A payout is the transfer of funds from your business account to a contact’s fund account. You need to have sufficient balance in your business account to process a payout. The various methods available for a payout are IMPS, NEFT, RTGS and UPI.

Are those payouts instantaneous?

Although IMPS and UPI payouts are near-instant, the other modes work only during banking hours. But we live in a world of ‘We want it now’, where sometimes the cooker explodes and everybody feels the heat. For instance, let’s say you had a significant business transaction to make, and you realise that the bank working hours are over. What do you do? Apart from the banking hours, there are other limitations like:

- Limitation on bulk transfer (IMPS and UPI)

- Cooling period on adding beneficiaries

- One cannot verify bank account before transferring

- Complex infra systems

There it goes, your ship is under attack. So what do you do?

RazorpayX

Whether you are making a one-off payment or processing a batch of hundred, move money seamlessly with RazorpayX, a platform to accelerate disruptors by making their financial operations intelligent, automated, and business-focused. Regardless of who you are, SME or enterprise, new age or incumbents. For every payout, you need to specify the amount, the contact and the purpose of the payout. The payout amount and the payout charges are deducted from your business account balance every time a payout is made. These appear as a debit against the business account on the successful creation of a payout. In case a payout fails at any stage of its processing, a reversal is created, which results in a credit to your business account.

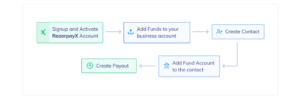

A diagrammatic overview of the payouts process in RazorpayX

By integrating with our flexible APIs and dashboard tools, customers can:

- Accept and manage payouts via NEFT, RTGS, IMPS, UPI and more

- Upload contacts in bulk and share payouts in one go

- Track, automate and accelerate money movements for informed and impactful business decisions

For example, Medlife, one of India’s fastest growing healthcare firm, wanted a solution to settle their million+ customers’ payouts from their closed wallets to bank accounts. RazorpayX helped Medlife offer a one-click payout to the customer’s bank account without requiring any human intervention. Results:

- Instant payouts from customer wallets

- Increased flexibility on the usage of wallet

- A new stream of revenue via wallet linked loyalty offers

Secure, fast and cost-effective payouts are very critical to enhance customer experience, and one of the key element to increase business success. So, what does efficiency mean for you?