Table of Contents

What is Buy Now Pay Later (BNPL)?

Buy Now, Pay Later (BNPL) is a short-term financing option that allows consumers to buy goods and services and pay for them in instalments over a period of time, typically with no interest.

BNPL has become a popular payment option in India recently because it is a convenient and affordable way to purchase goods and services online, especially for young consumers with limited credit history.

How Does Buy Now Pay Later (BNPL) Work?

To use BNPL, consumers simply need to create an account with a BNPL provider and provide basic information, such as their name, address, and date of birth.

The BNPL provider then conducts a soft credit check on the consumer – to confirm a steady source of income and the ability to repay. This credit check is not as stringent as checks for loans or credit cards.

Once approved, consumers can start shopping with merchants that offer BNPL at checkout. Consumers might have to pay a certain percentage of the total amount as a down payment, while the rest is financed by the BNPL provider. The consumer is then responsible for repaying the BNPL provider in instalments, typically over a period of 6 to 12 weeks.

BNPL is also called a POS instalment loan or Point of Sale financing since it is a type of credit offered at the point of sale. This means that consumers can apply for and receive credit immediately when they are making a purchase.

Buy Now Pay Later (BNPL) Effect on CIBIL Score

BNPL can affect your CIBIL score in two ways:

1. On-time payments can help improve your CIBIL score.

CIBIL scores are calculated based on a number of factors, including your payment history. If you make all of your BNPL payments on time, this can help to improve your CIBIL score over time.

2. Late or missed payments can damage your CIBIL score.

If you miss or delay your BNPL payments, this can have a negative impact on your CIBIL score. Late payments are reported to the credit bureaus, and they can stay on your credit report for up to seven years.

It is important to note that not all BNPL providers report to the credit bureaus. If you are unsure whether or not a particular BNPL provider reports to the credit bureaus, you should contact them directly.

Regulation Around Buy Now Pay Later (BNPL) in India

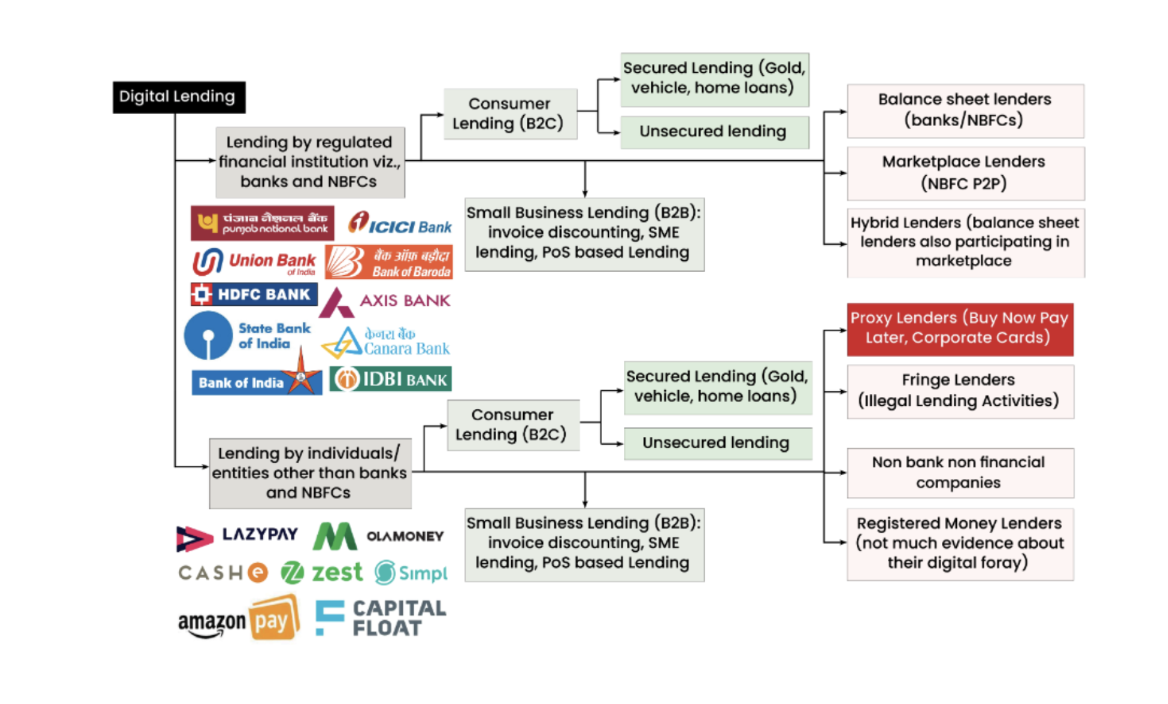

In India, Buy Now Pay Later (BNPL) companies are considered to be intermediaries between lenders (banks and non-banking financial companies) and borrowers (consumers). As such, they fall under the purview of the RBI, which is responsible for regulating lending and borrowing in the country.

In India, Buy Now Pay Later (BNPL) companies are considered to be intermediaries between lenders (banks and non-banking financial companies) and borrowers (consumers). As such, they fall under the purview of the RBI, which is responsible for regulating lending and borrowing in the country.

The RBI has taken a keen interest in BNPL companies, given their rapid growth in recent years. However, the regulatory framework for BNPL is still evolving. Currently, there are no specific regulations governing BNPL companies. However, they are subject to the general provisions of the RBI Act, 1934, and other applicable laws.

The RBI has issued a number of guidelines for BNPL companies, including:

- Mandatory credit checks on consumers before offering credit

- Cannot offer credit to consumers who have a bad credit history

- Limited credit to be offered to consumers

- Provide consumers with clear and transparent information about the terms and conditions of their products and services

Risks of Buy Now Pay Later (BNPL)

- Overspending: BNPL can make it easy to overspend, especially if you are not careful. It can be tempting to purchase items that you cannot afford right away, and it can be easy to lose track of how much you are spending.

- Late payment fees: If you miss a BNPL payment, you may be charged late payment fees. These fees can add up quickly, and they can make it difficult to get out of debt.

- Damage to your credit score: If you make late payments on BNPL loans, your credit score could be damaged. This could make it difficult to qualify for loans and other forms of credit in the future.

- Debt collection: If you are unable to repay your BNPL loans, the debt could be turned over to a collection agency. Collection agencies can use aggressive tactics to collect debts, and they can damage your credit score.

- Addiction: BNPL can be addictive. The ease of purchasing items without having to pay for them upfront can lead to compulsive spending.

Growth of Buy Now Pay Later (BNPL) in India

The BNPL market in India is growing rapidly, with a compound annual growth rate (CAGR) of over 300%. This growth is being driven by a number of factors, including the growing popularity of e-commerce, the increasing penetration of smartphones, and the rising demand for affordable credit options.

The first ever BNPL (Buy Now, Pay Later) company in India is widely considered to be ZestMoney. Founded in 2015, ZestMoney was one of the first companies to offer BNPL financing in India.

Some other leading BNPL providers in India include:

- Paytm Pay Later

- ZestMoney

- Simpl

- Affirm

- Slice

Future of Buy Now Pay Later (BNPL)

The future of BNPL in India is bright. The market is expected to grow significantly in the coming years, driven by the factors mentioned above. BNPL providers are also expanding their offerings to include new products and services, such as longer-term financing options and BNPL for businesses.

The Gross Merchandise Value of the BNPL industry is expected to grow at a compounded annual growth rate of 400% by 2026.

As the RBI regulates the BNPL industry, we can expect some limitations like limited credit, caps on fees and charges and more stringent credit checks.

Read more: