Reviewed by: Nihar Gopal Lohiya, PMM RazorpayX Escrow+

Table of Contents

What is an Escrow Account?

An escrow account holds money or assets until certain conditions are met by the parties involved in a transaction.

In India, escrow accounts are used for real estate, digital lending, e-commerce, digital marketplaces, online gaming and more. Escrow accounts significantly reduce the risk of non-payment or counterparty risks.

Benefits of an Escrow Account

Escrow accounts are required by law for certain kinds of transactions, like real estate or corporate mergers.

Other transactions like high-value payments or crowdfunding campaigns are strongly recommended to go through an escrow account.

This is because escrow accounts provide an important layer of protection and transparency to the parties involved in the transaction.

Escrow accounts minimize the risk of fraud and scams by safeguarding all funds until all terms and conditions of the agreement are met.

Here are a few more benefits of using an escrow account for your transactions:

- Escrow agent acts as a neutral third party to mediate any disputes

- Transactions are more streamlined by automating the payment and compliance process

- Features like multi-bank routing, auto reconciliation, trusteeship services and APIs

- Improved trust between parties involved in the transaction

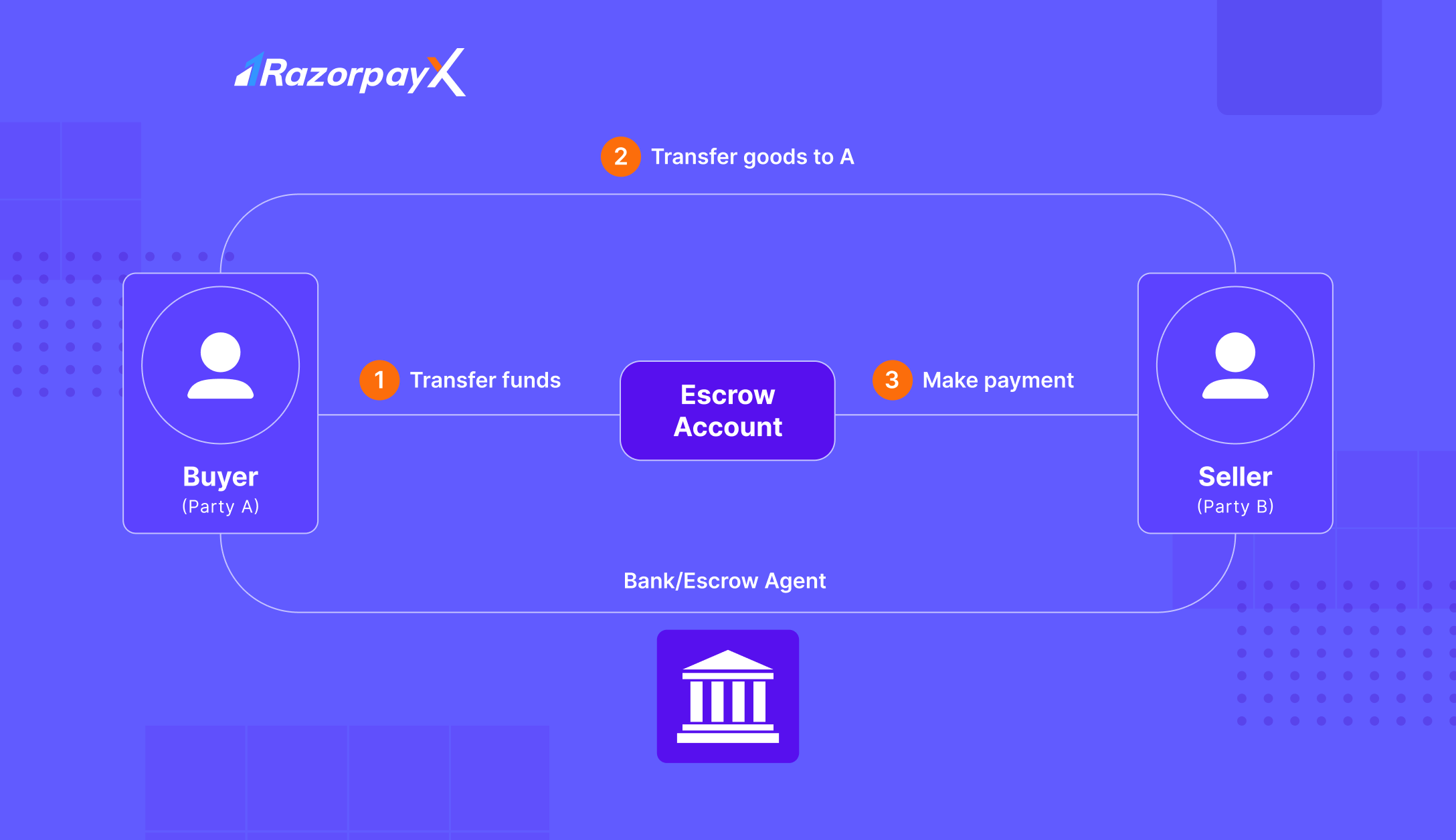

Understanding the Escrow Process

Escrow accounts are used in transactions where there is a risk that one or both parties may not fulfil their obligations.

In other words, this account is used when there is a chance that something might go wrong.

Escrow in India is used across industries and businesses in a range of transactions. The fundamental mechanism of an escrow account is as follows:

Key Takeaways

Key Takeaways

- An escrow account is a special kind of account that holds money or assets until certain conditions are met.

- Escrow accounts in India are used for real estate, digital lending, e-commerce, digital marketplaces, online gaming, and more.

- Using escrow accounts significantly reduces counterparty risk or risk of fraud.

Learn more about RazorpayX Escrow+

Escrow Agreement

An escrow agreement is a contract between 3 parties: a buyer, a seller and the escrow agent. The agreement lists the terms and conditions of the escrow payment.

A depositor deposits funds or assets with the escrow agent in this agreement. Once the terms in the escrow agreement are met, the escrow agent releases the money or assets to the beneficiary.

Format of Escrow Agreement

An escrow agreement generally contains the following details:

- Names and addresses of the buyer, seller, and escrow agent

- Description of the property or assets being held in escrow

- Amount of money or value of the assets being held in escrow

- Conditions that must be met before the money or assets are released

- Fees that will be charged by the escrow agent

- Procedures for resolving disputes

- The time period for completing the escrow payment

- Method for notifying the escrow agent of any problems

- Procedures for releasing the money or assets if the transaction is not completed

- Procedures for resolving disputes if there is a disagreement about whether the conditions of the agreement have been met

The agreement may be terminated if one or both parties do not meet these terms.

Types of Escrow

Escrow accounts are used in a variety of transactions across industries. Listed below are the major uses.

Escrow in Real Estate

Real estate transactions involve huge amounts of money and are high risk for both buyer and seller since there is the possibility that either party might not meet their obligations.

Escrow accounts help mitigate this risk. The escrow agent takes possession of the property and holds the buyer’s money till all terms and conditions are met.

Once met, the agent releases the property to the buyer and the money to the seller.

Escrow in Online Sales

Customer trust in e-commerce and digital marketplaces is very important. Most customers are wary of trusting online sellers because there is the risk of receiving defective products, or even not receiving the product at all.

To address these risks, most e-commerce sellers choose to receive money through an escrow account, which will only release money to the seller upon delivery and verification of the product.

Most online marketplaces also deal with a lot of vendors. Amazon, for example, does not manufacture most of the products it sells on its marketplace. It is only a middleman between the vendors who do and the people who buy.

Money earned from selling these products does not belong to Amazon – most of it has to be given to the vendor, and only a part of the sales will go towards Amazon’s revenue.

To foster vendor relationships and trust, most online marketplaces choose to receive money from sales in an escrow account from where the money is distributed back to the vendor and the commission retained by the marketplace.

Escrow in Online Gaming

Escrow in Online Gaming

Online gaming platforms like Dream11 and MPL allow players to play games online and win real money. Players must pay an entry fee to enter a game, out of which the prize money is paid to the winner. Till the winner is determined, the pool money is held in an escrow account to eliminate the risk of fraud.

Escrow in Stock Market

Sometimes, shares are issued in escrow – meaning that issued shares are not transferred to the owner until certain terms are met. In India, when a company issues shares to the public, the issuance is only valid if more than 90% of the shares are subscribed to.

If less than 90% of the shares issued are subscribed to, the money is returned back to the investors. To ensure this happens, the company issuing shares is required to open an escrow account and receive subscription money to that account.

Another common use of escrow payments when issuing stock is for employee compensation or bonus plans.

Escrow in Lending

In lending transactions, escrow payments are used to protect both the borrower and the lender. The borrower’s funds are held in escrow until they have met the terms of the loan, such as making all of the required payments.

The lender’s funds are also held in escrow until the borrower has met the terms of the loan. This helps ensure that both parties are protected in case of default.

Escrow in Acquisitions and Business Deals

Escrow accounts are also used by companies in mergers & acquisitions and other business deals like credit sales.

In the case of mergers, the deal amount is first deposited into an escrow account. Once the terms are met by both parties, the amount is released to the selling party.

In credit sales, the business might open an escrow account for the funds to be held until the vendor fulfils their side of the transaction.

For example, a business buys goods from a supplier on credit. The supplier agrees to deliver the goods in 30 days, and the business agrees to make the payment immediately – but the money will be transferred to an escrow account.

Once the supplier delivers the goods, the business verifies the condition and quality; the escrow agent then releases the funds to the supplier.

Escrow as a Service (EaaS)

Escrow as a Service (EaaS) enables instant online escrow account opening and management of escrow agreements. Escrow services eliminate the need for physical escrow accounts and provide a centralized platform for managing all aspects of the escrow process.

Benefits of Escrow as a Service (EaaS)

- Reduced costs: EaaS can significantly reduce the costs associated with traditional escrow services. EaaS can save businesses money on administrative fees, storage costs, and courier fees by eliminating the need for physical escrow accounts.

- Increased efficiency: EaaS can streamline the escrow process by providing a centralized platform for managing all aspects of the escrow agreement. This can help to reduce the time and effort required to complete escrow transactions.

- Enhanced security: EaaS can provide a higher level of security for escrow transactions. Using cloud-based technology, EaaS can help protect sensitive data from unauthorized access.

How to Open an Escrow Account Online

To open an escrow account online, you will typically need to follow these steps:

- Choose an escrow provider. Consider factors such as the provider’s fees, the types of transactions they support, and their customer service reputation.

- Create an account. This usually involves providing some basic information about yourself, such as your name, address, and contact information.

- Provide documentation like a copy of your driver’s license, passport, or business registration certificate.

- Deposit funds into the escrow account. This can usually be done via bank transfer, credit card, or debit card.

- Fund release instructions. This will typically involve signing an escrow agreement outlining the transaction’s terms.

Regulations around Escrow in India

In India, the law mandates the use of escrow accounts for certain kinds of transactions. It is important to know what the law says about escrow accounts and whether your business needs one or not.

- The Securities and Exchange Board of India (SEBI) mandates the use of an escrow account when issuing shares. This is to ensure that the money collected from investors is used for the intended purpose of issuing shares and is not misappropriated.

- The Reserve Bank of India (RBI) requires banks and non-banking financial companies (NBFCs) to use escrow accounts to hold property taxes and homeowners insurance payments for home loans. This is to ensure that these payments are made on time and that the home loan borrowers are not defaulting on their payments.

- The Real Estate (Regulation and Development) Act, 2016 (RERA) requires real estate developers to open an escrow account to hold the money collected from homebuyers. This is to ensure that the money is used for the construction of the project and is not misappropriated.

- The Information Technology (Intermediary Guidelines) Rules, 2011 (IT Rules) require online platforms that facilitate escrow services to comply with certain regulations. These regulations include registering with the Ministry of Electronics and Information Technology (MeitY), maintaining records of all transactions, and resolving disputes in a timely manner.

The regulations and laws around escrow in India are designed to protect the interests of all parties involved in an escrow transaction.

By complying with these regulations and laws, escrow agents can help to ensure that escrow accounts are used safely and securely.

Choosing the Right Escrow Account for Your Business

There are many different solutions on the market – the wisdom lies in knowing which is the right one for your needs and your business.

RazorpayX Escrow+ is the only escrow solution on the market with automated, 10-second disbursals, all-in-one escrow, trustee and banking services and more:

- Effortless auto-reconciliations

- Multi-bank routing

- Robust APIs

- Pre-approved money flows

- Plug & play industry modules

Talk to an escrow expert for free

FAQs

What is escrow account India?

An escrow account in India is a bank account where money or assets are held by a third party, called an escrow agent, until certain conditions are met. The escrow agent is typically a bank or financial institution.

What is escrow bank account?

Escrow bank account is a special kind of account provided by an escrow agent. It holds money or assets until certain conditions are met by the buyer and seller parties.

Why is escrow account used?

Escrow accounts are used by businesses and merchants involved in complex, risky transactions. They reduce counterparty risk and increase trust on both sides of the transaction.

Do banks have escrow accounts?

Yes, banks do have escrow accounts. Escrow accounts are a type of bank account where money or assets are held by a third party, called an escrow agent, until certain conditions are met. In the case of banks, the escrow agent is typically the bank itself.

Can I open an escrow account?

If you have the requirement for an escrow account, you can open an escrow account with an escrow agent or an escrow provider like RazorpayX Escrow+.

What is escrow as a service?

Escrow as a service (EaaS) is a type of escrow service that is provided by a third-party company. EaaS can be a convenient and cost-effective way to manage escrow accounts. It can also help to reduce the risk of fraud and errors.

What is an example of escrow services?

Escrow accounts can be used in online gaming to hold pool money that will be used to pay winnings. Online gaming companies like MPL or Dream11 use escrow extensively for this purpose.