India’s digital payments game is getting a major upgrade, thanks to two powerful innovations: the Digital Rupee vs UPI. But while they both sound futuristic and wallet-free, they play very different roles.

Think of it this way: Digital Rupee is like holding cash in a digital form, issued directly by the Reserve Bank of India. UPI, on the other hand, is the high-speed highway that lets your money move instantly between bank accounts.

In this guide, we’ll break down what each of these systems is, how they work, and—most importantly—how they differ. Whether you’re a curious student, savvy consumer, or a business owner navigating India’s fast-moving fintech world, this is your one-stop explainer.

Table of Contents

What is Digital Rupee?

The Digital Rupee, also known as e₹, is India’s official Central Bank Digital Currency (CBDC), introduced by the Reserve Bank of India (RBI). It represents a digital version of physical currency, maintaining the same face value and legal status as the paper notes and coins in circulation today. Unlike cryptocurrencies, which are decentralized and volatile, the Digital Rupee is centrally issued, regulated, and backed by the RBI, making it a trusted and stable digital alternative to cash.

The Digital Rupee was launched with the intent to modernize the financial ecosystem, promote cashless transactions, and reduce the dependency on physical currency. It blends the familiarity of cash with the convenience and security of digital payments, offering a seamless bridge between traditional and digital finance.

Key Features of the Digital Rupee:

- Issued and regulated by the RBI: As a sovereign-backed currency, it carries the same trust and security as paper money.

- Digital form of physical cash: It functions just like regular currency but exists entirely in digital format, stored in a digital wallet.

- Peer-to-peer and peer-to-merchant payments: Enables fast, direct transactions without the need for banks or intermediaries.

- Offline capabilities: In some implementations, transactions can happen even without internet access, crucial for rural and remote areas.

- Greater financial transparency: Every transaction can be traced, which helps reduce tax evasion, discourages black money, and supports economic compliance.

Use Cases of Digital Rupee:

1. Direct government benefit transfers (DBT):

Subsidies and welfare payments can be disbursed straight into recipients’ digital wallets, cutting out middlemen and delays.

2. Cross-border transactions:

The Digital Rupee can potentially simplify international payments by eliminating currency conversion complexities and reducing dependence on third-party systems.

3. Everyday retail usage:

Consumers can use e₹ to shop online, pay at stores, or settle bills, just as they would with cash or cards—only faster and more securely.

4. Digital store of value:

Just like physical currency, the Digital Rupee can be held in digital wallets as savings or for future use, without the risks associated with cash handling.

What is UPI?

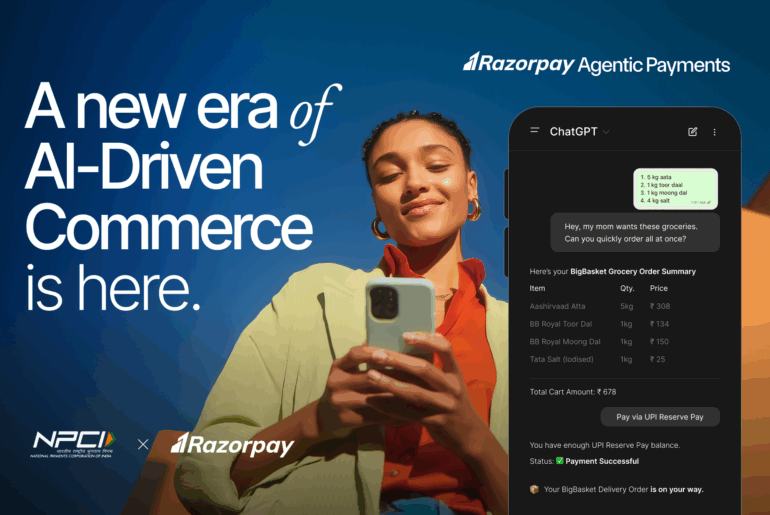

Unified Payments Interface (UPI) is a revolutionary real-time payment system developed by the National Payments Corporation of India (NPCI). Launched in 2016, UPI has become the lifeline of India’s digital payment infrastructure, enabling seamless bank-to-bank money transfers using smartphones.

Unlike traditional payment systems that require lengthy bank details or wait times, UPI allows users to send and receive money instantly using just a mobile number, UPI ID, or by scanning a QR code. It’s simple, fast, and widely accessible, making it one of the most used digital payment methods in the country.

UPI powers some of India’s most popular payment apps like Google Pay, PhonePe, Paytm, and the government-backed BHIM, allowing millions of users to conduct everyday transactions with ease.

Key Features of UPI:

- Instant payments, anytime: UPI works 24/7, 365 days a year—even on weekends and bank holidays. Whether you’re paying a friend at midnight or shopping online on a Sunday, transactions happen instantly.

- User-friendly and hassle-free: You don’t need to remember complex bank details. Just link your bank account to your mobile number and set a UPI PIN. Payments can be made using simple identifiers like a UPI ID or even a mobile number.

- Supports both P2P and P2M payments: UPI enables peer-to-peer (P2P) transfers between individuals as well as peer-to-merchant (P2M) payments for buying goods, paying bills, or making online purchases.

- QR code compatibility: Widely accepted by local merchants, street vendors, and businesses across India, UPI payments can be made by scanning static or dynamic QR codes, making it ideal for small-ticket payments.

- Advanced payment features: UPI supports features like:

- Auto-debit for recurring payments (e.g., subscriptions, loan EMIs)

- One-time mandates for scheduled transactions

- Pay-by-link for easy invoicing and payment collection

Key Differences Between Digital Rupee vs UPI

To better understand their unique roles, here’s a side-by-side comparison:

Feature |

Digital Rupee |

UPI |

| Nature | Digital form of currency (CBDC) | Transaction platform |

| Issuer/Operator | RBI | NPCI |

| Form Factor | Currency-like (token-based) | Interface for bank transfers |

| Legal Tender | Yes | No – it facilitates the transfer of legal tender |

| Transaction Type | Wallet-like transactions using digital currency | Bank-to-bank fund transfers |

| Anonymity | Higher (like cash, depending on implementation) | Lower – tied to bank account and KYC |

| Settlement | Final at issuance | Depends on interbank processing |

| Offline Capability | Possible (in pilot mode) | Requires internet connectivity |

| Interest Earnings | No interest (like physical cash) | Yes, funds stay in interest-bearing accounts |

| Security Control | Directly under the RBI | Depends on banks and payment apps |

Related Read: MPIN vs UPI PIN: What’s the Difference?

Conclusion

In summary, Digital Rupee and UPI are both powerful tools in India’s digital economy, but they are not the same.

- Digital Rupee is a legal tender in digital form, offering privacy, offline use, and direct central bank issuance.

- UPI is a payment platform that connects banks for instant, real-time money transfers.

While UPI simplifies payments, the Digital Rupee redefines money itself. As both systems evolve, they are expected to coexist, providing more choices and flexibility to users and businesses alike.

Frequently Asked Questions (FAQs):

1. What advantages does the Digital Rupee have over UPI?

The Digital Rupee offers better privacy and can function offline, making it a great alternative where connectivity is limited. It also reduces the reliance on intermediaries like banks and apps during transactions.

2. Can the Digital Rupee be used with UPI applications?

Currently, the Digital Rupee is not integrated into UPI apps, but in the future, the RBI could enable such interoperability to offer seamless user experiences.

3. Which is better for small transactions: Digital Rupee or UPI?

For now, UPI is more widely accepted and convenient for small, everyday transactions. However, the Digital Rupee could become a strong contender once adoption scales up and offline features are widely rolled out.

4. Is Digital Rupee secure for transactions?

Yes. The Digital Rupee is backed and regulated by the RBI, ensuring high levels of security and transparency in transactions.

5. Is Digital Rupee available for cross-border payments?

Cross-border usage is part of the future roadmap. The Digital Rupee could eventually simplify international remittances by eliminating third-party intermediaries and conversion fees.

6. How can UPI be integrated with Digital Rupee?

Integration could allow UPI apps to serve as front-end platforms for using Digital Rupee, enabling transactions just like you use cash or a card today—but this is subject to the RBI and NPCI frameworks evolving in this direction.