UPI reference number is a critical element in digital payment methods, particularly in the context of Unified Payments Interface (UPI) transactions. This unique alphanumeric code plays a pivotal role in tracking payments and ensuring their seamless execution.

In this article, we’ll delve into the significance of the UPI reference number and provide a step-by-step guide on how to track UPI payments online.

Table of Contents

What is the UPI Reference Number?

A UPI reference number is a unique 12-digit code assigned to every UPI transaction. Acting as a digital identifier, it ensures transparency and traceability, making it a vital element in the world of digital payments.

Tracking the UPI reference number is crucial for verifying payments and ensuring the funds reach the correct recipient. It also enhances transaction security by allowing users to confirm the authenticity of a transaction, reducing the risk of fraud.

Example of a UPI Reference Number

Suppose you make a payment using your UPI app to a merchant. After the transaction is processed, you receive a confirmation message stating the payment is successful, along with a UPI reference number like 123456987890. This code acts as a proof of payment and can be used for any dispute resolution or tracking.

How to Track UPI Reference Number?

Here’s a step-by-step guide on how to do the UPI reference number tracking:

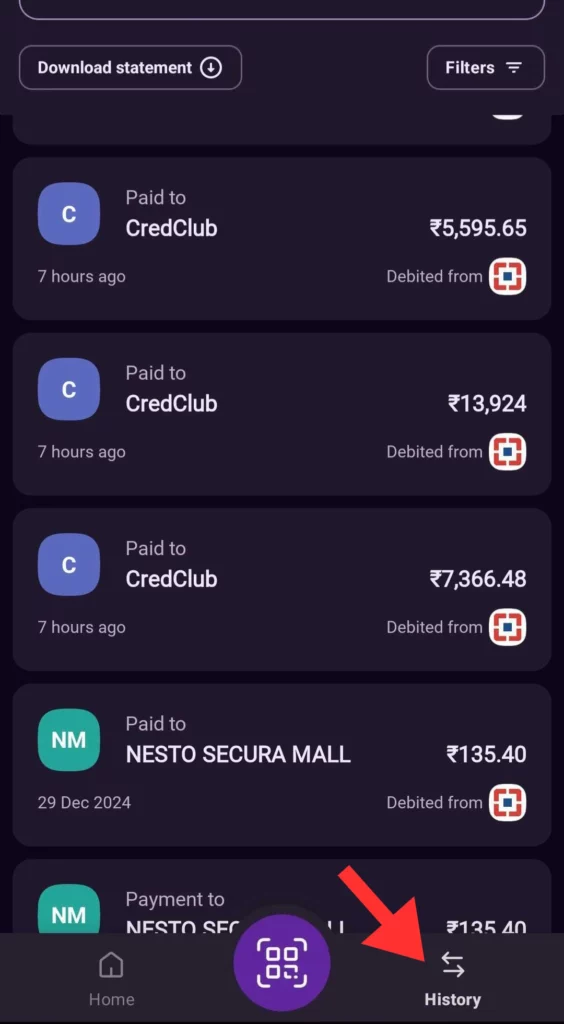

Step 1: Open the UPI app you use for making UPI payments and go to the “Transaction History” or “Payment History” section.

Step 2: Find or click on the specific transaction for which you need the UPI reference number.

Step 2: Find or click on the specific transaction for which you need the UPI reference number.

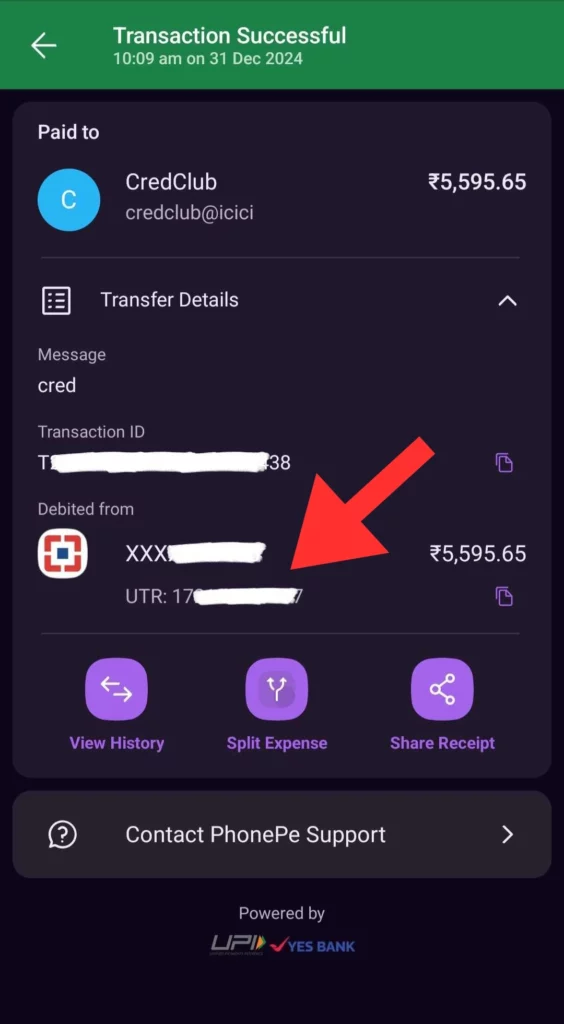

Step 3: View the date, time and amount, as well as a section labelled “Reference ID” or “UTR Number” This is your UPI reference ID, a unique 12-digit code for that particular transaction.

Step 4: The transaction status will be displayed, indicating whether it is pending, successful or failed.

Step 4: The transaction status will be displayed, indicating whether it is pending, successful or failed.

In case you use multiple UPI apps (e.g., Google Pay, PhonePe, BHIM UPI), you can also check each app’s transaction history using the reference number. You can also refer to your bank statement as it consists UPI reference numbers with the transaction details.

Step 5: Provide the reference number to the bank or app support for quick resolution.

Example:

Imagine you transferred ₹5,000 to a merchant but didn’t receive confirmation. You locate the UPI reference number (e.g., 123456789012) in your app and share it with the bank’s support team. Using this number, they confirm that the payment was successfully processed.

How to Find UPI Reference Number or ID?

After initiating and completing your UPI payment, check your transaction history or payment confirmation message in your UPI app (e.g., Google Pay, PhonePe, BHIM). The UPI reference ID is a distinct alphanumeric code mentioned along the transaction details. You can also access it by tapping on the transaction itself.

If you are sending a UPI Payment request, the UPI reference ID will be in the confirmation message received.

Locating a UPI reference ID is crucial because it serves as a reference point for resolving any transaction-related issues, confirming payments and tracking your financial activities.

Benefits of UPI Reference Number

Enhanced Security

UPI Reference IDs contribute to the robust security of digital transactions. They eliminate the need for sharing sensitive bank account details, such as account numbers and IFSCs. This minimises the risk of data exposure and fraudulent activities.

Effortless fund transfers

UPI Reference IDs simplify the process of transferring funds. You can initiate payments with just the recipient’s UPI ID or mobile number, making it convenient to send money to friends, family or businesses. This streamlined approach reduces the potential for errors and eases the burden of remembering complex banking information.

Speedy transactions

One of UPI’s most remarkable attributes is its speed. Payments made using UPI are typically processed within seconds, ensuring that funds reach the intended recipient swiftly. This quick turnaround time is especially beneficial in situations where immediate payments are required.

Easy bill payments

UPI payment methods extend beyond person-to-person transfers. Payment apps often include bill payment features, allowing you to settle utility bills, recharge mobile accounts, pay for online purchases, and more. This versatility simplifies financial responsibilities, consolidating various transactions into one platform.

Versatile payment links

UPI Reference IDs can also generate payment links. These links enable businesses and individuals to request payments by sharing a URL, streamlining the payment process for customers or clients. It’s a valuable tool for e-commerce, freelancers and service providers, enhancing the ease of receiving payments.

Related Read: IRDAI Bima ASBA: How UPI is Transforming Insurance Premium Payments

The Meaning of Reference ID in Bank

A reference ID is a unique alphanumeric code associated with a specific transaction, serving as an identifier. It plays a pivotal role in tracking and reconciling payments.

The benefits of a reference ID include enhanced transaction security, enabling efficient tracking of payment history and simplifying dispute resolution. This identifier is especially crucial in a UPI transaction, where it ensures that payments are correctly routed and aids in monitoring financial activities within the realm of modern digital payment methods and banking.

Related Read: Understanding Merchant Reference Number

Conclusion

UPI reference number is a 12-digit alphanumeric code that serves as a unique identifier for transactions, enhancing both security and tracking. It is important to find the UPI reference ID within UPI-enabled apps for monitoring your transactions. This reference ID simplifies fund transfers and bill payments, making transactions swift and secure.

Overall, UPI transaction reference number tracking plays a vital role in ensuring the seamless execution of digital transactions, allowing you to monitor your financial activities effectively while upholding the principles of convenience and security in modern banking.

Related Read: How to Check NEFT Transaction Status Using Reference Number?

Frequently Asked Questions

1. How many digits is a reference number?

A reference number is typically 12 digits long.

2. Can I use the same UPI reference number for multiple transactions?

No, a UPI reference number is unique to each transaction.

3. Is the UPI reference number the same as the transaction ID?

UPI reference number and transaction ID are different.

4. Do I need to share my UPI reference number during a transaction?

No, you do not need to share your UPI reference number during a transaction.

5. Can I share my UPI reference number with others?

Yes, you can share your UPI reference number for tracking and verification purposes.

6. What to do if the UPI reference number is lost?

Start by checking your transaction history in the UPI app. Alternatively, review your bank statement for the reference number along with transaction details. Finally, contact your bank’s customer support with transaction details to get the UPI reference number.