Table of Contents

What is a Beneficiary?

A beneficiary is a person or organization that benefits from a will, trust, retirement plan, insurance policy, annuity, financial transaction or another arrangement. Generally, a beneficiary is entitled to receive payments or other benefits from the assets held in the arrangement.

To maintain healthy vendor & customer relationships, business owners need to make real-time payouts. However, traditional banks impose a cooling period before allowing businesses to make payments to newly added beneficiaries, making it difficult to make instant payouts.

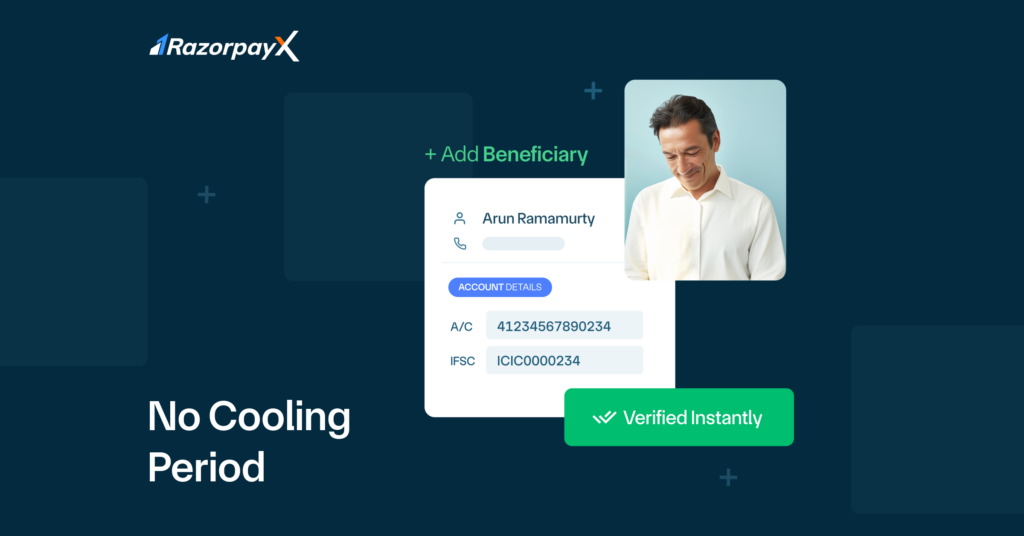

Modern banking solutions like RazorpayX Business Banking+ use technology and innovation to bypass the cooling off period and allow account holders to make payouts to beneficiaries instantly, in real-time.

How to Add a Beneficiary?

Let’s have a closer look at the steps to add beneficiaries:

- Login to your net banking portal

Log in using your user ID and password. Select the option for third-party transfers or fund transfers.

- Create a beneficiary

To transfer funds via NEFT, RTGS & IMPS, you’ve to select a payee or a beneficiary.

There are two options to do this, depending on if the beneficiary account is in the same bank or other bank branches. Add the beneficiary’s bank account details.

- Name of the account holder

- Account number

- Account type

- Add details of funds to be transferred

Once you have successfully added the beneficiary, choose the transfer option (NEFT, RTGS, IMPS) & add the fund to be transferred.

- Wait for the beneficiary to get activated

Banks generally take 30 mins to 4 hrs to authenticate beneficiary details. During this cooling period in the bank, the funds will not be transferred resulting in payment delays.

Once the beneficiary is activated, the funds are transferred to the specified account.

Depending on the mode of payment (NEFT, RTGS, IMPS) & the cooling period in the bank for receiver detail activation, the entire process of payouts can take up to 2 – 24 hrs.

Don’t want to wait? Make instant payouts with RazorpayX Business Banking+.

What is Cooling-off Period?

In banking, after adding a beneficiary usually a period of 30 min to 4 hours is needed by the bank before any transaction can be made to this beneficiary. This is known as the cooling-off period.

In cases where the vendor requires the fund to be transferred immediately, the cooling period in the bank can be a cause of concern. And if a receiver is added after banking hours, it gets approved & activated only the next day.

Note: The cooling period varies from bank to bank. For example, the cooling period for SBI bank accounts is 4 days from the time of approval. During the SBI cooling period, you can transfer an amount of up to Rs. 5 lakhs to the receiver. After the completion of the cooling period in the bank, you will be able to transfer up to the maximum limit.

How to Add Beneficiary Without Cooling-Off Period?

Timely payments to vendors or customers are crucial for business success & any delay can cause an interruption in service. Businesses need to ensure dispute-free, quick payments to vendors & customers.

New-tech solutions like RazorpayX Business Banking+ allow businesses to make 24×7 instant payments to customers, vendors and employees with no cooling period.

Add beneficiaries as a contact and make single or bulk payouts without any cooling period in the bank. You can also add multiple banks accounts or UPI IDs against one contact.

Instant Payouts without Beneficiary Account Details

Adding a beneficiary requires the business to already have the receiver’s bank account details – a UPI ID, bank account number and IFSC. In certain cases like cash on delivery refunds or security deposit refunds, the business might not have these details.

Furlenco solved this problem with RazorpayX’s Payout Links solution. Simply send a payout link to the beneficiary, and the entire process is automated from there.

Read more: Furlenco Reduces Customer Complaints by 70% on Automating Refunds via RazorpayX

Learn more about RazorpayX Business Banking+

Frequently Asked Questions

Who is a beneficiary?

A beneficiary is a person or organization that receives benefits from a will, trust, retirement plan, insurance policy, annuity, or another arrangement. Generally, a beneficiary is entitled to receive payments or other benefits from the assets held in the arrangement.

How to Add a Beneficiary?

Step 1. Head over to your net banking portal

Step 2. Add a beneficiary

Step 3. Add details of funds to be transferred

Step 4. Wait for the beneficiary to get activated

How to make instant payouts without adding beneficiary details?

With RazorpayX Payout links, businesses can remove the effort required to collect the beneficiary account details & automate payouts.

How to add a beneficiary without cooling period?

With RazorpayX, you can add beneficiaries as a contact immediately & make single or bulk payouts without any cooling period in bank.