Somewhere between ‘Oh! I forgot to buy the receipt book’ and ‘Can you teach me how to create GST invoices?’, the world started embracing digital payments. However, the fact is, it was a tough shift for a lot of businesses.

To make the process simpler, there came in a lot of tools and products that helped business ease the move. We can now say that gone are the days when you would have to stand for a couple of minutes while the seller created an invoice for you.

Today, anyone can start providing service from anywhere, create GST invoices and send it to their customer – everything within minutes!

While Razorpay empowers digital payments for your business, it is not limited to just that. You can send payment reminders, create GST invoices, disburse payouts and do a lot more with Razorpay.

This article talks about how to create GST invoices from your Razorpay dashboard and send it to your customers easily.

Need to Calculate GST based on different tax slabs? Our online GST Calculator tool makes it easy. You can also verify an find GSTIN information for any taxpayer using Razorpay GST Search tool.

Related Read: Excel Formula for GST Calculation: Step-by-Step Guide

What is a GST invoice?

An Invoice or a GST bill is a business instrument issued by a seller to the recipient of the goods and services. It is a document that indicates the name of both the parties involved.

An ideal GST bill has the following details:

- Business name

- Buyer’s name

- Date

- Product name

- Description

- Quantity of goods or services sold

- Details of the supplier and the purchaser

- HSN code for goods and SAC code for services

- Taxpayers’ and customers’ GSTIN (if registered under GST)

- Terms of supply

- Date of supply

- Price of each good sold or service rendered

- Discount details (if applicable)

- Signature

If your recipient is not registered under GST and the invoice value exceeds Rs 50,000, then the invoice should include the following details as well:

- Name and address of the recipient

- Delivery address

- Name of the state and state code

Why should a business issue a GST invoice?

There are various reasons why creating and issuing a GST invoice plays a vital role in business.

Proof of supply

For any business, an invoice acts as a legal document that proves the supply of goods and services by an authorised person. It forms the basis on which a supplier can demand payment from the buyer at any point in time.

Time of supply

Time of supply is the date on which the invoice is issued or the date on which the payment is received, whichever of two is earlier. GST is charged at the time of supply of goods and services. In this context, an invoice acts as a legal document for future references.

Claiming income tax return (ITC)

Invoice is that one document basis which any recipient can claim ITC for the purchase made by them. This means that any individual cannot claim ITC until they have a GST tax invoice with them.

[Suggested reading: GST Invoice Guide | Format, Rules & How to Create Online]

How to create GST invoices with Razorpay

It’s easy to create GST invoices with Razorpay no matter the size and the domain of the business. Follow the below-mentioned steps.

1. Sign up or log in to your Razorpay dashboard

2. On the left-hand side of your dashboard, click on the option labelled as ‘Invoices’

3. ‘Get Started’ with the process of creating GST complaint invoice

4. Tap on ‘Create Invoice’

5. You will get on an option to choose your ‘Invoice Label’

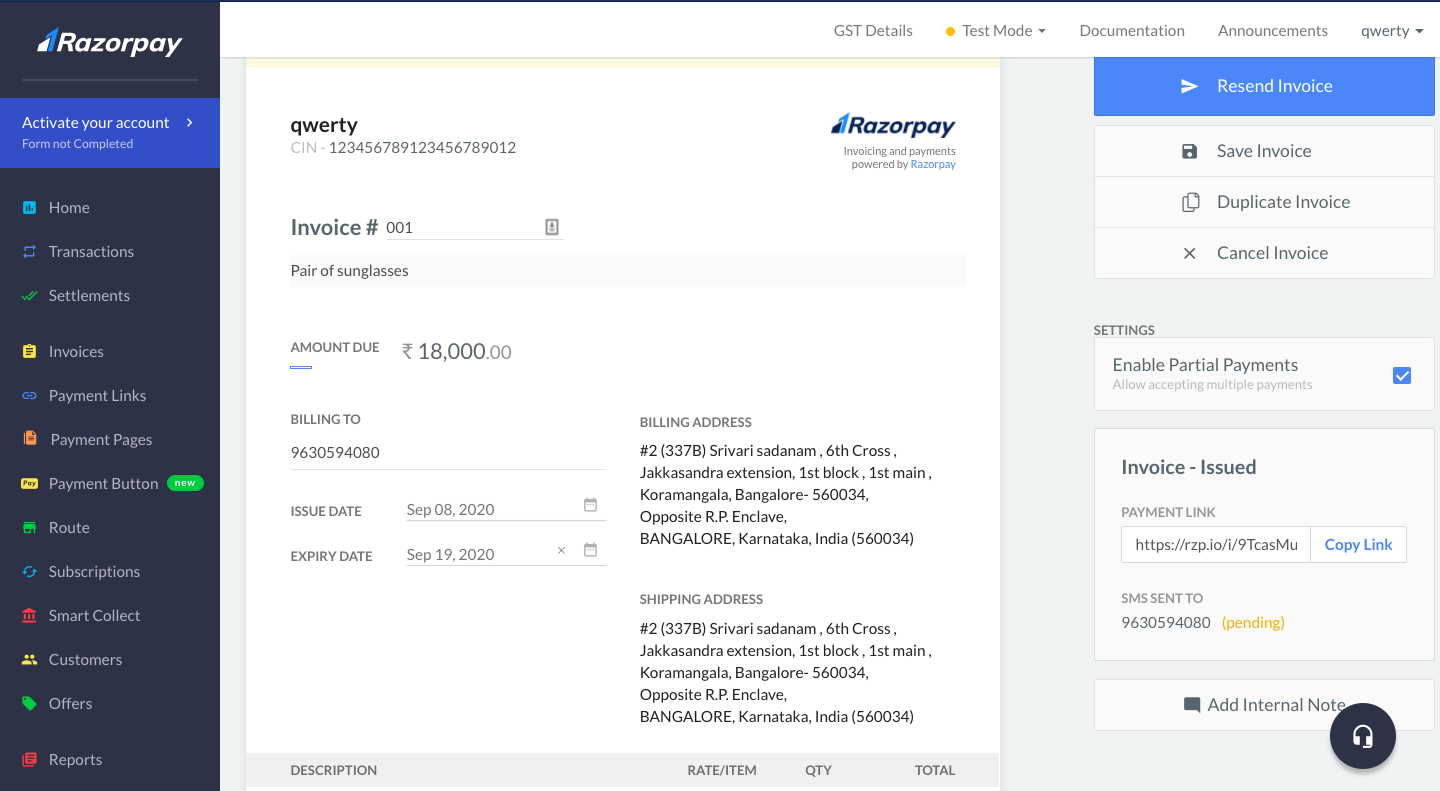

6. Choose your preferred currency and enter the further details like date, address, product details etc.

Pro-tip: Navigate to the right side of your dashboard to get add-on features like an option to enable partial payments, add GST details, change invoice label and so on.

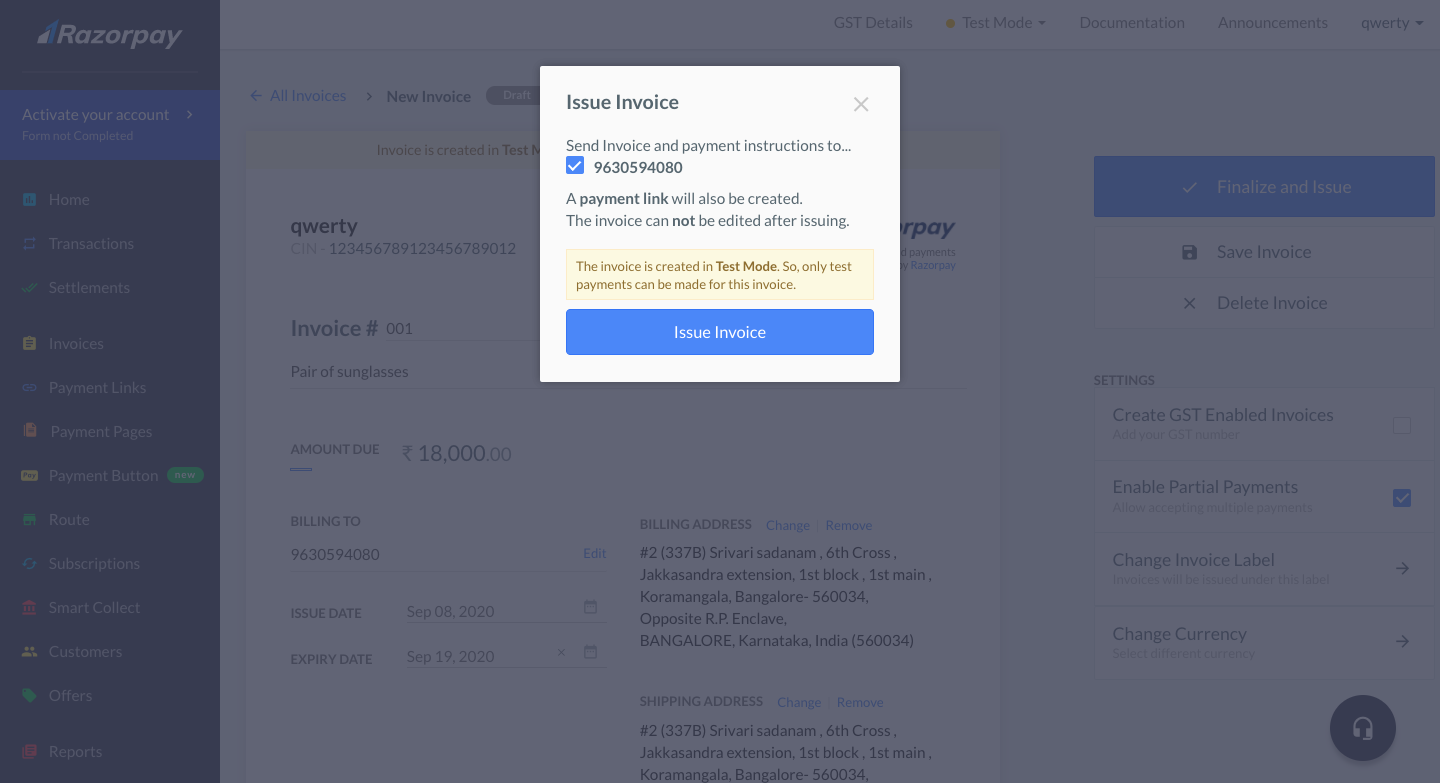

7. After adding all the details, click on ‘Finalise and Issue’

8. You will get a pop-up as a confirmation. Click on ‘Issue Invoices’ to confirm

9. Done! Your customer will receive an invoice as soon as you confirm

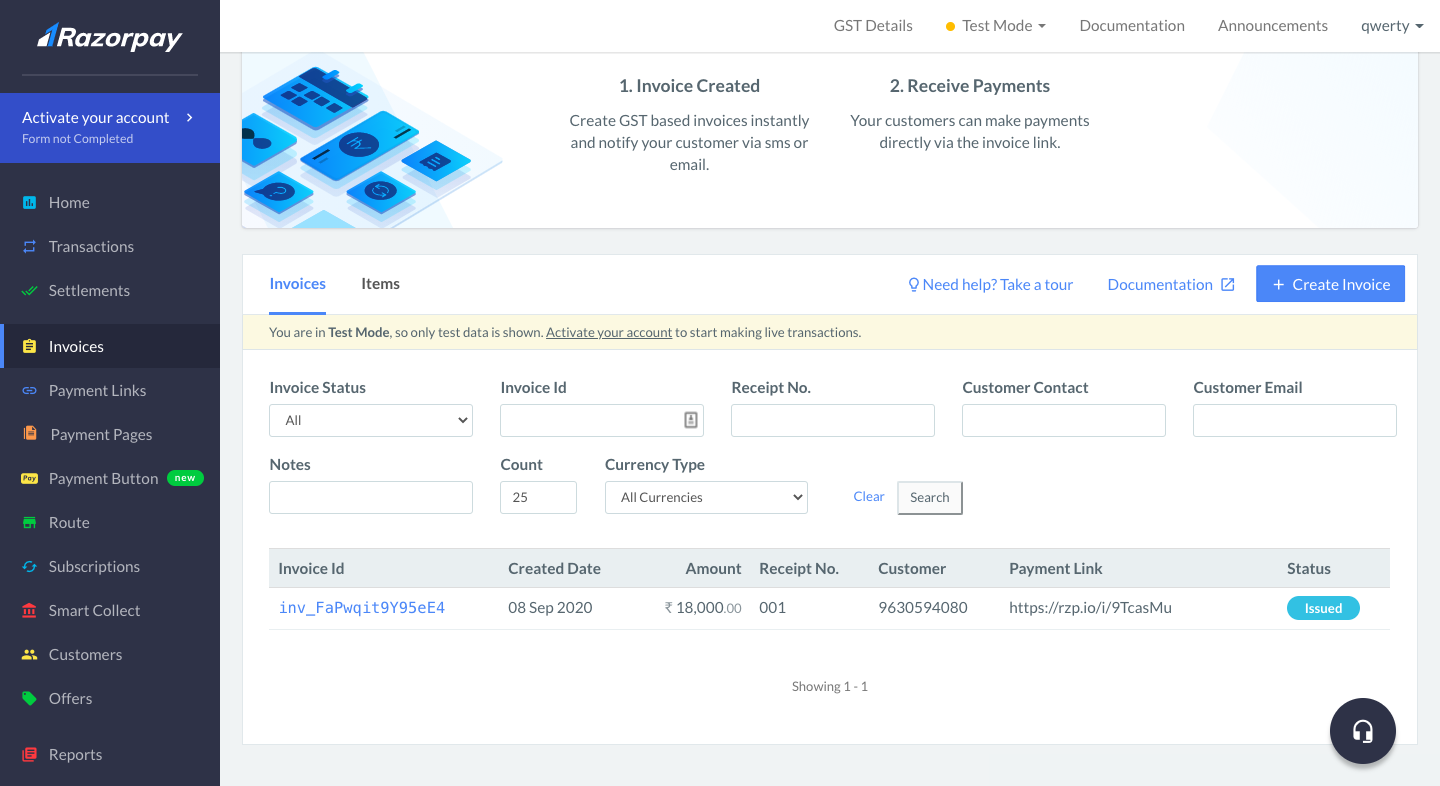

10. Navigate to your dashboard to view the status of all your invoices

Please note: You can use filters to find out the status of a particular invoice.

11. You can resend an invoice, copy the payment link or add an internal note at any point in time by clicking on a particular invoice

Did you know?

We, at Razorpay, have recently launched a mobile application – Razorpay ePOS, to cater to the mobile-first audience of the business ecosystem. With this, you don’t need to find a corner to place your laptop or operate from a desk to carry the most basic and essential jobs.

Razorpay’s ePOS app also enables you to create, share and track invoices. Your every customer invoice, with Razorpay, is now just a pocket away!

[Read more: Razorpay ePOS App – Simplifying Digital Payments for Offline Businesses]

Features of Razorpay invoices

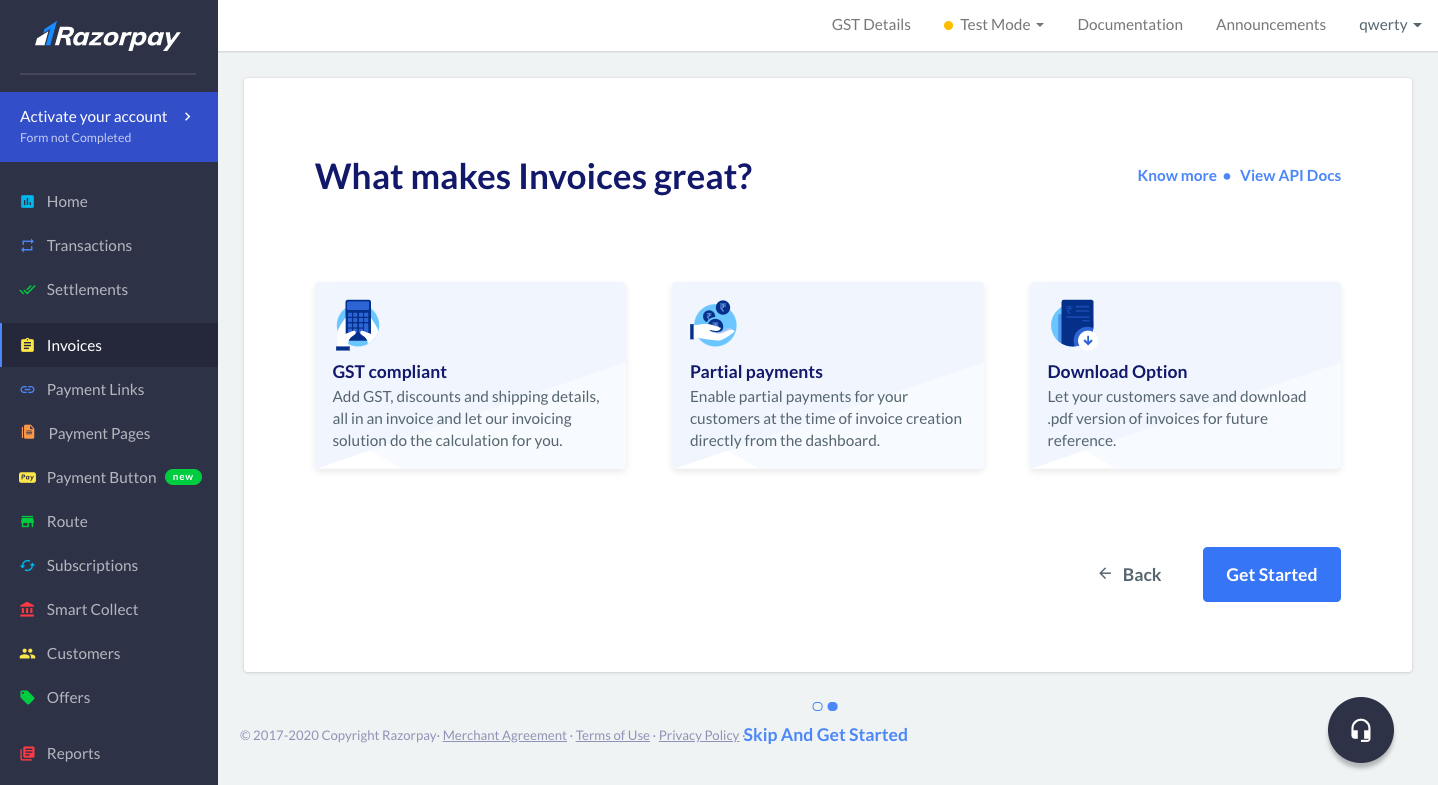

GST-compliant invoices

Create GST invoices, add discounts, enter shipping details and more – all in an invoice. Please sit back and relax while our invoicing solution does the calculation for you.

Offer partial payments

Enhance your customer’s payment experience by enabling partial payments for them. No long and tedious process to enable this. Select an option from the dashboard.

One time effort

Save hundreds of your business hours & human effort with Razorpay invoices. Save your line item once and use it across invoices.

Download functionality

Let your customers save and download the .pdf version of the invoices for future reference and legal needs. Not just your customers, even you, as a business, can download the reports in bulk from your dashboard.

Improved tracking

Increase accountability and transparency into your business by tracking all account receivables against invoices paid. Use filters for easy search from a list of invoices.

Dashboard reporting

Take better and informed businesses decisions by gaining useful insights from reports and real-time data available on the dashboard.

Does it look like all that headache of using multiple platforms for one task can be solved with Razorpay? Sign up today and check it out for yourself!

Are you already using Razorpay Invoices? We would love to hear your thoughts and experience in the comment section below.