With Razorpay’s latest UPI Collect updates, customers can expect an improvement in their metrics. Read how business can become 10x faster with UPI Collect.

UPI became the most preferred digital payment mode in 2020. Razorpay brings to you four UPI-based Apps that will completely transform your business.

2020 has seen a massive trend in brands going online to sell their products and services. Online customer acquisition does…

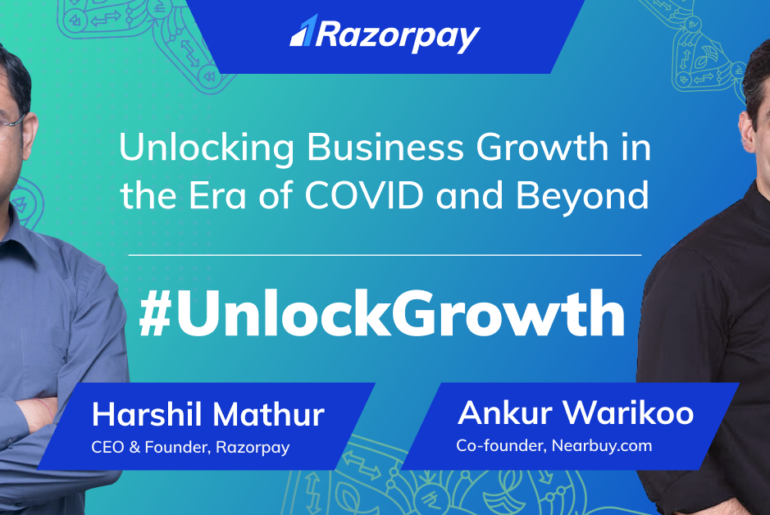

Ankur Warikoo and Harshil Mathur help you decode the changing times and give key lessons to Unlock Growth in the era of COVID and beyond.

Around 10% of customers who cancel auto-renewal would just prefer to pause if it was an option. Read how you can pause a subscription for your customers.

Razorpay’s Working Capital Loans helped Namaste Farm onboard small-scale vendors and grow their supply chain to provide fresh produce to customers.

UPI payments have seen nearly 100% year on year growth for the past 3 years. Read how you can scale up your business efforts via Razorpay UPI payment links.

Read this report to see what’s up with the top industries in the e-commerce world. Uncover and decode the industry’s behaviour, trends and insights.

In India, the months of October and November bring excitement and joy every year. Popularly known as the Festive Season,…

Razorpay partners with a number of businesses – from enterprises to SMEs. Find out how Razorpay assisted Vedika & Arjun in their business growth journey.