In order to keep a business afloat, an individual will need to secure adequate financing to ensure he or she has unrestrained working capital handy.

That is why company owners must consider diverse sources of finance to determine which solution is ideal for their business’s sustainable development.

What Are Some of the Different Sources of Finance?

Some significant sources of finance from where a company can avail funds include:

-

Traditional Financial Institutions

In general, a business can consider getting in touch with a traditional financier such as a commercial bank in order to gain access to formal credit. A business loan is granted on the basis of this business’s creditworthiness and the asset put forth as collateral.

However, whereas such means can be an effective strategy for blue-chip companies, the MSME sector had faced continued challenges in this regard. To elaborate, a lack of credit history or assets makes a start-up business a comparatively high-risk borrower by the standards of a bank. Therefore, a loan application from small businesses has a higher chance of rejection. That is why MSME business owners are now considering diverse alternative sources of finance.

-

Non-Banking Financial Companies

Several leading Non-Banking Financial Companies or NBFCs of this country had been crucial in the growth of start-up industries. Keeping small businesses in mind, these financiers generally offer comparatively lenient and straightforward eligibility parameters for their potential borrowers.

Business owners can also consider leveraging their existing real estate to open a secured line of credit with their financiers, as there is no end-use restriction for a loan-against-property. With competitive interest rates and longer loan tenures, an individual can pay off his or her debt without getting financially burdened by lump sum EMI expenditure.

-

Neo-Banking Solutions

The emergence of neo-banking platforms has successfully disrupted the traditional credit market around the world. In simpler terms, these platforms operate akin to a commercial bank without having any physical presence. Consequently, every function of such fintech platforms is done online, catering to the digitisation-centric aptitude of modern businesses.

Such sources of finance can also come in handy for start-up sectors. For instance, with RazorpayX-powered current accounts, a business borrower can utilise this platform’s state-of-the-art dashboard to add multiple add-on cards with lenient spending restrictions and higher credit limits.

-

Equity Financing

Notably, a company can use the means of equity financing too in order to raise funds for short-term liquidity boosts or long-term expansion plans. However, these sources of finance is inherently related to selling off a certain portion of the business’s ownership.

To elaborate, a company can receive a working capital boost from an investing entity by selling a certain portion of the business’s shares to this investor. Therefore, this entity can enjoy return-on-investment [ROI] from sharing the profits of this business as it crosses its breakeven point [BEP] down the line.

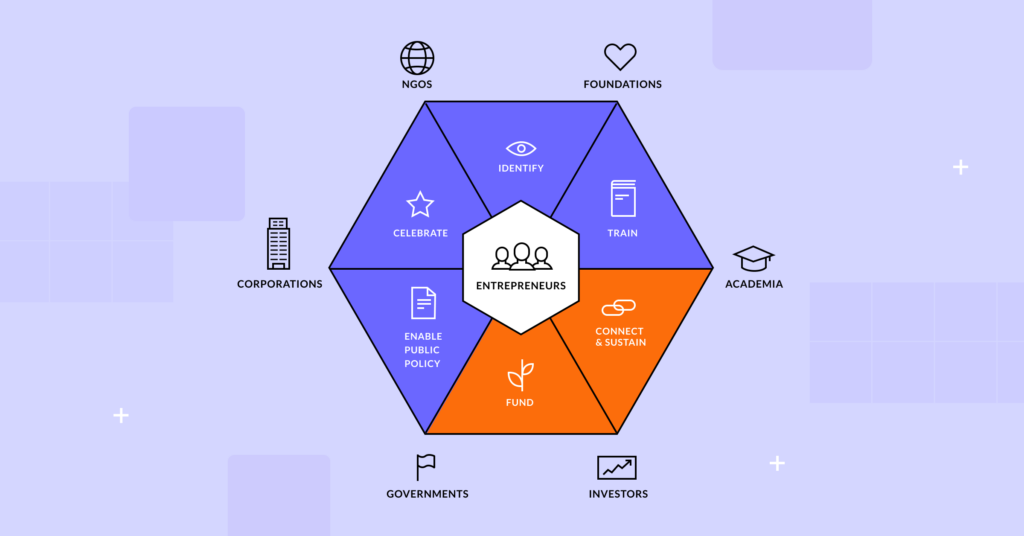

Interestingly, venture capitalists and angel investors play a crucial role in this regard. This group of entities specialise in financing small and new businesses against ownership shares of this business. However, these investors place a significant emphasis on a company’s competitive advantage, value proposition, and potential for growth. This way, they can secure a hefty return gradually.

-

Invoice Factoring and Discounting

A number of MSMEs are considering invoice financing as an ideal way of raising funds or as a source of finance. These invoices are generated during a product retail or service rendering. However, if cash remains tangled up in these unpaid invoices, then it can lead to a cash crunch issue for a start-up.

That is why businesses can leverage these invoices as collateral to receive funding from their financiers. Moreover, as this funding is technically an advance and not a loan, their business ledgers will not be adversely affected.

How RazorpayX Can Help Start-Ups Securing Alternative Sources of Finance?

As mentioned before, neo-banking facilities such as RazorpayX can come to the aid of small businesses looking for alternative sources of finance. For example, this platform’s corporate credit card has been an absolute game-changer, allowing small businesses to go toe-to-toe with their blue-chip counterparts in the competitive global marketplace.

This collateral corporate card allows you to enjoy exclusive business discounts and the ability to transact across the border without any difficulty. Moreover, following the modern trend of business process automation, this platform enables you to automatise repayment endeavours so that you can adequately manage your company’s fiscal in and outflows.

Frequently Asked Questions

Which aspects are crucial for a business’s healthy financial future?

One must consider several pivotal factors when making a financial plan for his or her business, such as:

-Proper cash flow management

-Wealth accumulation

-Tax regulation compliances

What are some advantages of using a neo-bank?

You can consider using a neo-bank as it offers facilities such as:

-Digital-first approach

-Personalised customer service

-Mobile-friendly user interface

-Around-the-clock service

-Competitive rates

-Easy integration of accounting tools and current accounts

-Automated payroll and tax filing options

What is the price for opening a RazorpayX-powered current account?

You can open a RazorpayX-powered current account for free.