Lately, corporate credit cards have been all the rage. They have seen a surge in demand because of the evolving needs of Indian businesses.

India is one of the prime ecosystems for entrepreneurs, with over fifty thousand ventures disrupting traditional businesses. Corporate credit cards are aiming to solve the hassles of digital spending for businesses.

So, if you don’t have a corporate credit card for your business yet, we’re going to tell you why it’s a good idea to get one. Read on.

What is a corporate credit card?

It is a type of credit card issued by a bank to a business. The business owner can choose to extend the card to their employees as well to help create a seamless reimbursement experience. This way, they don’t have to use their personal funds to pay for business-related expenditures and then, go through with the reimbursement process.

Corporate cards increase the company’s purchase power while improving the cash conversion cycle with short-term credit at no cost (zero interest).

Some expenses such as SaaS subscriptions, cloud services, and marketing expenses can only be done with a credit card. With corporate credit cards, you also get a higher credit limit than personal cards to be able to make all business expenses without affecting personal liability.

Apart from helping manage finances, corporate credit cards make compliance and reporting much easier for a growing business that needs to focus on the core business. They also have various perks to offer in terms of rewards and lower charges for international transactions.

How does a corporate credit card work?

A corporate credit card works pretty much like any other credit card. It can be used to make online payments as well as purchases at a PoS in brick-and-mortar. These payments get registered to the company’s statements, while the owner’s or employee’s personal funds don’t get tangled up in the process.

The card typically has the name of the company as well as the cardholder’s.

You can get a corporate credit card for yourself or employees from

- A card issuing company

- Partnering with a bank or a financial services provider

Corporate credit card vs personal credit card

A corporate credit card has a lot of advantages over a personal one for your business expenses. Here’s how.

No personal liability

Every business owner understands that business transactions can get tricky, mainly due to the high transaction value involved. Later, when such a situation arises – using your personal credit card risks your personal credit limit. However, a corporate credit card has no liabilities on the individual.

Expense management

As a business, you have complete control and visibility over spends. You can set an upper limit on funds that can be used by your employee. This helps you manage your expenses really well. And, you don’t have to worry about making reimbursements to your employee later on.

Higher spending limit

Corporate credit cards have a much higher limit on the funds you can access when compared to personal cards or business credit cards. They tend to have dynamic credit limits, depending on your business’ growth. This is a great benefit because as your requirements grow, your credit limit becomes higher.

No reporting hassles

You can claim all the business expenses paid from a corporate credit card in your profit and loss account. Whereas, personal card users have to audit their statements closely to separate business charges from personal charges. Without much effort, you will be able to claim accurate business expenses and reduce your tax liability.

Reduced expense fraud

You get greater visibility of expenses made by your employee when they use a corporate credit card. This helps the audit and finance teams to spot fraudulent purchases and non-business expenses better. Any expense or refund will occur on the same card, which means there’s no room for misuse.

Better credit score

A corporate credit card helps build your company’s credit score. This helps you get cheaper capital in the future. This is an easy and risk-free way to increase your company’s credit score.

Get your RazorpayX Corporate Credit Card

RazorpayX, an end-to-end business banking platform, has the best in class corporate credit cards for your business. You can avail an instantly approved card that offers simplified payments and superior expense management exclusively for Razorpay users. RazorpayX Corporate Cards offer immense flexibility with up to 50 days of interest-free credit period.

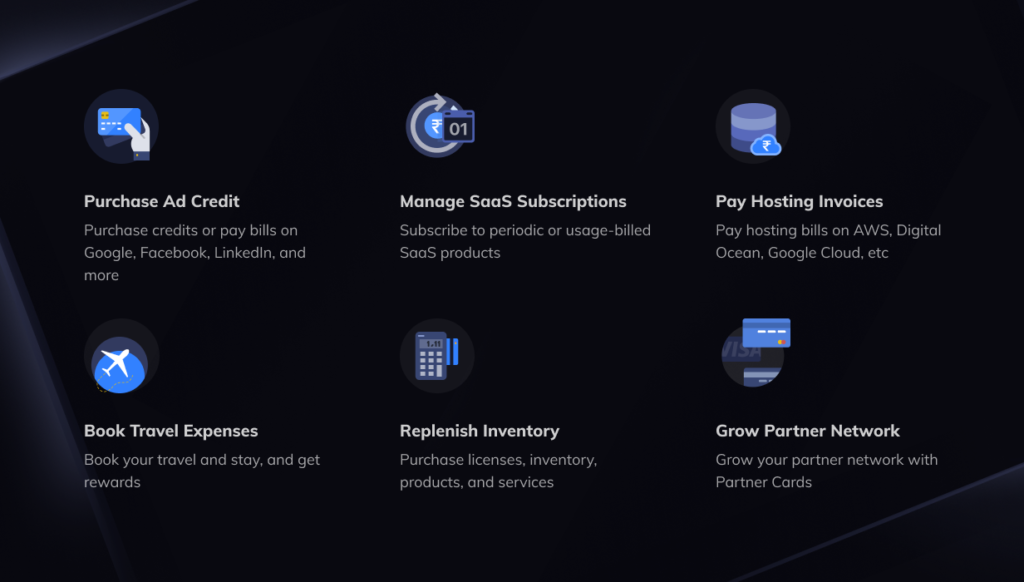

You can use the universally accepted card to make payments towards Google Ads, AWS, Facebook Ads, and so much more.

It’s equipped with dynamic credit limits, auto-repayment features, and a whole array of curated benefits!  Lately, many companies have found value in adopting a corporate credit card program that helps their engines run smoothly. So, let us ask you. Do you have a corporate credit card yet?

Lately, many companies have found value in adopting a corporate credit card program that helps their engines run smoothly. So, let us ask you. Do you have a corporate credit card yet?

The RazorpayX Corporate Cards are developed in association with SBM India, one of the biggest banks in the APAC region.