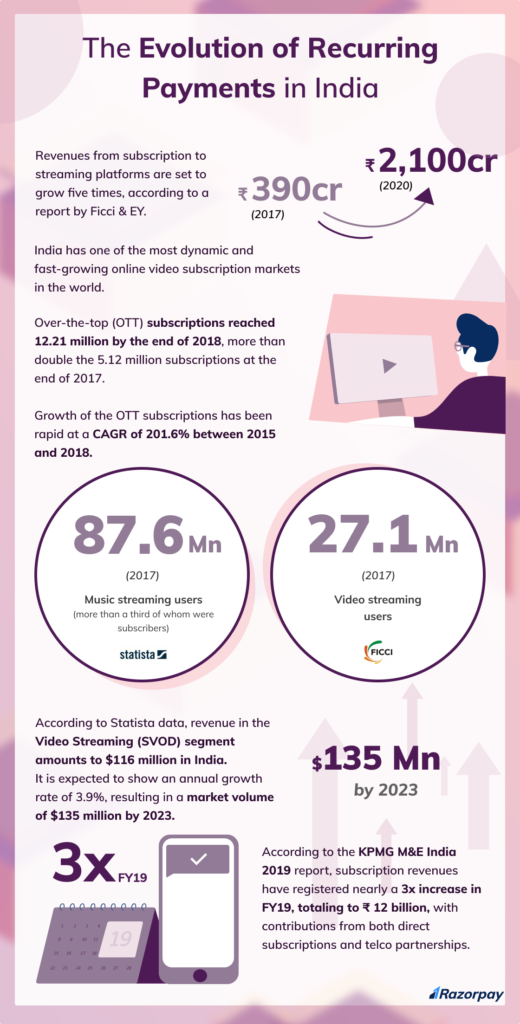

Lately, India has seen an unparalleled expansion of online businesses. With the online commerce industry penetrating the Indian market by 74%, close to 329.1 million people are projected to buy goods and services via online stores by 2020. While consumers have a mountain of options to choose from, the need for more innovative consumption models also arise.

Why?

- Convenience dictates consumer behavior. The ease of simply tapping a button to buy anything from anywhere, at anytime, is simply not beatable

- Consumers prefer “accessing” something over “owning” it

- Each consumer wants unique and personalised offerings, where they can tailor their experience

- Consumers demand flexibility, not only “what” to consume, but also “how”

This has led us to where we are now with recurring payments.

The recurring payments model has a far reaching impact. It creates opportunities for product differentiation, taps consumer segments, and improves customer loyalty. And so, it’s no surprise that its growth is catapulting.

Based on recurring payments on the Razorpay platform, here are a few highlights.

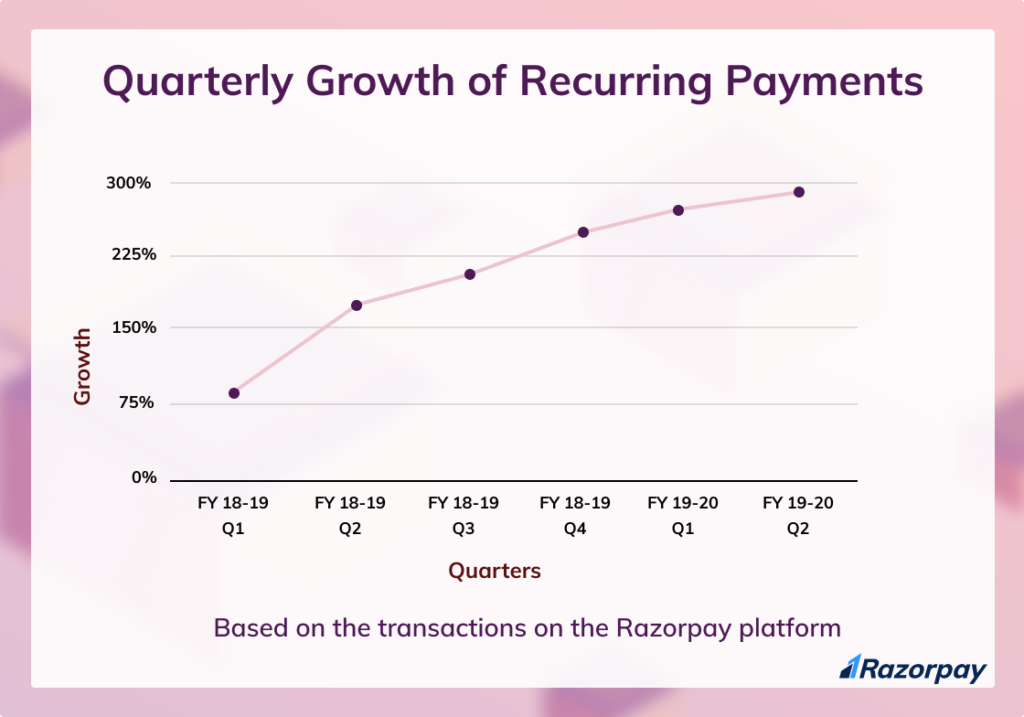

Earlier in FY18-19, recurring payments began to gain popularity. Based on transactions on the Razorpay platform, there was a 78% growth in Q1 as many businesses got onto the bandwagon. What started out with standing instructions on credit cards soon got extended to debit cards, and in some cases, to netbanking as well. Physical NACH got transformed to eNACH.

All of this led to recurring payments receiving an even better response in FY18-19 growing by 96% in the second quarter of that year. By FY19-20, recurring payments have gained strong ground in India. Although Q1 and Q2 seem to show a smaller growth percentage, the growth is still significant because by then, most businesses were already using a recurring payments model.

Now, we anticipate recurring payments to sprout on all cards and UPI as well, which will further fuel the growth of this mode of payment.

“India is a key part of our international subscription growth.”

– Reed Hastings, CEO, Netflix

Government initiatives have also been helping businesses move to the recurring payments model.

Related Read: What is Recurring Billing? – Types, Advantages, and Examples

RBI opens up recurring payments on cards – A step ahead for digital payments

In September 2019, RBI turned out with a circular to engender the utilization of cards in making recurring payments. The circular says that starting September, buyers will have the option to utilize their cards to make recurring payments to businesses through e-mandate.

The e-mandate and additional factor of authentication (AFA) should be done just once at the hour of the principal transaction. All transactions taking place, later on, will be completed consequently without the prerequisite of rehashed AFA.

RBI has set a cap of ₹2,000 for such transactions and notified that they will be permitted on debit and credit cards, and prepaid payment instruments (PPI) including wallets.

This will empower consumers, just as traders, to significantly profit by getting rid of the issue of authenticating transactions on numerous occasions.

The RBI circular likewise specifies that consumers will be given the aid to set recurring payments for a predefined fixed value or a variable value. To guarantee that the cardholder is protected, they will have the option to determine the maximum transaction value as well.

Further, to defend the interests of the consumers, RBI said that they will get a notification through SMS or email a day prior to when the recurring transaction is to be completed. This notification, carrying details regarding the amount, date and purpose behind the transaction, will enable cardholders to drop the exchange, on the off chance they wish to do so. Obviously, the cardholder can pull back the e-mandate anytime too.

This facility will go far in further advancing digital transactions in the nation. All the more so, consumers won’t be required to pay any additional charges for setting an e-mandate for recurring payments through their cards.

eMandate for netbanking and debit cards

In April 2019, NPCI received final approval by RBI for the full-fledged implementation of eMandate for netbanking and debit cards. NPCI informed all the banks to take immediate steps and implement both eMandate variants within June. While the limit for each eMandate is set at Rs 1 lakh, the organisation is to review the limit.

This facility will allow businesses to greatly improve the customer experience while solving collection-related problems at the same time since eMandate will allow them to take a one-time consent from the customer to debit them subsequently.

Related Read: What Is eMandate And How Does It Work?

UPI 2.0 with overdraft facility

The launch of UPI 2.0 in August 2018 was expected to bring many benefits to the payments landscape. In addition to current and savings accounts, consumers could have also linked their overdraft account with UPI to instantly make their transactions while the benefits of an overdraft account are retained. While the launch has not happened yet, it will be a gamechanger for recurring payments, given the immense popularity garnered by UPI in recent times.

What’s in store for recurring payments

“We believe that the recurring payments model will benefit not only customers, but businesses as well. With rapidly evolving consumer needs, this model will be a game changer for the Indian economy. Benefits like reduced transaction costs, convenience of upgrading or downgrading and reduced amounts of waste from unused assets will drive the adoption of recurring payments.”

– Harshil Mathur, CEO, Razorpay

Razorpay offers a full range of payment solutions for Recurring payments which include – recurring on cards, on bank account via eMandate or eNACH and Physical Mandate.

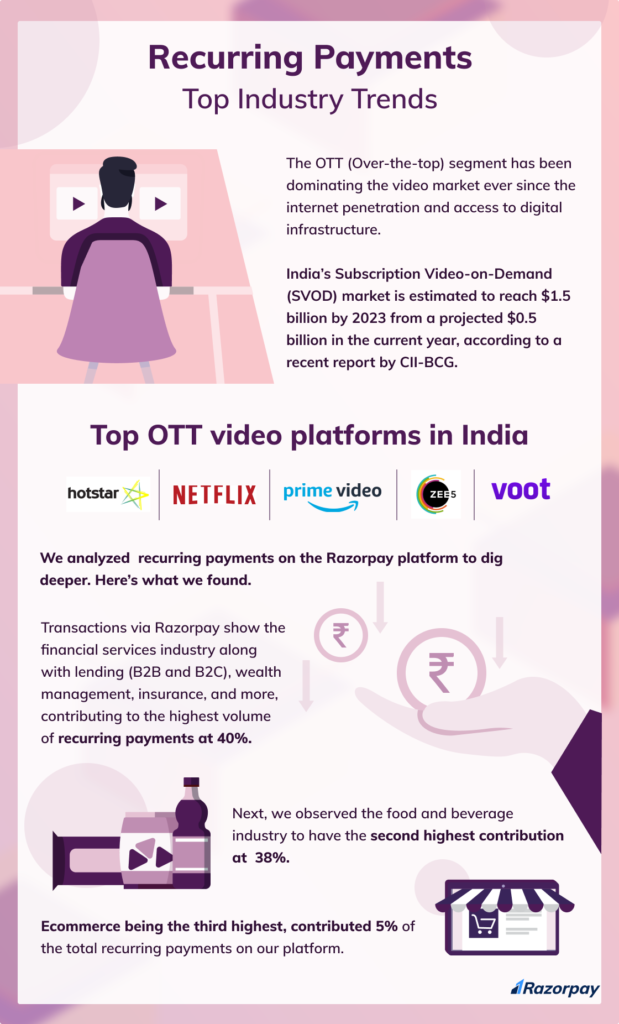

Interesting use cases for recurring payments on the Razorpay platform