Factoring is a way for businesses to convert unpaid invoices into immediate cash – with no risk involved.

How would this work? Here’s an example.

Picture this: you’re the founder of a small business, and your clients owe you money. They’ve promised they’ll pay you back in six months – they’ve even signed an invoice guaranteeing it.

But you need money now. You need to pay rent, your employees’ salaries, buy office supplies… do you take a loan? Do you borrow money from friends?

This is where factoring comes in.

Table of Contents

What is Factoring?

Factoring is a form of debtor finance where a business sells its accounts receivables to a factor at a discount. This provides the business with cash for immediate operational needs.

The third party factor purchases the accounts receivables – this means that when the receivables are paid by the debtor, the payment is made to the factor and not the business.

Factoring is largely used in industries like manufacturing, textiles and retail that rely on short term financing to manage cash flow; or have high seasonal demand and long credit periods from buyers.

Factoring Meaning in Finance

Factoring is a type of finance where businesses sell accounts receivable to a third party, also called a factor, at a discount.

By selling accounts receivable, or unpaid invoices to a third party at a discounted rate, businesses can unlock funding to cover cash flow shortfalls in the short term.

Factoring is an important source of capital for businesses – especially startups, or businesses that operate in industries with long receivable cycles, since it involves no collateral, no risk and ensures short-term liquidity.

How Does Factoring Work?

Factoring involves three parties:

- Business/Client Firm

- Factor

- Debtor

The debtor owes money to the business/client firm, which is documented in an invoice. The debtor is expected to repay the business within a certain period of time.

If the business has short term cash requirements, it can sell this invoice to a factor at a discounted rate.

The factor purchases the invoice from the business in exchange for cash, which the business can use immediately, instead of waiting six months for the original invoice to mature.

When the invoice matures in six months, the vendor/debtor will repay the original amount to the factor and not to the business.

Benefits of Factoring as a Source of Funding

| Fulfils Financial Needs | Young businesses have high overheads and daily operational costs. Factoring unlocks liquid cash in the short-term with minimal risk. |

| Reduces Risk | With factoring, businesses can insulate themselves from the risk of defaults and bad debts. These risks are taken on by the factor! |

| No Collateral Funding | Factoring is one of the few funding options where businesses do not need to provide collateral, making it completely risk-free! |

| No Credit Checks | Unlike bank loans, availing funding through factoring does not require high creditworthiness or extensive background checks. |

| Improves Cash Flow | Factoring is a great source of cash inflow especially for industries where receivables take a long time to convert to cash. |

Drawbacks of Factoring as a Finance Option

Factoring as a source of finance does also have its drawbacks – it reduces the business’s profit margin, since the business has to sell one of its assets at lower than cost.

Further, making debtors deal with a third party (the factor) may hinder the business’s relationship with them.

And lastly, – for a business to avail factoring as a source of finance, it has to have accounts receivable to sell in the first place! For businesses with no accounts receivable, factoring is completely out of reach.

Despite these drawbacks, factoring remains one of the most reliable and commonly used sources of short-term finance for businesses, especially startups.

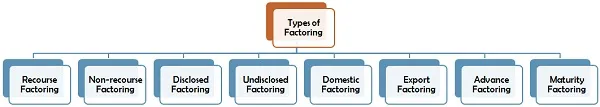

Types of Factoring

On the basis of default risk:

| Recourse Factoring | Non-Recourse Factoring |

| In this type of factoring, the factor does not take on the risk of default. If the debtor fails to repay the invoice, the liability falls on the business firm itself. | The liability of bad debt remains with the factor, and they cannot reclaim the money from the business in case the debtor defaults. |

On the basis of disclosure:

| Disclosed Factoring | Undisclosed Factoring |

| When the factor’s name is mentioned in the invoice by the debtor, and the debtor is fully aware that the invoice is being prefinanced by the factor. | The name of the factor is not mentioned, and the debt is repaid to the business – but the invoice and control is with the factor. |

On the basis of trade:

| Domestic Factoring | Export Factoring |

| When all three parties (factor, firm and debtor) reside and operate in the same country. | Where one or more parties operate or reside overseas. In export factoring, there are four parties involved: exporter/seller, importer/buyer, export factor and import factor. |

On the basis of payment:

| Advance Factoring | Maturity Factoring |

| The factor gives the business an advance payment in exchange for the accounts receivable. | The factor makes the payment only on the date of maturity of the invoice. Businesses opt for this method to insulate themselves from credit risk. |

Why Financial Management is So Important

Factoring helps business improve inflow of cash and reduces credit risk – two important parts of an overall financial management strategy.

Having a solid financial management strategy is key – especially for young businesses and startups. Here’s a few other strategies that make a high-growth financial management strategy.

- A solid investment strategy and a well-diversified portfolio

- Well-thought out budget and forecast plan for each quarter

- Top talent to facilitate and support growth – and employee retention plans to keep them

- Automated financial management for minimal errors and smooth finances

Read more:

Frequently Asked Questions

What are the types of factoring?

Primarily, there are four types of factoring, recourse factoring and non-recourse factoring, domestic and export factoring, disclosed and undisclosed factoring, lastly advance and maturity factoring.

How does factoring work in finance?

In factoring, a factor finances a company against its accounts receivables at a lower price. However, the factor charges a commission for the services it provides. Mostly small and medium size organisations acquire funding for their working capital needs by transferring the ownership of accounts receivable to the factor.

What is the difference between recourse and non-recourse factoring?

Recourse factoring is a type of factoring in which, any unpaid uncollectable or disputed invoice is recourse or sold back to the client. In non-recourse factoring, the liability of an account receivable is transferred to a factoring company. Factoring companies charge a much higher factoring fee with non-recourse factoring.

What is the typical factoring advance rate?

The rates of advances provided by factor companies vary on the industry and volume. The advance rate charged by factors can be anywhere between 80% – 95%.

How does invoice factoring benefit a business?

Factoring against accounts receivables can help companies with regular cash infusions that will significantly improve cash flow and operational working capital. With the help of factoring services, businesses do not have to manage receivables and collections of payments.