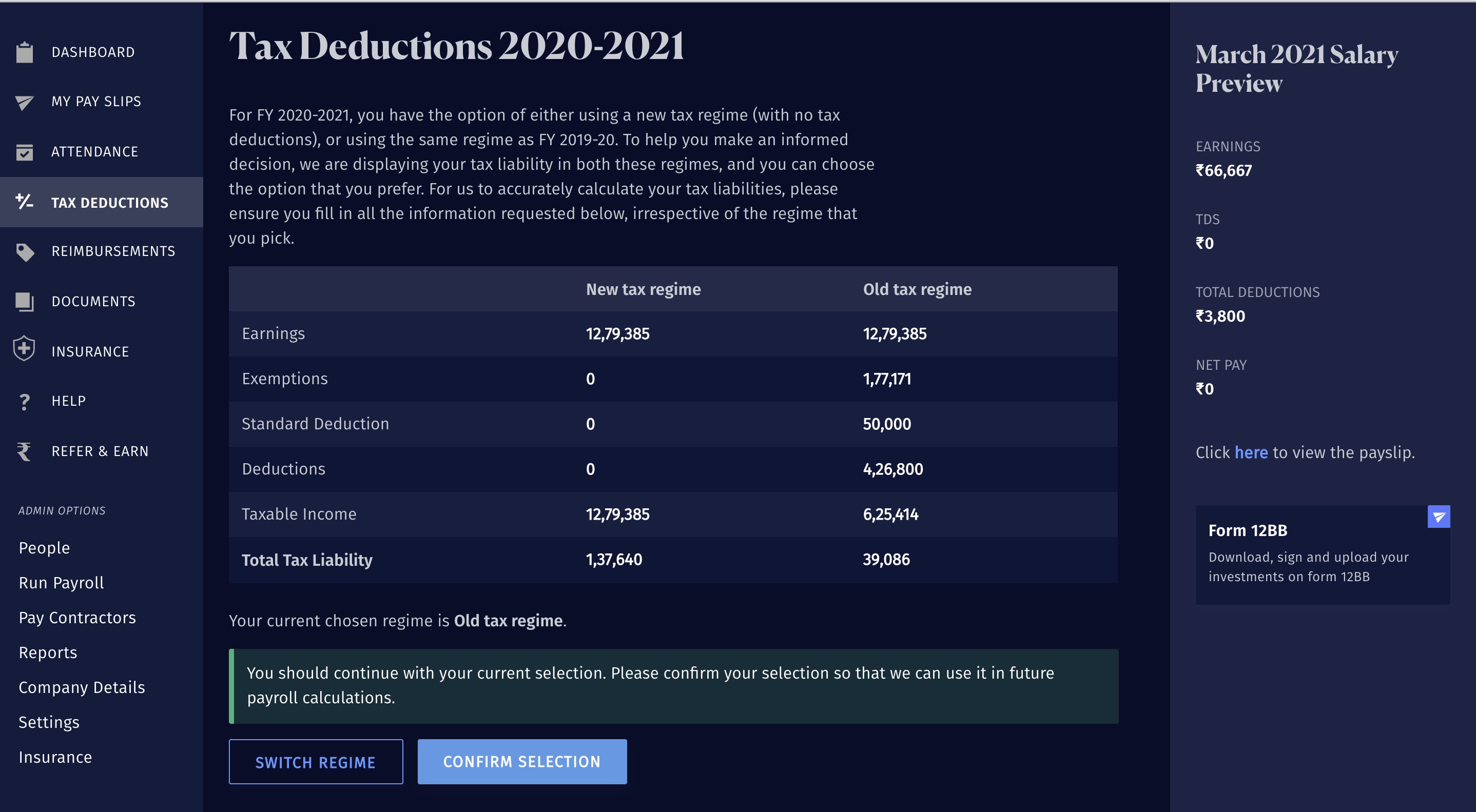

In Union Budget 2020, the government introduced a new tax regime with lower tax slabs, but with fewer exemptions and deductions. However, employees are free to compare and opt for the better-off regime based on their income.

To choose the best option, employees need to make tax declarations and calculate their tax liabilities.

[Must Read: All You Need to Know About The Dual Tax Regime ]

Once the selection is made, employers can deduct income tax accordingly from the employees’ salary.

How employers can verify supporting documents

Employers provide a cut-off date for submission of investment or expense proof. Generally, this date lies in January or February, so that shortfall of taxes is recovered in the remaining months of the financial year.

Here’s the checklist of verification tips for employers for the most popular tax-saving investments.

| Investments | Description | Documents to collect | Points to remember |

| House Rent Allowance (HRA) | For most employees, HRA is a part of their salary structure and provides benefits for the rental expenses made during the year.

The benefit amount available to employees is the least of the following:

|

Rent receipts | The rent receipts can be monthly/ annually

If the rent paid is higher than Rs 1 lakh in a year, owner’s PAN is mandatory |

| Leave Travel Allowance (LTA) | Applicable to employees whose salary structure includes LTA component

The exemption amount will be limited to LTA provided by the employer or actual travel costs, whichever is less |

Tickets for domestic travel and boarding pass in case of air journey | Applicable to only domestic travel expenses |

| Housing Loans EMIs | Employees can claim interest paid on housing loan for a self-occupied property of up to Rs 2 lakh in a financial year.

Also, the principal amount can be claimed under section 80C of the Income Tax Act up to a maximum of Rs 1.5 lakh in a year |

Loan certificate provided by the bank

A document declaring employees’ ownership in the property Property possession certificate |

Declaration should indicate borrowers and share of ownership |

| Life Insurance Premium | LIC premium paid during the year can be claimed as deduction under section 80C, up to a maximum of Rs 1.5 lakh | Receipts of premium paid | Premium paid for self, spouse and children is eligible

Payment should be made by the employee only |

| Public Provident Fund (PPF) | Employees can invest in a PPF account and claim up to Rs 1.5 lakh in a year under section 80C | PPF account statement or passbook | Either statement or passbook should have the account details and transfer record showing the amount along with the date of investment |

| Children Tuition Fees | Any amount paid towards children’s education can be claimed under section 80C, up to a maximum of Rs 1.5 lakh | School fees receipts | Tuition fees should be mentioned in the receipt

Deduction only allowed for tuition fees Available for full-time education courses including nursery |

| Medical Insurance | Medical insurance premium for self and family | Receipts of premium paid | Premium payment should be made by the employee only

Any amount paid, other than for preventive health check-up, should be in electronic form Medical bills for senior citizen parents can be claimed if there is no active insurance plan for them |

Mode and time of submission

Employers should collate online Form 12BB, income disclosure information, and documentary proofs. The employees will upload these documents to the online portal, and the payroll team can verify the same. Alternatively, some employers manually collate the data or combine both.

The tax declarations and their proofs should be submitted by the cut-off date.

Empower and enhance employee’s experience

To build trust and a sense of accountability among employees, employers should opt for payroll software that enables employees to access their payroll information, make updates to their tax declaration, and much more. All this comes as a part of India’s best payroll software, RazorpayX Payroll!

RazorpayX Payroll is built to focus on delivering a one-click, seamless, and end-to-end payroll processing experience. Combining the functionality of payroll software with that of outsourcing services, RazorpayX Payroll not only does payroll calculations but also executes payroll.

Executing payroll refers to the disbursal of salaries to the employees and the payment of statutory dues like PF, PT, ESI, and TDS.

RazorpayX Payroll also facilitates employees to help themselves with its ESS (Employee Self-Service) portal. It offers an intuitive dashboard for quick access to payslips & Form 16, update tax declarations, or request reimbursements.

Employees can enter details and upload supporting documents in the portal by clicking on ‘Edit’ under different investment heads.

With RazorpayX Payroll, employees can compare and choose their preferred tax regime during the time of their tax declaration for the financial year.

They can also see their projected taxes for the year based on their income and regime so that they can make an informed decision keeping their tax liability in mind.

RazorpayX Payroll – One stop solution for all things payroll

RazorpayX Payroll – One stop solution for all things payroll

Relying on obsolete payroll processing methods might put businesses at risk.

Since the software scales itself, RazorpayX Payroll helps businesses to carry out their payroll operations without any interruptions and help them stay up to date with changing regulations and compliance.