Are you a business owner or someone who is thinking of starting a business ? In that case, you should know about the operating cycle of working capital.

This financial metric helps you understand how much time a business needs to receive money from the sale of its inventory. You can use it as a metric to understand the financial health of a business.

Read on to learn more about the operating cycle of working capital.

Table of Contents

Understanding operating cycle of working capital

Operating cycle of working capital refers to the total number of working days that a business takes to buy inventory, sell it off, and then collect the proceedings from the sale.

If you wish to determine how efficiently a business is running, it’s the operating cycle of working capital you should be checking. It is important to note that all companies work towards maintaining a short working capital cycle.

But what does a short operating cycle reflect? It means that a business can quickly recover its investment in inventory. Moreover, it has enough liquidity to meet its obligations.

On the contrary, a long operating cycle creates a negative impact on the cash flow of a business. The longer the operating cycle the greater the level of resources ‘tied up’ in working capital.

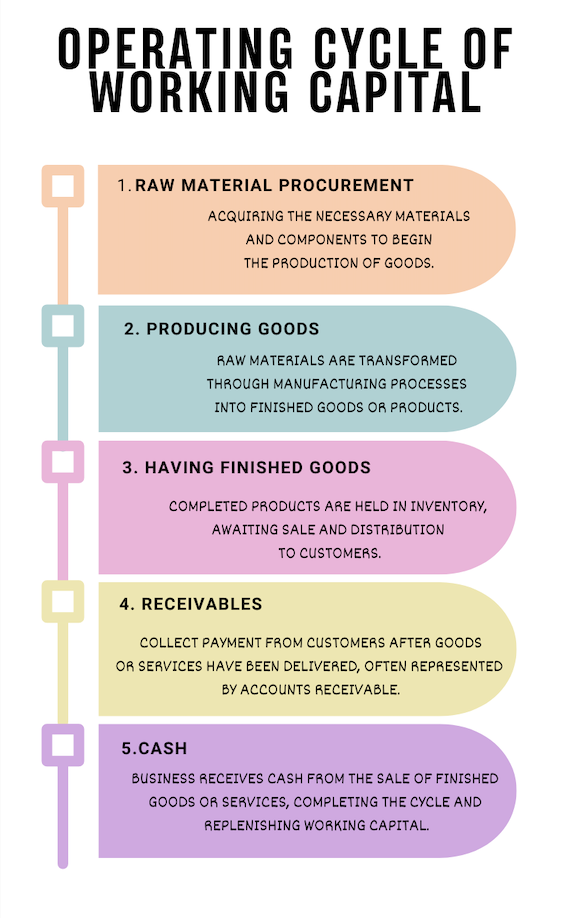

Steps in the operating cycle of working capital

For most businesses, the operating cycle of working capital is as follows:

Understanding the difference between an operating cycle and a cash cycle is crucial. While both offer valuable insights, a cash cycle reveals a company’s ability to handle cash flow, whereas an operating cycle assesses the overall efficiency of its operations.

Components of operating cycle of working capital

Here are the important components of an operating cycle of working capital:

-

Accounts receivable

This term is used to refer to the money that your business is supposed to receive from customers who have made their purchases on credit.

-

Inventory

Inventory is used to denote the products a company has in store for selling in the market to earn a profit.

-

Accounts payable

When a company buys goods and services on credit, the amount they have to pay falls under the category of ‘accounts payable’. It’s a form of current liabilities and reflects the short-term debt obligations of a company.

Calculation of operating cycle of working capital

The formula for calculating the operating cycle of working capital is as follows:

Operating Cycle = (Inventory Period + Accounts Receivable Period)

Here, inventory period = the number of days it will take to sell off the inventory. You can arrive at the result by dividing 365 by the quotient of the cost of goods sold and average inventory. Check the formula for the inventory period.

Inventory Period = 365 ÷ (Cost of Goods Sold / Average Inventory)

Now, the accounts receivable is equal to the total number of days required to receive the payment for goods and services sold. You have to use the quotient of credit sales and average accounts receivable to divide 365.

The detailed formula for the calculation of the operating cycle is as follows:

Operating Cycle = 365 ÷ (Cost of Goods Sold / Average Inventory) + 365 ÷ (Credits Sales / Average Accounts Receivable)

Significance of operating cycle of working capital

In this section, we’ll discuss the importance of the operating cycle of working capital:

-

Helps to measure a company’s financial health

The operating cycle of working capital helps one measure the financial health of a company. Evaluating the operating cycle would reveal how efficiently the assets of a company are being used. After all, efficient usage of a company’s assets has an important role in capital intensity, return on investment (ROI), and fixed overhead turnover.

If you look at the larger picture, you’ll find that the operating cycle provides an idea about the cost of a company’s operations and how quickly it can repay its debt.

-

Effect on profitability

The operating cycle of working capital can greatly impact a company’s profitability. If the cycle is long, a company will have a lot of time to sell off its products at a lower price to recover the amount already spent. It will diminish the company’s chances to invest in new growth initiatives. Moreover, it will decrease profits significantly.

-

Impact on a company’s relationship with its creditors

When the operating cycle is long, there are high chances of the company failing to pay adequately. It will automatically lead to higher rates of interest and fees. Failure to pay would also damage the reputation of an emerging business.

Positive vs. negative operating cycle of working capital

Confused about the differences between a positive and a negative operating cycle? Read the section below to get a clear idea.

-

Positive operating cycle

A positive operating cycle indicates that a business will take time to sell inventory, collect receivables, and pay suppliers, leading to a longer operating cycle. A positive cycle may signal a need for efficient inventory management.

-

Negative operating cycle

A negative operating cycle suggests that a business can quickly turn its current assets into cash, resulting in a shorter cycle. It indicates swift cash conversion, potentially enhancing liquidity.

Strategies for managing and improving operating cycle of working capital

As a business owner, you should always strive for a shorter operating cycle. This is because it will help you utilise cash to improve the financial health of your business. If the operating cycle is long, capital remains tied up and you will not be able to use them. Needless to say, capital is essential for the operations of a business.

Here, we’ll discuss the ways you can improve the operating cycle of working capital:

-

Don’t use working capital to purchase fixed assets

Don’t use your working capital to invest in fixed assets such as equipment, land, vehicles, and machines. These are expensive capital assets and if you use working capital to pay for them, there will be a decrease in funds and an increase in the risk of running your business smoothly.

-

Cut down on unnecessary expenses

Do a careful analysis of business expenses and reduce all unnecessary expenses. It will help you save more money that you can then use for investing in your business.

-

Reduce bad debt

Bad debt is considered unrecoverable and is written off as a loss by the creditor or lender. Every business owner tries their best to reduce bad debt to maintain an easy flow of working capital. Increase the margin on your goods and services to reduce all bad debt.

-

Shorten operating cycle

This is perhaps the most effective way to improve cash flow. Shortening the operating cycle of working capital would also generate working capital. Ask your customers for upfront payment or some deposits as it’ll help to improve the operating cycle.

How to shorten operating cycle of working capital

-

Collect payments as soon as you can

You should come up with strategies to collect payments from your customers as soon as you can. Consider offering discounts or attractive benefits to customers who pay early. Early payments go a long way in shortening the operating cycle of your business.

-

Handle inventory with care

Try not to buy bulk stocks. Instead, purchase in-demand stocks. An effective way to shorten your operating cycle is to calculate the number of working days required to sell off the inventory. Suppose it’s more than 60 days. In this case, you must come up with an appropriate strategy for sales to decrease the inventory time.

-

Pay bills on time

Maintaining a good credit score is important to secure credit on favourable terms and conditions for the growth and development of your business. An effective way to achieve this is to pay off outstanding bills on time. While paying suppliers on time is a good habit, paying too early should be avoided.

Examples of operating cycle of working capital

Let us understand the operating cycle of working capital with the help of a few examples:

Example 1:

Anu Agarwal has an apparel store. When will her operating cycle start? It’ll start from the time she purchases raw materials to create the apparel she sells. Moreover, the operating cycle will end only when all the apparel get sold and the cash reaches Anu.

Example 2:

Joseph owns a fast food store and he wants to check how efficiently his business is running. So, he needs to calculate the operating cycle of his business. Note that the cycle would start when Joseph starts paying for the raw materials he uses for making food items for his customers. In this case, the operating cycle of the business would not end until all the items have been sold and Joseph receives cash for all of them.

Net operating cycle vs. operating cycle

The operating cycle and net operating cycle are both financial metrics that provide insights into the efficiency of a company’s working capital management. Here’s a brief explanation of each:

Operating cycle

- The operating cycle represents the time it takes for a company to convert its current assets (e.g., inventory) into cash.

- The formula for the operating cycle is: Inventory Period + Accounts Receivable Period

- Inventory period is the average number of days it takes for a company to sell its inventory, and accounts receivable period is the average number of days it takes to collect receivables (money owed by customers).

Net operating cycle

- The net operating cycle refines the operating cycle by incorporating the time it takes to pay suppliers. It gives a more comprehensive picture of the entire working capital cycle.

- The formula for the net operating cycle is as follows: Operating Cycle – Accounts Payable Period.

- Accounts payable period is the average number of days a company takes to pay its suppliers.

Key Differences:

Scope:

- The operating cycle focuses on the time it takes to convert current assets into cash but doesn’t consider the time it takes to pay suppliers.

- The net operating cycle takes into account both the time to convert assets into cash and the time to pay suppliers, providing a more complete view of the working capital cycle.

Formula:

- The operating cycle formula is based on the combination of inventory period and accounts receivable period.

- The net operating cycle formula adjusts the operating cycle by subtracting accounts payable period.

Interpretation:

- A shorter operating cycle and net operating cycle are generally better as they indicate that a company is able to convert its resources into cash more quickly.

- A longer net operating cycle, in particular, may indicate that a company takes a longer time to pay its suppliers, which could impact its cash flow and liquidity.

To sum up…

The operating cycle of working capital is an important financial metric that you should know if you’re planning to start your business soon. To put it simply, it’s the number of days needed for a business to receive inventory, sell it, and then collect cash from the customers.

Its duration plays an important role in determining the cash flow of a business. It also has an impact on the profitability of a business and the company’s relationship with its stakeholders.

Did you know?

Razorpay offers working capital loans without collateral at competitive rates. Now, you can achieve your business goals by funding your short-term business cash needs with 24*7 withdrawals. The features of working capital loans by Razorpay are:

- Affordable financing: Collateral-free loans that are approved on the basis of your cash inflows instead of high credit score and guarantees

- Fast disbursal: Short turnaround time to activate your account and withdrawal processing so your business can get cash quickly

- Flexible repayments: Pay in easy EMIs. Choose your tenure as per your needs.

Check it out today to meet your working capital requirements 👇