Table of Contents

What is a RERA escrow account?

A RERA escrow account is a specific type of account mandated by the Real Estate (Regulation and Development) Act, 2016 (RERA).

A RERA escrow account is held by the developer of an upcoming construction project. This includes both residential and commercial projects. In India, real estate developers collect funding from buyers in the form of down payments, instalments, and other payments as per the payment schedule agreed upon in the sale agreement.

These payments are deposited into the RERA escrow account. The developer can only withdraw funds from the escrow account for the purpose of construction of the project, and only after obtaining the necessary approvals from the authorities.

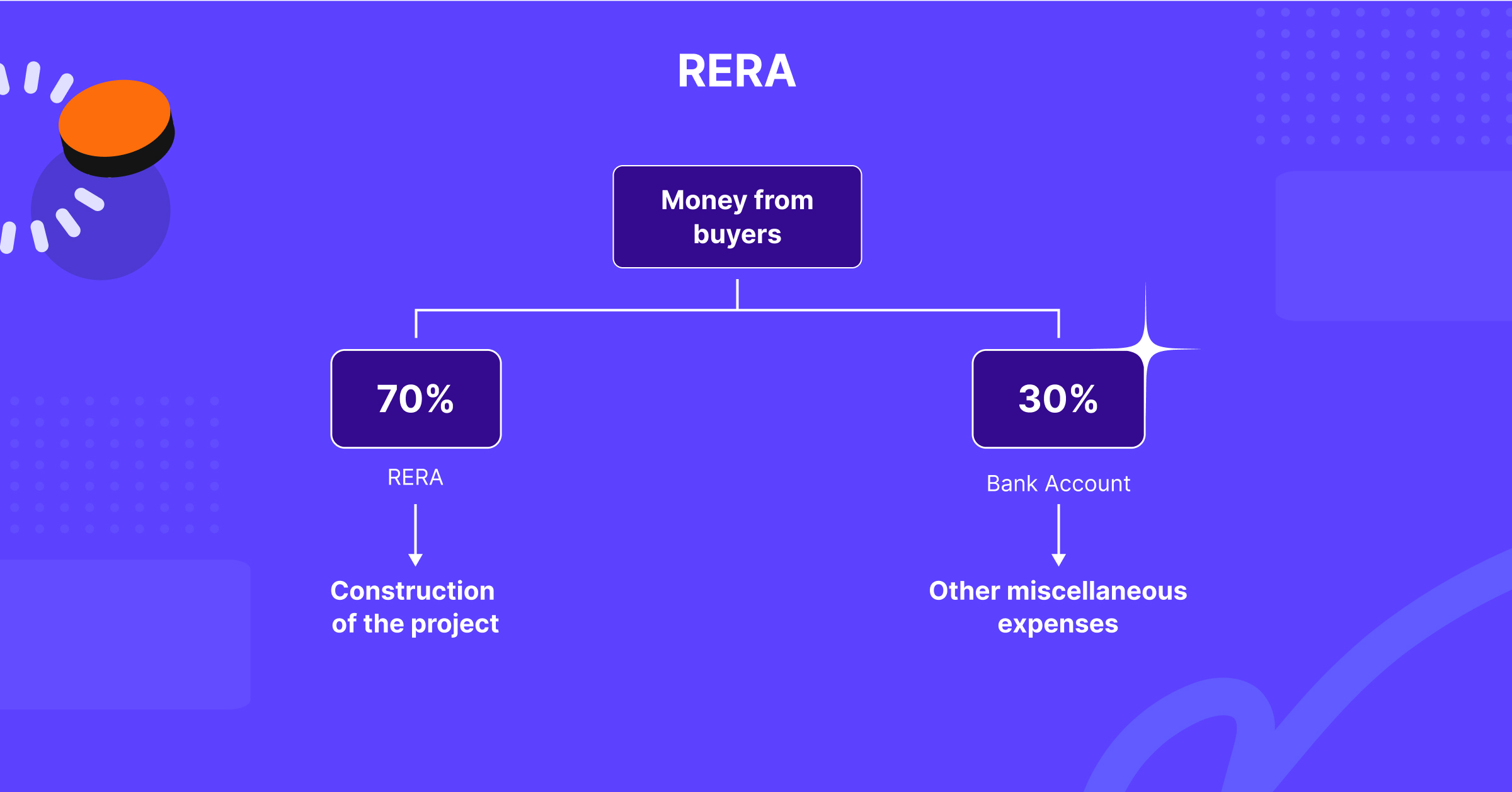

Under RERA, developers are required to deposit 70% of the funds collected from buyers into a RERA escrow account. These funds can only be used for the construction of the project for which they were collected.

What is an escrow account?

An escrow account is a third-party account held by a neutral party, typically a bank or a financial institution. The purpose of an escrow account is to safeguard funds until certain conditions are met.

Escrow accounts are used in various kinds of transactions and industries, like online gaming, digital lending and marketplaces. One of the major uses of an escrow account is in real estate.

In India, the Real Estate Regulation and Development Act (RERA) mandates the use of an escrow account in all real estate projects with a cost of more than ₹500 lakhs or more than eight apartments, whichever is less. This escrow account is called a RERA escrow account.

How does a RERA escrow account work?

All developers registered under RERA are required to open a RERA escrow account for each project they undertake. This includes both residential and commercial projects.

All developers registered under RERA are required to open a RERA escrow account for each project they undertake. This includes both residential and commercial projects.

The escrow account is managed by the developer of the project, and every project must have only one RERA escrow account.

70% of the funds collected by the developer should mandatorily go to this RERA escrow account. Deposits and withdrawals from and into this account are regulated by the RERA Act, 2016.

Real Estate Regulation & Development Act

The Real Estate Regulation and Development Act, 2016 (RERA) lays down a number of regulations governing the operation of RERA escrow accounts. These regulations include:

- The requirement to deposit 70% of the funds collected from buyers into the escrow account

- The requirement to use funds from the escrow account only for the construction of the project

- The requirement to provide regular updates on the status of the escrow account

- The requirement to obtain certification from an engineer, architect, and chartered accountant (CA) before withdrawing funds from the escrow account

How to open a RERA escrow account?

Developers can open a RERA escrow account with a scheduled bank in India. The process for opening a RERA escrow account is typically as follows:

- Submit an application to the bank along with the required documentation

- Pay the necessary fees

- Sign the escrow agreement

With the development of technology and digitization of processes, more and more companies and developers are choosing a digital route over the traditional banking route.

Learn more about online escrow accounts

Why is a RERA escrow account needed?

The law mandates a RERA escrow account for several reasons.

- Protection for homebuyers: RERA escrow accounts protect homebuyers from fraud and financial losses. The funds deposited into the escrow account can only be used for the construction of the project, and the developer cannot withdraw the funds without the approval of the Real Estate Regulatory Authority (RERA).

- Transparency: RERA escrow accounts promote transparency in real estate transactions. Developers are required to provide regular updates on the status of the escrow account to RERA and to homebuyers. This makes it easier for homebuyers to track their funds’ use and identify any potential problems.

- Accountability: RERA escrow accounts make developers more accountable for the use of funds. Developers can only withdraw funds from the escrow account after meeting certain milestones, such as completing a specific stage of construction. This helps to ensure that the project is completed on time and within budget.

- Reduce the risk of project delays or non-completion: By ensuring that funds are available for construction, RERA escrow accounts help to reduce the risk of project delays or non-completion.

- Boost investor confidence: RERA escrow accounts boost investor confidence in the real estate sector by providing a layer of protection for their investments.

- Promote financial discipline: RERA escrow accounts promote financial discipline among developers by ensuring that funds are used for the intended purpose.

Benefits of Digital RERA Escrow:

Convenience: Digital escrow accounts are a completely online solution, making it more convenient for both developers and homebuyers. Developers can open an online escrow account in minutes, and homebuyers can deposit funds into the escrow account using a variety of payment methods, including net banking, credit cards, and debit cards.

Transparency: Digital escrow provide real-time updates on the status of the escrow account to both developers and homebuyers. This makes it easier for all parties to track the use of funds and to identify any potential problems.

Security: Digital escrow accounts provide a secure platform that protects the funds deposited into the escrow account from unauthorized access. The platform uses the latest security technologies to ensure the safety of funds.

Learn more about online escrow accounts

FAQs

What is the escrow account for property purchase?

An escrow account for property purchase is a third-party account that holds funds from the buyer until the sale is complete and the buyer takes possession of the property. The escrow agent, typically a title company or a bank, disburses the funds to the seller and other parties involved in the transaction, such as real estate agents and mortgage lenders, once all of the closing conditions have been met.

What are the three types of RERA accounts?

There are three types of RERA accounts: Project escrow account: This account holds the funds collected from buyers for the construction of a real estate project. Land escrow account: This account holds the funds collected from buyers for the purchase of land. Maintenance escrow account: This account holds the funds collected from buyers for the maintenance and upkeep of a common area in a real estate project.

What is the difference between RERA and escrow account?

RERA, or Real Estate (Regulation and Development) Act, is a law in India that regulates the real estate sector. RERA escrow accounts are a specific type of escrow account that is mandatory for all real estate projects in India. The main difference between RERA and escrow account is that RERA is a regulatory body, while an escrow account is a financial instrument. RERA is responsible for regulating the real estate sector and protecting the interests of homebuyers, while escrow accounts are used to hold funds in a safe and secure manner until the closing of a real estate transaction.

Who owns money in a RERA escrow account?

The money in a RERA escrow account belongs to the buyers. The developer is not allowed to access the funds in the escrow account until all of the closing conditions have been met and the buyers have taken possession of the property. If the developer fails to complete the project, the buyers may be able to recover their funds from the escrow account. However, it is important to note that the escrow agent is not responsible for the completion of the project. The escrow agent is only responsible for holding the funds in a safe and secure manner and disbursing the funds to the appropriate parties once all of the closing conditions have been met.