Table of Contents

What Does Vesting Mean?

If you’ve been granted ESOPs or offered a deferred bonus, chances are you’re stumped by the concept of vesting. In reality, the concept is quite simple.

Here’s a detailed guide to everything you need to know about vesting, whether you are an employer, employee, or just plain curious!

Basics of Vesting

Simply put, vesting is an employee retention technique.

Employers give their employees a guarantee that if they stay for a specified term of employment, they will earn assets like equity stocks or retirement plans.

The intent is to give employees an incentive to stay with the business. Retaining top talent should be every business’s major goal, alongside profitability and growth.

Let’s understand how vested benefits work with the most common vested benefit: ESOP, or the Employee Stock Option Plan.

Understanding Employee Stock Options (ESOPs)

An ESOP is a contract that gives an employee the right to buy a stock at a predetermined price for a finite period of time.

Watch the below video for more:

How are ESOPs Vested?

As a vested benefit, employees have to fulfil the requirements of their vesting schedule in order to gain ownership of their ESOPs.

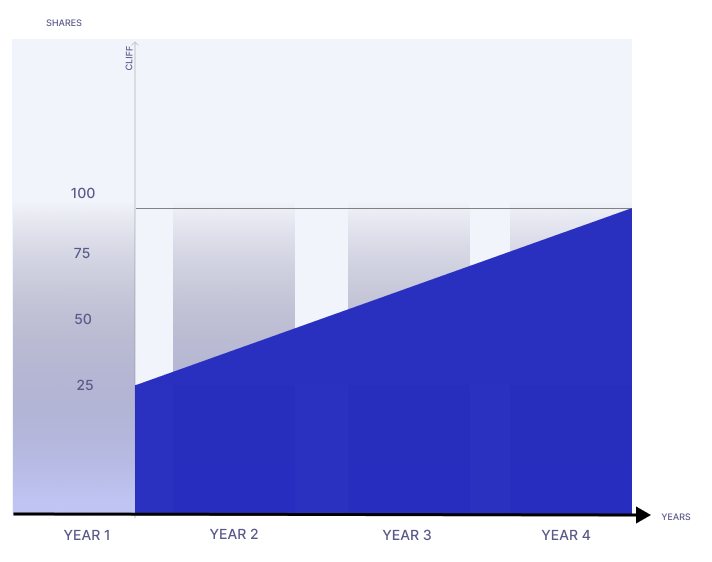

ESOPs typically start vesting only after a cliff period. Cliff period is the minimum period that an employee has to work for the company before any of the options start vesting. Let’s understand how ESOPs are vested using an example.

Example of ESOP

A company offers 100 ESOPs to its employee with the following conditions.

- Options granted: 100

- Grant price: Rs 1

- Cliff period: 1 year

- Vesting schedule: Time-based, 20% each year

After this initial one-year cliff period, 20% of the options will vest in the first year. This means that the employee can exercise 20% of his stock options by purchasing the shares at the predetermined price of Rs 1.

| Year | 2020 | 2021 | 2022 | 2023 | 2023 |

| Stock Units Vested | 20 | 20 | 20 | 20 | 20 |

| Total Units Vested | 20 | 40 | 60 | 80 | 100 |

Every year, 20% of the stock options vest – which means by the end of the fifth year, the employee can exercise all 100 of the stock options given.

Vesting Schedule: Meaning & Types

All vested benefits follow a vesting schedule, which details how the employee earns the benefits. These schedules can be tied to a period of time, a milestone, or a mix of both. Let’s understand each one.

Time-Based Vesting Schedule

This kind of vesting schedule gives the employee ownership of the asset over a period of time. The asset begins to vest after the cliff period.

This kind of vesting schedule gives the employee ownership of the asset over a period of time. The asset begins to vest after the cliff period.

The cliff period is the minimum required term of employment after which the employee begins to gain ownership of the asset.

Milestone-Based Vesting Schedule

Under a milestone-based vesting period, the employee gains ownership of the asset after a certain milestone is reached. The milestone is predetermined, and could be an IPO, completion of a business project or when the company hits a certain valuation.

Hybrid Vesting Schedule

A combination of both time and milestone based vesting schedules requires the employee to complete a period of employment and also hit the pre-decided milestone.

| Vesting schedule | Pros | Cons |

|---|---|---|

| Cliff vesting | Simple to understand and administer | Risky for employees |

| Gradual vesting | More employee-friendly | More complex to administer |

| Hybrid vesting | Best of both worlds | Can be more complex to administer than cliff vesting |

How to Calculate Vesting?

The formula for calculating vesting is:

Vested shares = (Number of shares x Vesting percentage) / 100

For example, if an employee has 100 shares of stock options with a vesting percentage of 25%, they would have 25 vested shares after one year.

Tax Implications of Vesting in India

In India, stock options and RSUs are taxed as perquisite income. This means that the fair market value of the shares on the vesting date is clubbed with the employee’s salary and taxed as per the applicable tax slab.

The tax rate for stock options or RSUs depends on the employee’s income tax slab. For example, if an employee is in the 30% tax bracket, they would pay 30% tax on the fair market value of the shares on the vesting date.

If you sell your vested shares, you will be taxed on the capital gains at the following rates:

| Holding period | Capital gains tax rate |

|---|---|

| Less than 3 years | 15% |

| More than 3 years | 10% |

Why is Vesting a Popular Employee Retention Technique?

Vested benefits are a win-win situation to both employer and employee. By offering a retention incentive to top talent, employers ensure low attrition rates. Founders who don’t have to worry about losing top talent can focus on expansion and growth!

Vested benefits like ESOPs and deferred bonus are only part of a larger financial strategy that all successful, high-growth businesses must have in place.

Here’s a few other strategies that employers keep in mind for good money management:

- A solid investment strategy and a well-diversified portfolio

- A well-thought out budget and forecast plan for each quarter

- Automated financial management for minimal errors and smooth finances

Learn more: Automated Business Finances

Vested vs Non-Vested Benefits

Companies also offer non-vested benefits, which do not follow a vesting schedule. These do not contribute to long-term employee retention efforts, but are just as important.

| Aspect | Vested Benefits | Non-Vested Benefits |

| Definition | Benefits earned and fully owned over time | Benefits immediately accessible upon employment |

| Ownership | Full ownership after completing vesting period | Immediate ownership upon joining the company |

| Vesting Period | Requires a specific length of service to vest | No vesting period required |

| Forfeiture | May be forfeited if employee leaves before vesting | No forfeiture as benefits are immediately owned |

| Examples | Employer contributions to retirement plans like Provident Fund | Basic salaries, PTO, health insurance, bonuses |

FAQs

What does vesting mean?

Vesting refers to the process by which an individual gains ownership or entitlement to a particular asset, typically through the passage of time or meeting certain conditions. It is commonly associated with employee stock options, retirement plans, and other long-term incentive programs.

What is an example of vesting?

For example, you are granted 1,000 ESOs with an exercise price of Rs 10 per share. The options have a vesting period of four years with a one-year cliff. This means that you need to work for XYZ Corporation for one year before any of the options vest. After that initial one-year cliff, the options begin to vest gradually over the remaining three years.

How is vesting calculated?

Vesting is typically calculated based on a predetermined schedule that outlines when and how an individual gains ownership or entitlement to a particular asset. The most common method for calculating vesting involves using a linear or stepped approach over a specified period.