eMandate is a digital payment service initiated by RBI and the National Payments Corporation of India (NPCI).

In 2001, you needed money and had to take a bank loan. After visiting your bank, you received a pamphlet with loan details. You compared other banks, gathered documents, submitted them, and waited for verification. It was a tedious process with manual steps, taking months and resulting in rejections.

In 2018, eMandate was introduced. You approached a bank for a loan and realized you could avail benefits without visiting the bank. eMandate simplified the process between service provider and customer. Read on to learn more:

What is eMandate meaning?

If you are wondering about e Mandate meaning, then it is a digital payment service initiated by RBI and the National Payments Corporation of India (NPCI). It serves as an underlying infrastructure for businesses in India to collect recurring payments without any human intervention. A mandate is a standard instruction that you provide to your issuing bank and other institutions allowing them to automatically debit the mentioned amount from your bank account.

eMandate is a convenient way for businesses and their customers to easily manage all the recurring payments like insurance premiums, SIPs, loan installment collections, etc. This eliminates the hassles of reminders and late penalty charges that eventually proves to be a win-win for both businesses as well as their customers.

While recurring payments in India have been present for a long time, they were primarily authorised by a physical form that the customer had to fill, sign and submit. This was an operationally expensive and manual process which took days to process. API-based eNACH, more commonly known as eMandate, was introduced by NPCI around 2018.

How do e-mandates work?

E-mandates are electronic authorisations that allow payers to set up recurring payments for various services or subscriptions. They are convenient, secure, and hassle-free. If you are wondering what is e-mandate process, here is the answer:

-

The payer provides consent to the payee for e-mandate initiation. This can be done through various methods, such as filling out forms, websites, or mobile apps. The payer can choose the payment amount, frequency, and duration.

-

The payer authenticates themselves using one of the options available, such as net banking credentials or debit card details. This ensures that the payer is the owner of the bank account and agrees to the terms and conditions of the e-mandate.

-

The National Payments Corporation of India (NPCI) acts as an intermediary in the e-Mandate process and validates the payer’s details and the payee’s request. NPCI is a non-profit organisation that facilitates digital payments and settlements in India.

-

The payer’s bank sets up a recurring payment instruction, enabling the payee to deduct payments automatically on due dates. The payer receives a confirmation message and can view the status of the e-mandate on their bank’s portal or app.

-

The payer can cancel the e-Mandate anytime by contacting their bank or the payee. The NPCI mediates in case of any disputes or issues arising from such transactions and ensures compliance with the regulatory guidelines.

Eligibility for the e-Mandate

The primary eligibility criteria for using e-mandates are:

-

You must have a bank account with a bank that is part of the National Automated Clearing House (NACH) system. NACH is a platform that facilitates interbank transactions, including e-mandates, through a central clearing agency.

-

You must have an Aadhaar card and mobile number linked to your bank account.

-

You must have a mobile number registered with your bank and your Aadhaar card. You will get an OTP to verify your identity and consent to create an e-mandate.

The documents required to set up an e-mandate are:

-

Submit a duly filled e-mandate form, which you can get from the service provider or merchant you want to pay through e-Mandate. The form will have details such as your name, bank account number, Aadhaar number, mobile number, frequency of payment, amount of payment, and validity period of the e-Mandate.

-

A copy of your Aadhaar card, which will be used to authenticate your identity and consent through biometric or OTP verification.

-

A bank account statement or passbook copy.

Some unique insights or details specific to e-mandate eligibility are:

-

The financial institution you want to pay through e-Mandate must be registered with the National Payments Corporation of India (NPCI) to offer NACH services.

-

The transaction limit for e-Mandates has been increased from Rs 15,000 to Rs 1,00,000 per transaction for specific categories: subscription to mutual funds, payment of insurance premiums, and credit card bill payments.

-

The e-Mandate service is available for debit and credit cards, prepaid payment instruments, and UPI.

The Types of e-Mandates

There are different types of e-mandates, depending on your chosen payment method. Here are two common types of e-mandates:

-

Debit card e-mandate: This type of e-mandate lets you link your debit card to a merchant or a service provider and authorize them to deduct a fixed or variable amount from your bank account at a specified frequency. The limit for a single transaction via debit card e-mandate is Rs 15,000.

-

Credit card e-mandate: This type of e-mandate permits you to link your credit card to a merchant or a service provider and authorize them to charge a fixed or variable amount to your credit card at a specified frequency. The limit for a single transaction via credit card e-mandate is Rs 1,00,0001, but only for certain categories, such as mutual funds, insurance premiums, and credit card bill payments.

Features and Benefits of Razorpay eMandate

Since its introduction, eMandate has come a long way, has added more than 30 banks, and introduced real-time authorization confirmation, which has helped more industries adopt the recurring business model. Listed below are some of the major advantages of eMandates:

- Increase customer retention: One-time digital authentication allows you to auto-debit your customer’s bank account helping your customer enjoy uninterrupted service–in the longer run building customer loyalty and customer retention. No constant payment reminders to your customers

- Reduces friction in payments: eMandate allows a business to auto-debit a recurring payment, thereby reducing the friction of a customer logging on to the website/app to make a payment. This assures the business of continuous cash flow that it can rely upon

- Reduces administrative costs: As the amount is auto-debited, the business teams do not have to chase the customer to make the payment. This cuts down the operational effort, invoicing effort and cost to the company

- Auto-reconciliation: Most of the details are tracked and captured online, hence reducing the time, effort and money involved in buying and maintaining multiple tools

- Simple and seamless process: The entire process is simple and just needs an active bank account and card details. One time enrollment for a lifetime of hassle-free service

- Flexibility in plan: With eMandate, the ability to debit a customer in the hands of businesses. This allows them to change the payment cycle or skip a cycle if need be. This adds to good user experience

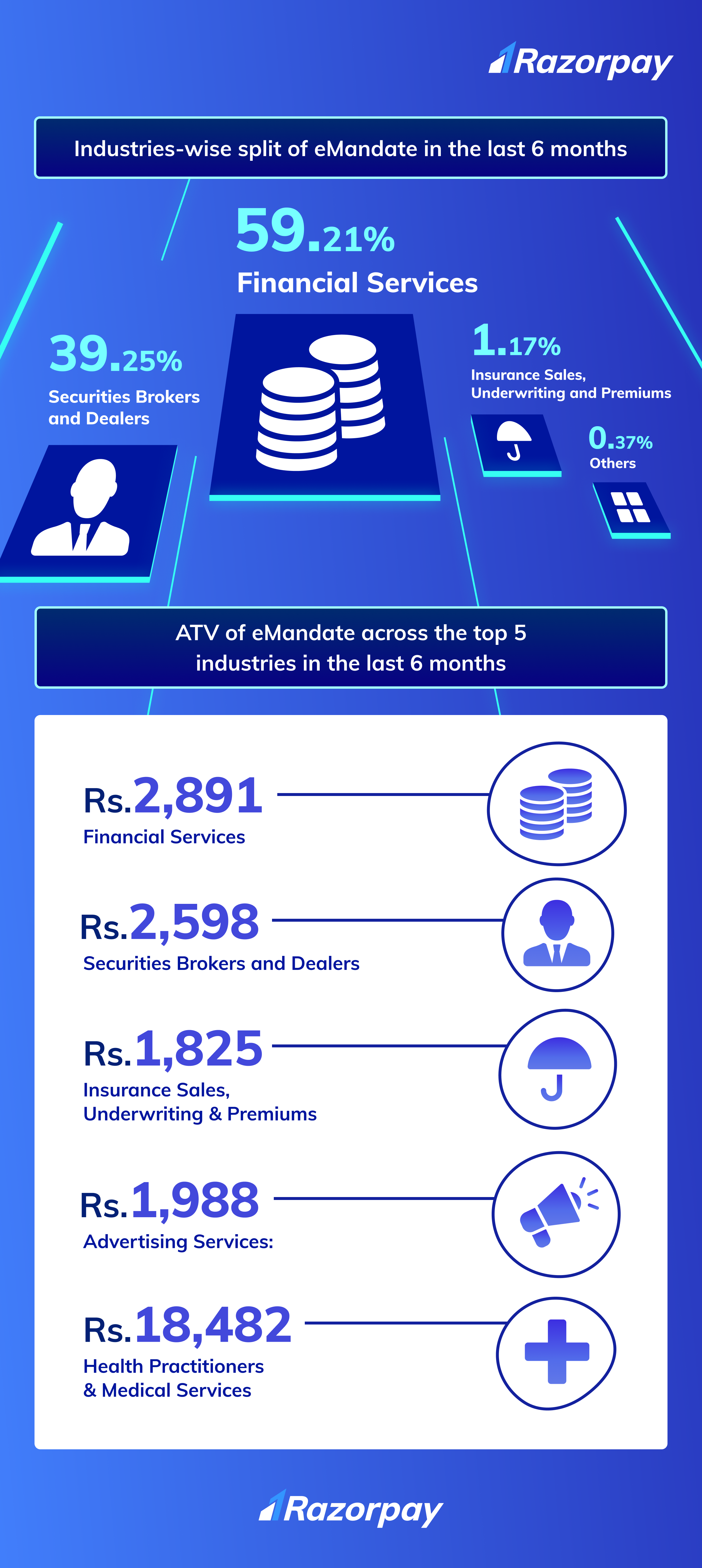

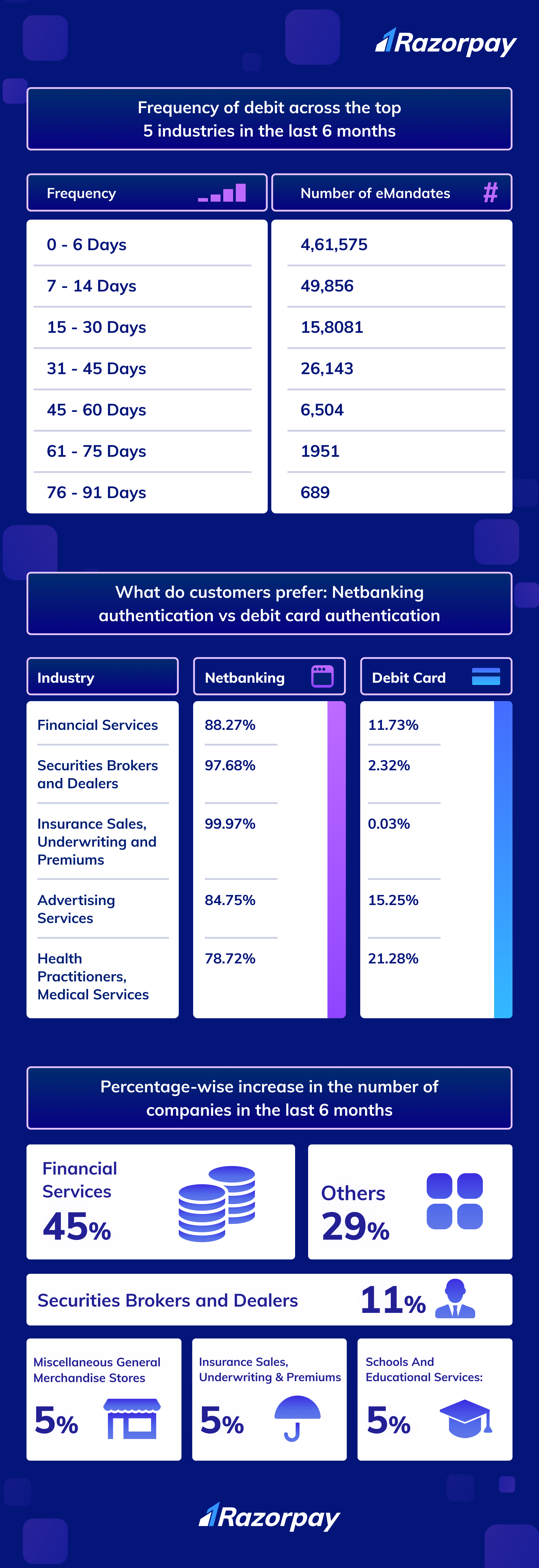

Which industries have adopted eMandate?

eMandate has steadily grown popular and has been adopted by multiple industries. Each industry has its challenges and uniquely uses eMandate. Let’s look at the industries that have benefited the most from eMandate.

Lending industry

Lending businesses have seen a drastic change in the way they operate. For the lenders, one of the benefits is the ease in the collection of loan repayment. They no longer have to go running behind an individual. The auto-debit feature of eMandate helps them deduct the said amount on a particular day each month. The customer on the other end does not have to go through multiple visits at the bank. The overall turn around time is also much lesser compared to the traditional method. Recurring payment model and eMandate in the said scenario have helped in reducing the operating costs to a large extent.

Wealth management platforms

In recent times, platforms like Wealthy, Groww, PaisaBazaar have emerged, which have made it easy for an individual to manage their portfolio, meet their financial goals, have a retirement plan in place and a lot more. Usually, these platforms offer you to consult with a dedicated counsellor or to create a plan by yourself. The risk appetite of customers has also gone up, and they are willing to invest in instruments such as mutual funds, equities, ULIPs and more.

Once a customer has decided on the instruments they want to invest in and the amount they wish to invest, businesses ask for an authorization for recurring debits. This authorization can be given digitally, authorizing your bank account via netbanking credentials or debit card details.

That’s it! With a few simple steps, you are all set to make wise choices with your finances. The best part is, neither of the parties has to manually visit a brick and mortar building. Mandates make sure a hassle-free experience for an investor and an ongoing business, without disruptions for the business.

Life insurance

Individuals have always made it a point to invest in life insurance policies so that they can make use of them in case there comes in some unseen disaster. Earlier either an individual was asked to pay the entire amount in one go or had to make sure they did not miss out on a single instalment. With the advent of eMandates, these life insurance providers have been able to ease the process. They can now sell a plan to the customer online. And the moment the customer signs up for a plan, they can set a particular date and an amount which will auto-debit without any manual intervention from the individual’s end. Hence, in the long run, easing the way life insurance companies used to operate so far.

Sponsorship programs By NGOs

We are living at a time where people have understood the value of CSR activities. A lot of people have started coming forward to help those in need. Some of the activities in which people are engaged to include sponsoring education for kids, taking care of the grocery needs of a household, bearing expenses of a pet in an NGO and a lot more.

However, with so much to do, there are chances that an individual misses out making the donation for a month. Many NGOs have started using eMandates to ease the entire donation flow so that they can do the needful at the right time without reminding the payee several times.

-

The customer raises a request for a recurring mandate

-

The business sends an authorization request on its portal or via a link

-

The customer gives the authorization via netbanking credentials or debit card details.

-

Details are sent to the sponsor bank and forwarded to NPCI

-

NPCI sends the requests to the issuing bank

-

The issuing bank either accepts the authorisation request.

-

The issuing bank shares its status with NPCI, which, in turn, shares its status with the sponsor bank. This status is then shared with Razorpay who in turn informs the business. All this in real time!

-

Razorpay activates the mandate.

How to Register for Razorpay eMandate?

API Integration of Razorpay Subscriptions is simple and easy. What’s more? There is a single integration needed to go live on all modes of recurring payments – cards, eMandate, PaperNACH and the upcoming UPI Recurring mandates.

However, if you wish to use Subscriptions on any of these modes without any integration, you can easily use the Razorpay dashboard to send out subscription links.

Conclusion

eMandates are a step forward in the world of digital payments. Many business verticals have been able to adopt this business model and have seen significant improvement in metrics like customer retention, cash flow management and a steady decline in delinquency. What are you waiting for? Sign up with Razorpay eMandate and plan your business growth now!

Recommended Read

Retain, Engage, Scale: Three Reasons To Build A Subscriptions Business

Frequently Asked Questions (FAQs)

What happens to e-mandates with low bank account balances?

If your bank account balance is low at the time of the e-Mandate transaction, the transaction will be declined by your bank. You will receive a notification from your bank or the merchant about the failed transaction. Depending on their terms and conditions, you may have to pay a penalty or a late fee to the merchant.

How can I verify my e-mandate status?

You can verify your e-mandate status by logging into your bank’s website or mobile app and checking the list of active e-mandates under the payments section. You can also contact your bank’s customer care or visit the nearest branch to get the details of your e-mandates.

What’s the typical duration of the e-mandate process?

The typical duration of the e-mandate process varies depending on the mode of authentication and the bank involved. Generally, it takes between 2 and 7 working days for the e-Mandate to be registered and activated by the bank after you complete the authentication process.

What different subscriptions can merchants offer through e-Mandate?

Merchants can offer different types of subscriptions through e-Mandate, such as fixed amount, variable amount, one-time, recurring, or ad-hoc. You can choose the subscription that suits your needs and preferences. You can also modify or cancel your e-Mandate at any time before the next transaction date.

What’s the minimum amount for an e-Mandate?

The minimum amount for an e-mandate depends on the merchant and the bank. Some merchants may have a lower limit for e-Mandate transactions, while some banks may have a minimum balance requirement for e-Mandate accounts.

What’s the maximum amount for an e-Mandate?

The maximum amount for an e-Mandate is Rs 1,00,000 per transaction per the RBI guidelines. However, this limit applies only to specific categories of transactions, such as subscriptions to mutual funds, payment of insurance premiums, and credit card bill payments. For other categories, the limit remains Rs 15,000 per transaction. You should also check with the merchant and the bank for additional limits or charges for e-mandate transactions.