2020 has seen a massive trend in brands going online to sell their products and services. Online customer acquisition does not end when you get them to your website and interest them in your offering. Your customer will be onboarded successfully if you can give them a seamless buying experience which includes smooth payments and order confirmations.

One of the most harrowing experiences for a customer is failed payment. It can not only make them dissatisfied with your company but add to a negative word of mouth. What’s more is it can lead to cart abandonment, making your brand lose sales and customers. Lastly, it can flood your customer support and social media channels with complaints and demands.

Money is the most important thing for any customer. They want to see it being spent efficiently and wisely. So, what can a brand do to ensure their customer’s hard-earned money reaches its destination successfully, without any roadblocks? Razorpay Downtime Notifications has the answer!

What leads to a failed payment?

Online payments are one of the most complex systems in the online commerce world. There are multiple parties involved for one successful transaction, each passing the payment’s information through their networks. For instance, there are three stages involved in the lifecycle of a card payment.

This complex system can face problems sometimes. The issue is that there are multiple processes and parties involved in a single transaction. Thus, it might not be easy to pinpoint what causes a payment failure. Think of it as machinery – even if the smallest part malfunctions, it can cause the whole machine to break down.

While every party tries their best to maintain their technical systems’ in good health, sometimes fluctuations happen due to unexpected reasons. For example, in the case of a card transaction, the failure might be due to:

- Fluctuations at Razorpay

- Issues with the authorization bank

- A malfunctioning network

- Problems on the side of the issuer bank

[Read more about the lifecycle of online card payment here. ]

A consumer, however, tends to think of a failed transaction as the brand’s fault. This is one of the reasons why so many consumer complaints on social media revolve around payments. Thus, what companies need is a system to warn consumers about any payment discrepancy and reduce the chances of failed transactions.

What is Downtime?

As per the dictionary definition, downtime is essentially the time during which a system or a machine is unavailable and out of service. In the case of payment, this downtime can be in the case of a payment method or a bank.

Razorpay, as a part of its Rainy Day kit, wants to reduce payment hassles as much as possible. This means that we want to detect the fluctuations that might happen in the system.

With our continued focus on customer experience, these fluctuations, known as Downtimes, are detected at Razorpay in the least time possible, within seconds.

Razorpay Downtime Notifications – Detecting Fluctuations Effectively

Razorpay Downtime notifications are communication sent to the customers whenever Razorpay observes a fluctuation on various payment instruments. This means that if we find a particular system or party that can result in a failed payment, we will intimate the customers in advance via Downtime Notifications.

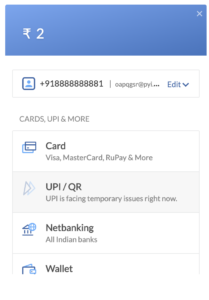

In simpler words, nowadays, there are multiple ways to make payments, from net banking and card payments to UPI and wallet transactions. However, a particular route might be blocked or unavailable due to operational or other reasons. With Downtime, we are alerting the merchants and, as a result, the end customers of this blockage.

This can help your customers in avoiding a particularly risky payment method. Additionally, if a consumer chooses to go ahead with the said payment method, the notification would have informed them in advance of any failure that might occur.

Types of downtimes communicated

Downtimes are detected as per payment method, i.e., cards, UPI, and netbanking. Below is a list of all the downtimes we detect and communicate to our customers:

- Cards: Fluctuations in a specific network, issuer, or overall card transactions. For example, transaction failures may be happening for VISA cards only, or cards issued by HDFC, or the entire card system might be down. As per the case, the consumer is notified

- UPI: Fluctuations in specific VPA handle, PSP App, or overall UPI transactions. For example, transaction failures are identified for distinctive VPA handle such as @oksbi or an entire PSP like PhonePe and communicated accordingly

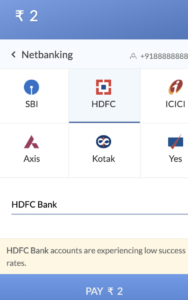

- Netbanking: Fluctuations in specific banks or overall netbanking. For example: whether transactions are failing for some banks such as BOI or entire net banking is down

Ways to communicate downtimes

It is not enough to detect downtimes. This feature’s positive effect will be seen if our merchants know about the fluctuations timely and effectively. Once detected, the downtimes are communicated to our merchants in two ways:

- Emails: Razorpay merchants can raise a support request to subscribe to these notifications if not subscribed already. This communication is sent to all the merchants subscribed to downtime notifications.

- Webhooks: We post every downtime creation as well as their resolution on our downtime webhooks. Razorpay merchants can integrate and listen to the downtime webhook easily. This webhook can be configured under “webhooks” within the settings section of the Razorpay dashboard.

How to enable Downtime Notifications

At Razorpay, our constant endeavor is to make sure that we assist our customers to the best of our abilities, whenever possible. This is why Downtime Notifications will be readily and automatically available to a majority of our customers, with special accommodations for custom use-cases.

- Standard Checkout: For customers who are already using Razorpay services for a standardized checkout, Downtime Notifications will be auto-enabled for their business.

- Customized and S2S(Server to Server) Checkout: If your company is looking for a customized Downtime Notification setting, we give the option of listening to the downtime events using a webhook or use an API Integration for the same. You can check it out here.

What are the advantages of Razorpay Downtime Notifications?

A smooth payment experience can help you unlock customer delight all the way through. With Razorpay Downtime Notifications, you can not just benefit your customer but also enhance internal operations.

Lower your customer complaints and queries (dummy stats and brand)

Faulty payments or unsuccessful transactions can lead to high customer complaint volumes. Nowadays, aggrieved customers often turn to social media to post about their brand experience, affecting how other potential customers view your brand. This puts high pressure on internal teams like social media managers and customer service personnel.

[bctt tweet=” Over 83 percent use social channels to talk about customer service experiences (always or sometimes) – Business Today ” username=”Razorpay”]

With Razorpay Downtime Notifications, you can reduce this pressure internally by preventing customer dissatisfaction altogether. Our system notifies customers of the payment channel, which they should avoid to ensure successful transactions. Additionally, you can choose to block a particular payment method, ensuring that customers transact through other channels.

Enhanced customer experience

Today, every point where a customer can interact with your brand becomes a part of their experience. Successful payment is a hygiene factor for companies, but everything from checkout to the credit of the amount can contribute to their experience.

With Razorpay Downtime Notifications, your brand puts in the effort to ensure that customers reduce their chances of payment failures. This, in turn, leads to fewer payment defaulters making the overall customer experience a delight for them.

[bctt tweet=”According to a statistic by Temkin Group, after having a positive experience with a company, 77% of customers are likely to recommend it to a friend. ” username=”Razorpay”]

Brand trust and credibility

If customers have a bad payment experience with a brand, they might think twice about returning to it. This is because customers, in India especially, are very particular about money. Any wrongful debit or missed credits can make them lose trust in your company.

If you ensure smooth and correct transactions for your customers, they are more likely to trust your systems and return for a repeat purchase. With Downtime notifications, you can reduce the chances of a bad payment experience and increase your credibility among buyers. This might also lead to more returning customers and a high frequency of orders.

Safeguard your payments with Razorpay

Make your customers’ brand journey seamless and successful with Razorpay’s Downtime Notification. Sign up today to start accepting payments with Razorpay and get valuable additions along the way!