Have you ever found yourself at an ATM, only to realize you’ve left your wallet at home? Or been in a situation needing cash with only your smartphone on hand? Don’t worry. With the UPI ATM cash withdrawal feature, you can withdraw money using your smartphone at an ATM. This article explains UPI ATM cash withdrawal, how to use UPI for cash withdrawals at ATMs, and covers all the details you need to know.

Table of Contents

What is UPI ATM Cash Withdrawal?

UPI ATM Cash Withdrawal is a service offered by the National Payments Corporation of India (NPCI) that facilitates cardless cash withdrawals from ATMs utilizing the Unified Payments Interface (UPI). This innovative technology eliminates the need for physical debit cards, enhancing convenience and security for users.

Known as Interoperable Cardless Cash Withdrawal (ICCW), this service marks a significant milestone in cardless transactions, with India introducing its first UPI-ATM on September 5, 2023, in Mumbai.

Some of the prominent features of this cardless withdrawal feature are:

- Interoperability: The UPI ATM is compatible across various banking systems, allowing usage with multiple bank accounts regardless of the bank.

- Transaction Limit: There is an upper limit of ₹10,000 per transaction using the UPI ATM. It is also subject to daily UPI limits and bank-specific restrictions.

- QR Code-Based Withdrawal: Using QR codes ensures security by eliminating risks associated with cards, such as cloning, making it a safer and more secure method.

- Instant Cash Dispensation: Once confirmed, the UPI ATM instantly dispenses the requested cash, debiting the same from your account.

- Single UPI App: With a single UPI app, you can withdraw cash from multiple accounts, simplifying the process and reducing the need for multiple cards.

How to Withdraw Cash using UPI at an ATM?

Here is a step-by-step guide on how you can withdraw cash from an ATM using UPI on your smartphone:

Step 1: Locate a UPI-Enabled ATM

ATMs may explicitly indicate if they are UPI-enabled. Look for ‘UPI Cash Withdrawal’ at the bottom right or top left corner of the ATM screen to confirm UPI withdrawal support.

Image Credit: NPCI

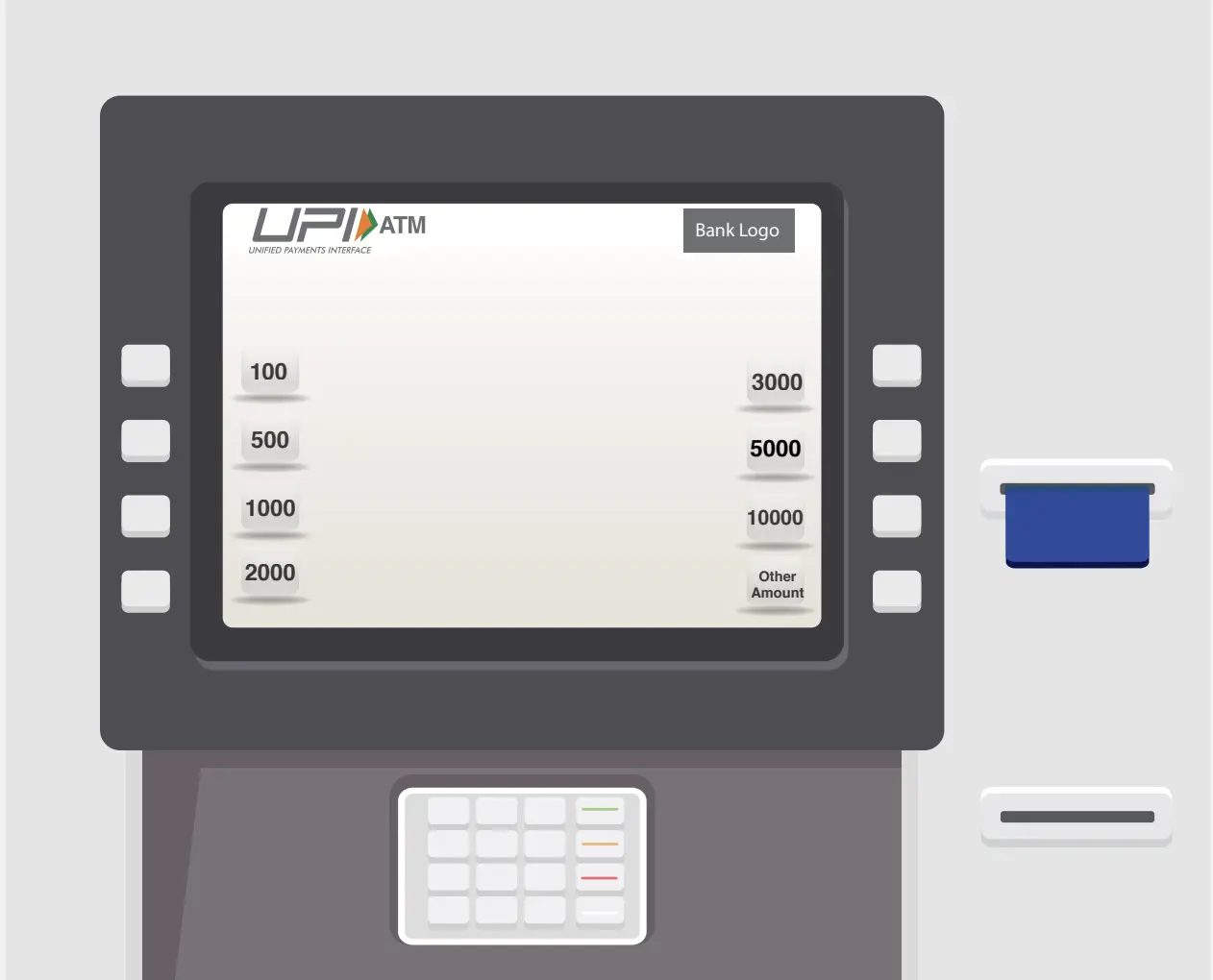

Step 2: Select the Amount to Withdraw

Select the amount you wish to withdraw, or enter a custom amount using the ‘Other Amount’ option.

Image Credit: NPCI

Step 3: QR Code Presented

A single-use dynamic QR code will be displayed on the screen, which is valid for 30 seconds or until the scanning process is completed, whichever comes first.

Image Credit: NPCI

Related Read: Related Read: ATM Withdrawal Limit for 2024

Step 4: Scan QR Code Using UPI App

Use the UPI application on your smartphone and scan the QR Code. The screen will automatically time out once the transaction is completed.

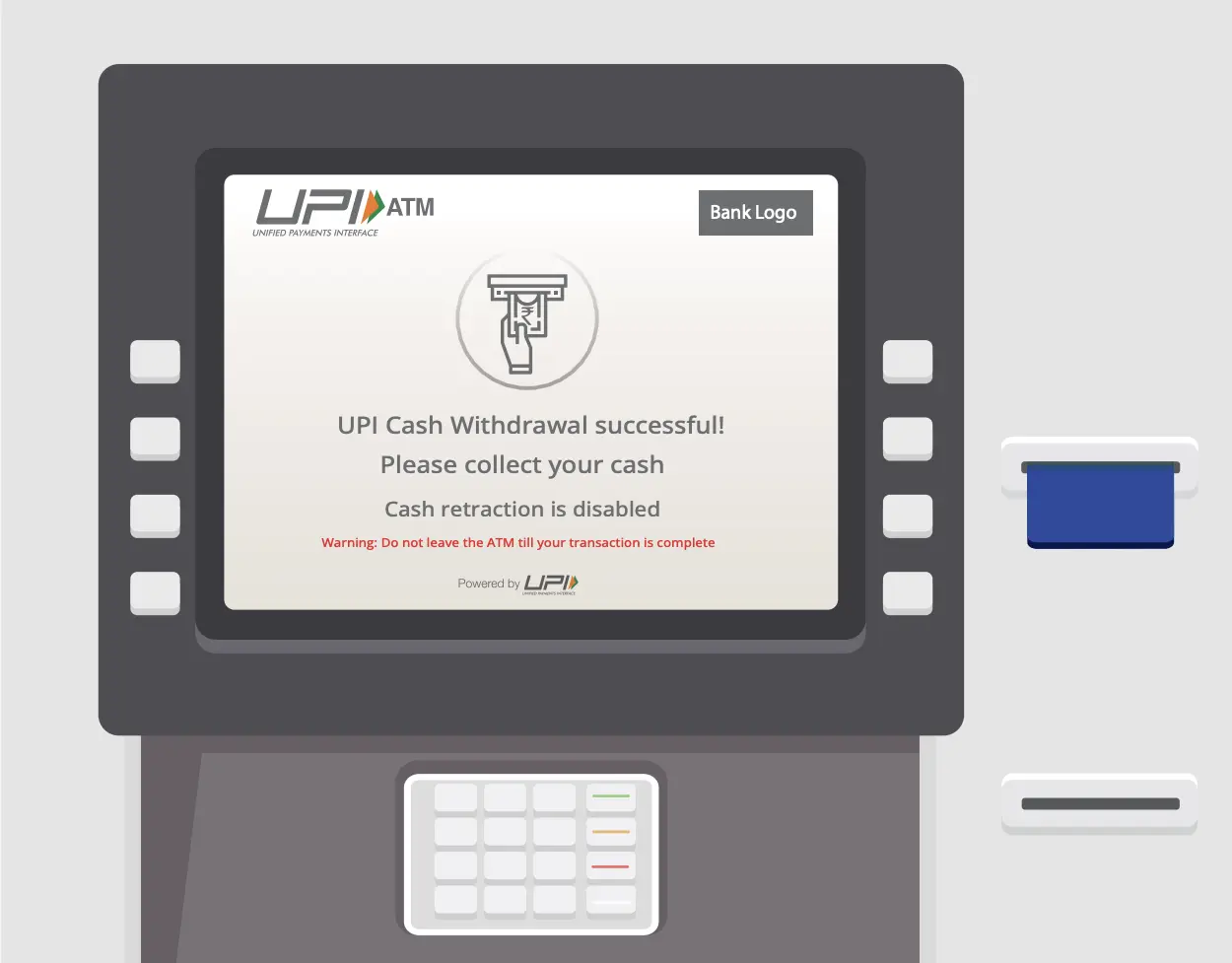

Step 5: Enter UPI PIN and Collect Cash

On your UPI application, enter your UPI PIN and collect cash from the ATM.

Image Credit: NPCI

UPI ATM Cash Withdrawal Benefits

- Enhanced Security: ICCW eliminates the risks of card-related frauds, such as card cloning and skimming, since it does not involve the use of a physical card.

- Accessibility: This service is easily accessible, as it is supported by most banks and ATMs that use the UPI platform. Additionally, if you haven’t received your physical card after opening a new account, you can still withdraw money using this feature.

- Convenience: With UPI ATM withdrawals, you don’t need to carry a physical card, thus avoiding the risk of losing or misplacing it. This method offers a convenient way to access cash without any hassle.

- Cash Withdrawals from Multiple Accounts: While traditional ATM transactions with a card limit you to one account, UPI ATM transactions allow you to choose from multiple linked accounts.

UPI ATM Transaction Limits and Charges 2025

You can withdraw up to ₹10,000 per transaction using the UPI ATM, which falls within the existing daily UPI limit and is subject to your bank’s restrictions. The National Payments Corporation of India (NPCI) does not charge any fees for UPI ATM transactions. However, the usual ATM fee structure still applies, depending on your account type and the number of monthly ATM transactions allowed.

List of Banks Offering UPI ATM Cash Withdrawal Services in 2025

| Bank of Baroda | Arunachal Pradesh Rural Bank |

| Ujjivan Small Finance Bank | Union Bank of India |

| State Bank of India | Fincare Small Finance Bank |

| Equitas Small Finance Bank | Indian Bank |

| City Union Bank | Cosmos Bank |

| Suryoday Small Finance Bank | Yes Bank |

| GP Parsik Sahakari Bank Ltd | Canara Bank |

| Janata Sahakari Bank | Central Bank of India |

| The Mehsana Urban Co-op Bank | Bank of India |

| Andhra Pragathi Grameena Bank | Meghalaya Rural Bank |

| Federal Bank | Utkarsh Small Finance Bank |

| Andhra Pradesh Grameena Vikas Bank | Punjab National Bank |

| Chhattisgarh Gramin Bank | Punjab and Sind Bank |

| Telangana Grameena Bank | UCO Bank |

| Uttarakhand Gramin Bank | IndusInd Bank |

| Saurashtra Gramin Bank | HSBC |

| Rajasthan Marudhara Gramin Bank | Karur Vysya Bank |

| Karnataka Vikas Grameena Bank |

The full list can be found on the NPCI website.

How is UPI ATM Withdrawals Different from Cardless ATM Withdrawals?

The Reserve Bank of India permits ICCW transactions, which include both cardless cash withdrawals and UPI-ATM withdrawals. The key differences between these two methods lie in their processes and convenience.

Cardless cash withdrawals require initiating the request through NetBanking, which involves adding beneficiaries, inputting mobile numbers, and entering one-time passwords. This method can be time-consuming and involves multiple steps.

On the other hand, UPI-ATM withdrawals offer a more streamlined approach. With UPI-ATM, you can instantly withdraw cash using any UPI-enabled app by simply scanning a QR code and authenticating the transaction with your UPI PIN. This method eliminates the need for pre-authorization and multiple steps, making it quicker and more convenient.

Conclusion

UPI ATM withdrawals offer a modern, convenient, and secure method for accessing cash without needing a physical card. By simply using a UPI-enabled app on your smartphone, you can withdraw cash instantly by scanning a QR code, enhancing security and ease of use. With widespread support across various banks and ATMs, this feature ensures accessibility and flexibility. So, even if you forget your wallet at home, you can still withdraw money effortlessly using the UPI ATM withdrawal feature.

FAQs

1. Is UPI ATM cash withdrawal available at all ATMs?

No, UPI ATM cash withdrawal is not available at all ATMs. Only UPI-enabled ATMs from participating banks support this feature. Look for ‘UPI Cash Withdrawal’ on the ATM screen to confirm its availability. For the full list of banks, check the NPCI website.

2. How can I find a UPI cash withdrawal ATM near me?

To find a UPI cash withdrawal ATM near you, look for ATMs that explicitly state ‘UPI Cash Withdrawal’ on their screens. This indication is usually found at the bottom right or top left corner of the ATM screen. You can locate ATMs near you from NPCI website.

3. Can I use Google Pay to withdraw money from an ATM?

Yes. Google Pay can be used with UPI-ATM machines by scanning the QR code displayed on the ATM screen using the Google Pay app. Once you scan the QR code, you can authenticate the transaction with your UPI PIN directly through the app.

4. I cannot find the “UPI cash withdrawal” option on the ATM, what should I do?

If you cannot find the “UPI cash withdrawal” option on the ATM, check for compatibility by looking for specific signage indicating UPI support. Consider using another ATM known to offer this service or contact your bank for assistance.

5. What should I do if the UPI-ATM transaction fails?

If a UPI-ATM transaction fails, ensure your internet connection is stable and retry the transaction after confirming the QR code scan and UPI PIN entry. If the issue persists, contact your bank’s customer support for assistance and clarification on the transaction status.

6. Can I use Bank of India UPI at ATMs for cash withdrawals?

Yes, you can use Bank of India UPI at ATMs for cash withdrawals, provided the ATM is UPI-enabled and supports this feature.

7. Is the UPI PIN and ATM PIN the same?

The UPI PIN and ATM PIN are distinct. A UPI PIN is used exclusively for transactions through UPI applications, whereas an ATM PIN is a four-digit code essential for authenticating debit card transactions

8. How secure is UPI ATM cash withdrawal compared to using a physical ATM card?

UPI ATM cash withdrawal offers enhanced security compared to using a physical ATM card. It eliminates risks like card cloning and skimming since it doesn’t involve a physical card. The use of QR codes adds an additional layer of security, making transactions safer and more secure.

9. Are UPI ATM withdrawals available 24/7?

Yes, they are available 24/7.

10. Can I use UPI for ATM withdrawals if I have multiple bank accounts linked to the same UPI app?

Yes, you can use UPI for ATM withdrawals even if you have multiple bank accounts linked to the same UPI app.