Your RazorpayX account, in partnership with RBL bank, is operating as usual with no changes.

With RazorpayX Corporate Cards, ThinkTac was able to streamline business expenses and reduce administrative overhead costs by 70%.

With Razorpay Instant Settlements for Amazon Sellers, you can get your Amazon payouts balance settled into your bank account within 7 seconds.

RazorpayX is a quantum leap into automating internal financial operations, which can help Chartered Accountants, CFOs, and other stakeholders in the company save time and reduce overheads.

Razorpay Cash Advance is a line of credit facility. It is a useful and popular tool that businesses use to overcome gaps in cash flow and grow.

If your company uses corporate credit cards, here are a few best practices surrounding card use, expense reporting, and approvals.

Has banking ever evoked happiness in you? I’m sure traditional solutions haven’t. I’m sure what I’m about to tell you, will. Founder, meet Positive Banking.

Struggling with sharing OTPs to your CA & finance team for EVERY compliance, vendor and salary payments? Do yourself a favour and don’t miss this 2 min read.

With RazorpayX Vendor Payments, you’ll never have to dig for an invoice, ever again. Read on to unlock an effortless Vendor Payments experience.

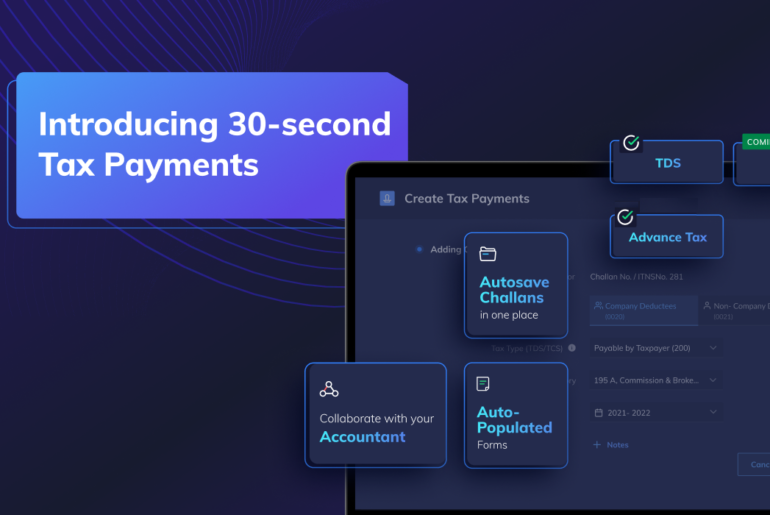

With RazorpayX Advance Tax Payments, paying advance taxes takes only 30 seconds. Never miss a deadline or worry about increased tax liabilities.