Interest Rate Calculator

Loading Interest Rate Calculator…

Check Razorpay products for your business

Razorpay POS

Collect payments swiftly in your store with Razorpay POS and its interesting offers.

Payment Pages

Easiest way to accept international and domestic payments with custom-branded online store.

What is an interest rate calculator?

- An interest rate calculator is a digital tool that performs complex financial calculations instantly

- Eliminates the risk of manual errors in complex calculations.

- Saves time by providing instant and accurate results

How to use the interest rate calculator

- Enter Details – Input the principal amount, interest rate (APR), and time period (years, months, or days).

- Set Compounding – Choose how often the interest should compound (daily, monthly, quarterly, annually).

- Run Calculation – Click the calculate button to process the data.

- View Results – Instantly see the outcome with accurate values and projections.

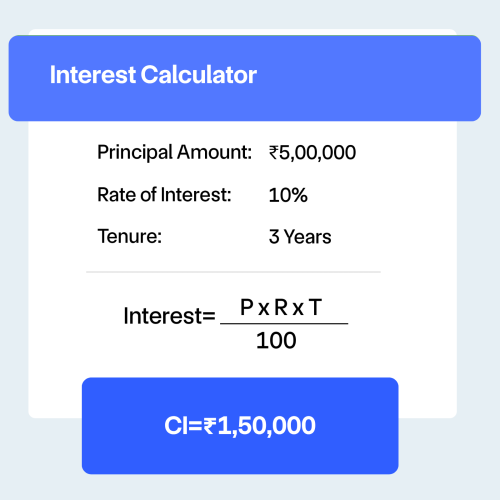

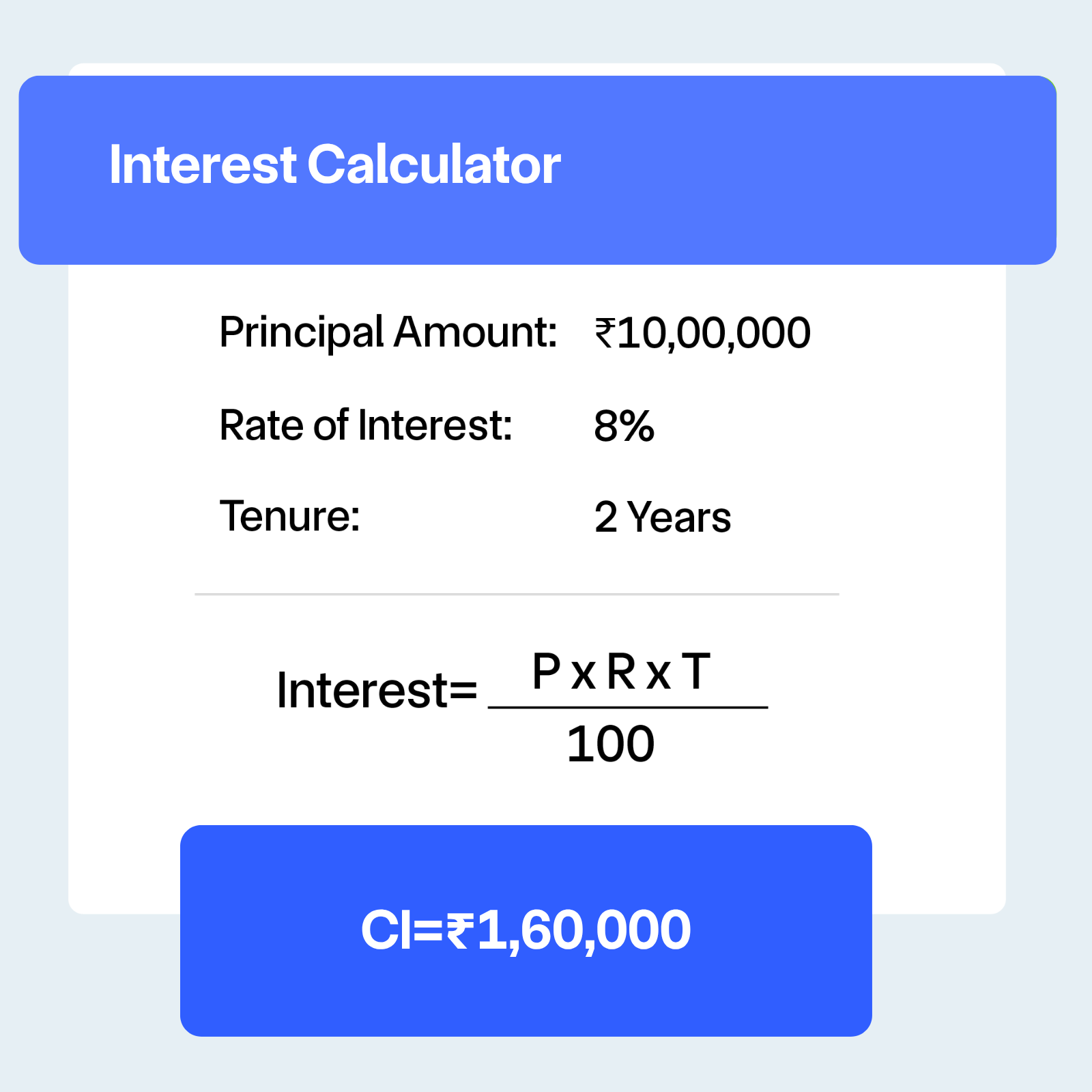

Interest rate formula with example

- Simple Interest Formula: Interest = P × r × t Where: P = Principal, r = annual interest rate (decimal), t = time in years

- Compound Interest Formula: A = P(1 + r/n)^(nt) Where: A = final amount, P = principal, r = annual interest rate, n = compounding frequency per year, t = time in years

-

Example: Priya invests ₹5,00,000 in a savings account offering 6% annual interest compounded quarterly for 4 years.

P = ₹5,00,000 | r = 6% = 0.06 | n = 4 (quarterly) | t = 4 years -

Total amount payable ≈ ₹6,34,120

Total interest earned ≈ ₹6,34,120 – ₹5,00,000 = ₹1,34,120

How the interest rate calculator helps you

Saves time

No need for manual complex formulas results are instant and accurate.

Improves financial clarity

Shows exactly how much you’ll earn on savings or pay on loans.

Better decision-making

Helps compare different banks, loan offers, or investment options easily.

Avoids mistakes

Eliminates calculation errors that can cost money in the long run.

Visualize growth

Many calculators show charts/tables so you can clearly see how interest impacts money over time.

Optimizes strategies

Lets you test different interest rates, tenures, and amounts to choose the most cost-effective or profitable option

What is a good interest rate?

- Compare rates from multiple lenders or institutions — mortgage rates between 6–8% and personal loans between 6–15% are generally considered reasonable.

- For savings or investments, look for 4–5% APY on high-yield accounts or 6–8% annual returns on conservative options.

- Remember, “good” rates depend on market conditions and your credit profile — always benchmark against current averages before deciding.

Use cases for interest rate calculator

Loan planning

Quickly compare EMIs, total interest, and repayment schedules for home, car, or personal loans.

Investment decisions

Estimate how savings, FDs, or mutual funds will grow over time.

Credit card analysis

See how interest accumulates if you carry balances

Frequently Asked Questions

How often should interest compound for maximum benefit?

Daily compounding provides the highest returns, though for most savings amounts the difference between daily and monthly compounding is minimal.

Can I use the calculator for loan payments?

Yes, an interest rate calculator can compute monthly loan EMIs, total interest paid, and let you compare loan terms to find the most cost-effective option.

What’s the difference between APR and APY?

APR (Annual Percentage Rate) applies to loans and includes fees, while APY (Annual Percentage Yield) is used for savings and reflects the impact of compounding.

How do I calculate the effective annual rate?

Use the formula: (1 + r/n)^n – 1, where r is the nominal annual rate and n is the number of compounding periods per year.

Should I prioritize paying off debt or saving money?

It’s generally better to clear high-interest debt first, like credit cards, since their rates usually exceed what safe investments can earn.

Can the calculator handle both simple and compound interest?

Yes, modern calculators support both. Simple interest is straightforward, while compound interest considers reinvested interest, showing more accurate long-term growth.

How accurate are online interest rate calculators?

They’re very accurate for standard calculations. However, results may vary slightly in real scenarios due to bank fees, taxes, or changing interest rates.

Can I use the calculator for investment planning?

Absolutely. It helps estimate future returns on savings accounts, fixed deposits, or mutual funds, letting you set realistic long-term financial goals.