SUMMARY:

Explore working capital examples through real-life business scenarios. Learn how its effective management shapes business operations, ensures liquidity, and influences overall financial health.

Working capital is the fund required by a company to carry out its day-to-day operations seamlessly. It’s also referred to as the net working capital (NWC) and is the difference between a company’s current assets and its current liabilities.

Working capital can be either positive or negative. Positive working capital indicates that a business has enough liquid assets to pay off immediate debts. However, a negative working capital indicates that a business will not be able to pay off immediate debts. Both of these metrics act as indicators of the financial health of a business.

In this blog, we’ll look at the top 5 working capital examples.

Working Capital Examples:

In this section, we will explore different working capital examples to understand the concept better.

Working capital example 1:

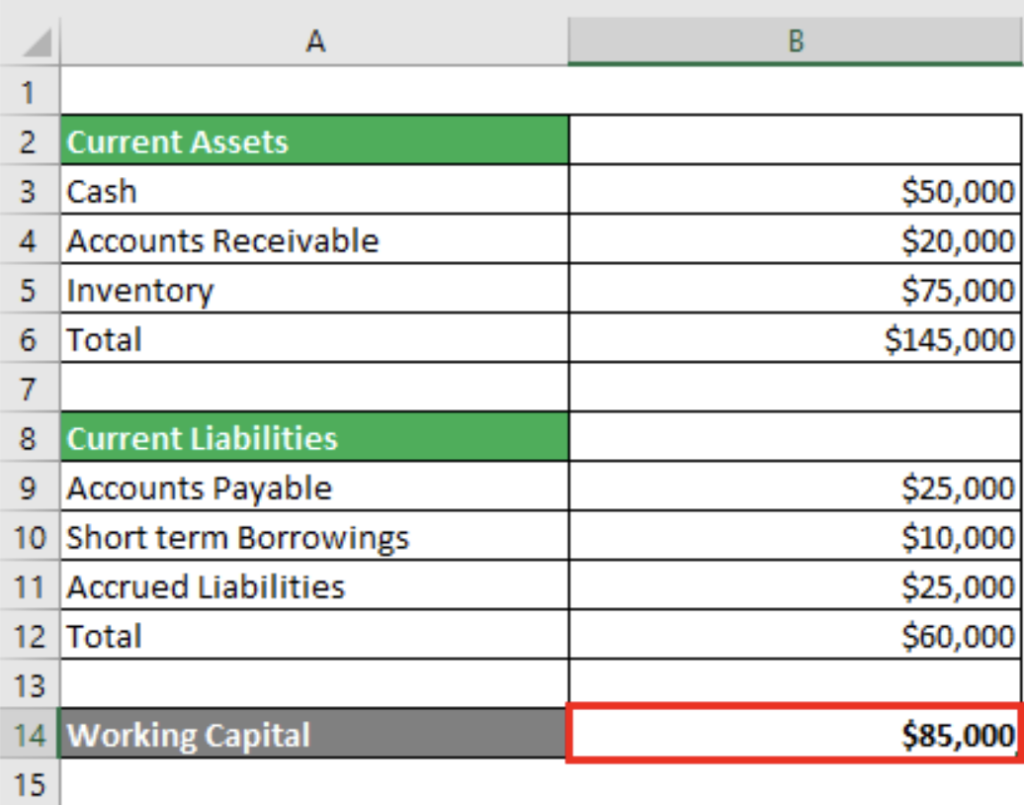

Let’s take into consideration the balance sheet of the multinational company Wells Fargo to calculate working capital.

The formula for calculating working capital is as follows:

The formula for calculating working capital is as follows:

Working capital = (Current Assets – Current Liabilities)

In this case, working capital would be

$1,45,000 – $60,000 = $85,000

The working capital of Wells Fargo is positive which indicates that Wells Fargo can pay off its short-term debts immediately. The company holds a good amount of cash even after paying off its debts. Overall, the calculation shows that Wells Fargo has a good financial position in the market.

Working Capital Example 2:

A negative working capital is possible in the retail sector. For example, the retail giant Walmart purchases 2,00,000 DVDs. It’s supposed to pay the seller within the next 30 days. However, the company has plans to put those DVDs up on the shelf before 30 days.

Suppose Walmart has sold off all the DVDs by the 17th of the month and made a profit. In all probability, Walmart would be able to pull a similar feat with most of its other products as well. Considering that new cash is being generated continuously, Walmart doesn’t face any difficulty in paying off its accounts payable.

However, the timing of the cash flow will forever remain important because it helps to maximise its efficiency. Checking inventory with accounts payable is an important way to check whether a company employs this strategy or not.

Working Capital Example 3:

Suppose an India-based organisation has current assets of Rs. 20,00,000 and current liabilities of Rs. 9,00,000. Accounts receivables of Rs. 85,000 falling under current assets get declared as bad debt and will be written off in the Profit and Loss account in the following year.

The net working capital, i.e. Rs. 11,00,000 may be positive on paper, but may not project a true picture of the financial condition of the company. The main reason is that Rs. 85,000 is considered as bad debt and doubtful recovery.

So, one has to adjust the net working capital with the accounts receivable portion to get the revised net working capital of the business. Needless to say, it’ll have an important effect on the strategic decision-making by the top management of the company.

Working Capital Example 4:

Let’s look at another working capital example.

There’s a company named XYZ Limited which has current assets of Rs. 2,00,000 and current liabilities of Rs. 90,000. However, the inventory of Rs. 1,50,000 (falling under current assets) has become entirely obsolete. This is because the items have been lying in inventory for the past 6 months. Its market value will be Rs. 50,000.

Here, the net working capital of XYZ Limited would be Rs. 1,10,000. It’s a positive value. But, the market value of the products lying in inventory has decreased to Rs. 50,000 and one should consider it to be the actual recovery price.

The revised net working capital would be as follows:

(Rs. 2,00,000 – Rs. 1,50,000 + Rs. 50,000 ) – Rs. 90,000 = Rs. 1,00,000.

Don’t forget that the company needs to sell off its inventory as soon as possible to maintain liquidity.

A negative working capital leads to a stressful situation for a company as it’s not really in a position to fulfill its daily obligations due to liquidity crunches.

Working Capital Example 5:

In this section, we’ll look at how some of the most known brands address their working capital needs:

- Amazon

Customers pay upfront after buying products from Amazon. As a result, Amazon does not face working capital problems as long as the cash keeps coming in.

- McDonald’s

McDonald’s has had negative working capital in the past. It’s common for restaurants and similar businesses to have negative working capital. During the period 1992 to 2000, this famous fast-food restaurant chain had a negative working capital of nearly $698.5 million. However, it hasn’t hampered their growth and development.

- Dell Computers

Dell Computers asks for upfront payments from customers. This strategy has helped the company to maintain an edge against its competitors. Dell Computers maintains minimum inventory and very low working capital.

Final word…

Looking at these working capital examples, one can easily understand that it’s an indicator of whether a business is being effectively managed or not. While positive working capital shows good financial health of an entity, negative working capital may not always be bad. The latter depends a lot on a business’s trajectory.

If a business entity wishes to increase its working capital, it should first analyze the root cause of problems within its operations. Only then can it come up with effective strategies to improve working capital.

Maintaining adequate working capital is crucial for several reasons, contributing to the overall financial health and operational efficiency of a company.

Leveraging working capital loans can be an effective way for businesses to maintain adequate working capital. This quick access to funds helps address short-term cash flow gaps and ensures that the company has the necessary liquidity to meet its operational needs.